ASEAN: The ultimate winner of a China-US rivalry (Part I)

China's dominance on the global stage continues to grow. It could just become another "sun" in a solar system that has revolved around the US in the post-war era. But can two "suns" coexist? And what will happen to the other planets around them? This two-part essay is adapted from Prof Tan Kong Yam's recent speeches in China and the US.

Is it too late to stop China's ascent?

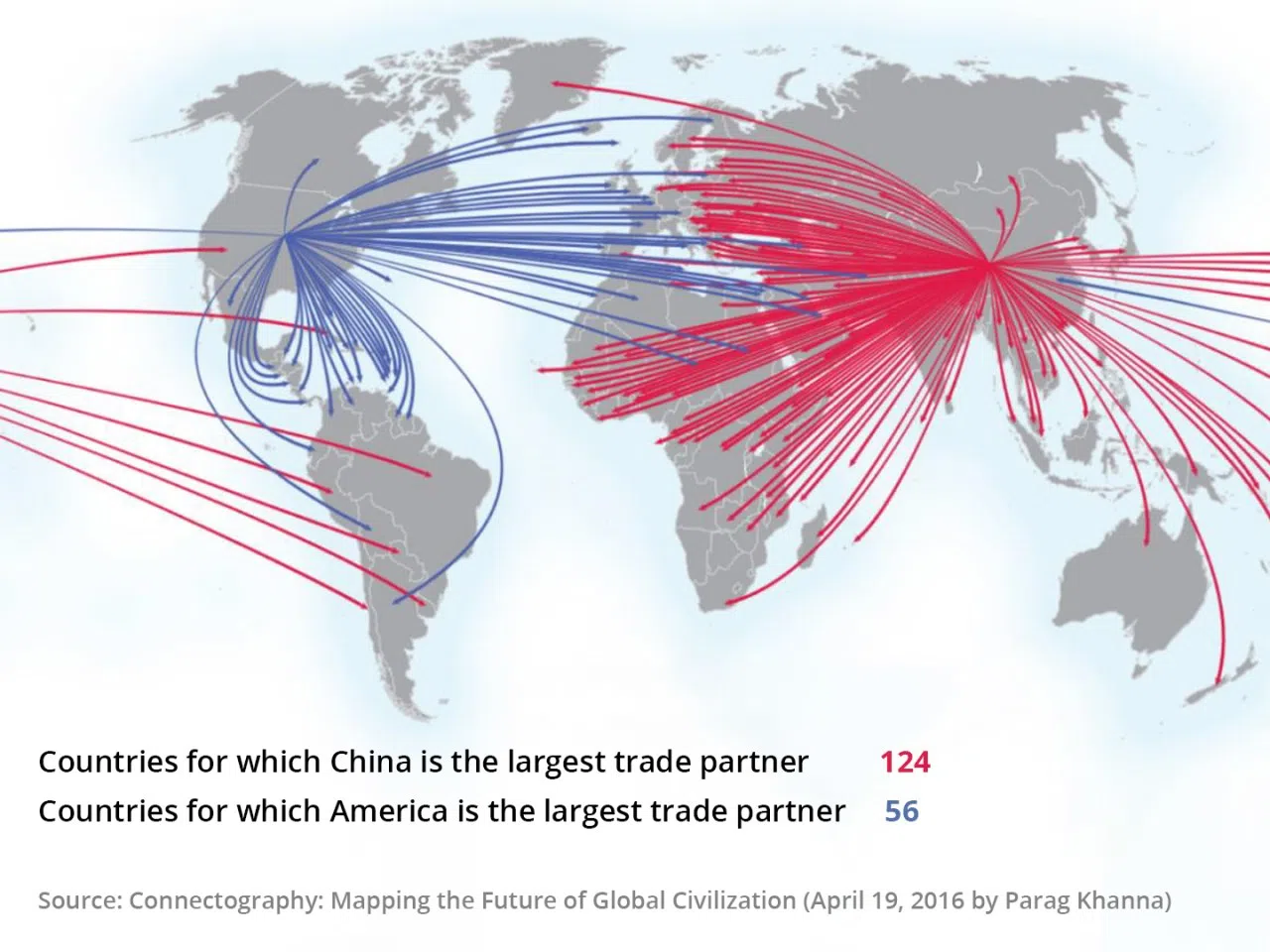

Twenty years ago, China was much less important. Today, it is the largest trade partner to 124 countries out of a worldwide total of approximately 200 countries. In comparison, the US is the largest trading partner to only 56 countries. China is also the largest trading partner to many countries in the Asia-pacific region including India, Japan, Australia, and virtually all Southeast Asian countries. Thirty percent of trade exports of Australia goes to China, while 5% goes to the US.

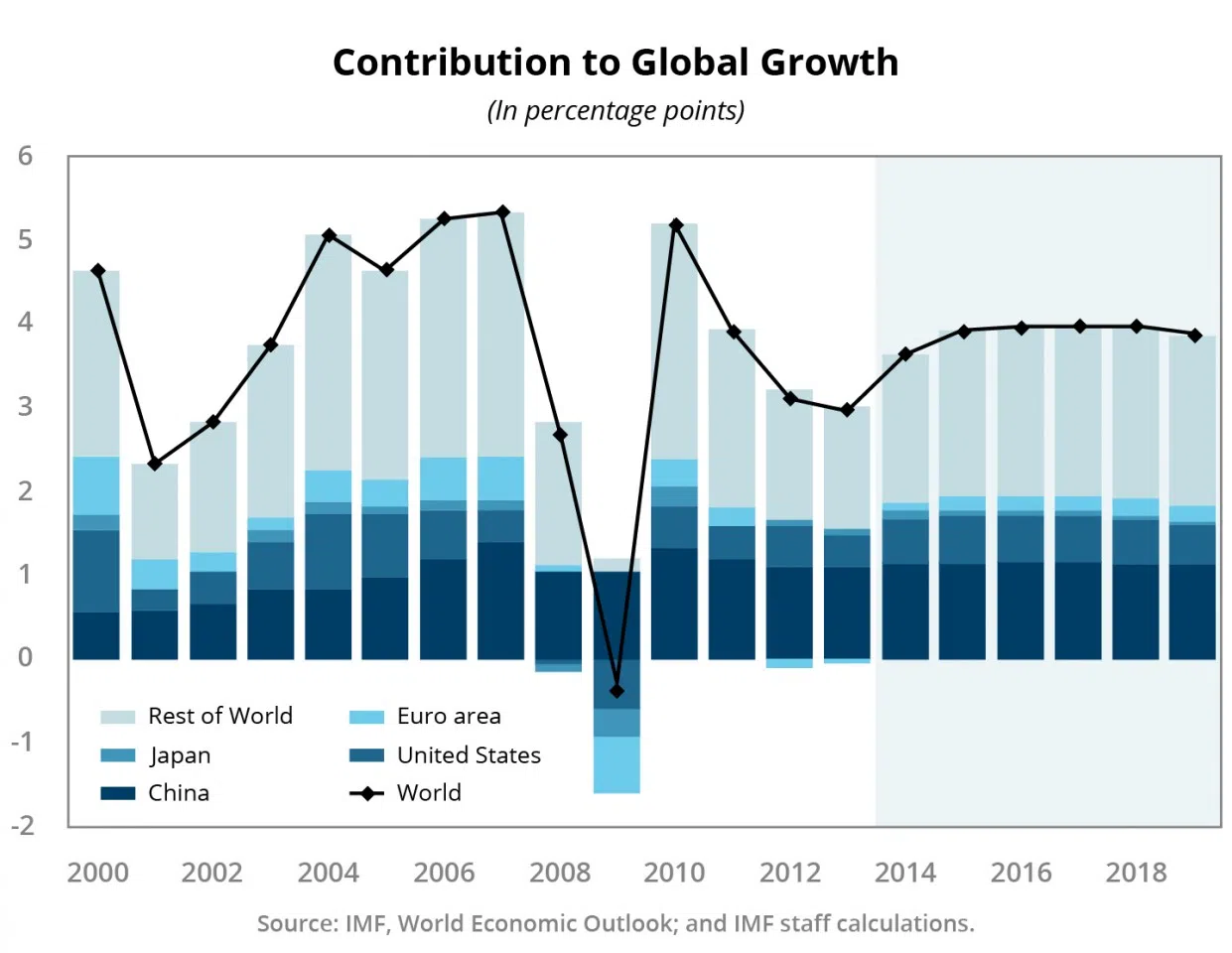

Globally, an International Monetary Fund report estimated that from 2008 to 2018, for every 100 USD increase per annum in global GDP, $30 to $40 was contributed by China, while $15 was contributed by the US. Although the US is still the world's largest economy, China is growing at a faster speed, which explains China's current significance as an economic entity and a trading nation.

Imagine China as Yao Ming - China's famous basketball player. It is not inconceivable that the war hawks of the US' defence and security establishment will want to stop Yao Ming from becoming a formidable player on the field. Statistically, the US' GDP in 2001 was $10.62 trillion (currencies in USD) while China's was a mere $1.34 trillion. In other words, China's GDP in 2001 was but 13% of the US'. George W. Bush was then the President. He and especially Vice President Dick Cheney, grew to be very wary of China and was certain that China would pose a major threat in the future.

Has Yao Ming grown up?

The 9/11 attacks came as a shock and prompted America to shift its attention from the China challenge to Islamic terrorism. Coincidentally, China became a member of the World Trade Organisation on 11 December 2001. Henceforth, China's economy was at full throttle. This was China's first golden opportunity.

The second golden opportunity came in 2008 when America was still at war with Afghanistan and Iraq. After years of broad-based growth, China's economy had become a force to be reckoned with. The 2008 financial crisis was a major setback for America with unemployment rates skyrocketing. Crisis management proved to be an all-consuming task for the superpower, diverting the US attention again from the China challenge.

For about 16 to 20 years, China had devoted itself fully to economic development and managed to overcome some major hurdles. As a result, "Yao Ming" has grown up, bringing about a major shift in the global economic landscape.

Let us take a look at the relative positions of America and China over the past decade. In 2008, America's GDP was $14.7 trillion and China's GDP was 31% of that, standing at $4.6 trillion. In 2018, America's GDP was $20.5 trillion and China's GDP was 66% of that, translating to $13.6 trillion. Also in 2018, in terms of purchasing power parity, America's GDP was $20.5 trillion, while China's was $25.3 trillion, a whopping 123% of America's GDP.

Let us return to the analogy of Yao Ming. According to an NBA report, most professional basketballers reach their peak at approximately 27.7 years old. In 2001, Yao Ming was 3.6 years old (China's GDP was 13% of America's GDP then). In 2008, Yao Ming was 8.6 years old (31%). By 2018, Yao Ming was already 18.3 years old (66%).

Thus, the US is facing a tough challenge now. Yao Ming has already grown up. It is possible to wound him but perhaps too late to curtail or hold back his growth.

In the mid to long term, there are tremendous tools and weapons at China's disposal: its growing market and the innovative potential of its state-owned and private high-tech companies working together. This is a long game and China will have to find ways to boost domestic consumption and to unleash the innovation potential of its enterprises. Whether China can pull it off will determine its relative position vis-a-vis America as well as the fate of this generation of Chinese.

Domestic consumption and China's autonomy

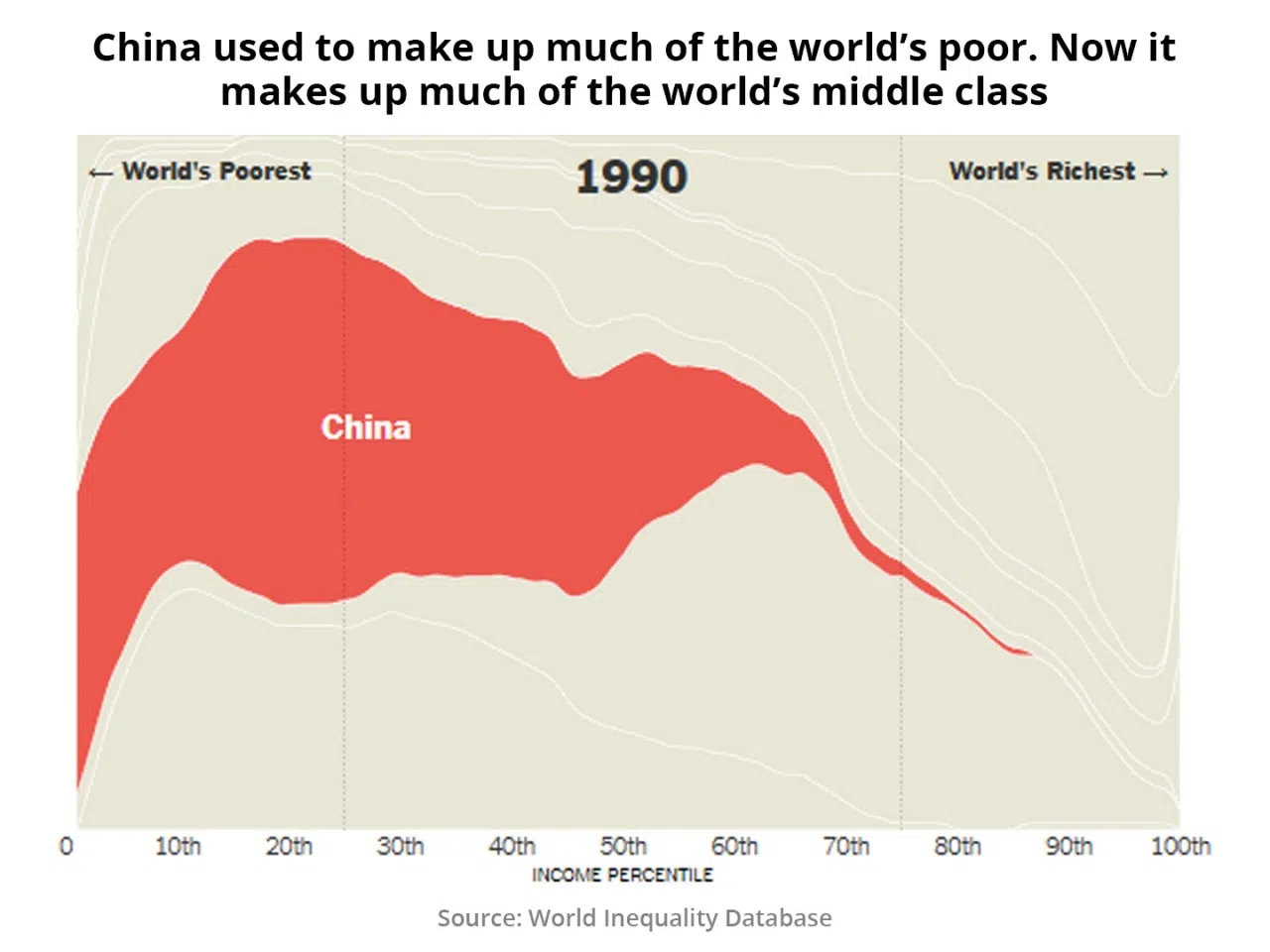

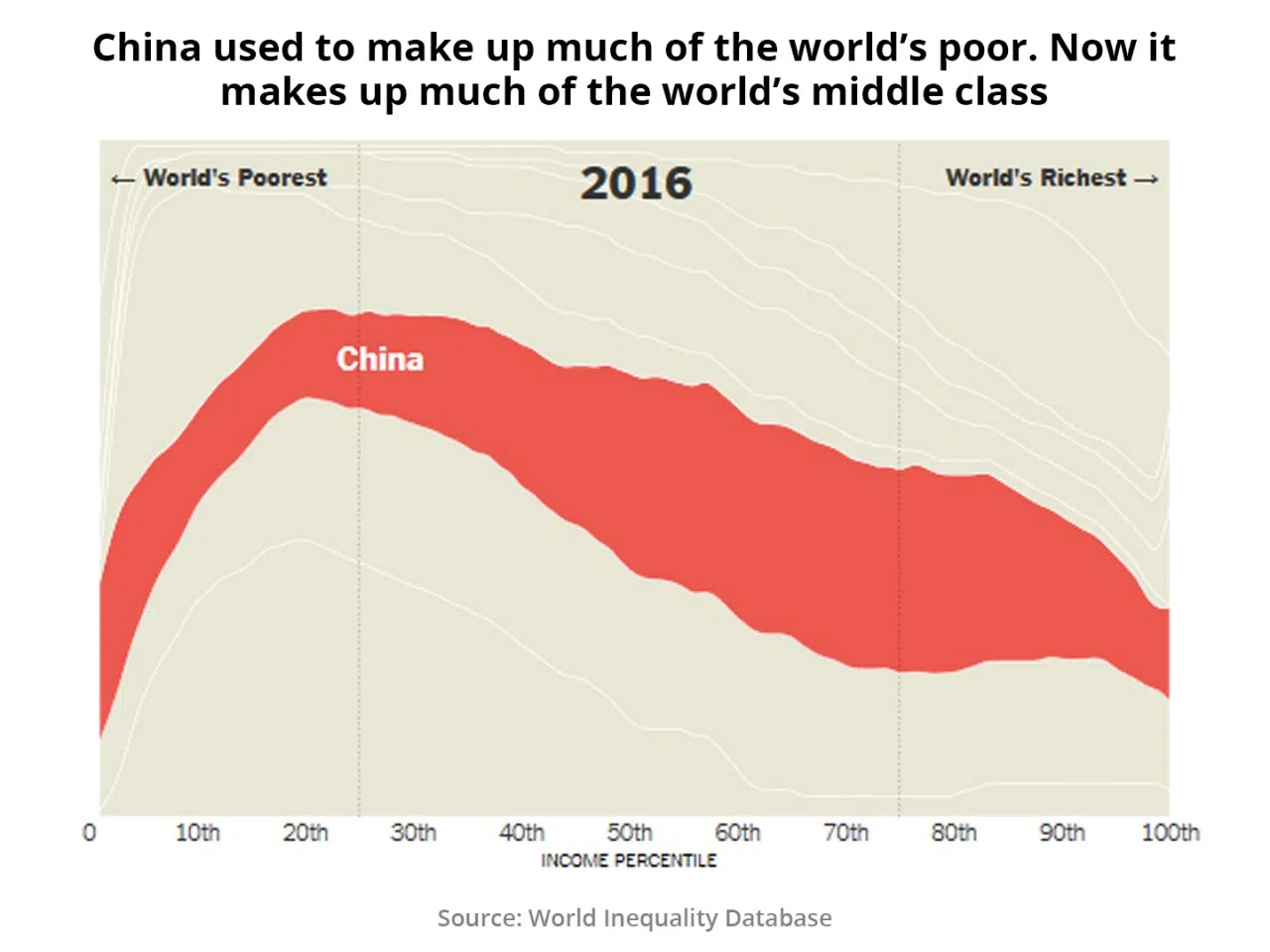

The two figures below illustrate the income distributions of the world's population. It is clear that China in 1990 was still backward and poor. The income level in China was positioned mostly at the lower 50th income percentile vis-a-vis that of the workforce worldwide. By 2016, the income of China's population grew exponentially, with a lot more people joining the middle and upper income at the global level.

Although the majority in China was once among the world's poorest, an increasingly large number of people have become the world's middle class. China is getting stronger and becoming more powerful.

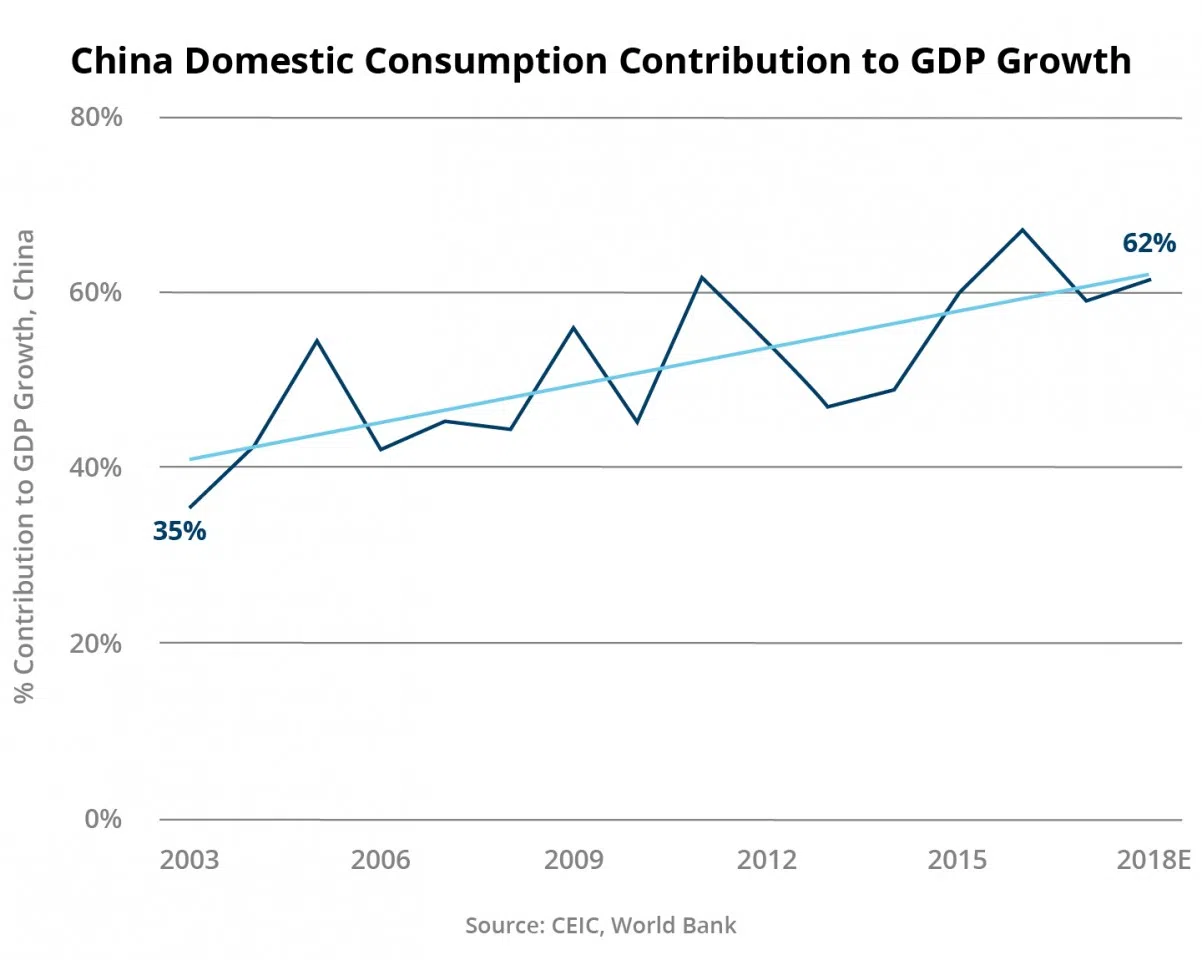

In 2003, a mere 35% of China's GDP growth was contributed by domestic consumption, with the remaining 65% stemmed mainly from exports and investments. China was heavily dependent on exports as an engine of growth, especially exports to the US market. By 2018, China's domestic consumption was already accounting for 62% of the country's GDP growth. Recently, this percentage is nearing 70%. If the locomotive is propelled by the domestic market, China will gain more autonomy and not overly rely on the US. America's trade policies will also have a lesser impact on China. This is China's long-term goal.

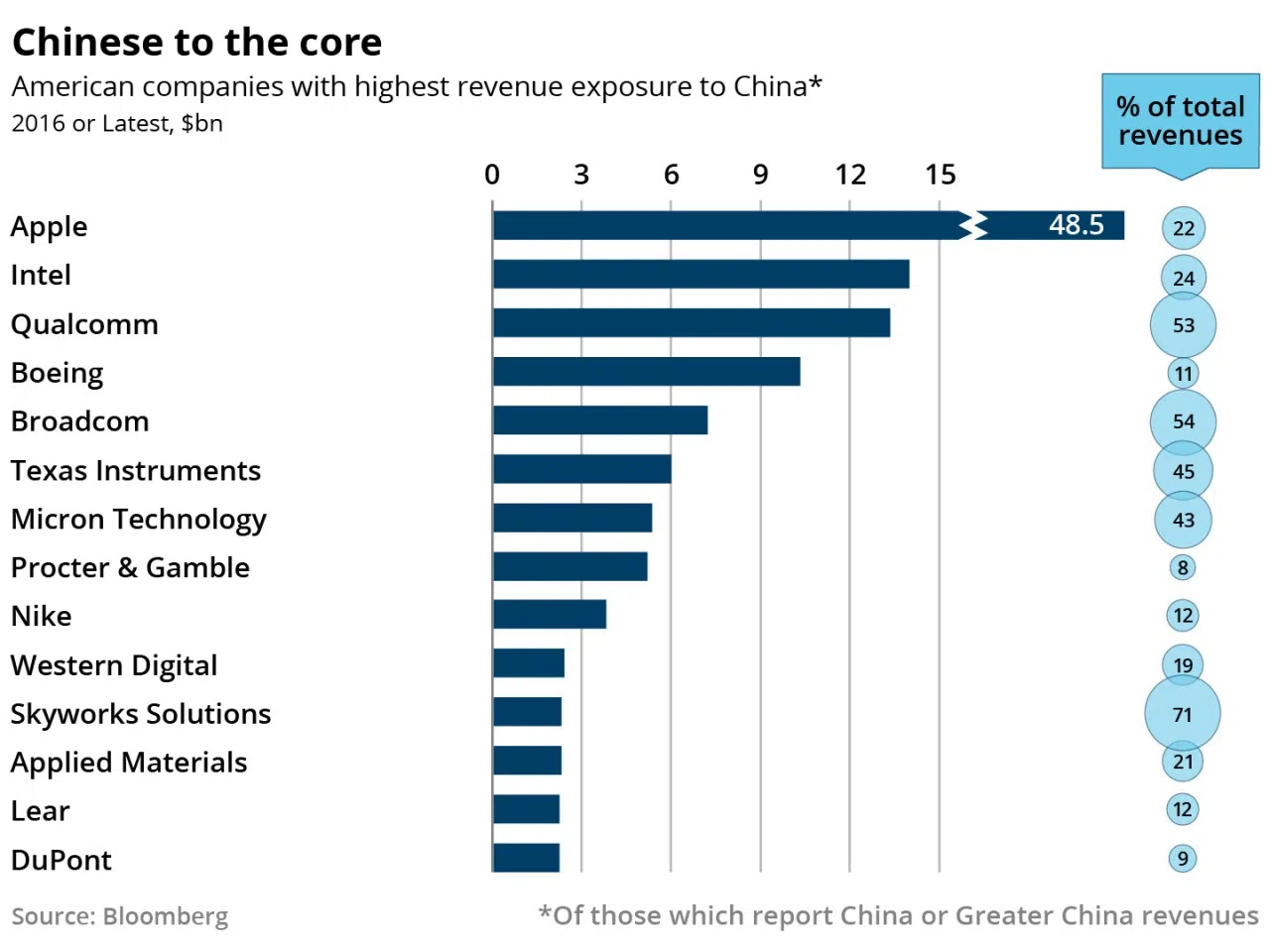

If the growth of China's domestic consumption can be sustained, the outlook of American companies in China will look up as well. American companies like Apple, Intel, and Qualcomm are increasingly dependent on the China market, ranging from 20% to 50% of their total global sales. Hence, many of these large enterprises dread being dragged into the China-US trade war as China markets contribute substantially to their bottom line to a varying degree.

Will the real tech leader please stand up?

The semiconductor industry sits at the core of the modern technology industry, and the US has long been in its leading position. Jimmy Goodrich, Vice-President of the Global Policy department of the Semiconductor Industry Association, is convinced that the semiconductor is human history's greatest achievement. "Semiconductors remain the core of modern electronics. Whether you're driving, surfing the net or using a supercomputer, they are all made possible by semiconductors." Simply put, innovation in semiconductors trigger the innovation of technological products.

The American chip industry's direct-hire employees have reached 250,000 and reaped an annual sales revenue of $164 billion. Upon establishing clusters of semiconductor manufacturers, supplementary businesses can then provide services to them.

A small but important part of the semiconductor industry is its application in the defence industry such as the manufacture of missiles and radars. Thus, expertise in semiconductor technology gives a country a decisive edge in military technology. America's strong manufacturing capability and defence industries underpin its economic prosperity and global competitiveness and at the same time, enables the US military to defend the country.

A worry of the Trump Administration now is the unprecedented challenges confronting America's defence industry: cuts and uncertainties in its government's expenditure, a decline in key markets and supply chains, active industrial policies of competitors (e.g., China), and a lack of key skills in its domestic labour force.

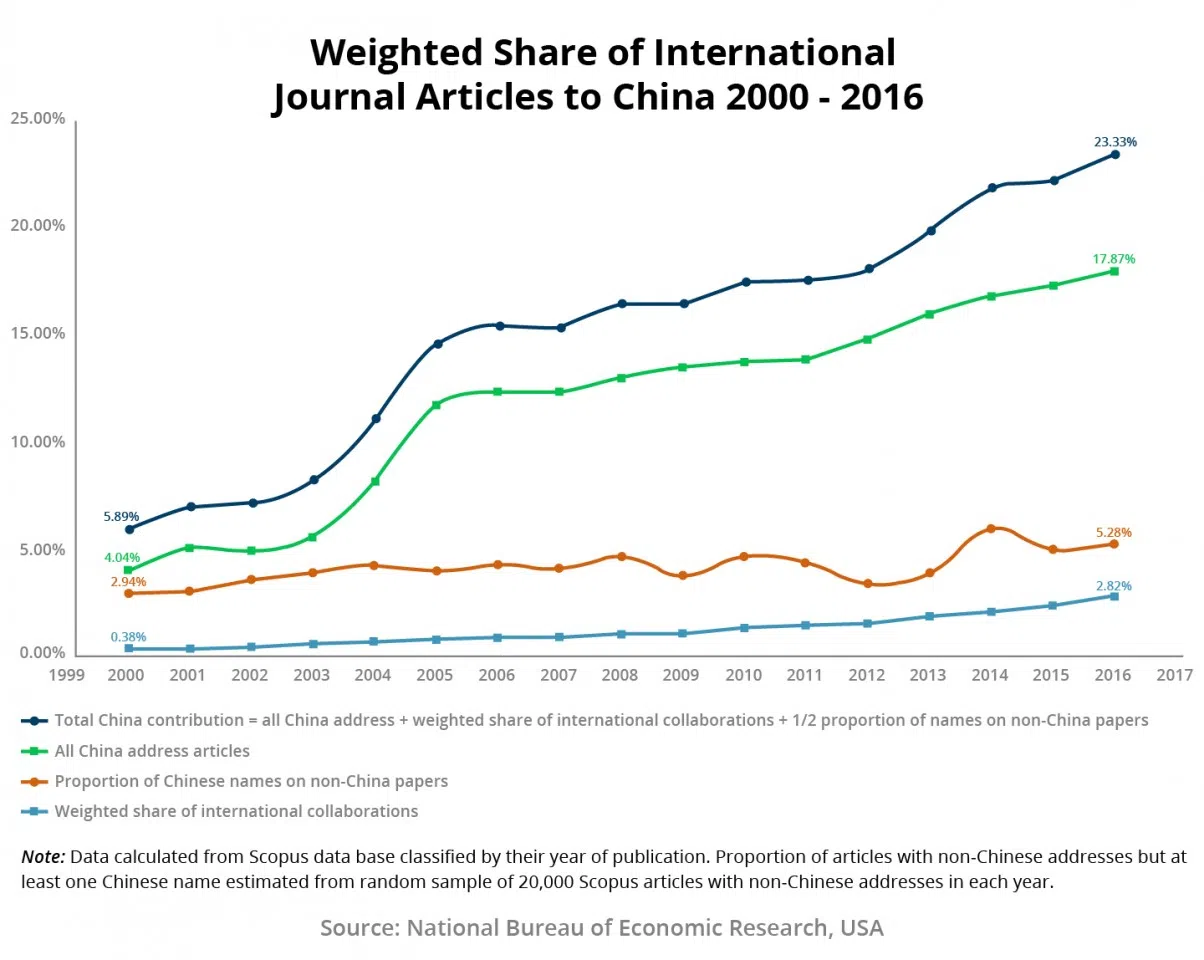

At present, China is experiencing rapid growth in its scientific research, and the US is fully aware of this. Peter Orszag, President Obama's Director of the Office of Management and Budget, said, "We may not want to admit it yet, but the rise of China to the top ranks of global scientific achievement is now a historical fact."

In 2018, there was a worldwide total of 260 unlisted companies valued at over $1 billion; companies that are known as "unicorn companies". Of these unicorn companies, the majority of them were internet software and services companies (15%), followed by e-commerce companies (14%), and fintech companies (12%).

Although America has the largest number of unicorn companies (47%), this percentage was reduced by 7% between May 2017 and August 2018. At the same time, China's percentage of unicorn companies has increased from 23% to 30%. The proportion of unicorn companies in other countries is: UK (6%), India (4%), Germany (2%), Israel (2%).

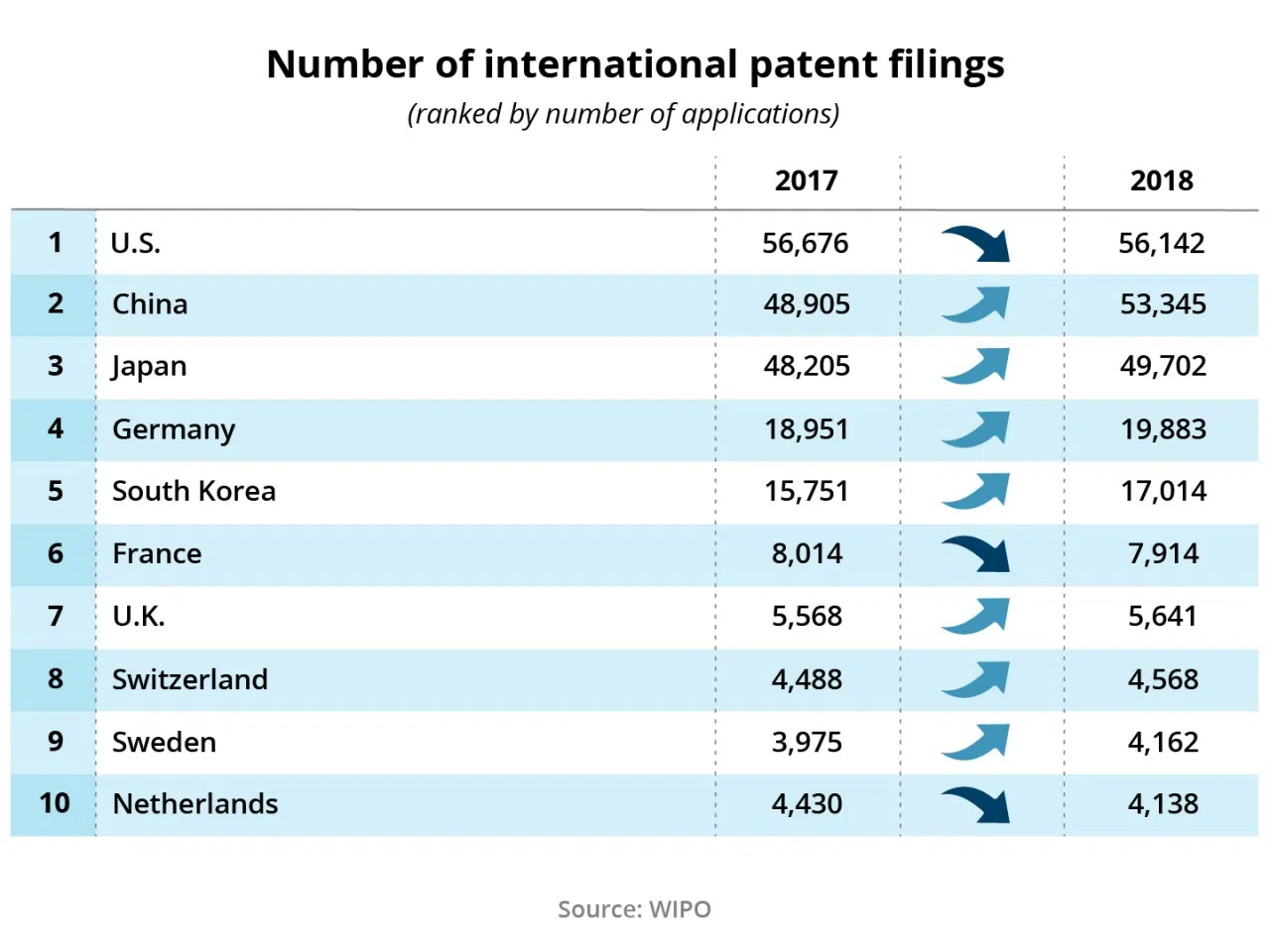

First, the figure below illustrates the global rankings of the number of international patent filings by country. Patent filings are important indicators as they represent countries that possess skills unavailable to the rest of the world. It is a fact that the US still retains the top spot, but its total year-over-year number between 2017 and 2018 has decreased. At the same time, China's number of filings has increased, gradually catching up with the US.

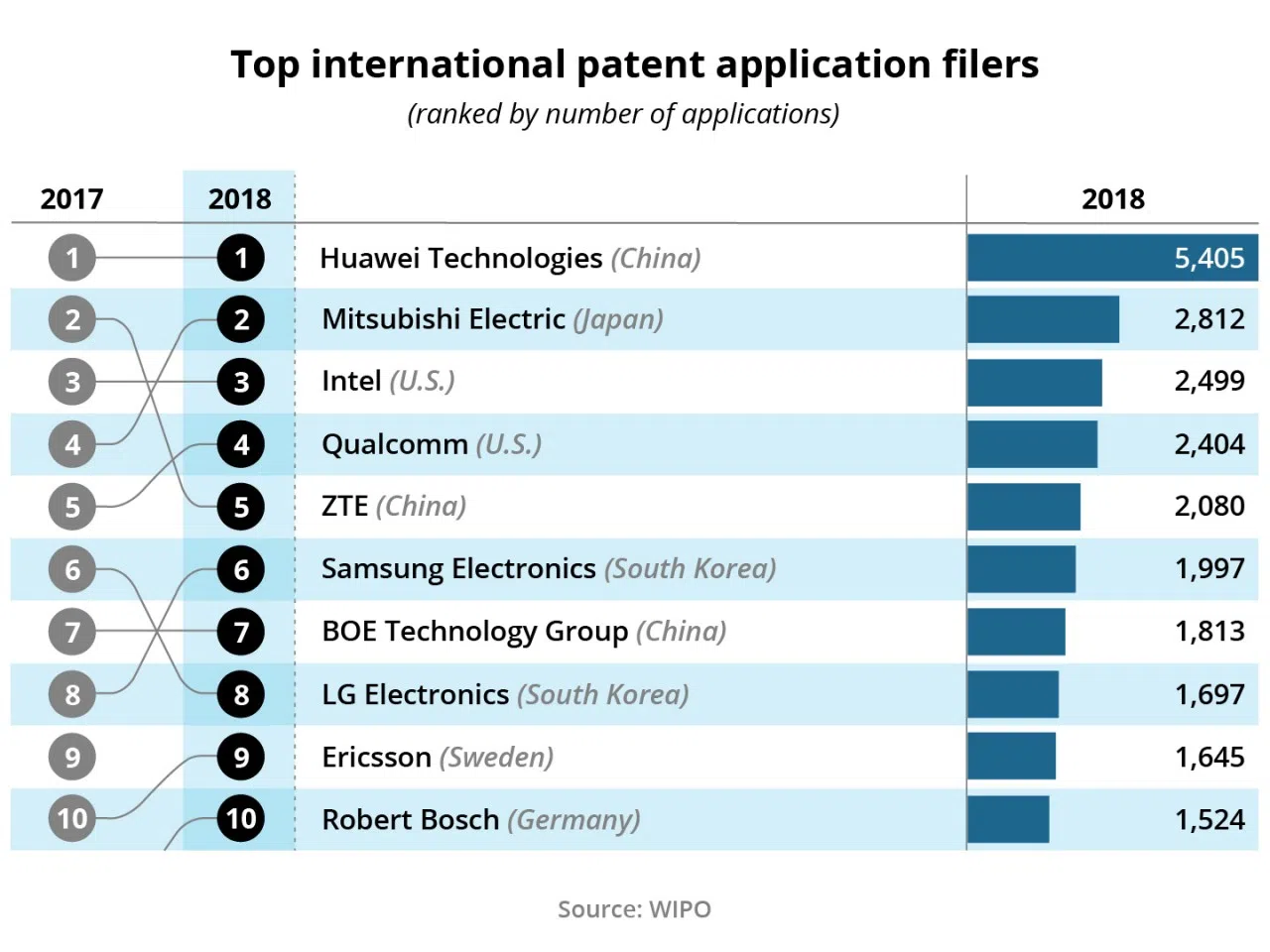

Second, it is also helpful to look at the top international patent application filers by enterprise. The enterprise that took top spot between 2017 and 2018 was not an American enterprise, but China's Huawei. Notably, the total number of applications filed by America's Intel (2,499) and Qualcomm (2,404) was still less than half of Huawei's total applications of 5,405. This explains why the China-US trade war mainly targets Huawei: the US is worried that if it does not strike now, it will be too late to strike a blow when the gap widens.

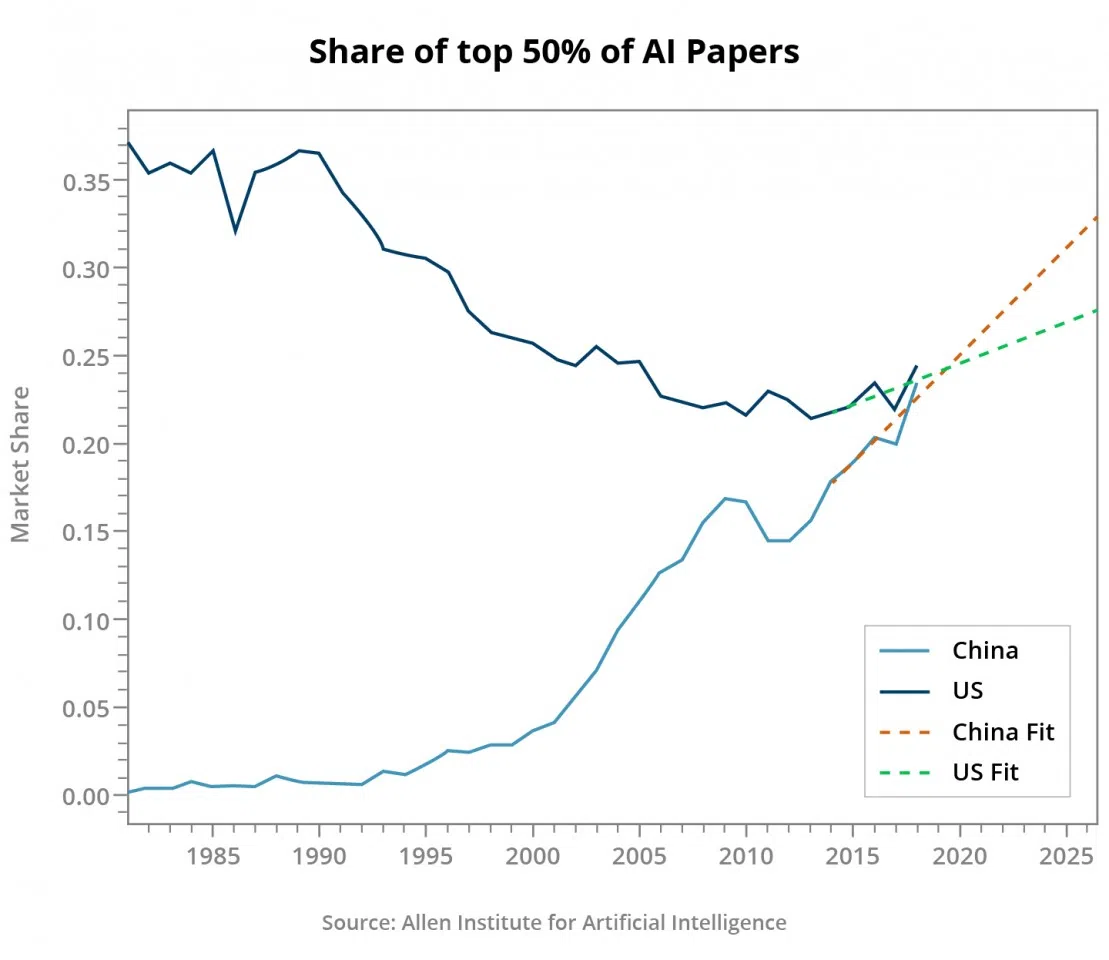

Third, an even more important indicator is the battle of the best AI papers. The number of AI papers published by China has broken the scale; in the past, China's low share of papers was contrasted by the US' extremely high share. However, as can be observed from the graph, if the current trend is to persist, China will overtake America by 2020. This is what worries the US. Notably, although the US is still in the lead with the most number of world-class experts in AI research, four out of the ten most preeminent leaders in AI were originally Chinese nationals (the US is worried that they may still return to China). In other words, this is a competition for the best AI brains.

Figures: Prof Tan Kong Yam. Reproduced by Jace Yip.

![[Big read] Paying for pleasure: Chinese women indulge in handsome male hosts](https://cassette.sphdigital.com.sg/image/thinkchina/c2cf352c4d2ed7e9531e3525a2bd965a52dc4e85ccc026bc16515baab02389ab)

![[Big read] How UOB’s Wee Ee Cheong masters the long game](https://cassette.sphdigital.com.sg/image/thinkchina/1da0b19a41e4358790304b9f3e83f9596de84096a490ca05b36f58134ae9e8f1)