ASEAN: The ultimate winner of a China-US rivalry (Part II)

China's dominance on the global stage continues to grow. It could just become another "sun" in a solar system that has revolved around the US in the post-war era. But can two "suns" coexist? And what will happen to the other planets around them? This two-part essay is adapted from Prof Tan Kong Yam's recent speeches in China and the US.

Trade war's effects on overseas Chinese

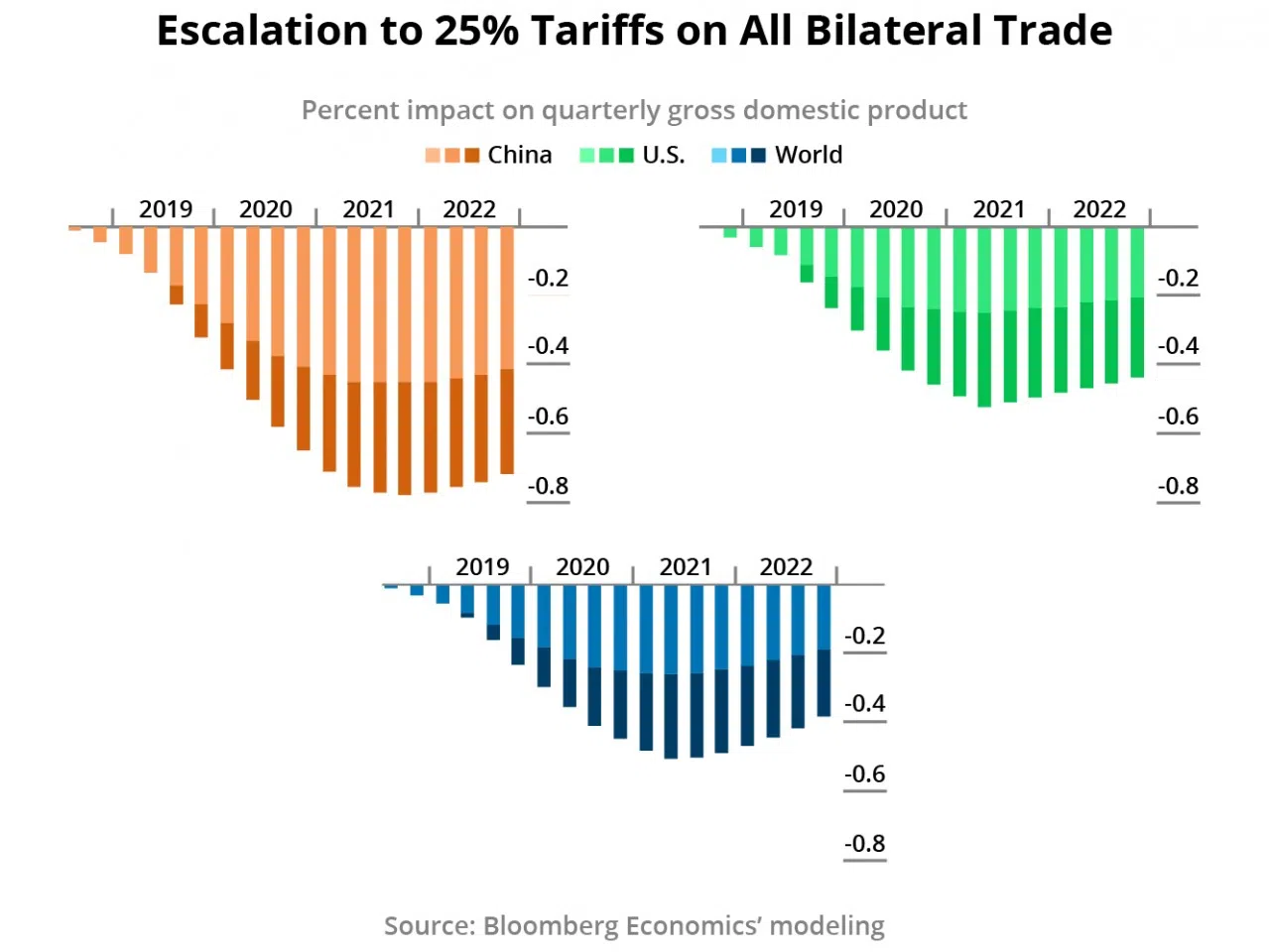

Let us consider the nightmare scenario of the China-US trade war. Simulations done by Bloomberg indicate the estimated effect on the US, China, and the global economy.

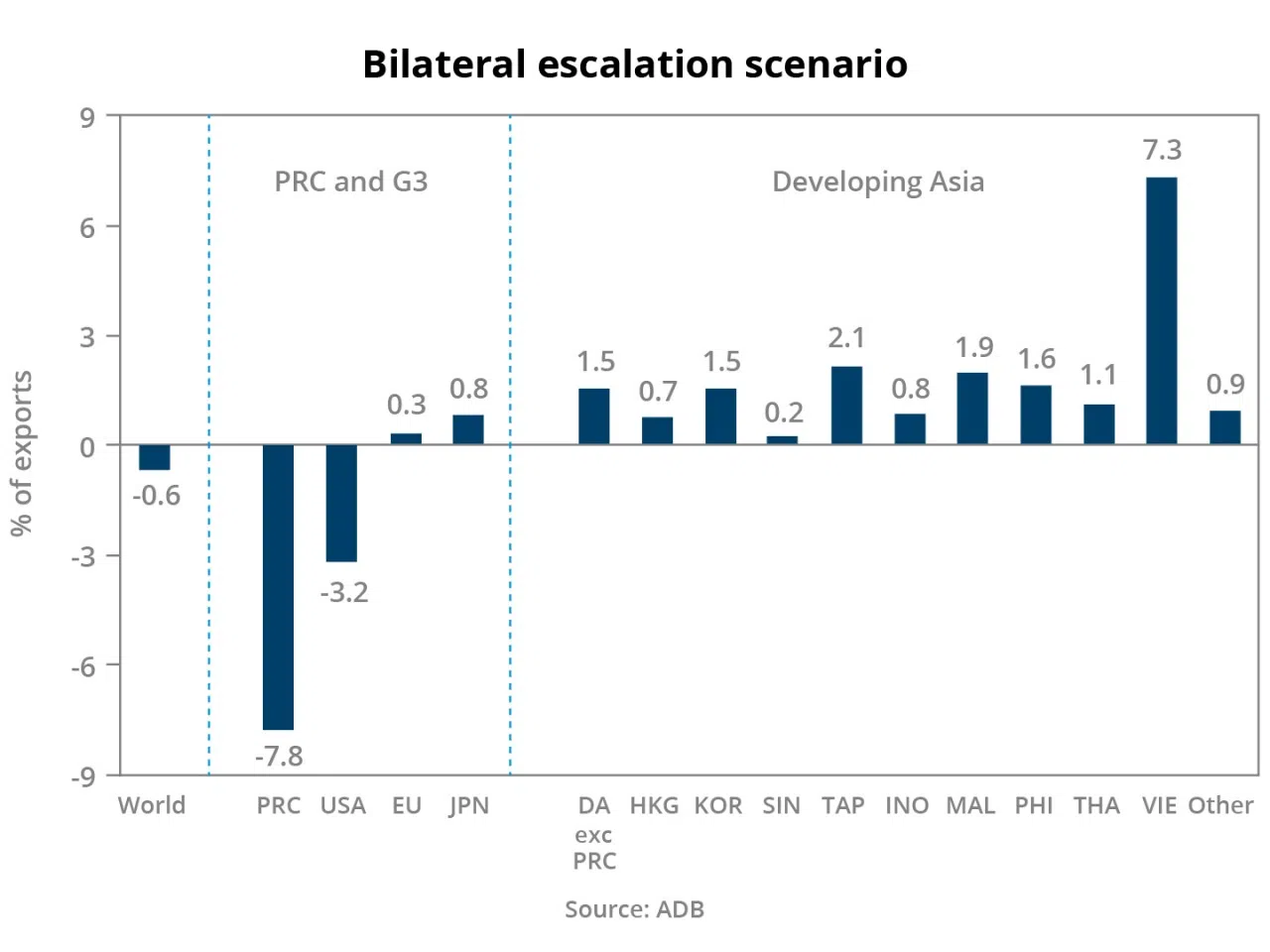

The two figures below relate to tariffs. We understand that $300 billion worth of import goods still do not have tariffs imposed on them. If we reach the point of an escalation to 25% tariffs on all bilateral trade, the impact on China, the US, and the world will gradually be felt from 2019 to 2022.

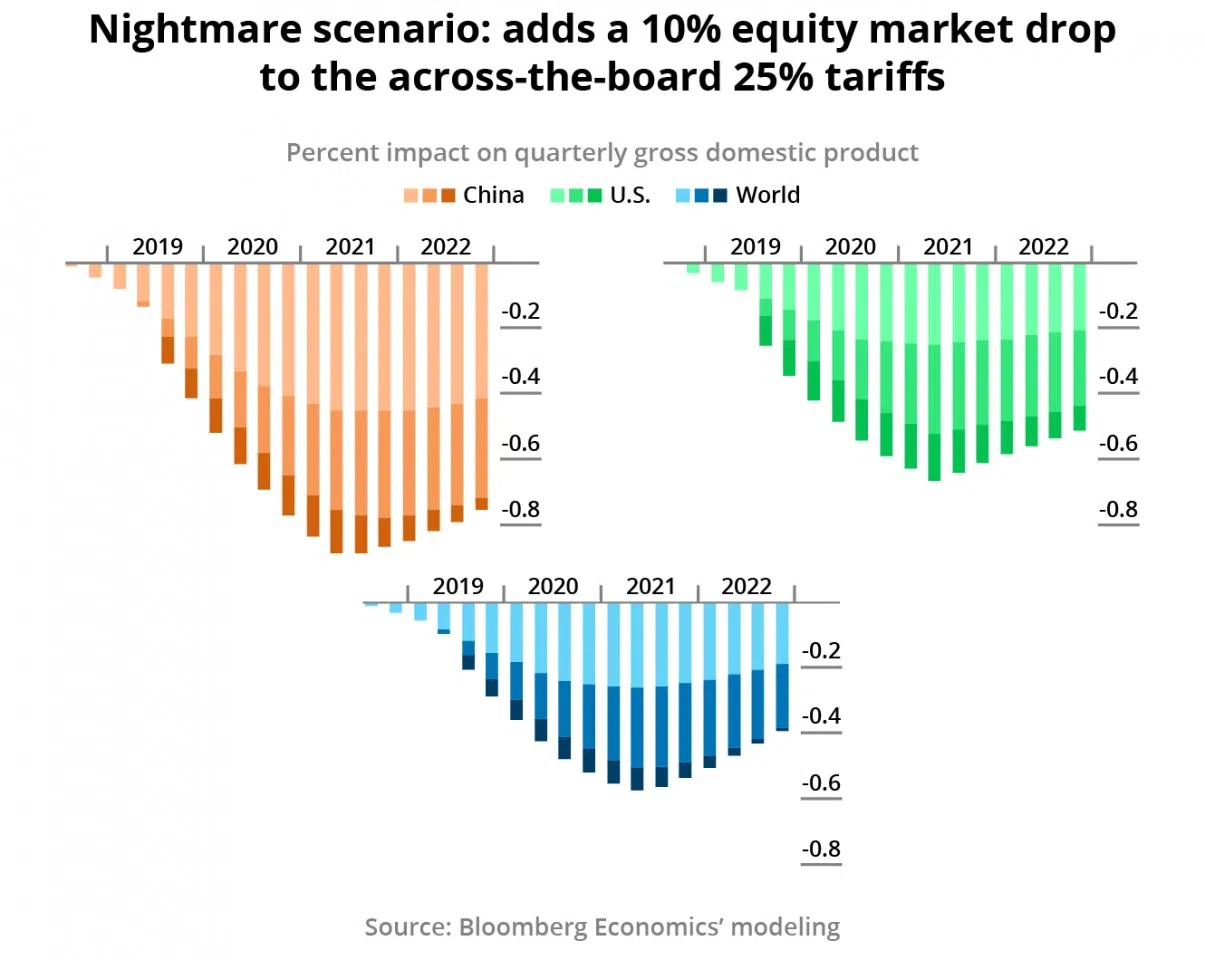

The nightmare scenario is the escalation to 25% tariffs on all bilateral trade, as well as a 10% equity market drop due to the loss of confidence. Additionally, this will result in a painful consequence on the GDPs of China and US between 2019 and 2022. We can see that the biggest hit will gradually increase from 2019, and Trump's presidential campaign could be greatly affected.

The global risk that comes from the China-US trade war does not only affect these two countries. The Four Asian Tigers (Hong Kong, Singapore, South Korea, and Taiwan), as well as many other parts of the world, will also be affected.

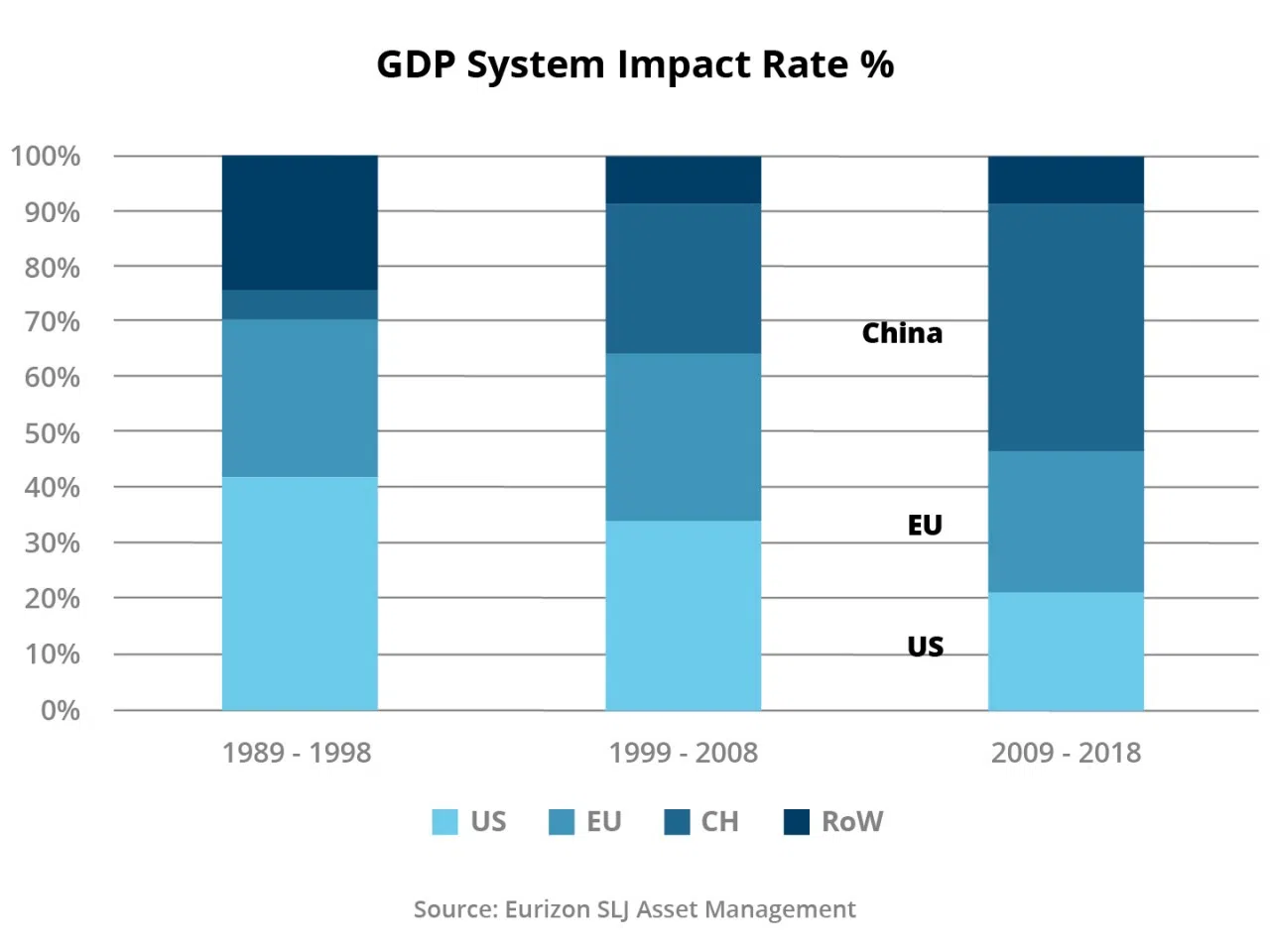

Over the past decade, the reach of China's global influence is already on par with the combined reach of the US and the EU. Consider this analogy: two elephants are in a fight. The elephants will get injured. However, the elephant's skin is thick and will not be severely harmed. Ultimately, the small animals (the majority of small- and medium-sized countries) are the ones that will suffer more serious consequences.

In the short term, Southeast Asian countries will reap some benefits as many factories will relocate from China to the region.

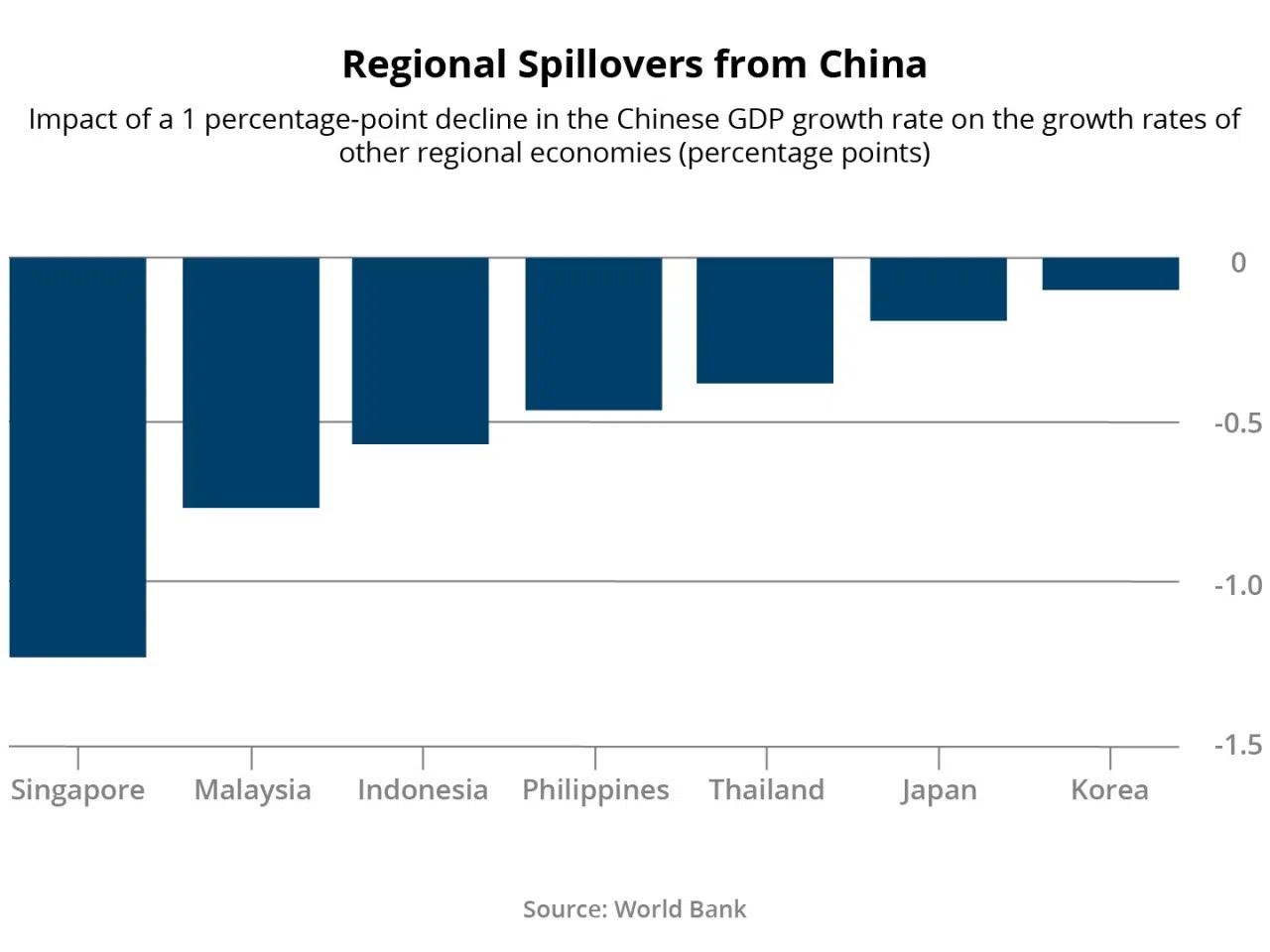

In the long run, however, negative effects abound. Although relocating the factories will boost the economy, the decline of China's and America's GDP will, in turn, depress exports from Southeast Asian countries. The regional spillovers from China, that is, the impact of a 1%-point decline in the Chinese GDP growth rate on the growth rates of other regional economies is huge, akin to the relationship between the elephant fight and its impact on other smaller animals.

Who will benefit?

In this trade and tech war, Asia, especially Southeast Asia, will become a greatly contested region. Undoubtedly, America will adopt a divide-and-rule strategy with regards to Asia, in the hope of weakening China. Overseas Chinese may be targeted given their prominent roles in the economies of various Southeast Asian countries. To top it off, they are delicately connected to the political and military elites in these countries.

A few global trends could emerge out of this, one of them being the coexistence of two suns in the solar system. In the 50s, America's GDP constituted 40% of the world's GDP. It was the biggest Sun in the solar system, with other planets revolving around it dutifully. Now then, if a planet such as Jupiter gradually becomes larger in size approximating that of the sun, just like the current China, other planets might be enticed to revolve around it, resulting in the emergence of two suns in the solar system.

The interconnected technological ecosystem between America and China and the supply chain of key components of the international economic system may be decoupled. This will lead to fragmentation and reallocation of the global supply chain, which in turn will dampen the investment climate. Many believe that Japan, Korea, Taiwan and their respective enterprises will be the ultimate winners, but this is an illusion. If the tech war does not stop, they will also be the casualties of this fight, as they are the main suppliers of the key product components that China is striving to reduce its reliance on. The EU may also face serious collateral damage. And then, who will be the winners of the trade and tech war that resulted in, among other things, the outflow of foreign direct investments, supply chain migration, and the escalation of increased competition between China, America, and Japan? ASEAN countries.

Figures: Prof Tan Kong Yam. Reproduced by Jace Yip.

![[Big read] Paying for pleasure: Chinese women indulge in handsome male hosts](https://cassette.sphdigital.com.sg/image/thinkchina/c2cf352c4d2ed7e9531e3525a2bd965a52dc4e85ccc026bc16515baab02389ab)

![[Big read] How UOB’s Wee Ee Cheong masters the long game](https://cassette.sphdigital.com.sg/image/thinkchina/1da0b19a41e4358790304b9f3e83f9596de84096a490ca05b36f58134ae9e8f1)