China's new measures to attract foreign capital may not be enough to boost confidence

The Chinese authorities have been working to restore confidence in the economy, especially among foreign businesses and investors. The latest policy move is a raft of 24 measures aimed at attracting foreign capital. However, it seems that there has been a lack of attention on these measures, and it is still unclear how far they will go in drawing investments back.

The Chinese stock market resumed its slide this week, with stock indices in mainland China and Hong Kong not only losing the gains accumulated since the Chinese Communist Party's Politburo session last month, but reaching new lows.

Stock-buying friends in chat groups joked that the only good news this week is that "it will at most drop for another day or two, then it'll be the weekend."

Battered confidence

Investors are lamenting the recent string of bad news, seemingly forgetting that just last weekend, the Chinese government issued a document aimed at boosting the economy, with suggestions on further optimising the foreign investment environment and attracting foreign investment in China.

The 24 measures to attract foreign capital are another economic stimulus policy by the authorities, following the 20 measures to restore and expand consumption and the 28 measures to promote the private economy. However, there has been less discussion about the 24 measures than the previous two policies, and its impact on the market is quite limited.

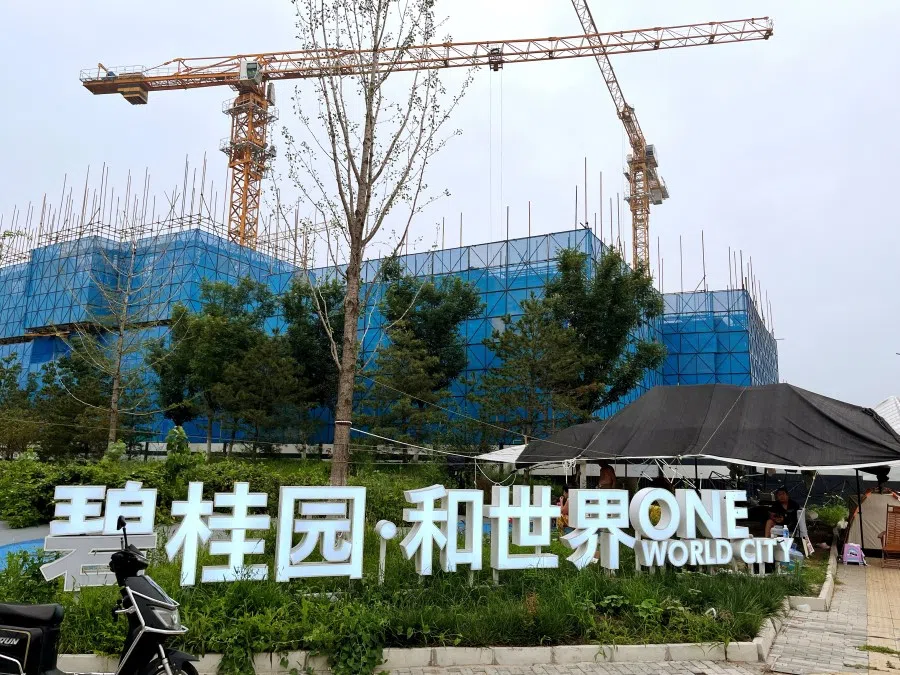

The release of the 24 measures was somewhat untimely. The day before the policy was announced, leading real estate developer Country Garden announced the suspension of trading for 11 of its onshore bonds, intensifying the market's concerns about real estate companies' debt risks. Furthermore, economic indicators released in July showed a decline across the board, indicating a difficult start for the economy in the second half of the year, while the official suspension on publishing the rising youth unemployment rate has further damaged investor confidence.

Another major concern for foreign companies is the chilling effect caused by the revised counter-espionage law.

Dampening the positive effects of the 24 measures are a slew of negative news: the real estate market falling back to a low and possibly deteriorating further, sustained weak domestic demand, and a persistently high unemployment rate reflecting gloomy expectations. These reflect the various challenges in the current Chinese economy and what investors are worried about.

Another major concern for foreign companies is the chilling effect caused by the revised counter-espionage law. The revised counter-espionage law, which took effect in July, expands espionage activities beyond national secrets and intelligence to include "documents, data, materials and items related to national security and interests", without specific details.

When the concerns of foreign business people about the counter-espionage law were raised during a briefing on the 24 measures, a Chinese Ministry of Commerce official responded, "As long as companies operate in compliance with the law, there is no need to worry."

Missing details

However, this year, Chinese law enforcement agencies have conducted raids on foreign corporate offices in China, such as consulting firm Bain and corporate due diligence firm Mintz Group, which has left foreign companies feeling uneasy. Last month, there was news that Morgan Stanley would be relocating over 200 technology developers from mainland China in response to the stricter data regulations, further increasing concerns about data security.

The chamber also stressed that it is "extremely important" to publish detailed implementation guidelines. In other words, the confidence of foreign companies will remain low until the policy takes effect.

Addressing this point, the 24 measures mention the exploration of a "convenient and secure management mechanism" for cross-border data flows and establishing a green channel for qualified foreign enterprises, to promote secure, orderly and free flow of data. The document also proposes to implement relevant tax incentives and optimise policies related to foreign entry and exit, while ensuring that foreign companies participate in government procurement activities in accordance with the law.

The European Union Chamber of Commerce in China believes that the 24 measures could significantly boost business confidence, but only if they are implemented "in a timely, coordinated and consistent manner". The chamber also stressed that it is "extremely important" to publish detailed implementation guidelines. In other words, the confidence of foreign companies will remain low until the policy takes effect.

Losing support

Amid sluggish exports and lacklustre domestic demand recovery in China, the importance of boosting foreign investments is evident. But with growing geopolitical tensions and slowing economic recovery, foreign investors' confidence in the world's second largest economy continues to wane.

According to a survey conducted in March by the American Chamber of Commerce in China among over 900 enterprise members, as many as 55% no longer considered China as a top-three market for investment. Data released by the State Administration of Foreign Exchange in August also showed that direct investment liabilities - a measure of foreign direct investment (FDI) in China - slumped to just US$4.9 billion in the second quarter of the year, the lowest level in 25 years.

At the same time, US President Joe Biden signed an executive order last week restricting US enterprises and individuals from investing in China's cutting-edge technologies such as semiconductors, quantum information technologies and artificial intelligence capabilities, further impacting foreign companies' investments in China.

Berkshire Hathaway had reduced its stake in BYD 12 consecutive times since August last year, cutting down its shareholding from about 20% to less than 9%.

On 17 August, Xinhua News Agency published a commentary titled "Chinese market allure won't diminish despite US smears", pointing out that despite Washington's relentless suppression, the investments of several developed countries in China still increased significantly in the first half of the year. The Chinese version of the commentary even cited American business magnate Warren Buffett as an example, stating that his company, Berkshire Hathaway, has gained an around 30-fold return on its BYD investment since 2008.

But what the commentary failed to mention is the fact that data from China's Ministry of Commerce has found that FDI declined 2.7% y-o-y in the first half of this year - the first decline in three years. Furthermore, Berkshire Hathaway had reduced its stake in BYD 12 consecutive times since August last year, cutting down its shareholding from about 20% to less than 9%.

Everyone's watching

A massive consumer market, efficient and comprehensive supply chain, rapid growth potential - this is the impression that foreign companies have had of the Chinese market for many years. But after the three-year-long pandemic, consumption is weakening, industrial chains are relocating, and the economy is under unprecedented pressure.

Amid intensifying China-US rivalry, foreign companies in China could become victims of geopolitical tensions, making them more cautious in decision-making.

Although it did not make a splash, the 24 measures' aim to boost foreign investment is no less important than that of the policies on expanding consumption and boosting the private economy. The allure of the Chinese market depends on how officials will reassure investors and protect the rights and interests of foreign enterprises in China. What will be done next is more important than what is written in the documents.

This article was first published in Lianhe Zaobao as "没激起水花的"吸引外资24条"".

Related: Crisis of trust underlies Chinese private sector's unwillingness to invest | Why are private enterprises reluctant to invest in China? | China needs a new model of economic development to revive the economy | Struggling economy now a taboo topic in China | Low consumer confidence will dampen China's push to boost consumption | China's economy lacks foundation for expanding consumption