Taiwan's booming semiconductor industry plays crucial role on world stage

Taiwan's semiconductor industry has been making waves not just domestically, but internationally. Zaobao correspondent Woon Wei Jong examines why for Taiwan, strategically and economically, possessing advanced semiconductor technology is as good as striking gold.

Taiwanese semiconductor manufacturer TSMC has seen its stock prices take a recent jump, doubling from NT$339 (about S$16) early last year to a high of NT$679 (about S$32) this past Thursday, becoming quite the cash cow for investors.

There have been recent anecdotes of quite a few stockholders becoming rich, including a woman who bought 13,000 shares 20 years ago for about NT$100 each - this investment of less than S$60,000 is now worth a handsome S$400,000.

But many who missed the boat are still moaning: "While prices were jumping from NT$200 to NT$400, I was wondering if I could still afford to buy in. Now at nearly NT$700, I'm still asking: Do I dare to buy in?"

... long-term investors who bought in at a low are still calmly watching for TSMC to hit the latest target of NT$1,000.

In fact, many sharp-eyed people jumped on this money-making bandwagon long ago. According to Taiwanese media, TSMC has some 662,000 shareholders, which is a significant number.

Of course, the biggest winner is TSMC's founding shareholder the National Development Fund (NDF), which holds 1.65 billion shares. Over 34 years, it has invested a total of NT$2.2 billion (about S$104 million) - calculating dividends and share allotments, each share cost NT$0.3 (about S$0.01), and it has now made some NT$1.1 trillion (about S$52 billion).

But even as people are flocking to buy in, foreign investors are also selling high to cash out, and the share price fell back on 24 January 2021. Short-term speculators are likely to get their fingers burned, while long-term investors who bought in at a low are still calmly watching for TSMC to hit the latest target of NT$1,000.

TSMC has been leading the Taiwan Stock Exchange in setting new highs. Other semiconductor-related companies, such as semiconductor chip manufacturer United Microelectronics Corporation (UMC), mobile chip manufacturer MediaTek, semiconductor assembly and testing company ASE, and Foxconn - which announced its entry into electric vehicles - have been seeing record high share prices.

But while TSMC's market value is number nine in the world and within striking distance of Facebook at number eight, Taiwan's semiconductor industry is also not a "one-person arena".

A heavyweight industry supporting jobs and livelihoods

Last month, Lianhe Zaobao reported that the competition between industry leaders TSMC and UMC and their technical collaborations with various countries has spawned over 10,000 semiconductor-related companies in Taiwan and a thriving supply chain system involving hundreds of thousands of workers in integrated circuit design, manufacturing, and assembly and testing, distributed from the upstream to the downstream of the supply chain.

The semiconductor industry, made up of over 10,000 "soldier ants" - enterprises of all sizes - is lively and thriving, and the recent red-hot share prices of semiconductor companies reflect the confidence of local and overseas investors in Taiwan's semiconductor industry.

... Foxconn founder Terry Gou said that Taiwan is like "the sun at half-past five in the morning" and all ready to rise, with its advantages in the semiconductor industry and edge in pandemic containment.

The signs are that after decades of nurturing highly educated research talents, as well as investing in independent research and development, Taiwan's semiconductor industry is booming.

On 13 January, Taiwan's Foxconn announced its joint venture with Chinese automotive company Zhejiang Geely Holding Group, seeking to capture a slice of the electric vehicle market. On 21 January, Foxconn founder Terry Gou said that Taiwan is like "the sun at half-past five in the morning" and all ready to rise, with its advantages in the semiconductor industry and edge in pandemic containment.

Strong, and growing stronger

Taiwan Institute of Economic Research researcher Liu Pei-chen shared with Zaobao and the Taiwan media evidence of the booming Taiwan semiconductor industry showing that it has been in a world-leading position since 2019.

Liu said, as a result of an imbalance in supply and demand of the data storage market, there was a 12% decline in global semiconductor revenue in 2019 as compared to the 2018 total. But Taiwan reported a growth of 1.7% in the same year as a result of its leading advanced processes.

According to Liu, while the annual sales volume of the global semiconductor industry grew 5.1% last year, benefitting from business opportunities arising from distance learning and remote working due to the pandemic, Taiwan's semiconductor industry reported a whopping 20% increase.

Readers familiar with the China-US tech war would be aware that the boom Taiwan is seeing is due to TSMC's world-leading advanced technology in manufacturing chips at 5 nm and below process nodes, as well as the US clamping down on mainland Chinese semiconductor enterprises.

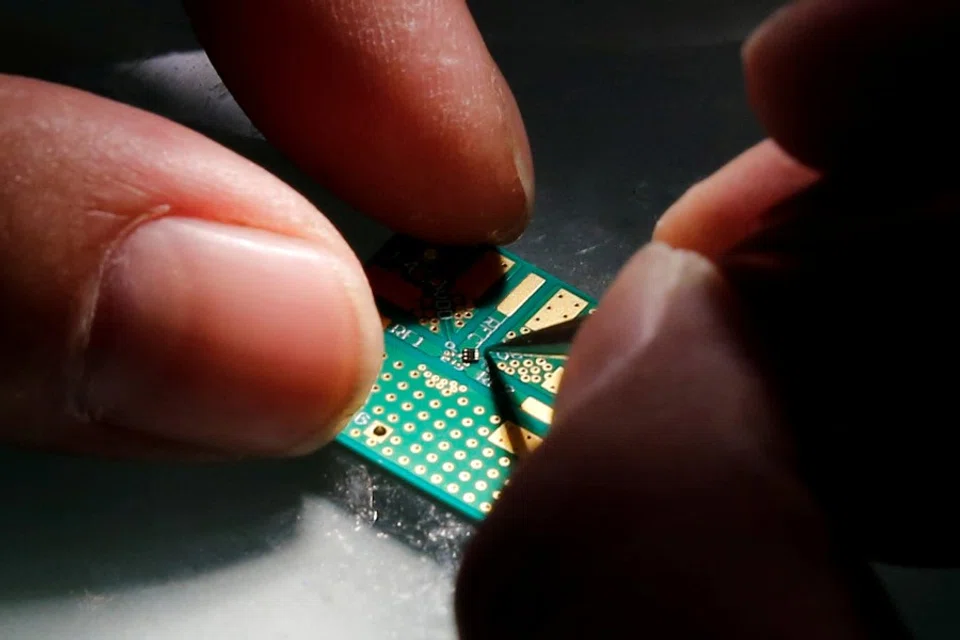

Numerous experts told Zaobao that semiconductor chips lie at the heart of cutting-edge technology and are widely used in artificial intelligence. Be it in mobile phones, computers, household appliances, automotives, or even military weapons, semiconductor chips with faster transmission speeds can provide a decisive edge whether in people's daily lives, businesses, or on the battlefield.

Since over 30 years ago, official research institutes have been set up with the aim of transferring technology to enterprises and they have strived to retain their talent through stock and profit sharing.

Advanced semiconductor technology - as good as striking gold

That is why people have described semiconductors as "new oil" and even a strategic resource.

The reason why Taiwan is leading the world in the semiconductor industry is mainly because its society attaches great importance to basic scientific research and it has long been sending top-notch talents to universities at home and abroad to study physics and electrical engineering. Since over 30 years ago, official research institutes have been set up with the aim of transferring technology to enterprises and they have strived to retain their talent through stock and profit sharing. Additionally, there has also been fierce competition between numerous industry players, and technical cooperation with elite enterprises from around the world.

This is a big revelation that Taiwan's semiconductor industry has given the world. Persisting with independent research and development, keeping the industry within its borders, absorbing talents domestically and from abroad, further driving exports through domestic demand, and doing business with the world - these have all proven to be good moves.

... can it also send help and offer assistance, contribute more technological innovations that benefit humanity, as well as promote cross-strait cooperation and exchanges on the scientific, technological, trade, and economic fronts to narrow the psychological distance between people on both sides of the Taiwan Strait?

Taiwan's semiconductor giants can give mainland counterparts a lift

Faced with tough challenges, the mainland's semiconductor industry is also absorbing talents and engaging in independent research and development at the moment. With the mainland's abundant talents and "whole-of-nation" efforts, a breakthrough will certainly be found. After all, adversities can become opportunities with a change in mindset.

The mainland's population of 1.4 billion is too big a market for Taiwanese businessmen to pass up. Taiwan has already shown that it is able to skilfully manoeuvre its way around the sensitive China-US trade war. In the future, can it also send help and offer assistance, contribute more technological innovations that benefit humanity, as well as promote cross-strait cooperation and exchanges on the scientific, technological, trade, and economic fronts to narrow the psychological distance between people on both sides of the Taiwan Strait?

The world is watching.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)