US companies in China: No place that can take China's place

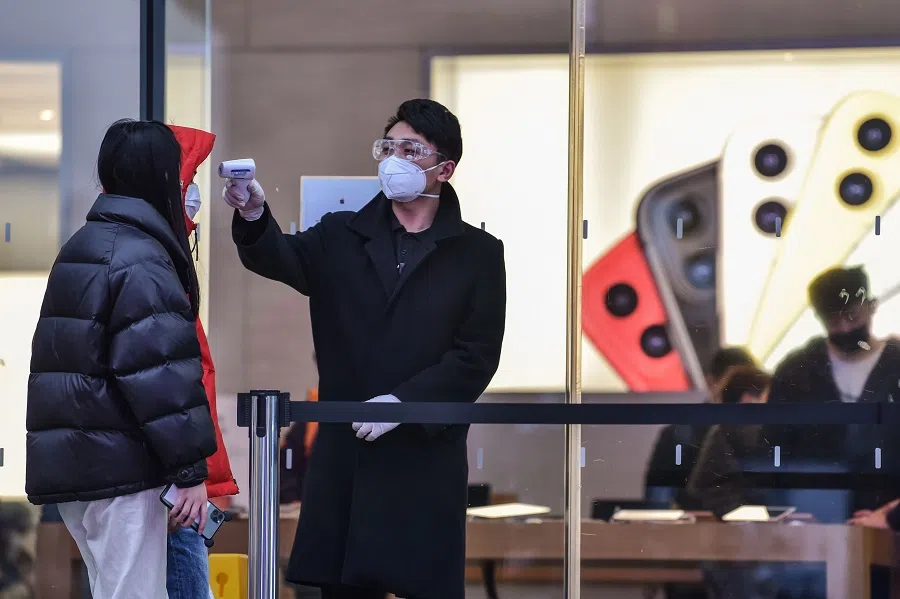

Despite a proposed White House executive order to reduce dependence on China for medical supplies, and a promise by US National Economic Council President Larry Kudlow that the US government will pay for US companies to return home, US companies in China are not biting. Zaobao correspondent Chen Jing speaks to some company leaders to find out why.

US medical supplies manufacturer Premier Guard's two factories in Guangdong resumed full production recently after a two-month halt due to the coronavirus outbreak. While there has been a jump in orders for operating gowns and face masks, company founder Charles Hubbs is not happy.

He told Zaobao that the company has to pay the salaries and social security of its workers accrued during the period of shutdown, while prices of materials are ten times what they used to be. And they do not get government subsidies because they are "a foreign-funded company".

"considering raw materials, logistics, and labour, there is no place that can take China's place" - Charles Hubbs, Premier Guard

When Hubbs came to China 30 years ago to set up the factories, he had his eye on the vast business opportunities and low costs. But over the past 10 years, China's operating costs have kept rising while competition has grown more intense. Couple these with recent frequent trade friction between China and the US and Hubbs is beginning to think about moving his factories. But after looking at Vietnam, Cambodia, and the US markets, he has decided to stay put, because "considering raw materials, logistics, and labour, there is no place that can take China's place".

These same considerations are making many other US companies in China think twice about leaving. Since the China-US trade war began two years ago, the US government has stepped up on encouraging the manufacturing industry to leave China and relocate back to the US. The urgent need for medical supplies in the US due to the coronavirus outbreak has made US President Donald Trump even more determined to "de-sinicise" or stop US firms from being too reliant on China.

US government's carrot not enticing enough

At the end of last month, White House trade adviser Peter Navarro announced that the government was about to release an executive order that would help relocate medical supply chains from China and overseas. Shortly after, US National Economic Council director Larry Kudlow proposed on 9 April that the US government will "pay the moving costs" of every American company that wants out of China, including expenses for plants, equipment, intellectual property, structures, and renovations. The idea is to encourage US companies to return to the US and invigorate the US economy, while reducing dependence on supplies from China. However, this generous-looking proposal is not sufficiently attractive for the businesses and industry players that Zaobao spoke to.

American Chamber of Commerce in Shanghai President Ker Gibbs said most of the Chamber of Commerce's 1,500 members provide products and services to the China market, and moving back to the US would not be realistic unless they gave up this huge market.

Gibbs was previously on the management teams of major US companies such as Apple and Disney. He said companies consider factors including labour, supply chain, and distance from target markets when establishing factories. "The spending power of China's consumers is growing, and there is a comprehensive local industrial ecosystem. These are the key reasons that attract US companies to stay."

"Want me to give up this competitive edge and start again back in the US? No way!" - Philip Richardson, Trueanalog

US businessman Philip Richardson, who supplies audio equipment to Europe and US markets, told this reporter that what companies need even more than hardware is raw materials and workers, and the US has no edge in these areas. "What Kudlow said shows that he knows nothing about how the supply chain really works."

Richardson's Trueanalog audio equipment factory in Panyu, Guangdong, resumed operations after a one-month delay, but the current global spread of the coronavirus has led to a 30-50% reduction in export orders to Europe and the US, with a loss for the first half of this year all but confirmed. Despite this, Richardson has no thought of leaving China. He said the copper, steel, and magnets needed in the manufacturing of speakers are all available within a 100km radius, and the company has built strong relationships with suppliers over the years. He said, "Want me to give up this competitive edge and start again back in the US? No way!"

Pull factors more significant than push factors

The fact is, even at the height of the China-US trade war last year, a survey of 100 US companies by the US-China Business Council showed that even though 80% of respondents had their operations affected by the trade war, only 3% intended to move back to the US and 10% to other countries, while the other 87% chose to remain in China. (NB: Between 6-13 March, the American Chambers of Commerce in Beijing and Shanghai and PricewaterhouseCoopers conducted a survey of 25 companies with global revenue of over US$500 million. Results show that a mass exodus of US companies from China is not on the cards. Almost 70% of respondents expected their China operations to return to normal in less than three months. That said, the proportion of respondents who think that economic decoupling between the US and China is unlikely fell from 66% (when last asked last October) to 44%.

...the good coordinating mechanisms and effective measures implemented by China for the resumption of work, are way ahead of many Southeast Asian countries that have sunk into the crisis of shutdowns.

Senior partner David Buxbaum of Anderson & Anderson LLP, a law firm that provides legal services to various US companies in China, told us that the US government's move to bring enterprises home for strategic reasons during these extraordinary times is understandable. However, he thinks that there is no need for all US enterprises to move out of China, especially when the economic order in China is gradually being restored. He said, "The phase one trade agreement signed early this year has helped improve the harsh environment that US companies in China had to operate under. If US companies are able to flourish in China, it is beneficial for the US economy as well."

American multinational investment bank and financial services company Morgan Stanley also predicted in April that the pandemic would slow the process of moving supply chains out of China. Firstly, the shadow of a global economic downturn would cause companies that have initially wanted to set up factories elsewhere to slow the pace of investments. Secondly, the good coordinating mechanisms and effective measures implemented by China for the resumption of work, are way ahead of many Southeast Asian countries that have sunk into the crisis of shutdowns. This demonstrates the advantage that a traditional manufacturing major power has over other emerging markets.

Foreign enterprises moving out of China a long-term trend

However, Gibbs thinks that having experienced the impacts of the trade war and the ongoing pandemic, US enterprises would have a better handle on managing the risks associated with an over-reliance on the Chinese market. While US companies would not give up the Chinese market, companies with strong financial resources may attempt to diversify their production bases to numerous other countries to avoid disrupting their supply chains.

It is not only the US government that has pushed for a "de-sinicisation" of enterprises amid the pandemic. The Japanese government has also decided to set aside ¥243.5 billion (roughly S$3.23 billion) to help companies bring production facilities back to Japan or move to other countries in its stimulus package announced two weeks ago.

...even if the US government implements a policy that reimburses the relocation costs of US companies, only multinational enterprises will benefit.

Hubbs sees foreign companies moving out of China as a long-term trend and plans to seize this opportunity to develop new businesses. He said, "We can provide consultation services to other manufacturers based on our rich experience in setting up factories in China and overseas field study. We can help them to avoid needless false starts as they shift their supply chains elsewhere, and discover more possibilities outside of China."

Multinationals have the greatest mobility

Compared with small and medium enterprises (SMEs) that heavily rely on China's supply chains, multinational enterprises with production lines all over the world have the necessary conditions to leave as they please. Among these multinational enterprises, the cost for technological enterprises to shift elsewhere is the lowest.

In a survey of 119 member companies of the American Chamber of Commerce in the People's Republic of China released last month, large US companies with over 2000 employees have the least dependence on Chinese SMEs. Based on the responses, the research and development industry is not as reliant on China's supply chain as industrial, consumer goods, and services industries. 22% of interviewed industrial enterprises think that they are highly dependent on the SMEs, but none of the technological enterprises think so.

"Our employees are all Chinese. Helping us to tide through this tough period is also helping the locals to keep their jobs." - US businessman Philip Richardson

Hence, Richardson predicts that even if the US government implements a policy that reimburses the relocation costs of US companies, only multinational enterprises will benefit. He said, "To the small enterprises, the differences between the salaries of Chinese and American employees are already too much to bear. The daily wage of a Chinese employee is around US$60 (roughly S$85.70) while the daily wage of an American employee is US$170. Would the US government help reimburse the difference in wages?"

However, Richardson also hopes that the Chinese government will consider the needs of small foreign enterprises like his own that have slogged for a long time in Chinese soil when it launches aid measures. He said, "Our employees are all Chinese. Helping us to tide through this tough period is also helping the locals to keep their jobs."

Related: How many US companies will leave China? | From supply chain to BRI, a super-connected China impacts the world | Wake-up call for ASEAN countries: Curb over-reliance on China and seize opportunities of global supply chain restructuring | Covid-19: US needs to revive its manufacturing industry and rebuild itself

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)