China's three-year stock slump resists policy prescriptions for rebound

China ended the year with the world's worst-performing equity market and its blue-chip CSI 300 Index down for the third straight year, losing 35% over 36 months. Amid different approaches to stabilising the stock market, several economists think that the key is to formulate appropriate policies and promoting necessary structural reforms to help get the economy back on track to its potential growth rate.

(By Caixin journalists Wang Juanjuan, Yue Yue, Quan Yue and Denise Jia)

Chinese investors began 2023 full of optimism that an economic rebound fuelled by resilient export growth, relaxed real estate policies and other regulatory prescriptions would lead to a turnaround for the nation's bear market in stocks. Instead, China ended the year with the world's worst-performing equity market and its blue-chip CSI 300 Index down for the third straight year, losing 35% over 36 months.

The bear market for equities - triggered by the pandemic - now reminds investors of the 2015 stock market crash when A-shares lost a third of their value in one month and a series of government interventions did little to quell investor fears.

Since August, the authorities have launched a series of support measures, such as lowering the stamp duty on stock trades, tightening regulations on initial public offerings (IPOs) to limit the number of IPOs and reducing the minimum margin ratio for stock purchases through margin financing. Since October, China's US$1.24 trillion sovereign wealth fund, Central Huijin Investment Ltd., has repeatedly bought exchange-traded funds (ETFs) and shares of state-owned banks.

In December, the country's securities watchdog released new rules for listed companies' share buybacks and cash dividends, aiming to boost market confidence. The measures failed to reignite investor optimism. The CSI 300 benchmark continued its decline in the first three weeks of January before recovering some lost ground end of January. The index was still down 10% for the new year.

Different from previous A-share slumps, in which heavy-leveraged institutional investors suffered the worst losses, the current bear market has hurt individual investors the most.

Experts have diverging views on the current regulatory policies to stabilise the stock market. Some call for a halt to IPOs, limits on selling by large shareholders and the rapid establishment of a stabilisation fund to buy shares. Others say it is necessary to respect the laws of the market and that government should notplace too many restrictions on stock trading.

"Rescuing the market is not a long-term solution," Hu Zuliu, who also goes by Fred Hu, founder and chairman of private equity firm Primavera Capital and a former economist at the International Monetary Fund, told Caixin in January in Davos, Switzerland. "The focus should be improving fundamentals and improving confidence."

Snowball-triggered selloff

Different from previous A-share slumps, in which heavy-leveraged institutional investors suffered the worst losses, the current bear market has hurt individual investors the most.

Among the more than ten listed brokerages that have posted 2023 results, all but one reported increased net profit, and most cited gains from investments.

Chinese retail investors who loaded up on derivative products known as "snowballs" have been hit particularly hard, further undermining market confidence.

Snowballs are derivatives that promise sizeable interest payments as long as the underlying stock indices trade within a certain range. Once the index breaches a pre-set lower limit, it will trigger a so-called knock in that leaves holders with substantial losses.

The protracted A-shares rout has led to many snowball products, especially those tracking the CSI Smallcap 500 Index and the CSI 1000 Index, breaching the knock-in level, triggering forced sales of the futures contracts.

A screenshot of a snowball investor's online chat that went viral online recently showed that the investor bought 8 million RMB (US$1.11 million) of snowball products tracking the CSI 500 Index. After the index dropped more than 25%, the investor's investment was wiped out, the screenshot showed.

As snowball products are traded in the over-the-counter market, there is no public data on the scale of their use. China Futures Co. Ltd. and Cinda Securities estimated the value of snowball products tracking the CSI 500 Index and the CSI 1000 Index at 200 billion RMB. Sinolink Securities estimated the market at more than 327 billion RMB. Multiple brokerages estimate that the decline in stocks has pushed 100 billion RMB of snowball products near their knock-in level.

"Buying stocks is buying the future. How can you expect the stock market to rise when listed companies generally have poor earnings and no revenue growth?" - a market veteran

But some analysts say the snowball-triggered selloff is not enough to move the whole market. "The concentration of snowball knock-ins is at most just one of the reasons for the recent market decline, and one that is easy to be seen on the surface, but it can't play a decisive role in terms of quantity," a public fund manager in Shanghai told Caixin on 24 January. Many people ignore that the fundamentals of A-shares since last year are not very good and a large number of listed companies have posted worse-than-expected financial results, the fund manager said.

"The problem is not just the stock market," a person close to the regulators told Caixin. "The root cause is the macroeconomic and external environment." The person cited the weak economic recovery, a sluggish real estate market and a "decoupling" between China and the US.

Although China managed to generate 5.2% growth in 2023 GDP, many challenges at the microeconomic level remain and many listed companies are under financial pressure, Hu said.

One market veteran said in August: "Buying stocks is buying the future. How can you expect the stock market to rise when listed companies generally have poor earnings and no revenue growth?"

During last year's third quarter, 5,279 Chinese listed companies reported total revenue of 53.27 trillion RMB, an increase of only 2.22% from the 2022 third period. Among them, 1,041 companies reported net losses for the first three quarters, and almost half of them posted profit declines ranging between 13.3% and 37.5%, according to their financial reports.

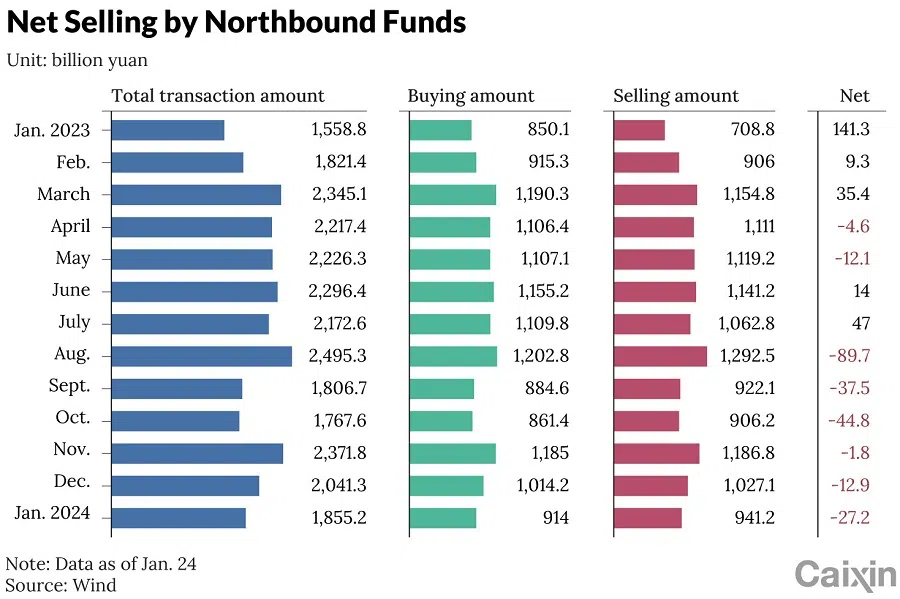

Northbound funds, mainly consisting of foreign capital by offshore investors flowing back to the A-share market through Hong Kong, are often referred to as smart money and have long been seen as a bellwether for foreign investor sentiment.

Since August, foreign holders have sold net 213.8 billion RMB of A-shares as of January 24, according to data from Wind Information Co. Ltd.

Call off IPOs

Some experts say Chinese regulators should suspend IPOs again, as they did in previous stock market routs. China suspended IPOs in 2013 and for about five months in 2015.

Since the sharp drop in stock prices in August, the China Securities Regulatory Commission (CSRC) has gradually slowed the pace of IPOs. At that time, many investors expected the tightening period to last longer than the previous suspension. There speculation was that the regulator would apply the brakes for at least a year by tightening the listing threshold.

At a press conference in September, the CSRC responded to reporters' questions on the matter cautiously, saying such speculation was incomplete or inaccurate.

In July, August, October and November, the Shanghai and Shenzhen stock exchanges and their Nasdaq-like tech boards did not process any IPO applications. Then the exchanges reviewed 20 IPO applications in the last week of December.

In 2023, Shanghai and Shenzhen stock exchanges approved 245 IPOs, 38% fewer than in the previous year. Only 32 new listings occurred from September through December amid efforts to temporally slow IPOs in response to market fluctuations, Yan Bojin, head of the CSRC's department of public offering supervision, said at a press conference on 12 January.

"The CSRC and stock exchanges will continue to uphold stringent IPO standards, enhance the quality of listed companies from the start and perform counter-cyclical adjustments," Yan said.

Hong Hao, chief economist at Grow Investment Group, believes the suspension of IPOs can temporarily reduce the capital that IPOs divert from existing stocks, but it would not cure the market's decline.

"It is normal to see more IPOs when the market is good and less when the market is down," said a managing director at a brokerage. But manually controlling the number of IPOs is not in line with the concept of the IPO registration system, which is to return the power to the market and investors, he said.

Historical data also show that the suspension of IPOs won't rescue the market, but creates backlog of initial offerings that flood the market later.

In the last market slump in 2015, the CSRC suspended IPOs between July and November of that year, during which the Shanghai Stock Exchange Composite Index still fell 3%.

From 1994 to 2015, the CSRC suspended or tightened IPO approvals nine times, with the duration ranging from three months to 15 months, according to data from Topsperity Securities. During the nine suspensions, the Shanghai Stock Exchange Composite Index fell five times and rose four times, suggesting that IPO suspensions are not co-related to subsequent market moves.

Regulators should try to maintain a certain pace for IPOs because a suspension could build up the demand for shell buying and boost speculation for small cap and junk stocks... - an executive at a small brokerage

"Instead of calling for calling off IPOs, it is better to think about why there are still a large number of new issues when the stock market has been depressed for so many years," a former analyst at ArrowGrass, Deutsche Bank's hedge fund, told Caixin.

While A-share IPOs and financing decreased in 2003, the Shanghai and Shenzhen Stock Exchanges still rank first and second in the world respectively in terms of fundraising, according to a report by PwC. The consulting firm expects China's A-share IPOs will outpace all other markets this year.

China has never established an effective price mechanism for IPOs, according to an executive at a small brokerage. No matter which company is going public, retail investors rush to buy their new shares, the executive said.

Regulators should try to maintain a certain pace for IPOs because a suspension could build up the demand for shell buying and boost speculation for small cap and junk stocks, which will cause further chaos in A-share prices, the executive said.

Despite the current macro and micro economic challenges and the wavering of investor confidence, many economists have pointed out that the fundamentals of China's economy have not reversed. To stabilise the stock market, the key is to formulate appropriate policies and promoting necessary structural reforms to help get the economy back on track to its potential growth rate, they said.

This article was first published by Caixin Global as "Cover Story: China's Three-Year Stock Slump Resists Policy Prescriptions for Rebound". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)