[Big read] Can China have its own SpaceX?

Walking into Yizhuang New Town, Yinghai town, in Beijing's Daxing district, one sees on both sides of the quiet streets a scattering of residential houses, old factories and large areas of land awaiting development amid metal scaffolds.

This small town about an hour's drive away from Beijing's city centre seems to be slumbering, but come April, it will be transformed into China's base for the high-tech commercial aerospace industry - an area dotted by textile factories with simple exteriors will be reconstructed into a "rocket street", gathering China's leading aerospace firms and pushing the area to the forefront of China's commercial aerospace technology.

A national effort

In February, the Beijing government announced that it would create China's first commercial aerospace research and production hub in Yinghai. Rocket Street, a rocket park set to become a national demonstration zone, will occupy the most centralised location in the aerospace area. Construction will begin on this 140,000-square-metre facility in April this year, and it will be ready for use by the end of 2025.

The large-scale Rocket Street construction project caps off China's commercial aerospace industry, which has been growing in the past nine years and is now set for a rapid takeoff.

In the past few years, local governments all over China have been stepping up efforts to nurture an aerospace giant that can rival US commercial aerospace leader SpaceX.

In 2015, Chinese officials released its medium- to long-term development plan for civilian space infrastructure development for 2015 to 2025, encouraging social capital to partake in the development of national civilian space infrastructure and related applications, marking the start of China's development in commercial aerospace.

Due to intensifying US-China aerospace competition, the CCP's Central Economic Work Conference announced in December 2023 that it would "open up new paths for future industries", including the field of commercial aerospace, providing a shot in the arm for its development.

In the past few years, local governments all over China have been stepping up efforts to nurture an aerospace giant that can rival US commercial aerospace leader SpaceX.

In January, Beijing announced an action plan to accelerate the development of commercial aerospace innovation. It aims to attract and nurture high-tech enterprises, specialised, refined and new firms, as well as unicorns to build specialised industry-dedicated zones and business parks by 2028.

Local governments in Shanghai, Tianjin, Chongqing and Shenzhen among others, have also come up with policies to support the aerospace industry in the past few years.

China's commercial aerospace industry optimistic for future growth

This great push from the authorities has led to a boom in the growth of China's commercial aerospace industry.

According to data from qcc.com, there are currently more than 21,000 aerospace-and-satellite related firms in China, with 51,400 new firms established in 2023, a 42.84% year-on-year growth.

China launched a total of 270 satellites into space last year, with 137 or 65% of them being commercial satellites. China's commercial aerospace industry also set new launch records, with 67 orbital launches in 2023, which accounted for 30% of global orbital launches, coming in second, behind only the US's 116 launches, which accounted for 52% of the global total.

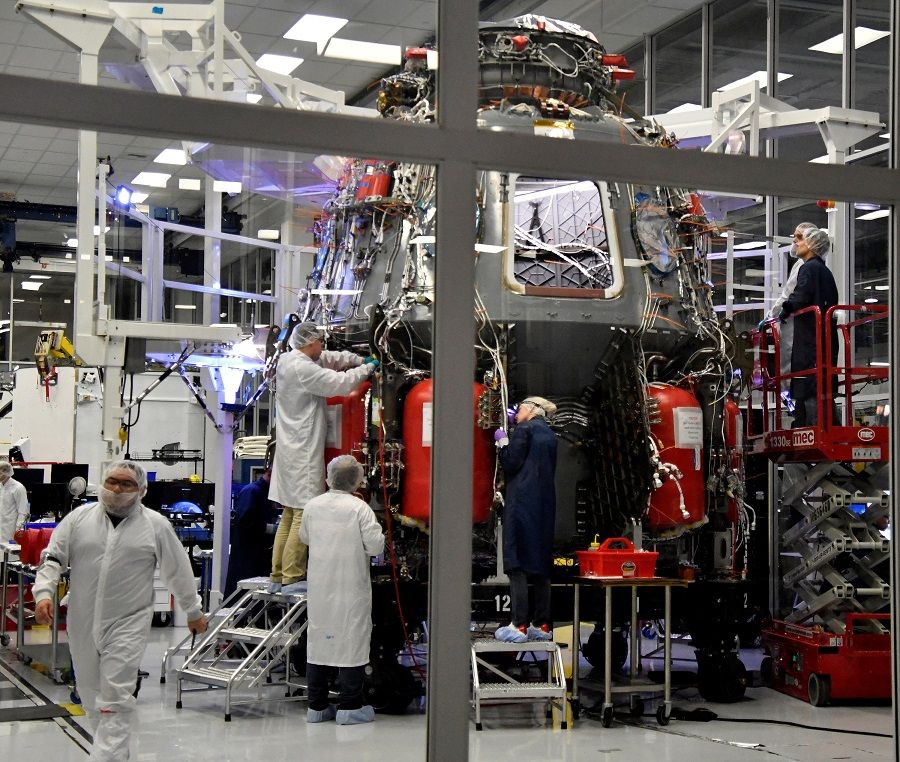

As of publication, there are at least six private aerospace firms that have successfully launched a rocket into orbit, including Space Pioneer, LandSpace and Orienspace.

In an interview with Lianhe Zaobao, a Space Pioneer representative said: "There is an unprecedented opportunity for growth for China's commercial aerospace industry, spurred on by the strong demand in the satellite internet market."

Co-founder and co-president of Orienspace Yao Song pointed out when interviewed that China's commercial aerospace market is "very clearly an emerging industry that will continue its rapid growth for the next ten years".

He felt that China's commercial aerospace industry has built up some capabilities in the past decade, and has a good foundation in launching rockets, manufacturing satellites, measurement and control among other areas. "In the coming years, satellite internet, as a next-generation communication technology, will be an important infrastructure. China is very willing and capable of strengthening its construction efforts. As a significant consumer of applications, it would in turn spur the rapid development of many commercial aerospace sectors, such as commercial rockets, satellite manufacturing, satellite payload and so on."

A LandSpace representative said when interviewed that China has advantages such as a comprehensive industrial system, the capability for industrial development across the board, low production and manufacturing costs, and a huge pool of engineering talent among others, and that "there is much room for development in the future, providing wide market opportunities for China's commercial aerospace industry".

Space capabilities - economically, militarily, and diplomatically - are part of the US-China competition. - Ian Christensen, Director, Private Sector Programmes, Secure World Foundation

Commercial aerospace an area for China-US strategic competition

The commercial aerospace sector has become an increasingly important second race track in the China-US aerospace competition. Research by think tank Taibo Network showed that the commercial aerospace industry globally would be in its golden phase for development from 2023 to 2028, and by 2025, the market size for China alone would hit 2.8 trillion RMB.

Ian Christensen, director of private sector programmes at Secure World Foundation, said when interviewed that "space is viewed in many countries around the world as an emerging sector of strategic and national interest, and China is no exception".

He said: "Many of the programmes in China's commercial space sector - including broadband satellite internet, satellite navigation services and satellite earth observation and remote sensing projects - are being done to provide service to domestic needs and infrastructure, including supporting e-commerce."

Christensen pointed out that politically, the Chinese government has seen the progress made by the US and European space sectors, and wants to compete. Space capabilities - economically, militarily, and diplomatically - are part of the US-China competition.

Lynette Tan, chairperson of Singapore-based space consulting firm Space Faculty, said when interviewed that the global space industry is worth US$546 billion dollars, and the majority of that industry lies in commercial applications. Therefore, as China develops its space ecosystem, it is inevitable that the focus will eventually include the growth of the commercial space sector, adding that these commercial ventures encompass a wide range of applications, such as remote sensing data acquisition and processing, as well as the development of application software tailored for agriculture, transportation, environmental monitoring, and disaster assessment.

Based on the "first come, first served" principle, once an orbit is at maximum capacity, it cannot be used by those who come later.

LEO satellites a key battleground

The satellite systems industry is the most competitive field when it comes to commercial aerospace competition; with orbit track and radio frequency being finite resources, the first-come-first-serve system adopted by the International Telecommunication Union (ITU) means that each country must race against time to fight for a spot in space.

Statistics show that low Earth orbit (LEO) satellites are dominating the space development scene, accounting for a whopping 98.9% of satellites launched globally in 2022.

However, there is a limited capacity for LEO satellites in space, with no more than 60,000 LEO satellites orbiting between 300 and 1000 kilometres. Based on the "first come, first served" principle, once an orbit is at maximum capacity, it cannot be used by those who come later.

Whether in terms of national defence strategy or commercial considerations, LEOs are an important strategic resource that countries are racing to take a bite out of. One of the main reasons why many governments are promoting the development of commercial spaceflight is to leverage the power of the private sector to dominate the LEO landscape.

Starlink, a satellite internet constellation operated by American aerospace company SpaceX, is currently the world's largest LEO satellite constellation with a fleet of nearly 42,000 satellites.

In September 2020, the China Satellite Network Group Co submitted its "GW" satellite constellation plan consisting of 12,992 satellites to the ITU to construct its own satellite internet network. China's G60 Starlink, another major satellite internet project, also plans to launch over 10,000 satellites. Based on the current launch capacity of commercial rockets, it will take until at least 2030 to complete the massive launch demand. Commercial spaceflight has now become a choke point in the development of the satellite internet.

The person-in-charge of Space Pioneer told Lianhe Zaobao that under the dual support of policy and capital, the size of the satellite launch market grew from 376.4 billion RMB (US$52 billion) in 2015 to 1.26 trillion RMB in 2021, with a compound annual growth rate of 22.35%. Based on the normal market growth rate over the past five years, the size of the commercial spaceflight market is expected to exceed 2.83 trillion RMB by 2025.

Apart from expanding a country's presence in orbit, commercial spaceflight companies also play an important role in expanding the country's space discourse.

Michelle Hanlon, executive director of the Center for Air and Space Law at the University of Mississippi, said when interviewed, "Strategically, there may be certain things a commercial entity can do that a sovereign nation cannot."

There are many gaps in the existing Outer Space Treaty, such as in Article VI, which requires that sovereign nations authorise and supervise the activities of their nationals. It also requires them to assure that all activities "conform" with the provisions of the Outer Space Treaty, which offers private aerospace companies more flexibility in interpretation.

Hanlon said, "The United Nations Committee on the Peaceful Uses of Outer Space is pushing to allow commercial stakeholders to have a say in how future activities may be regulated. This could be perceived to put China at a disadvantage if commercial entities from other countries outnumber them."

China's commercial spaceflight sector is tightly bound to official policies, leading many people to question if this model can nurture a Chinese space giant that can surpass SpaceX.

Both a challenge and an opportunity

The highly autonomous US commercial space development model is seen as one of the key reasons why SpaceX is able to freely make rapid technological breakthroughs. On the other hand, China's commercial spaceflight sector is tightly bound to official policies, leading many people to question if this model can nurture a Chinese space giant that can surpass SpaceX.

Most interviewed academics think that the tight official leadership is both an opportunity and a challenge for China's private space enterprises.

Roger Handberg, a space policy specialist at the University of Central Florida, told Lianhe Zaobao that while China's space technicians have great potential, the question is to what extent will the government allow them to go forward in pursuit of opportunities that do not exist today. He said, "Commercial space is about the future, not necessarily the planned directions laid out by the government which makes it both exciting and unsettling."

Taking the US as an example, he pointed out that the US government learned in the aftermath of the end of the Cold War to allow the commercial sector to go forward even when that distressed the bureaucrats in NASA and the military. The development of commercial spaceflight in the US has exceeded NASA's original expectations, and commercial spaceflight has in turn contributed to the development of American space exploration.

Handberg said, "Whether the Chinese government is willing to assume that 'risk' is the question only China can answer. If the support is positive, then China will move forward more quickly than otherwise."

... private space companies in China face strict official regulations and must report their activities to the authorities, including cybersecurity, space security, and their latest technological developments, which may limit their innovative capabilities. - Professor Namrata Goswami, Thunderbird School of Global Management, Arizona State University

Lynette Tan of Singapore's Space Faculty assessed that with a strong government presence and influence, coupled with the language barriers, China may not have a natural advantage attracting overseas companies to operate in China, which could be a limiting factor in encouraging the diversity of ideas and talent. The question remains how successful China will be in exporting its commercial space services to other countries and driving greater collaboration under the perceived shadow of the government's influence.

Namrata Goswami, a professor at the Thunderbird School of Global Management, Arizona State University, said in an interview that one of the biggest advantages of commercial spaceflight in China is government support such as subsidised rates and access to state-owned spaceports. Chinese officials have provided clear and long-term guidelines for private space enterprises, which offers the Chinese commercial space industry another advantage.

However, this could also put pressure on private companies. Goswami pointed out that private space companies in China face strict official regulations and must report their activities to the authorities, including cybersecurity, space security, and their latest technological developments, which may limit their innovative capabilities.

Despite its rapid development, China's commercial spaceflight sector still significantly lags behind the US. Goswami predicts that it may take until around 2030 before Chinese companies may catch up to the level of capabilities of the US, and that the only thing that might slow US commercial capabilities down and render them ineffective is the lack of strategic coherence about space by US presidential administrations and lack of ambition.

This article was first published in Lianhe Zaobao as "不让美国一枝独秀 中国商业航天乘势升空征苍穹".