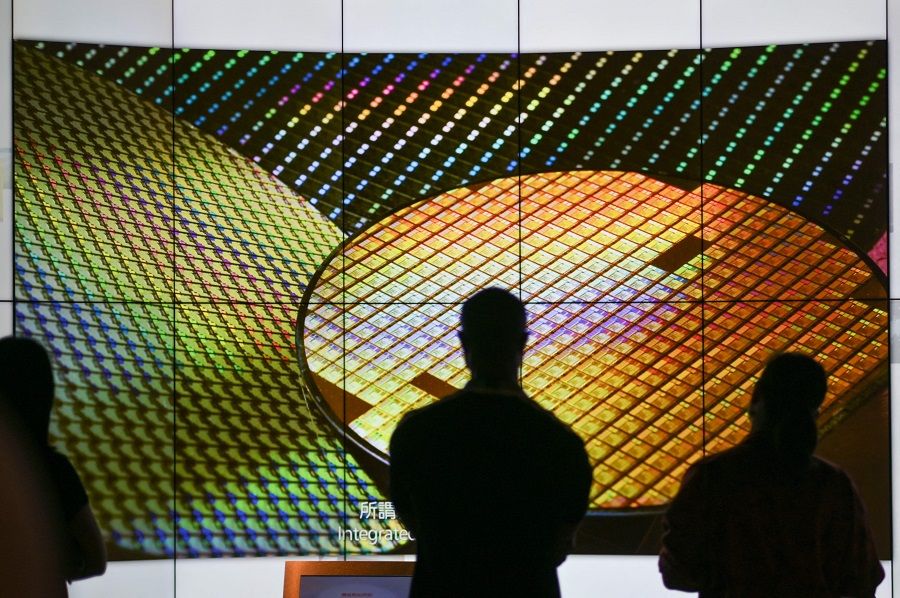

Has China's chip sector reached the end of the line?

On 25 September, just days before the Mid-Autumn Festival, Huawei held its autumn launch. The spotlight was on movie star Andy Lau, ambassador for the company's high-end Mate 60 RS Ultimate Design.

With a starting price of 11,999 RMB (US$1,670), the Mate 60 RS is the deluxe version of the Mate 60 Pro, which also previously garnered global attention. Both phone models are equipped with the same 7-nanometre (nm) Kirin 9000s chip produced by Semiconductor Manufacturing International Corporation (SMIC).

However, the chip was not highlighted at the launch, which seemed like a deliberate attempt to minimise the attention towards it from the outside world.

Manufacturing partners backing away

Huawei CEO Ren Zhengfei is no stranger to shelling out huge sums of money on technological development and recruiting global talents. Established by Huawei in 2004, HiSilicon is mainland China's largest fabless semiconductor design factory, with a market share in the mainland exceeding that of US chip giant Qualcomm.

HiSilicon released the Kirin 9000 chipset in 2020 but outsourced the manufacturing of the chip to Taiwan Semiconductor Manufacturing Company (TSMC) because HiSilicon only has design capabilities and not production capacity. Prior to that, the HiSilicon-designed Kirin 970, 980 and 990 chipsets were also produced by TSMC via its 10-nm and 7-nm processes.

Fuelled by the advanced chips produced under the HiSilicon-TSMC alliance, Huawei shipped 55.8 million units of phones in the second quarter of 2020, snagging a 20% global smartphone market share and overtaking South Korea's Samsung. It even became the world's largest smartphone manufacturer in terms of market share at one point.

Why did TSMC comply with the US to boycott Huawei? It is because TSMC uses numerous patented US technologies.

But all good things must come to an end - following ZTE Corporation, Huawei was caught in the middle of the China-US tech war. While Huawei spent a fortune on research and development, it was accused by the US of stealing its advanced technologies. Coupled with the fact that some countries were concerned with the security of data stored on Huawei phones, the company's global market share took a nosedive.

In July 2020 during an investors conference, TSMC chair Mark Liu confirmed that the company will no longer supply chips to Huawei after the grace period for the US export ban on Huawei ends in mid-September that year. Huawei was TSMC's second largest customer, second only to Apple.

A month later during the China Info 100 held in the mainland, Richard Yu, CEO of Huawei Consumer Business Group, said, "Unfortunately, in the second round of US sanctions, our chip producers only accepted orders until 15 May. Production will close on 15 September. This year may be the last generation of Huawei Kirin high-end chips."

Under the dual blow of the pandemic and US sanctions, Huawei's global sales plummeted and no longer posed a threat to Samsung and Apple. The US's cutting off of HiSilicon's access to advanced chips badly impacted China's telecommunications sector and gave the US an absolute lead in the global 5G race.

Why did TSMC comply with the US to boycott Huawei? It is because TSMC uses numerous patented US technologies. Similarly, Dutch chipmaking equipment giant ASML covets the mainland Chinese market, but is restricted by US tech sanctions on China due to ASML's use of patented US technologies. Thus, the company is unable to supply extreme ultraviolet (EUV) lithography machines to the mainland.

The US government placed Huawei on a trade blacklist in May 2019. But the ban at the time only applied to goods that have 25% or more of US-originated technology or materials. Suppliers across the world, regardless of whether they are US enterprises, are required to obtain US government approval to supply such products to Huawei.

Restrictions were tightened the following year, stipulating that any product containing patented US technologies and software would need to be approved by the US. As a result, TSMC could no longer do business with HiSilicon. During the 120-day grace period, Huawei placed an urgent order totalling US$700 million, which included Kirin 9000 chipsets for the Mate 40 smartphone.

...mainland China's traditional realist paintings are usually painted with a fine brush, but SMIC was able to use a thick brush to produce 7-nm chips. - Lin Yi-jing, Taiwanese tech expert

Technological breakthrough?

TSMC originally supplied over 90% of Huawei's smartphone chips. Without TSMC's technological support, Huawei's profit declined by more than half while its global market share plunged from the top three to about tenth place.

Unexpectedly, the Kirin 9000 chip, which Huawei itself thought was going to die a natural death, was revived three years later.

The Kirin 9000s chipset used in the Mate 60 RS is manufactured by the mainland's SMIC. This chip attracted global attention because previously, the Kirin 9000 chip used in the Mate 40 and produced via TSMC's 5-nm processes was not 5G-capable under US sanctions. This time, however, SMIC was able to produce 5G-capable chips via its 7-nm process. Does this mean that mainland China's semiconductor sector has overcome US sanctions and achieved a technological breakthrough?

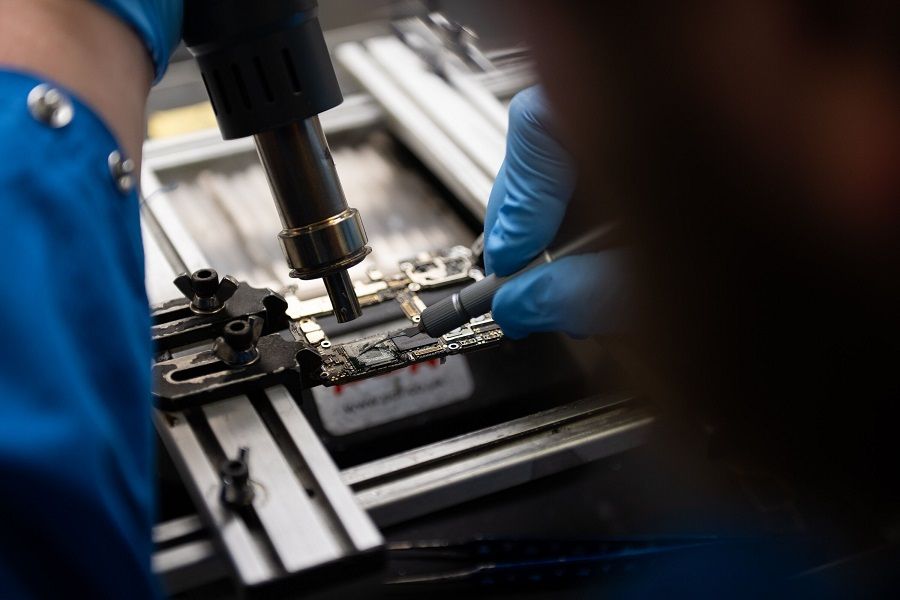

Major manufacturers produce 7-nm chips using EUV lithography machines. But under US sanctions, enterprises with relevant technologies such as ASML and Tokyo Electron Limited cannot supply these machines to mainland China. As a result, SMIC can only use the more outdated deep ultraviolet (DUV) lithography system to produce its 7-nm chips.

Taiwanese tech expert Lin Yi-jing (林宜敬) illustrated this with a vivid analogy: mainland China's traditional realist paintings are usually painted with a fine brush, but SMIC was able to use a thick brush to produce 7-nm chips. This is certainly commendable from a technological standpoint.

However, producing 7-nm chips with DUV lithography systems requires multiple exposures, which would affect yield and cost, making it difficult to achieve mass production. Taiwanese semiconductor practitioners estimated that SMIC's 7-nm process has a yield of less than 15%, compared with TSMC's 80%.

Chung-Hua Institution for Economic Research vice-president Wang Jiann-Chyuan pointed out that the yield of 7-nm chips produced through DUV with multiple exposures must reach around 70-80% before it becomes profitable.

Furthermore, this is not considered a major breakthrough in semiconductor technology either - TSMC's first-generation 7-nm chips were produced using DUV lithography systems in 2018. Samsung and Intel also previously accomplished the same. But because of the low yield, these three advanced manufacturers quickly switched to the EUV lithography machine instead.

...the mainland China's "little pinks" are "overexcited", thinking that SMIC can thus produce 5-nm and 3-nm chips. He asserted that this is somewhat a "castle in the air" - the 7-nm process is the "end of the line" for China.

Based on tests and measurements, the Kirin 9000s chipset produced by SMIC using DUV lithography systems is equivalent to Qualcomm's Snapdragon 865 chip, which powers Xiaomi's Mi 10 Pro smartphone released in 2020. While it may be better than TSMC's 10-nm process, its efficiency is lower than the TSMC's 5-nm chip used in Huawei's Mate 40 smartphone in 2020.

In addition, the more advanced DUV models capable of producing 7-nm chips that ASML supplies to mainland China have also fallen under US restrictions as of 1 September, and can only be exported until the end of the year.

Ray Yang, consulting director at Industry, Science and Technology International Strategy Center of Taiwan's Industrial Technology Research Institute, said that the mainland China's "little pinks" (小粉红, blind supporters of Chinese nationalism) are "overexcited", thinking that SMIC can thus produce 5-nm and 3-nm chips. He asserted that this is somewhat a "castle in the air" - the 7-nm process is the "end of the line" for China.

More accurately, if the US does not ease its sanctions on mainland China's semiconductor sector, it would be extremely difficult for the mainland to independently build its own EUV lithography machine to develop more advanced processes.

Turning the tide with major investment

Why didn't Huawei highlight the Kirin 9000s chipset at the launch event? Research fellow at Academia Sinica and expert on the semiconductor industry Wu Jieh-min pointed out that news of the revival of Huawei's Mate smartphone series under the Huawei-SMIC alliance were made with great fanfare with clear rent-seeking motives.

He noted that many telecommunication enterprises are eyeing the mainland's third round of investment by the state-backed Big Fund worth US$41.1 billion. In other words, the companies concerned will be able to receive a significant subsidy from the Big Fund regardless of whether the Kirin 9000s chip brings in economic benefits or will still be produced in the future.

Despite support from the Big Fund, mainland China's semiconductor sector reported lacklustre growth this year.

Will the whopping US$41.1 billion investment fund help China's semiconductor sector "overtake on the bend" (弯道超车)? While this figure seems massive, TSMC's capital expenditure in 2023 exceeded US$32 billion, which is already 80% of the investment.

Besides, based on past records, ineffective and redundant investments coupled with corruption had cost the Big Fund a huge sum of money. Last year, the Big Fund was embroiled in a corruption scandal, and several executives of Sino IC Capital, which managed the fund, were investigated and punished.

Despite support from the Big Fund, mainland China's semiconductor sector reported lacklustre growth this year. Based on SMIC's financial report released in August, its net income and revenue for the second quarter of the year fell about 20% compared with the same period last year, while its gross margin was in the range of about 20%.

Andy Lau's advertising slogan for the Mate 60 RS goes like this: "I keep telling myself, if I want to do something, I'll be sure to give it my all."

Does the launch of this smartphone symbolise mainland China's semiconductor sector making a big step towards giving its all for excellence or does it mark the end of the line for the development of China's advanced processes, just like what Yang opined?

We will know the answer soon.

This article was first published in Lianhe Zaobao as "华为新手机对中国半导体业意味着什么?".