Huawei: China's Tesla challenger in the making?

Huawei has long denied that it will enter the auto manufacturing industry. Instead, the company has emphasised its partnership with automakers to build autonomous driving technology. However, since the launch of a luxury electric SUV, the M5, the market has begun speculating whether Huawei's stance on the auto business has changed.

(By Caixin journalists An Limin, Zhang Erchi, He Shujing and Denise Jia)

Huawei Technologies Co. Ltd. has repeatedly dismissed speculation that it wants to be China's Tesla challenger. But its deep collaborations with automakers may justify such speculation, industry insiders say.

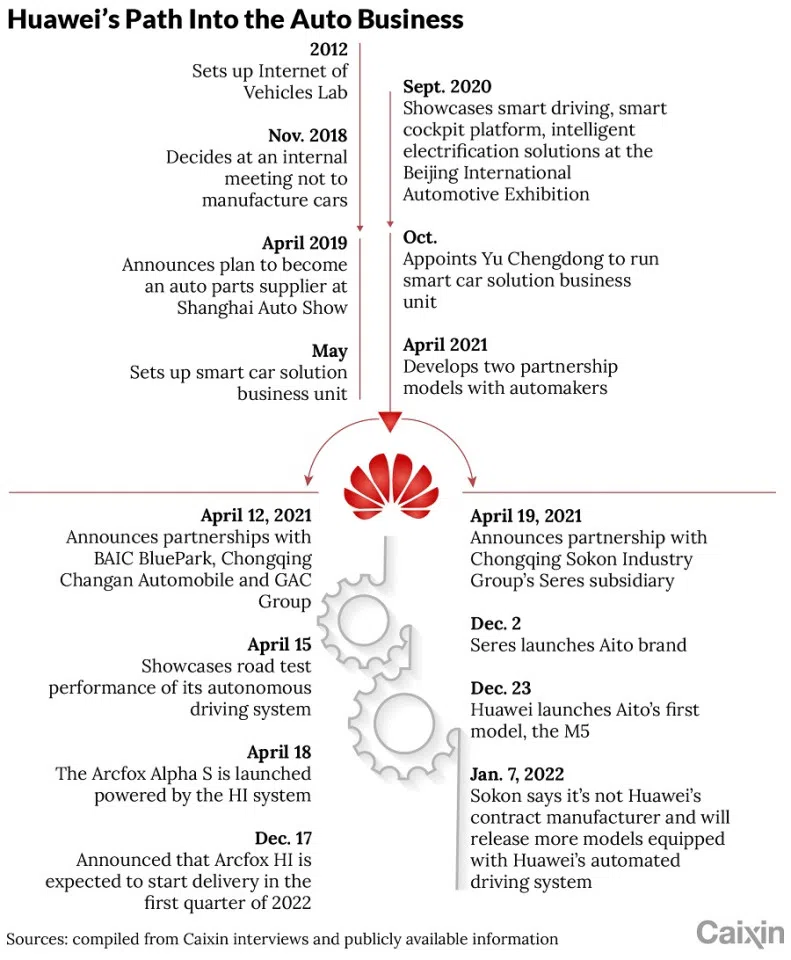

Since April, Huawei has established partnerships with automakers BAIC BluePark New Energy Technology Co. Ltd., Chongqing Sokon Industry Group Co. Ltd., Chongqing Changan Automobile Co. Ltd. and GAC Group to help them build sub-brands by using Huawei's autonomous driving technology.

At the Shanghai Auto Show last April, Sokon and Huawei unveiled the Seres SF5, featuring components and a smart cockpit system developed by Huawei. Branded as "Huawei Smart Selection", the model is sold in Huawei's flagship smartphone stores across the country.

Eight months later, the companies launched a luxury electric SUV, the M5, under the AITO brand name, equipped with a digital cockpit system powered by Huawei's Harmony operating system. At Huawei's product launch event in December, Yu Chengdong, CEO of the Huawei Smart Car Division, spent more than an hour introducing the vehicle.

The model is filled with Huawei components, people close to the partnership said. Through the M5, it is widely believed that Huawei is close to making cars with Sokon as its contract manufacturer.

Huawei's founder and chairman Ren Zhengfei has always opposed making cars.

Debate over making cars

Huawei's move into auto-related technology dates back to 2013, when it quietly started a unit to develop internet-based auto applications. At a senior management meeting at the end of 2018, the company decided it would not make cars itself. In April 2019, the company made an inaugural appearance at Shanghai's international auto show, disclosing a plan to become an auto parts supplier. A month later, Huawei officially set up an auto business unit to provide smart car solutions to automakers.

Huawei's founder and chairman Ren Zhengfei has always opposed making cars. In an internal memo in October 2020, Ren said, "Anyone who suggests Huawei build cars can find another job." The memo is said to be effective for three years. In May, Huawei said any reports it plans to make cars or take a stake in the auto manufacturing industry are rumours.

Yu, a strong advocate for the auto business inside Huawei, has never publicly been at odds with his boss. In an interview on 9 January 2022, Yu also denied that Huawei is actually making cars, saying that it is collaborating with all its partners with "the same attitude", just a little more deeply with Sokon.

Huawei is conflicted on the issue.

Since the launch of the M5, the market has begun speculating whether Huawei's stance on the auto business has changed.

Huawei is conflicted on the issue, industry participants say. On the one hand, it hopes to reassure auto manufacturers by consistently emphasising that it is only "helping them to build good cars" while looking for opportunities to penetrate the smart car solutions market and eventually become a platform for auto parts supply. On the other hand, it wants to go deeply into the auto manufacturing process, the industry participants said.

Huawei's partnerships with automakers take two forms. One is "Huawei Inside", or HI, in which automakers use Huawei's smart car system and the vehicles are identified with "HI" in their model names. Such collaborations include BAIC BluePark's Arcfox, Changan's Avatar E11 and GAC's Aion.

The other is "Huawei Smart Selection", the vehicle made with Sokon. The main difference is that in Huawei Smart Selection, Huawei provides sales channels and has a bigger voice in development and marketing. The HI model is focused on sales to businesses, while Huawei Smart Selection targets consumers.

Currently, the two business models coexist and compete, a strategy Huawei often adopts in its key businesses. For example, in the smartphone business, Huawei long maintained two brands: its own Huawei brand and budget phone brand Honor. The two channels had their stores and competed with each other before Huawei sold Honor to a consortium of buyers in November 2020.

When senior management could not initially decide which direction would succeed, they allowed two teams to test both directions and compete with each other, a mid-level manager at Huawei told Caixin. When a clear picture emerged of which direction was more likely to succeed, the two teams could eventually merge, the manager said.

Ren prefers the HI approach, based on Huawei's successful experience in its partnership with UK telecom giant Vodafone Group in entering the European market. Huawei hopes to copy the Vodafone partnership in the auto industry.

Sokon had established products and was willing to give Huawei more power in the collaboration, helping the two companies to reach a deal quickly...

Close ties with Sokon

At an investor meeting on 7 January 2022, Sokon's then chairman Zhang Xinghai stressed that the company is not Huawei's contract manufacturer. But without the partnership with Huawei, the small Chongqing-based auto company wouldn't have gained attention as a major electric vehicle player.

Sokon originally had ambitious plans to enter the US. Its subsidiary SF Motors spent US$110 million to buy an assembly plant in Indiana that once built Hummer SUVs for General Motors Co. It also spent US$33 million to acquire a battery technology company created by Tesla co-founder Martin Eberhard.

But the US plan never took off. In July 2019, SF Motors announced layoffs, acknowledging its strategy was too aggressive. In February 2021, the company sold the Indiana factory and switched its focus back to China.

Sokon reported a net loss of 2.3 billion RMB (US$362 million) in 2020. The Huawei partnership appeared as a white knight rescuer. Sokon had established products and was willing to give Huawei more power in the collaboration, helping the two companies to reach a deal quickly, people close to the matter told Caixin.

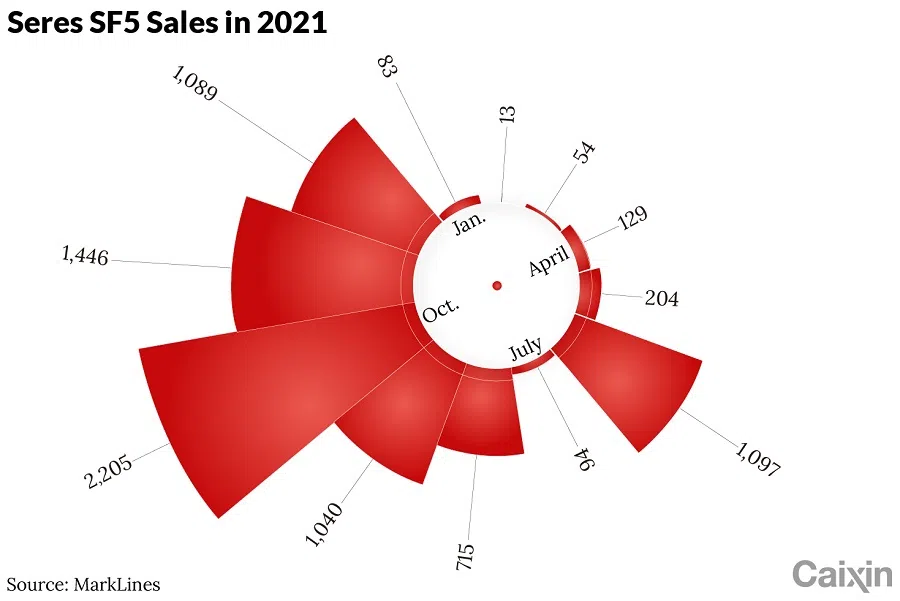

After the launch of the Seres SF5, Sokon said it received orders for more than 3,000 vehicles within two days, compared with the fewer than 1,000 of the original SF5 model sold in 2020.

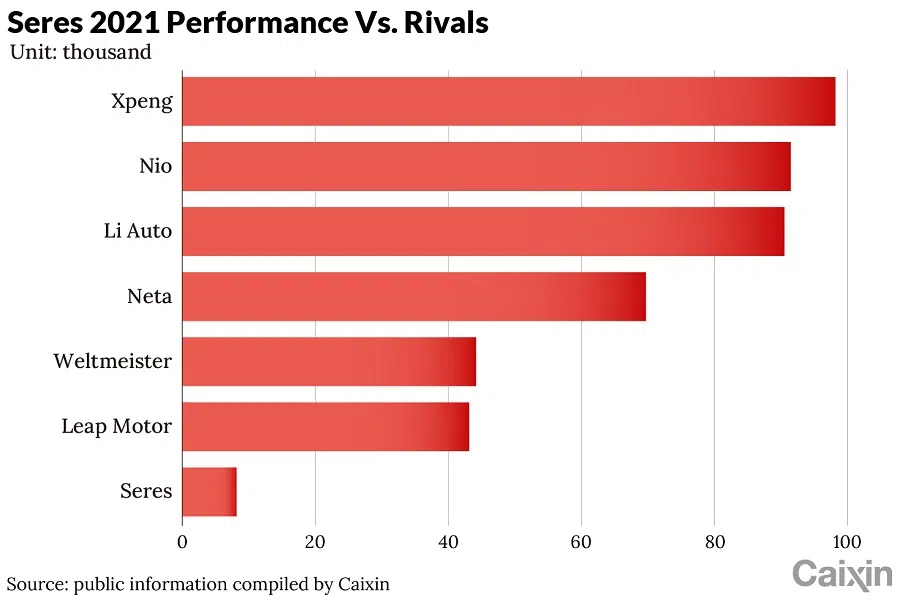

However, subsequent delivery data were disappointing, reflecting problems with the collaboration model. Huawei's role as a sales channel is too limited to help boost the Sokon brand. The product itself also lags behind rivals in extended-range technology and driving experience.

Sokon delivered about 8,000 SF5s in 2021, far behind sales of Xpeng, Nio and Li Auto, each of which exceeded 90,000 last year.

Huawei is known for quickly launching newer versions of its smartphones. Usually, the third generation is considered the best. Consumers are worried that Huawei and Sokon will follow the same strategy with cars...

Huawei and Sokon quickly responded with a new model. For the M5 launched in December, Huawei participated more deeply in the design in addition to providing the Harmony operating system.

But as orders for the M5 grew, buyers of the SF5 were irked because production of SF5s was suspended as the company tried to deliver the new model. The HiCar system in the SF5 cannot be upgraded to Harmony. Some SF5 cars also had quality issues. Eventually, Sokon offered 10,000 RMB (US$1,575) in subsidies to SF5 owners to swap their cars for the new model.

Huawei is known for quickly launching newer versions of its smartphones. Usually, the third generation is considered the best. Consumers are worried that Huawei and Sokon will follow the same strategy with cars, making them hesitate to buy the early versions. An all-electric model of the M5 and two SUVs equipped with Huawei's automatic driving system are expected to be launched this year and next, which could hurt sales of the current model, people close to the companies said.

Unlike smartphones, which consumers replace frequently, automobiles are more durable. If Huawei uses its smartphone-upgrading strategy for automobiles, it may hurt the brand image and consumer confidence, said a person at an automaker partner of Huawei.

Huawei has high expectations for the M5. Yu said Huawei plans to sell the model at 1,000 stores by the end of 2022. Assuming each store sells 30 cars a month, total annual sales could reach 300,000, Yu said.

Switching from phones to cars

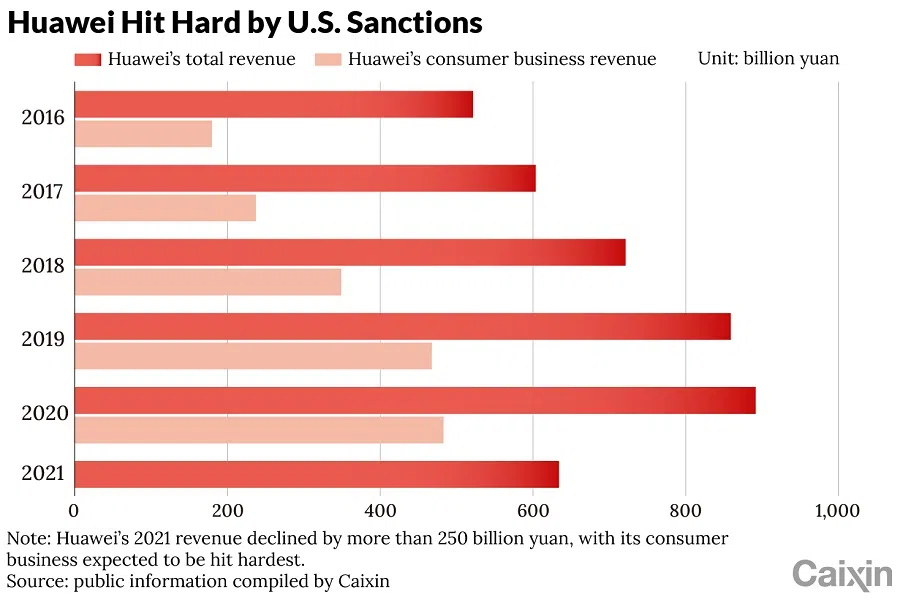

When Huawei's senior management decided in 2018 not to make cars, employees interpreted the decision as a cautious stance as the telecom equipment producer had zero experience in the auto industry. Meanwhile, Huawei has been under pressure following US sanctions that have crippled its core businesses selling telecom networking equipment and smartphones. In Germany and France, where Huawei's 5G equipment is still allowed, Huawei was concerned that stepping into the auto industry might change the attitude of countries with significant car manufacturing.

After enduring three rounds of US sanctions, the Chinese telecommunications giant suffered a 78% decline in its global cellphone sales in 2021. In the first half of 2021, the company's revenue dropped 29% from the same period a year ago.

While waiting for the ability to rebuild its cellphone business, Huawei needs to maintain its sales channels.

Since 2020, Huawei's consumer business has been forced to carry out a restructuring, called the "Nanniwan Plan", shifting focus from smartphones to products including computers, smart watches, headphones, speakers, TVs and other devices that are less affected by the US sanctions. But in those markets, Huawei faces fierce competition from dominant players such as Lenovo, Xiaomi, TCL and Hisense.

Meanwhile, China's new-energy vehicle market is booming, attracting many tech companies to jump in. "The mobile phone is a product with frequent upgrading, strong demand and high value, and the only other product that can make up for the loss of mobile phones is smart electric cars," Yu said in April at the launch of the Seres SF5.

Huawei also needs to solve the survival problem of its stores and dealerships amid the sharp decline in cellphone sales.

Huawei has been forced to build up its own chip development, potentially allowing it to fully design and manufacture chips in China someday to sidestep restrictions from the US or other countries. While waiting for the ability to rebuild its cellphone business, Huawei needs to maintain its sales channels.

The cost of switching from selling mobile phones to selling cars at Huawei stores is not high, several Huawei dealers told Caixin. A dealer said it costs less than 1 million RMB to transform a Huawei cellphone store into a car showroom. "For Huawei's dealers, 1 million RMB is not a big bet," the dealer said. The transformation can not only maintain their relations with Huawei but also tap into China's 4 trillion RMB auto market, "a win-win", the dealer said.

While selling cars, dealers do not have inventory pressure and can have a profit margin of 7% to 10%, they said. Each store needs only two cars for display and test drives. Once customers make an order, the cars will be delivered from the automaker. Dealers can receive a commission of at least 10,000 RMB for each car sold, they said.

Liu Ran contributed to this report.

This article was first published by Caixin Global as "In Depth: Huawei's 'Will They or Won't They' Relationship With Automaking". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] Paying for pleasure: Chinese women indulge in handsome male hosts](https://cassette.sphdigital.com.sg/image/thinkchina/c2cf352c4d2ed7e9531e3525a2bd965a52dc4e85ccc026bc16515baab02389ab)

![[Big read] How UOB’s Wee Ee Cheong masters the long game](https://cassette.sphdigital.com.sg/image/thinkchina/1da0b19a41e4358790304b9f3e83f9596de84096a490ca05b36f58134ae9e8f1)