Long tethered to Apple, Chinese suppliers seek new options

Chinese component suppliers are trying to curb their reliance on Apple, the latest American giant caught in the US-China tug of-war. In the early days, Chinese firms able to make it onto Apple's supplier list were able to breathe a little easier. But with reliance comes exposure, and a need to adapt amid news of Apple's decreasing sales and rumoured plans of making production shifts to other countries.

(By Caixin journalists Liu Peilin, Qin Min and Mo Yelin)

Jittery Chinese component suppliers are trying to curb their reliance on Apple Inc., the latest American giant caught in the US-China tug of war, as their executives talk up the prospect of making things like automobile parts.

It comes as worsening relations bring renewed scrutiny of the Chinese supply chains of America's most successful firms - many of which owe their growth to lower-cost mainland component-makers and contract assemblers.

Apple's massive and sophisticated supply chains

Firms such as Luxshare Precision Industry Co. Ltd. and GoerTek Inc., which make much of their revenue selling parts and labour to Apple, are also being pinched by a consumer electronics market slowdown and rising labour costs.

Privately, an overreliance Apple's business has long been a source of unease at such firms. But those concerns have come to a head as the Cupertino, California-based giant faces political pressure at home to move its operations out of China. It also follows Covid-zero related production snags that highlighted the firm's vulnerability to Chinese regulatory winds.

There has been no official word from Apple about any plan to abandon its long-running China strategy. Apple CEO Tim Cook was all smiles when he visited Beijing for the China Development Forum in March, telling an audience that the relationship between his firm and China is "symbiotic". Apple has more than 95% of its iPhones, Airpods, Apple Watches, MacBooks and iPads made in the country, according to J.P. Morgan analysts in a September report.

But there have been signs. Reuters reported in March that new Apple contracts were awarded to manufacturers in neighboring India, while Nikkei Asia said this month the US firm is in talks to make laptops in Thailand. J.P. Morgan's analysts predicted that around 25% of Apple products will be manufactured outside of the Chinese mainland by 2025.

Last month a senior executive at Weifang, Shandong-based GoerTek, which makes Apple's branded wireless headphones the AirPods, warned that geopolitical risks are driving his client to seek a rapid production shift to India and Vietnam, regardless of cost. GoerTek vice-president Kazuyoshi Yoshinaga told Bloomberg that his firm was planning to invest in a new Vietnam plant while also eyeing an Indian expansion.

The disclosure was considered remarkable given the omerta that hangs over Apple's supply chain. GoerTek announced Yoshinaga had resigned from the firm for "personal reasons" in a short statement about a week later.

Some of Apple's Chinese suppliers have been gently talking up their efforts to diversify - not only away from the firm that pioneered smartphone technology, but from consumer electronics.

Despite that, analysts say it would take years for Apple to recreate the massive and sophisticated supply chains it has built in China. Meanwhile, insiders say that some Chinese suppliers are in a poor position to follow the firm overseas, especially to India where there is a sense New Delhi is targeting mainland tech firms.

Efforts to diversify

Some of Apple's Chinese suppliers have been gently talking up their efforts to diversify - not only away from the firm that pioneered smartphone technology, but from consumer electronics.

Grace Wang Laichun, chair of Luxshare, told an audience at a business event in Guangzhou that her company has "put a lot of emphasis on pushing into new markets" such as telecoms and automobiles, according to a February report by the South China Morning Post. She did not mention Apple, according to the report.

In a February statement sent to Caixin, Wang said she expects the auto sector to see the biggest growth in the next five years. Luxshare is thus pushing ahead in the booming car component business and in particular the niche area of electric connectors for cars, which it has been making since 2008. The company said at a February investor event that it is aiming to achieve a 10% share of the domestic automotive connector market, which by its reckoning could grow into a 10 billion RMB market by 2030.

Wingtech Technology Co. Ltd., which has made notebooks for Apple since 2021, is also eyeing autos as its next major growth area in a play to make products such as organic light emitting diode (OLED) displays for carmakers.

The company established a unit in 2020 to expand its carmaker client list and has grown its staff to 300 from 100 about a year ago, according to Wingtech Chief Technology Officer Gao Shuai, who heads the automobile business. Gao said his company has already won orders from around ten automobile firms, including leading electric car maker Li Auto Inc.

These promising plans will be no short-term lifeline, however. Gao said he expects autos to contribute about 800 million RMB to the firm's bottom line this year. Meanwhile Luxshare's automobile business recorded sales of just 2.1 billion RMB in the first half of 2022, or around 2.58% of its total.

Chinese firms made up 40 of Apple's most recent list of its top 200 suppliers for the 2021 fiscal year. When Apple began publishing the list in 2012 they numbered fewer than ten.

Apple addiction

It's no surprise that some Chinese Apple suppliers are exploring new options. The one-time Silicon Valley tech startup has spent big to build up its Chinese supply chain, fostering mainland companies that have grown alongside it. But a change is on the wind.

Chinese firms made up 40 of Apple's most recent list of its top 200 suppliers for the 2021 fiscal year. When Apple began publishing the list in 2012 they numbered fewer than ten.

The few fortunate Chinese firms able to make it onto Apple's supplier list could once rest on their laurels. Luxshare Precision Industry, founded in 2004, made annual revenues of 154 billion RMB in 2021, up from 1 billion RMB in 2010, the year before Apple first contracted it to provide electrical connectors for its laptops and iPads.

GoerTek, the acoustics equipment supplier, saw its annual revenue increase more than ten-fold during the years from 2013 to 2022 to 105 billion RMB. Another big supplier, Lens Technology Co. Ltd., which has since 2007 supplied lenses and related glass components to Apple, grew its revenue more than three-fold to 45 billion RMB between 2013 and 2021.

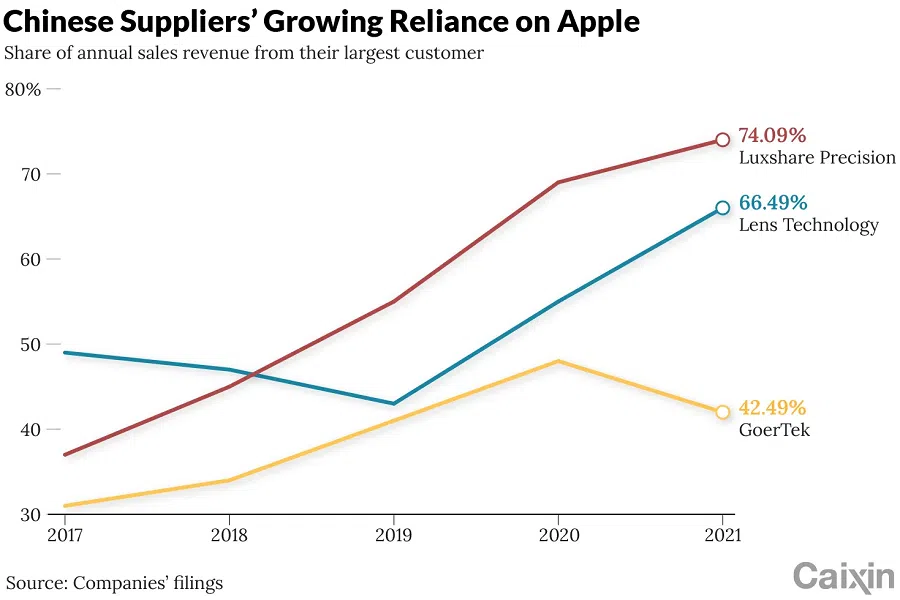

Along the way, those suppliers became increasingly dependent on Apple's business. In 2021, Luxshare's sales to its largest customer made up 74% of its total revenue, according to its latest annual report, up from 36.6% in 2017. That number for GoerTek was 31.1% in 2022 and 42.5% in 2021, from 30.8% in 2017, and for Lens Technology was 66.5% in 2021, up from 49.4 % in 2017, according to their latest annual reports.

While the companies didn't explicitly name Apple as their No. 1 customer - except for Lens Technology - the US firm is widely assumed to be their biggest client.

Lens Technology called Apple its biggest customer in its 2021 earnings. Meanwhile Luxshare has been aggressively talking up its iPhone casing business and is currently the major supplier for Apple Watches. And together with GoerTek, the firms have taken over Apple's entire AirPods business, according to J.P. Morgan's report.

Meanwhile, Shenzhen Everwin Precision Technology Co. Ltd., which supplies metal-alloy chassis used to make MacBooks, counts Apple as its major client, with the firm contributing 35.3% of its annual sales in 2022, the year after it made Apple's top 200 supplier list.

But with reliance comes exposure. When OFilm Group Co. Ltd.'s subsidiary was placed on a US trade blacklist in 2020, it was forced to cease supplying camera modules to Apple. The company's revenue in the following year was cut by more than half. The firm was removed from the list in 2022.

In November, GoerTek informed investors that it would reduce its 2022 revenue forecast by up to 3.3 billion RMB after a major overseas client told it to halt production of an "acoustic product".

Ming-Chi Kuo, an analyst with brokerage TF International Securities Group Ltd., identified the product as Apple's AirPods Pro 2, saying that it was "more likely due to production issues rather than demand issues".

Slowing business

After years of rapid expansion, a weakening electronics market is slowing Apple's business. The company shipped 226.4 million iPhones to customers around the world in 2022, roughly one-fifth of the smartphones sold globally that year. That was 4% less than the previous year, though the firm beat the average sales contraction of 11.3%, according to figures compiled by International Data Corp. (IDC), a market research firm. But after sales in 2021 increased 15.9%, it was a dramatic turn.

Growth of the company's PC business, which includes desktop and laptop computers, slumped to 2.5% last year, down from more than 20% for the previous two years, according to IDC.

India has emerged as a key destination for the American firm [Apple], owing to a combination of a favourable labour market, robust tech sector and relatively healthy relations with Washington.

Luxshare, GoerTek and Lens Technology - three of Apple's largest mainland-listed suppliers - had already seen their revenue growth slow significantly while profit margins edged lower over the past two years.

In 2022, Lens Technology's revenues grew by just 3.15% to 46.7 billion RMB, down from 22.6% and 22.1% for the previous two years, according to the firm's earnings reports.

Luxshare has yet released its 2022 financial results but Guosheng Securities predicted in a November report that the company's revenues will grow by 40% in 2022, down from 66.43% for 2021. The company reported a rare net income drop in 2021 - a decrease of 2.14% year-on-year - which it put down to a global shortage of semiconductors, as well as rising costs in areas such as raw materials and transportation. Speaking about Luxshare's efforts to diversify, one consumer electronics analyst told Caixin that once a supplier relies on a firm for more than half of its revenue, it may already be too late to do so.

Overseas options

Another option for China's Apple suppliers is to compete in the overseas markets where the firm is rumoured to be moving. But this is not without risks.

India has emerged as a key destination for the American firm, owing to a combination of a favourable labour market, robust tech sector and relatively healthy relations with Washington. J.P. Morgan's analysts estimated that Apple is likely to make around 25% of its iPhones in India by 2025. But regular spats between New Delhi and Beijing are threatening the ability of Chinese firms to follow it.

Indian authorities appeared to launch a blitz last year on Chinese tech firms operating in the country, with several high-profile Chinese smartphone makers facing tax evasion claims. In one case, India's anti-money-laundering agency seized 55.51 billion rupees (US$726 million) from a local unit of Xiaomi Corp. after accusing the company of breaching the country's foreign-exchange laws.

"Even if you make money in India, whether you can get it out is a big question," said a Lens Technology insider who asked not to be named.

Chinese firms are keener to expand in the neighbouring country of Vietnam, according to the recent Luxshare statement sent to Caixin.

A long list of Chinese suppliers has set up factories in Vietnam including Luxshare, GoerTek, Lens Technology, as well as smaller ones such as Lingyi iTech (Guangdong) Co., which makes magnetic components.

Still, Chinese suppliers have their own considerations. While small scale and lower tech suppliers may be able to pull up stumps for a cross-border move, that is unlikely to be the case for asset and investment heavy companies like panel giant BOE Technology Group Co. Ltd., according to Dong Min, a deputy head at the China Video Industry Association.

"A panel production line requires at least 40 billion RMB in investment," Dong told Caixin. "BOE will not build a new overseas production line just for Apple."

This article was first published by Caixin Global as "In Depth: Long Tethered to Apple, Chinese Suppliers Seek New Options". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)