China's cloud giants seek profits abroad as domestic margins dwindle

Chinese cloud providers such as Tencent and Huawei are stepping up their game and entering overseas markets, in competition with global players like Amazon. How will these Chinese cloud giants do in territories like Southeast Asia and the Middle East, especially given the rise of AI and large language models?

(By Caixin journalists Liu Peilin, Wang Xintong, Zhang Erchi, Guan Cong and Kelsey Cheng)

Cloud computing has become a new battleground in the China-US fight for tech dominance.

China's biggest cloud service providers, including units from Alibaba, Tencent and Huawei, are betting big on overseas expansion as profits dwindle in their saturated home market.

But as Chinese competitors push overseas, they are encroaching on the territory of global players such as US giants Microsoft and Amazon, which dominate many markets around the world.

Chinese cloud providers have accelerated their global presence this year, thanks largely to the buzz around generative artificial intelligence (AI), which has led to a surge in global demand for computing services.

To gain an edge, Chinese players are increasingly targeting regions less plumbed by their US counterparts, such as Southeast Asia and the Middle East.

In September, Huawei Technologies Co. Ltd. opened a new cloud service centre in Saudi Arabia. The centre "will be our focus in serving the Middle East, Central Asia and Africa," said Jacqueline Shi, president of Huawei's cloud global marketing and sales service, at its opening in Riyadh.

The push abroad comes as Chinese companies are facing slowing growth and fierce competition at home, which has triggered a price war earlier this year that has squeezed profit margins.

Tencent Cloud also moved into Saudi Arabia this year, partnering with the Gulf state's telecom operator Mobily in February to further grow its global presence. The Chinese company's business now covers regions including Asia, America, Europe, the Middle East and Africa.

The push abroad comes as Chinese companies are facing slowing growth and fierce competition at home, which has triggered a price war earlier this year that has squeezed profit margins. They are also feeling the pressure of Washington's ever-tightening restrictions on Chinese access to advanced technology.

But it remains unclear how much the expansion will affect the companies' bottom line.

Qiu Yuepeng, president of Tencent Cloud, doesn't expect foreign expansion to bring explosive growth to Chinese cloud vendors in the short term. He said, "It's too early to say there is a 10- or 20-fold opportunity in overseas markets."

In the area of highly contested AI services, overseas demand for Chinese-developed large language models (LLMs) is still nascent, an employee at the Singapore branch of a Chinese cloud computing company told Caixin in July.

Emerging market expansion

China's cloud computing vendors have steadily been building up their international business for years, especially in lucrative Western markets. But a series of events have disrupted their plans, including the European Union's tightening of cross-border data transfer rules in 2018 and the persistent, growing pressure from the US.

Leading cloud provider Alibaba Cloud suffered a major setback to its global aspirations in 2021 when TikTok-parent ByteDance Ltd. dropped the company as the services provider for its overseas business. TikTok had been using Alibaba's Singapore-based cloud services as a backup for its US operation, people familiar with the matter previously told Caixin. The social media sensation was under intense scrutiny from Washington at the time.

Consequently, emerging markets have come into focus for some of China's major cloud providers.

Southeast Asia, for example, "has both an internet dividend and a demographic dividend," Song Yingqiao, vice president of Alibaba Cloud's intelligence international business unit, told Caixin in explaining the company's entry into the region.

Tom Leighton, co-founder and CEO of Akamai Technologies Inc., a US-based cloud services and cybersecurity company, agreed, noting that Southeast Asia has become an important destination for Chinese enterprises expanding overseas.

Akamai's revenue from Southeast Asia grew rapidly in 2022 thanks to increased purchases of its services by Chinese vendors in the region, Leighton said.

Chinese firms have also stepped up their investment in new data centres in Southeast Asia.

In October 2021, Alibaba Cloud opened its first data centre in the Philippines. The firm said that it would invest more than 6 billion RMB (US$840 million) over the next three years in overseas infrastructure expansion, among other things.

In September 2022, Alibaba Cloud unveiled a new three-year plan to invest an additional 7 billion RMB in overseas markets while building six more data centres around the world, including in the Malaysian capital of Kuala Lumpur.

These efforts have helped the company's overseas operations grow more than 20-fold over the past five years, an Alibaba Cloud employee told Caixin. The cloud giant now operates data centres in 30 regions around the world, a third of which are located in Southeast Asia.

Similarly, Huawei Cloud has turned to Southeast Asia in recent years, opening 10 data centres in Singapore, Bangkok and Jakarta. Tencent Cloud also now has eight data centres in those three countries.

Meanwhile, Saudi Arabia, which is accelerating its digital transformation, has become another preferred market for Chinese cloud service providers.

Demand for cloud services in the Middle East country is outstripping supply, Hu Dan, vice president of Tencent Cloud International for the Middle East and North Africa, told Caixin.

This could be attributed to the current AI craze, which has triggered a wave of development of LLMs and increased demand for cloud computing globally.

Saudi Arabia's cloud services market is expected to reach US$3.46 billion this year and more than double to US$7.53 billion by 2028, according to consultancy Mordor Intelligence.

AWS, the cloud computing arm of US e-commerce giant Amazon, quoted up to eight times the price offered by Tencent Cloud for the same services in 2020. - Kenneth Tan, CEO, BeLive Technology

Competitive advantages

As Chinese cloud providers go head-to-head with US competitors, they need to adopt distinctive strategies, said Jimmy Yu, senior vice president of international business at GDS Holdings Ltd., one of China's largest data centre operators.

For example, Tencent's strategy is to deepen its focus on gaming and audio/video, Qiu said.

Kenneth Tan, co-founder and CEO of Singapore-based video software startup BeLive Technology, told Caixin, "Top foreign cloud vendors don't have products or services specifically for video and livestreaming, but Tencent's technology allows a live broadcast to be streamed to eight social platforms, which is an essential demand for us."

In addition, the lower price offered by Tencent was a key reason why BeLive chose to work with the Chinese company, Tan said. His company initially used Amazon Web Services (AWS) but found that its video and livestreaming solutions were more expensive and less supportive for use on the Chinese mainland and in Africa compared with Chinese providers.

AWS, the cloud computing arm of US e-commerce giant Amazon, quoted up to eight times the price offered by Tencent Cloud for the same services in 2020, according to Tan.

Personalised and fast response to customers is another advantage of Chinese cloud vendors, Yan Tianpei, CEO of a Chinese AI video editing company called Shanjian, told Caixin.

Take the cooperation between Shanjian and Tencent Cloud as an example. Yan said they have a WeChat messaging group including nearly 20 service staff from Tencent Cloud that respond at all hours. By contrast, most global cloud service providers communicate via email and usually take at least a day to respond due to more complex workflow, Yan said.

A more personalised response is also why Hospisoft, a Mexican company that provides management software for hospitals, chose to work with Huawei Cloud.

"Whenever we have a problem, we can call the service staff and quickly find a solution," Cesar Macias, general manager of healthcare software provider Hospisoft, told Caixin. "Cheap prices are important, but such service is even more critical."

Still, some Mexican companies are concerned about the risks of partnering with Huawei.

"The UK and Canada have already restricted Huawei from doing business [there], and many people are worried about whether Huawei will still be able to do business in Mexico in the next 10 or 20 years," said one of the Chinese company's local customers.

Push factors

One of the main drivers of Chinese cloud providers' overseas expansion is shrinking margins in the domestic market.

There are three main types of cloud computing service: Infrastructure as a service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS): Most domestic cloud vendors are in the IaaS business, which has lower profit margins, several industry insiders told Caixin. Once these cloud providers encounter performance bottlenecks, expanding overseas is the inevitable choice.

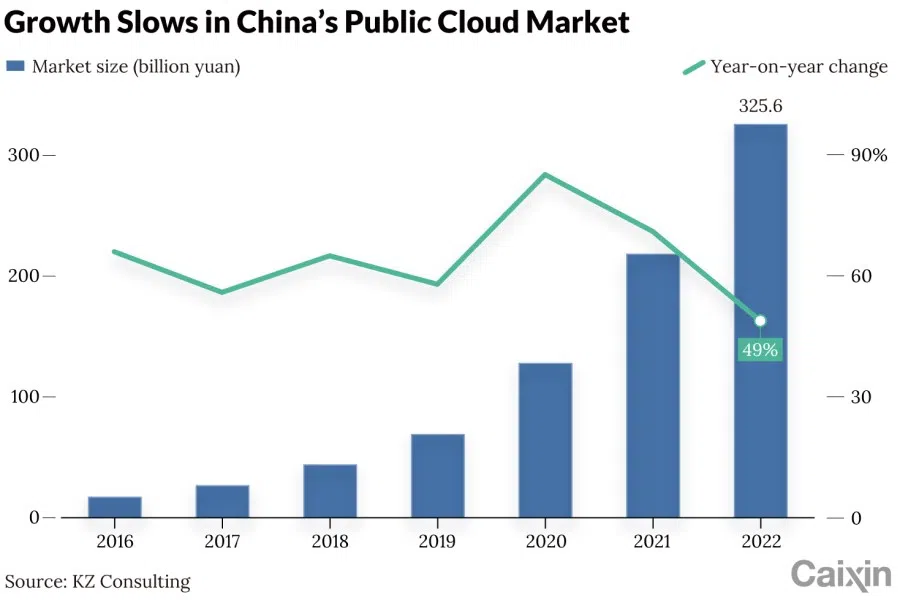

And growth of China's public cloud services has slowed in recent years. In the first half of 2023, IaaS and PaaS, which accounted for nearly 80% of the cloud market, grew 15.9% year-on-year, according to IDC. This is the slowest growth rate in three years, the global market data provider said.

China's public cloud market grew 49% year-on-year in 2022 to 325.6 billion RMB, slowing from 71% the year before, according to KZ Consulting.

... competition heated up this year with China's major cloud vendors offering more and more discounts to attract new clients, in a move to protect their share of an increasingly competitive market.

To stay competitive, cloud providers began slashing prices.

Price discounts have been a phenomenon in the cloud market as far back as 2021, when ByteDance launched Volcano Engine in December that year with more than 80% off for certain services.

But competition heated up this year with China's major cloud vendors offering more and more discounts to attract new clients, in a move to protect their share of an increasingly competitive market. They are also being threatened by the country's three state-owned telecom giants - China Mobile, China Telecom and China Unicom - nascent players in the market who managed to generate triple-digit revenue growth in their cloud computing businesses in 2022.

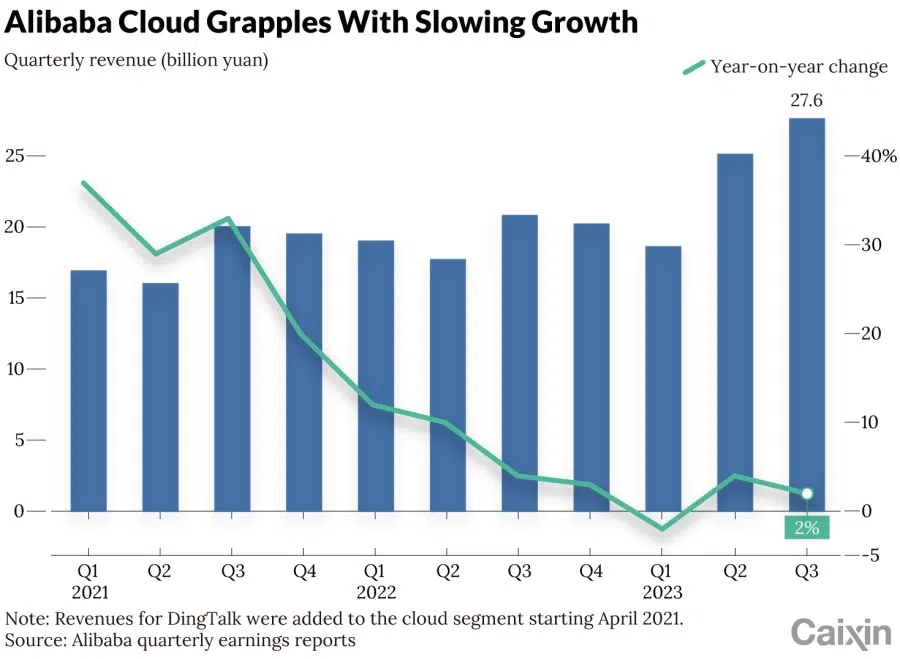

Alibaba Cloud, meanwhile, has struggled following the pandemic, despite being the leading cloud service provider on the Chinese mainland with a 34% market share in the first quarter of 2023.

In the quarter that ended in March, the unit's revenue fell 2%, its first ever year-on-year quarterly decline since Alibaba's US IPO in 2014. To attract more customers and cut costs, the company slashed prices for its core cloud products by as much as 50% from April and began laying off staff in May, with a plan to cut 7% of its employees. Those efforts worked somewhat, with Alibaba Cloud logging a 4% revenue increase in the June quarter and a 2% growth in the September quarter.

Alibaba Cloud was also striving to boost its revenue and overseas business to secure a higher valuation for an IPO, one person familiar with the company told Caixin. But the business suffered another blow in November when the planned spin-off was cancelled.

Tencent followed its larger rival by amping up discounts in mid-May, with price cuts of up to 40% for cloud servers in some regions.

Qu Yunxu also contributed reporting.

This article was first published by Caixin Global as "In Depth: China's Cloud Giants Seek Profits Abroad as Domestic Margins Dwindle". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)