Taking a long hard look at Macau's stellar performance

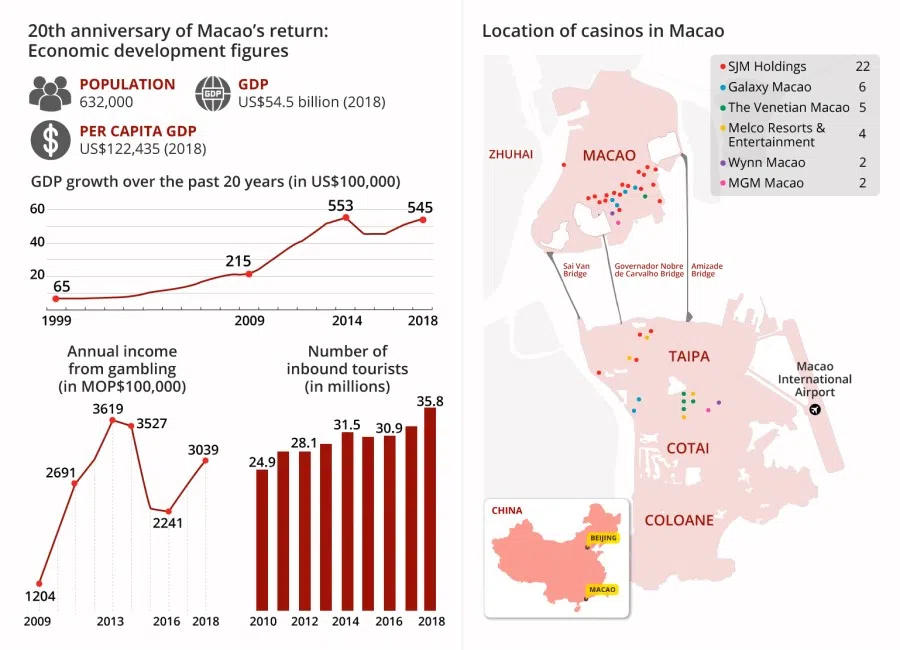

Since its return to mainland China in 1999, Macau has seen rapid progress and growth. But despite the impressive figures, issues with governance and bread-and-butter issues such as housing remain. On the 20th anniversary of Macau's return to China, Zaobao reporter Tai Hing Shing looks at the challenges facing the Macau SAR government.

Born and bred in Macau, 37-year-old Feng Baojian runs a pharmacy next to the famous Ruins of Saint Paul's. Each day, he sees waves of tourists, and has also witnessed Macau's breathtaking transformation over the past 20 years.

Feng recounts that as a student back in 1999 before Macau's return to mainland China, there was little law and order. Arson cases broke out every so often, and students went straight home after school without lingering on the streets. It was not until Macau's return to China that the Macau SAR government worked closely with the mainland government to produce a significant improvement in law and order.

Feng notes that there is practically 100% employment in Macau, and there is no fear about finding work.

Likewise, Macau's economy was in a slump before the handover. In 2002, the Macau SAR government decided to open up the gambling industry, and the following year, the central Chinese government implemented the Individual Visit Scheme, allowing travellers from mainland China to visit Hong Kong and Macau on an individual basis. This led to the rapid growth of Macau's economy, and working incomes saw a jump.

Feng says he joined the workforce soon after Macau's return, when his sales job fetched only 4,000 to 5,000 Macanese pataca (MOP), or about S$675 to S$844. Today, his salary is four or five times that figure, at over MOP$20,000.

Feng notes that there is practically 100% employment in Macau, and there is no fear about finding work. Of the four staff at the pharmacy where he works, one is a foreigner, because it is difficult to hire locals. "Previously, Macau's economy was not good, and a lot of people had to go to Taiwan to work. Now, it's the other way around; many Taiwanese are coming to work in Macau instead." This shift illustrates Macau's enormous progress, which makes Feng happy with how Macau is now, following its return.

Many people in Macau share Feng's sentiments. According to a survey on public sentiment in Macau released last year by Hong Kong University, over the 20 years between 1999 and 2018, public trust in "one party, two systems" has remained relatively high, while self-identity as Chinese nationals (中国人) has also been quite highly rated between 7 and 9 out of 10.

Credit to "one country, two systems"

Professor Lok Wai Kin of the University of Macau also gave a 90% rating to Macau's performance since its return. He says that the Macau SAR government inherited a messy situation when Macau was returned to China, including a poor economy, high unemployment, and a rolling cash balance of about MOP$3 billion left from the Portuguese administration. With the opening up of the gambling industry and the Individual Visit Scheme, Macau's GDP has grown rapidly over the past 10 years, with strong results in various macroeconomic indicators.

Prof Lok feels the main reason for Macau's achievements following its return is that it has taken full advantage of "one country, two systems". Whenever the central government rolls out a new policy, it generally takes into account what Macau needs, including signing the Closer Economic Partnership Arrangement (CEPA) with Macau in 2003, and advocating the integration of Macau into the Greater Bay Area development in recent years.

He says, "In recent years, the central government has leased part of Hengqin island (in Zhuhai, Guangdong) to Macau, where Macau law is enforced. Strictly speaking, this contributes zero revenue to Zhuhai, but the central government is still willing to do so because it wants to make things easier for Macau in encouraging its growth."

Economic and social headwinds

However, behind the impressive figures, economic and social problems have also arisen in Macau over the past few years, waiting to be resolved by the new Macau SAR government.

Prof Lok points out that besides the continued dominance of gambling as the only major industry, Macau's biggest problem is that its governance - in areas such as transparency and efficiency - needs to improve.

He says, "Macau used to be a little fishing village, and expectations were not high. But now, it is an international hub, and expectations have risen; for instance, it is really unacceptable that it took over ten years for the Light Rapid Transit system to be up and running. The Macau SAR government needs to deepen its structural reforms to improve its capabilities and efficiency."

Professor Song Ya-nan of the Macau University of Science and Technology says that some tough issues the Macau SAR government will have to face are the rich-poor gap and housing.

She observes that previously, new residential units in Macau could easily measure about 100 square metres, but with rising property prices, developers are launching more new units measuring about 50 square metres. As this trend continues, most people of Macau are gradually being priced out of the property market.

She says, "Right now, most people in Macau aged 40 and above can still afford to buy homes, but young people below 40 have to depend on their parents to buy a home. It will be even more difficult for the generation after to afford their own homes. There is growing dissatisfaction among young people over this, and it is getting to be a little like Hong Kong. The Macau SAR government should defuse this bomb before it explodes."

Developing Macau into an economic hub

This reporter understands that Beijing intends to develop Macau into an economic hub. Academics feel this is both an opportunity and a challenge for Macau.

Mainstream media in China has been trumpeting Macau's achievements in the 20 years since its handover, from being a good example of "one country, two systems", to areas such as the rule of law, education, and economic growth. Foreign reports cite claims that a renminbi-denominated stock exchange will be set up in Macau, to accelerate the ongoing development of a renminbi settlement centre. At the same time, Beijing will also set aside land in mainland China near to Macau, to be developed.

Prof Song feels that Macau's financial industry has always been small and inward-looking, which makes its development into an international financial hub like Hong Kong unrealistic; however, its future cannot be underestimated.

Citing the example of the stock exchange, Prof Song says there are currently about 10 Macau companies listed on the Hong Kong stock exchange, and once the Macau stock exchange is set up, these companies are likely to go for a second listing in Macau.

She says, "When news first came out of a possible stock exchange in Macau, some companies already said they want to be listed in Macau. After all, funding costs in Macau are low, and local companies are more motivated to be listed in Macau because of local pride."

On the other hand, other challengesu may hinder Macau's financial industry growth. First, the community is conservative and slow to accept new ways and ideas. "For years, people have become accustomed to the high-income gambling industry," says Prof Song. "They lack the motivation to work harder for their money."

Second, there is a lack of local financial talents in government financial regulatory departments and private financial organisations, which means many foreign talents are needed. But in contrast to Singapore's relatively open attitude to foreign talent, conservative Macau is worried that the livelihood of locals will be affected, and the Macau SAR government usually gives in and does not dare to bring in a lot of foreigners.

Third, there is a lack of talents in the Portuguese language who can facilitate dealings with Portuguese-speaking countries. The University of Macau does provide Portuguese language classes, but mainly to train translation talents, which is not quite the same as language talents in business, finance, trade, and law.

Prof Song says, "In recent years, the Macau SAR government has stepped up on teaching Portuguese in primary and secondary school, but the effect will only be seen in the next decade or so. Results are unlikely to be significant in the short term."

Despite the above, Professor Kevin Tsui, a visiting scholar at the Chinese University of Hong Kong, feels that the Macau financial sector is still worth developing. First, as a special administrative region of mainland China under "one country, two systems", Beijing will give policy support to Macau. Second, the Macau SAR government has money, "and having money definitely helps in developing the financial sector!" he says.

The common law of attraction

But Prof Tsui also reminds us that Hong Kong and Macau are former colonies with different legal systems; while the former goes by Basic Law based on common law traditions, the latter goes by a civil law system inherited from its Portuguese colonial masters.

He explains that financial laws protecting small investors differ according to various legal systems. Places that go by common law rather than civil law are more concerned about protecting the interests of small investors. In other words, Macau has some work to do to give confidence to international investors.

As to how Macau will grow its financial sector, Prof Tsui feels the Macau SAR government can look at how Qianhai in Shenzhen is learning from Hong Kong in offering advantages in taxes and funding; it can also learn from Singapore in rolling out measures to attract foreign investments.

Macau should also focus on being an "honest broker" to build channels of communication for external trade to help strengthen China's cooperation with Portuguese-speaking countries. Specifically, these channels would be Brazil-Latin America, Portugal-EU, and Angola/Mozambique-Africa.

She said Portugal is more inclined towards China, citing that Portuguese Foreign Minister Augusto Santos Silva went against the request of US Secretary of State Mike Pompeo in stating that Chinese companies will not be excluded from supplying 5G network technology. "With the current tense China-US relations, Beijing will be happy to have Macau encouraging China-Portugal cooperation through people and trade interaction, and in turn boosting China-EU relations."

Tourism and gambling no longer sure-win sectors

Once upon a time, trishaws were the main mode of transport for tourists in Macau. Resident Yin Jianqiang, 59, has been riding a trishaw since 1982, plying his trade around the Casino Lisboa.

Mr Yin says that the industry peaked in 2003, the year mainland China began the Individual Visit Scheme. Droves of tourists from mainland China came to Macau to gamble at the Casino Lisboa, after which they would want to go sightseeing by trishaw, resulting in a steady stream of business for Mr Yin.

"Back then, the tourists were particularly generous. Sometimes we overran the agreed timing by about ten minutes or so, and they would tip me MOP$500 to MOP$1,000 (about S$84 to S$169) just like that."

Unfortunately, the good times did not last. As mainland China tourists got more familiar with Macau, they became less enthusiastic about using trishaws. Subsequently, the Macau SAR government opened up the gambling industry and many US-funded companies came in to Macau. In particular, the Venetian attracted many people when it opened, and the Casino Lisboa became quieter.

"Now, I only get one or two rides a day at most. Once, after taking a passenger one or two kilometres, he said he wanted to get down and see if there were any restaurants around. But then he ran off, and I didn't get a single cent." Mr Yin laments that he used to earn about MOP$20,000, but now he gets only MOP$4,000 to MOP$5,000 at most, just about enough to live on. As he is illiterate and does not want to be a construction worker, he can only stick to this job.

The ups and downs of the trishaw business reflect the changes in Macau's gambling sector over the past decade. Initially, Sociedade de Turismo e Diversões de Macau (which owns Casino Lisboa) was the only licensed operator. But since the sector opened up in the 2000s, there are currently six licensed operators. Among them, Las Vegas Sands and Wynn are US-funded enterprises, while MGM is shared equally by American and Macau companies.

With US-funded companies swarming into Macau's gambling industry, local casinos such as SJM Holdings (Sociedade de Jogos de Macau) quickly felt a clear impact, while Sands China, MGM China, and Wynn Macau have earned bucketloads over their 10 years in Macau. As of the end of 2018, since getting listed, these three companies have made a total accrued profit of over HK$180 billion (about S$31.2 billion), and the people of Macau are starting to criticise the authorities, saying that bringing in foreign-funded companies is "giving money away to foreigners".

However, with US president Donald Trump signing the Hong Kong Human Rights and Democracy Act into law, the market is concerned that the move will anger China and affect the chances of US-funded companies getting new gambling licenses in Macau.

How the Hong Kong Human Rights and Democracy Act will come into play

In March this year, the Macau SAR government extended the gambling concessions of SJM Holdings and MGM China to 2022, which means the bidding and renewal process for all six gambling concessionaires in Macau will be synchronised. However, with US president Donald Trump signing the Hong Kong Human Rights and Democracy Act into law, the market is concerned that the move will anger China and affect the chances of US-funded companies getting new gambling licenses in Macau.

A Bloomberg commentary noted that of the three US-funded operators, Sands China faces the highest risk, explaining that Las Vegas Sands CEO and chairman Sheldon Adelson is close to Trump and the Republicans, and the authorities might think twice if and when Macau needs to approve Sands' license again.

The commentary noted that Wynn Macau is in a similar situation, as its founder Steve Wynn was previously involved in Republican party matters. As for MGM China, it might be less affected because its shareholders include the people of Macau.

Hong Kong current affairs commentator Micro Chow also feels it is likely that one out of the six current operators will lose their license when the Macau SAR government decides on the next round of renewals. This will keep Macau's gambling industry as stable as possible, while allowing the Macau SAR government to stamp their authority on the proceedings, so that nothing is taken for granted.

He predicts that Beijing is most likely to axe either MGM or Wynn, because these two operators have a smaller market share than Sands, and can serve as an initial warning to the US. "The fact is, the most anti-China group in the US right now is the Democrats. They're the ones who precipitated the passing of the Hong Kong Human Rights and Democracy Act. With that perspective, Sands is a pro-Republican enterprise, so Beijing may not make any major moves."

However, early this month, veteran Macau journalist Lam Chong wrote a piece where he analysed that out of the three operators with US funding, only MGM is not involved with US politics. The other two are deeply involved in US partisan politics, having funded the Democratic and Republican presidential and senatorial candidates, and having close links with the two main intelligence and security agencies in the US.

Lam felt that in the interests of national security, coupled with the China-US competition, the Macau SAR government might change its policy on gambling licenses; they will not be automatically renewed, but require fresh bids, with added clauses and conditions on safeguarding national security, cutting off channels of political offerings.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)