Export slowdown reveals cracks in one of China's economic pillars

(By Caixin journalists Yu Hairong, Wang Liwei and Kelsey Cheng)

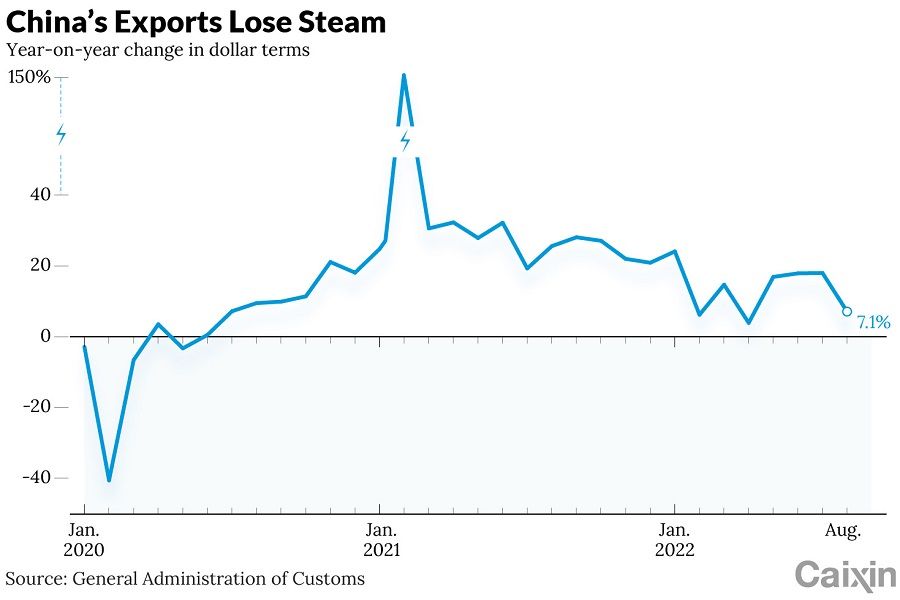

China's disappointing trade figures in August highlighted an increasingly apparent trend - export growth has been slowing since mid-2021.

Chinese goods exports grew 23.9% year-on-year in US dollar terms in the third quarter of last year, and 22.7% in the fourth, according to Caixin calculations based on data from the General Administration of Customs. This year, the trend continued, with the figure falling to 15.6% and 12.8% for the first two quarters respectively. Taken with the combined year-on-year growth rate of 12.3% for July and August, the series shows a gradual slowdown in exports.

The timing couldn't have been much worse for China's economic policymakers. The export boom had helped keep the country's economy humming during the coronavirus pandemic as lockdowns left overseas consumers with few spending options other than buying goods, many of which were made in China.

It was an auspicious development, because China's long-running plan to restructure its economy to be more dependent on services had hit a setback during the pandemic as the constant threat of outbreaks took a toll on domestic spending on services. Meanwhile, tough restrictions on the real estate industry had created another drag on growth, leaving the economy with few drivers other than exports and the old standby of infrastructure investment.

With China's economy already facing drags from real estate and consumer spending, the slowdown in goods exports poses a particular problem as they make up a sizeable share of GDP.

The latest export figures indicate that the former of the two remaining pillars could be in danger of toppling. China's exports grew 7.1% year-on-year to US$314.9 billion in August, according to customs data. August's growth, the lowest since April - when the commercial hub of Shanghai was under lockdown - came in well below the average 12% estimated by analysts surveyed by Caixin. It also marked a notable slowdown from July's robust growth rate of 18%.

China's export growth slowed primarily because of waning demand in its largest overseas markets, coupled with baseline effects and other statistical distortions that disrupted the year-on-year changes in July and August, according to officials and analysts.

"The slowdown in external demand growth is the biggest uncertainty faced by China's foreign trade," Wang Shouwen, a vice -minister at the Ministry of Commerce, said at a press conference on 27 September.

"Our companies are reporting declining orders, as import demand from some major markets is declining. Inflation is high in some major economies and its crowding-out effect on general consumer goods is increasing," Wang said.

"China's export growth is finally retreating towards more normal pre-pandemic levels after two years of exceptional growth on a high base, [amid] a slowing global economy and a post-pandemic shift in the consumer preferences of developed economies towards services," economists led by Lu Ting at Nomura Holdings Inc. said in a report in early September.

With China's economy already facing drags from real estate and consumer spending, the slowdown in goods exports poses a particular problem as they make up a sizable share of GDP. In 2021, exports of goods and services accounted for 20% of China's GDP, according to data from the World Bank. Economists and research institutions have been repeatedly cutting their growth forecasts for the world's second largest economy, including Fitch Ratings Inc., which on 14 September revised down its China's GDP estimate for this year to 2.8%, well below Beijing's target of "around 5.5%" announced in March.

The boom in foreign demand that occurred at the start of the pandemic has faltered in recent months due to rising consumer prices in the US, and a shift in consumer spending from durable goods to services that has occurred as many economies have opened up...

Spending shift

The causes of August's slowdown fall into two categories. The first is waning foreign demand. Exports to the US, one of the top three overseas destinations for Chinese goods, shrank 3.8% year-on-year in US dollar terms that month, compared with an 11% increase in July, customs data show.

The same trend can be seen in China's two other largest markets. For exports to the 27-member European Union, year-on-year growth slowed to 11.1% in August from 23.2% in July. For exports to the ten member states of the Association of Southeast Asian Nations, year-on-year growth slowed to 25.1% in August from 33.5% the previous month.

"The overall decline in export growth to the various regions looks to be evidence of a decline in external demand," China International Capital Corp. Ltd. (CICC) chief economist Peng Wensheng wrote in a research note.

The boom in foreign demand that occurred at the start of the pandemic has faltered in recent months due to rising consumer prices in the US, and a shift in consumer spending from durable goods to services that has occurred as many economies have opened up, according to multiple analysts.

In other words, once most of the world started loosening their Covid-19 restrictions last year, consumers were once again free to spend on travelling, dining out and other services that weren't available at the height of the pandemic.

Consumers in the US in particular have been buying fewer goods, hurting demand for Chinese exports, analysts from Industrial Securities Co. Ltd. wrote in a 7 September report. Meanwhile, China's share of US product imports has been slipping - from 20.6% in 2019 to 19.7% in 2020 and 18.6% in 2021, though it remains the largest supplier of goods to the world's biggest economy, according to data published by the UN Department of Economic and Social Affairs.

In addition, the global economy has been slowing, with the J.P. Morgan Global Composite PMI falling into contractionary territory for the first time since June 2020 in August.

The decline in new orders "is particularly concerning and suggests that multi-decade high inflation is weighing considerably on global demand," Bennett Parrish, global economist at J.P. Morgan Chase Bank, said in a 6 September report.

Statistical distortions

The second factor behind August's slowdown comes from baseline effects and other distortions. CICC's Peng pointed out that the export slowdown in August is in part due to a low baseline effect in July 2021. That month, typhoons disrupted major Chinese ports, creating an unusually low base of comparison for this July's exports, which rose by a promising 18% year-on-year.

The effect faded the following month, however, as factory conditions returned to normal and exports kicked back into gear. Coming off a higher baseline from the previous year, August 2022's export growth was much less impressive.

Rising prices have also inflated this year's export numbers, which have been driven more by inflation than by higher shipment volumes, according to analysts at Macquarie Group Ltd. According to them, inflation was responsible for about half of July's headline export growth.

... the gloom might force Beijing to reconsider some of the policies that have dragged on the economy, such as its "zero-Covid" policy, tech sector crackdown and restrictions on real estate.

'Major drag'

Analysts don't see an export recovery happening anytime soon. "China's export growth is expected to be on a downward trend in the next few months and fluctuate over the short term due to factors such as the pandemic," analysts at Citic Securities Co. Ltd. said in a 7 September report.

The Nomura economists expected export growth to drop to around 6% year-on-year in September and become a "major drag on growth in 2022".

CICC's Peng predicted that exports could shrink in the fourth quarter, leaving the growth rate for all of 2022 between 8% and 10%.

Analysts at Guotai Junan Securities Co. Ltd. also had a dark outlook. "There could be rapid downward risks and even negative growth at the end of the year," they said in a 7 September report.

All that said, the Nomura economists see a bit of silver around the edges of the cloud. They put forward the idea that all the gloom might force Beijing to reconsider some of the policies that have dragged on the economy, such as its "zero-Covid" policy, tech sector crackdown and restrictions on real estate.

"In this regard, falling export growth may not be such a bad thing," they said.

This article was first published by Caixin Global as "In Depth: Export Slowdown Reveals Cracks in One of China's Economic Pillars". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: Has China's monetary policy reached its limit? | Street vendors making a comeback in Shanghai to boost ailing economy? | Can SOEs' property buying spree save China's ailing property market? | [Future of China] China's economy now and in the future | When will China end its zero-Covid policy and open up its borders?