Shanghai's Covid shutdown is disrupting domestic and global supply chains

(By Caixin journalists Shen Xinyue, Yu Cong, Bai Yujie, Yang Jinxi, Zhang Erchi, Qu Yunxu, Bao Zhiming and Han Wei)

Shanghai is fighting a losing two-front war: the battle to contain its worst Covid-19 upsurge and the struggle to meet the basic needs of the city's 25 million people.

China's largest city - a sprawling coastal nexus for finance, tech, manufacturing and shipping - is in the third week of lockdowns intended to stop the pandemic's spread. And yet the stealthy Omicron variant is driving record-high infections. On 19 April, Shanghai reported 18,901 new cases, including 16,407 that were asymptomatic.

Stringent virus-control restrictions confining almost everyone at home have ground the city to a halt. Although easing measures were implemented in parts of the city last week, movements are still largely limited.

Disruptions to international supply chain

Everyone is feeling the pinch. While residents scramble to buy daily necessities online, suppliers and couriers are under pressure to deliver orders as the city's logistics system buckles. Fears of contagion, movement restrictions in and out of Shanghai, and questions about who can take delivery jobs and what vehicles they can drive have left the city underserved, sparking public outrage over food shortages.

Although major e-commerce platforms including Alibaba Group, JD.com and Meituan pledged to increase manpower in Shanghai to boost local delivery services, Caixin learned that most of them are unable to run at full capacity under the virus curbs.

Businesses are paying a heavy toll. Shanghai, with annual GDP exceeding 4 trillion RMB (US$627 billion), is a financial and commercial centre that is crucial for industries including automobiles, semiconductors and other electronics. Shanghai has the world's largest container port and serves as a hub for China's vast global trade network. Disruptions are rippling through international supply chains for goods from electric vehicles to iPhones.

A one-month shutdown could slash Shanghai's income by 61%, reducing national income by 8.6%... according to a research led by Song Zheng, an economics professor at The Chinese University of Hong Kong.

Many semiconductor and auto manufacturing lines have been forced to suspend or reduce production in Shanghai and neighbouring regions because of virus controls and supply shortages.

On 14 April, He Xiaopeng, CEO of electric-vehicle maker XPeng Inc., warned that Chinese automakers may have to halt production in May if shutdowns persist in the Shanghai area.

A one-month shutdown could slash Shanghai's income by 61%, reducing national income by 8.6% because of the logistics disruptions and rising business costs, according to a research led by Song Zheng, an economics professor at The Chinese University of Hong Kong. That would mean a 0.7% loss for China's GDP, Song said.

A Western Securities estimate based on changes in freight volumes showed that Shanghai's lockdown may drag down China's GDP by 1 percentage point from the first quarter level to 4.6%.

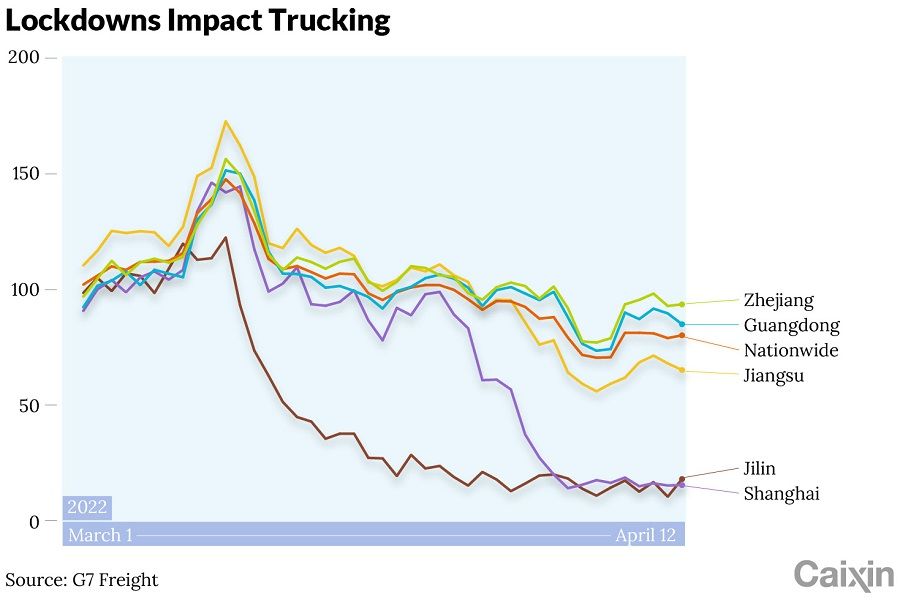

The logistics chaos sparked by the Shanghai outbreak reflects differing policy understandings and poor coordination among regions under China's zero-Covid strategy. Authorities have implemented policies to different extents, analysts said.

Amid rising unrest, central government departments have issued a series of decrees supporting logistics and supplies to regions hit by outbreaks. On 11 April, China's State Council issued a set of guidelines designed to ensure logistics flows, followed by detailed measures from road, railway and aviation authorities.

On 12 April, 162 highway exits and 81 service centres that were previously closed for virus control were reopened, data from the Ministry of Transport showed. Local authorities in Zhejiang and Jiangsu set up transfer centers to test ways for intercity freight trucks to deliver goods without direct contact to reduce infection risks.

During a forum on 16 April, Vice Finance Minister Liao Min said he expects more financial policies to be issued to help in the recovery of the country's logistics industry.

"No matter what, the situation is improving," a staffer at e-commerce giant JD.com said. The company is allocating resources and personnel under the assistance of authorities to improve market supplies in Shanghai, the person said.

Last week, JD.com said it dispatched more than 100 autonomous delivery vehicles to the city to deal with the last mile of deliveries.

Logistics chaos

On 8 April, one week after most residential compounds in Shanghai entered a full-scale lockdown, e-commerce giant JD.com unveiled an ambitious plan to supply more than 16 million daily necessity items and deploy 3,000 deliverymen to meet the city's basic needs for the next month.

Residents in Shanghai soon found that they needed to wait as long as a week for JD.com's popular same-day delivery service.

JD.com said it was confident with the plan for its "Asia No. 1" unmanned logistics centre in Shanghai's Jiading district and more than 100 smaller warehouses around the city.

But the reality was rugged. The Asia No. 1 centre suspended operations after infections appeared among staffers days later while nearly two-thirds of JD.com's employees in Shanghai and surrounding areas could not work normally under virus control rules.

Residents in Shanghai soon found that they needed to wait as long as a week for JD.com's popular same-day delivery service.

An executive at a retail company said that "JD.com underestimated the complexity" of Shanghai's situation. "There are blockages and checkpoints hindering both material transportation into Shanghai and courier services to reach communities inside the city. That can't be solved by a single enterprise," the executive said.

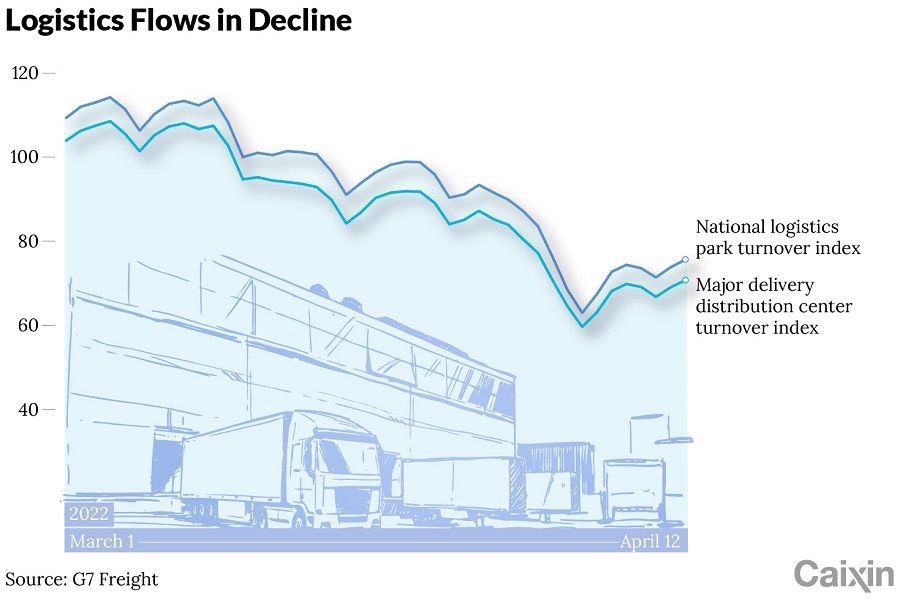

Many local authorities across the country have since implemented travel restrictions amid virus flare-ups, leading to highway closures and roadblocks. According to data from the transport ministry, 678 highway exits and 364 service centres across China were shut as of 10 April.

In Shanghai, strict entry rules were implemented as the city was sealed, allowing access to specially licensed vehicles that provide basic supplies.

"The transportation of goods is a mess in the Zhejiang, Jiangsu and Shanghai regions," said Chen Shunxiang, who runs a small truck freight service company.

The complex procedure to obtain the certificates and frequent traffic jams caused by highway closures have made it increasingly difficult for drivers to stay on schedule.

According to Chen, intercity truck drivers face greater risks of being stranded in virus-hit regions or stuck between destinations for days because of strict local virus curbs. Some drivers have to stay in their vehicles for days on the highway before they are cleared to continue trips.

In many places, truckers are required to present negative virus tests conducted within 48 hours upon arrival plus other certificates and health proofs. The complex procedure to obtain the certificates and frequent traffic jams caused by highway closures have made it increasingly difficult for drivers to stay on schedule. Moreover, many drivers have been confined at home under local lockdown measures.

According to a freight industry source in Wuxi, Jiangsu province, the number of truck drivers in operation in the region is down at least 60%. Short capacity, longer transport times and rising fuel expenses pushed up freight costs by nearly 30% in early April from the same period last year, according to the China Federation of Logistics & Purchasing.

Declining truck services have snarled the Port of Shanghai, the world's largest container port. Road freight accounts for more than 50% of the container transport volume in the port.

In the latest outbreak, the port has managed to maintain normal operations using a closed-loop system under which workers live on-site and are tested regularly. But shortages of workers and truck services have left vessels stranded offshore, people familiar with the matter said.

Some of the congestion is rippling out to other ports, with ships being diverted to nearby Ningbo and Zhoushan to avoid the trucker shortage and warehouse closures in Shanghai.

The domestic air cargo link is partially broken due to the Shanghai outbreak.

Bettina Schoen-Behanzin, vice president of the EU Chamber of Commerce in China, estimated that the Shanghai port's handling of goods has declined by 40% from normal.

Air freight also declined dramatically during the lockdown. According to flight tracking site VariFlight, more than 98% of flights scheduled in and out of Shanghai's Hongqiao and Pudong airports were scratched between 6 and 12 April.

Pudong International Airport is the biggest air cargo gateway for China, accounting for 50% of the country's total trade volume by air.

The domestic air cargo link is partially broken due to the Shanghai outbreak, an air freight agent said.

International freight operators also cancelled flights in Shanghai due to concerns over a lack of ground services, a Pudong Airport staffer said. The number of cargo planes operating in Shanghai dropped by more than 505 on 13 April, data from VariFlight showed.

Businesses under pressure

Logistics disruptions in Shanghai and the surrounding Yangtze River Delta region, China's major manufacturing hub, are rippling through industrial chains, rattling business across China and beyond.

A survey by the EU Chamber of Commerce in China found that 30% of companies questioned said they were hit by supply disruptions. The American Chamber of Commerce in China found that 57.3% of companies surveyed were affected by the disruptions.

MacBook maker Quanta Computer Inc. and iPhone assembler Pegatron Corp. last week announced production halts at their facilities in Shanghai and Kunshan...

Since Shanghai entered a two-phased lockdown on 28 March, an expanding list of companies in electronics, semiconductors and automobile production have reduced or suspended operations under virus restrictions.

Shanghai hosts many of China's leading semiconductor manufacturers including the country's largest chip foundry, Semiconductor Manufacturing International Corporation (SMIC). In 2021, integrated circuit sales in Shanghai rose 24.5% from the previous year to 257.9 billion RMB (US$40.4 billion), a quarter of the national total. The city is also home to many automobile manufacturers including electric-car giant Tesla Inc.

In nearby Kunshan, Jiangsu province, virus restrictions also affect downstream businesses in the chip supply chain. The electronics hub and home of many Taiwanese businesses has been under a citywide lockdown since 6 April.

MacBook maker Quanta Computer Inc. and iPhone assembler Pegatron Corp. last week announced production halts at their facilities in Shanghai and Kunshan, moves that will affect the delivery of Apple Inc. devices, TF International Securities said.

SMIC and Hua Hong Semiconductor Ltd. have arranged closed-loop systems to ensure that some of their employees can continue to work on production lines. But chip-packaging companies, which rely on intensive labour, are affected most by the virus restrictions, Minsheng Securities said in a research note. For chipmakers in Shanghai, a more serious challenge is to secure trucks to get their materials and products delivered.

If Shanghai cannot resume production by May, all of the tech and industrial players that have supply chains in the area will come to a complete halt, especially the automotive industry - Huawei Technologies Head of Consumer and Auto Division, Richard Yu

Semiconductor makers in Shanghai are mainly relying on inventory to continue production and will face material shortages if the lockdown measures continue for months, Sinolink Securities said.

The auto industry is prone to production glitches due to its long, complex supply chains and limited inventories. Since the Shanghai lockdown began, several major automakers have halted or reduced production because of short supplies of parts.

Tesla's factory in the Pudong District of eastern Shanghai halted production on 28 March, losing 39,900 units of output. Germany's Volkswagen AG suspended assembly lines in Anting on 1 April due to shortages of parts.

On 9 April, electric-car startup Nio Inc. said that its halted output due to Covid-19 restrictions that forced parts suppliers in several places, including Shanghai and the provinces of Jilin and Jiangsu, to suspend manufacturing since March.

"If Shanghai cannot resume production by May, all of the tech and industrial players that have supply chains in the area will come to a complete halt, especially the automotive industry," said Richard Yu Chengdong, consumer and auto division head of Huawei Technologies, in a WeChat post.

"That will pose severe consequences and massive losses for the whole industry," Yu wrote.

This article was first published by Caixin Global as "Cover Story: The Disrupted Lifelines of the Shanghai Outbreak". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: Can Shanghai meet its zero-Covid deadline and resume production? | Why is China obsessed with zero-Covid? | Shanghai's worsening Covid-19 outbreak is turning political | Why rumours spread faster than outbreaks in Shanghai | As the virus spreads, can China calm its people and contain the outbreaks?