[Big read] What is the US's next move as China breaks through the chip blockade?

China's Huawei suddenly launched a new smartphone, equipped with a 7-nm chip said to be made in China and with network speeds reaching 5G levels, shocking the US political circles. What far-reaching impacts will China's breakthrough in chip technology have? How will Washington respond? Lianhe Zaobao correspondent Edwin Ong takes us through the recent developments and what it means for the US's strategy against China's tech advancements.

Chinese tech giant Huawei suddenly launched its new Mate 60 Pro smartphone during US Commerce Secretary Gina Raimondo's visit to China in late August. Over a week later, it launched pre-orders for another two new phones, signalling a potentially strong return to the 5G phone market four years after the China-US tech war began.

Huawei rising back up

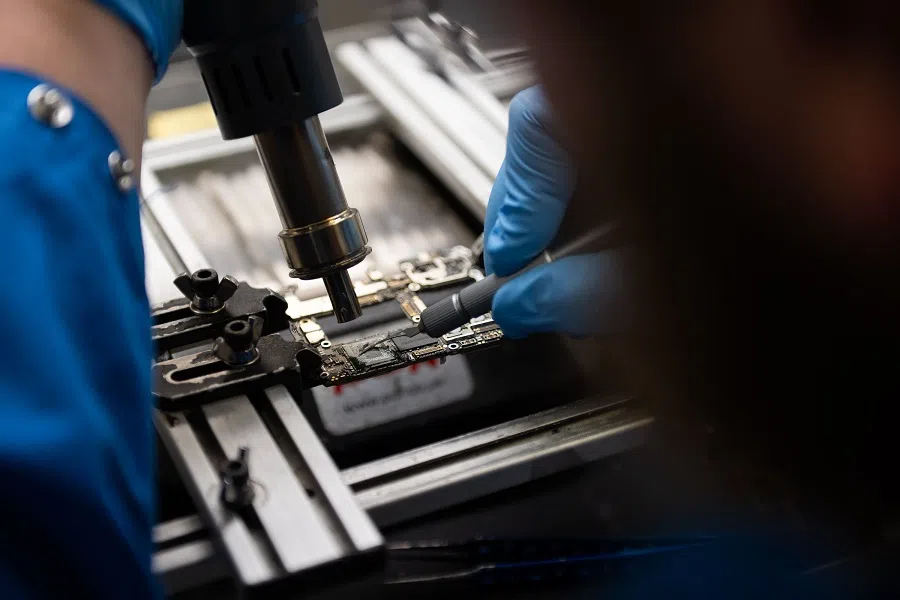

Various parties analysed that Huawei has achieved a technological breakthrough as its new phones are equipped with 7-nanometre (nm) chips produced by China's largest chipmaker, Semiconductor Manufacturing International Corp (SMIC), and can reach 5G-level internet speeds. This rattled the nerves of US politicians, who are scrambling to find loopholes in the tech sanctions against China. Some US lawmakers have even publicly called for an end to all tech exports to Huawei and SMIC.

The China-US chip war began in 2019 when then US President Donald Trump put Huawei, its chip design unit HiSilicon and other tech enterprises on an Entity List on national security grounds, thus prohibiting US companies from supplying unauthorised products and technology to them. In 2020, the US's Commerce Department further tightened its restrictions on Huawei, blocking global chip supplies to the company, and preventing it from obtaining US chips through third parties.

After US President Joe Biden took office, his administration further strengthened the chip blockade against China, comprehensively blocking China's alternative paths, from equipment and technology to talent.

Also, its chip, which has been identified as the Kirin 9000s, is designed by HiSilicon and produced by SMIC using the 7-nm process.

Huawei, which has consistently been among the world's top three smartphone brands since 2015, saw its smartphone development and sales take a serious hit following US sanctions, with smartphone shipments falling to 35 million units in 2021, down 81.6% from 2020. It was reported late last year that Huawei has depleted its smartphone chipsets inventory and could be forced out of the global smartphone market.

The sudden emergence of Huawei's new smartphones and domestically produced chips has sparked heated debates on China breaking through the US tech blockade. TechInsights, an information platform for the semiconductor industry, and Bloomberg analysed that Huawei sourced most of its smartphone parts domestically, with the exception of its memory components, which are from South Korea's SK hynix. Also, its chip, which has been identified as the Kirin 9000s, is designed by HiSilicon and produced by SMIC using the 7-nm process.

China's tech breakthrough

Sergelen Rocky Uriankhai, tech consultant and executive director of a tech think tank in Taiwan (科技力智库), told Lianhe Zaobao that the semiconductor industry is currently the main tech battleground between China and the US, as chips are the foundation of many other tech competitions, including artificial intelligence. China's 7-nm tech breakthrough implies that it has made a "major breakthrough" in the chip war, while helping other domestic scientific and industrial research firms in need of chips to "heave a sigh of relief".

... the emergence of Huawei's chips has a "clear symbolic significance" as it exemplified the enterprise's resilience and innovation and the fact that the company was not crippled by US sanctions. - Professor Zhu Feng, Institute of International Relations, Nanjing University

Professor Zhu Feng, director of Nanjing University's Institute of International Relations, said in an interview that the US has adopted a "new Cold War" approach in dealing with Chinese high-tech firms, and is attempting to meet its geostrategic interests and needs by restricting China's technology and markets. Indeed, Huawei's global smartphone sales surpassed Apple in 2019, but growth stalled after an all-out crackdown by the US.

Zhu Feng evaluated that the emergence of Huawei's chips has a "clear symbolic significance" as it exemplified the enterprise's resilience and innovation and the fact that the company was not crippled by US sanctions.

Associate Professor Zhu Feida of Singapore Management University's School of Computing and Information Systems also noted in an interview that just three years ago, Huawei relied on the US for over 15,000 components. Yet, in the face of harsh sanctions imposed by the US and its allies, Huawei was able to rely on itself to basically achieve domestic production within an unexpectedly short amount of time.

The production of Huawei's new smartphone amid the US's tech blockade not only ignited a surge of national pride and was lauded by netizens as "putting up a good fight", but also triggered a buying frenzy on 29 August when pre-sales started. Global Times published a commentary on 30 August saying, "The resurgence of Huawei smartphones after three years of forced silence is enough to prove that the US' extreme suppression has failed."

In addition, as Raimondo, who spearheaded the inclusion of Huawei on the Entity List back then, was visiting China when Huawei launched its new smartphone, Chinese netizens sarcastically crowned her as the ambassador of Huawei's new phone.

Zhu Feida assessed that after being suppressed by the US for several years, Huawei suddenly launched a new high-end smartphone model during Raimondo's visit to China, "hoping to achieve an unexpected and shocking effect". This is also a "huge confidence booster" to China, as it demonstrates that China can break through the West's united technological blockade against the country.

... China may only need three to five years or even less to catch up to the level of chip processes of developed countries. - Associate Professor Zhu Feida, School of Computing and Information Systems, SMU

The gap between China's and US's chip processes

However, Zhu Feng also pointed out that "it is still too early" to assert that China is fully capable of overcoming US chip controls, and that the source and development of Huawei's chips also remains to be further ascertained.

Whether the 7-nm chips produced by SMIC are 100% made-in-China is still widely debated. Quoting Ray Yang, consulting director at Industry, Science and Technology International Strategy Center of Taiwan's Industrial Technology Research Institute, Deutsche Welle reported that SMIC chips may still have used US technology because almost all of the electronic design automation (EDA) tools necessary for the chip manufacturing process come from the US. Some of the older deep ultraviolet (DUV) lithography machines imported from the Netherlands may also contain US components.

Zhu Feida said frankly that China is mainly using technological innovation to simulate high-end effects with low-end chips, and that the 7-nm chips may not be fully domestically produced yet. But he predicts that China may only need three to five years or even less to catch up to the level of chip processes of developed countries.

Liu Pei-chen, researcher at Taiwan Institute of Economic Research's Taiwan Industry Economics Database, said in an interview that Huawei's chips may be produced by the DUV machine using multiple exposure technology. If the yield of 7-nm chips produced in this manner is around 50%, it will still be able to reach a certain scale of mass production even though manufacturing time has increased. However, to manufacture the more advanced 5-nm chips, the yield of multiple exposures will be "very poor", with extremely low capacity too.

China has to ensure that it can be self-reliant in every node of the semiconductor industrial chain if it wants to catch up. - Sergelen Rocky Uriankhai, tech consultant and executive director of a tech think tank in Taiwan

Some people think that China could be manufacturing 7-nm chips regardless of the cost. Chung-Hua Institution for Economic Research vice-president Wang Jiann-Chyuan said on a television programme that the yield of 7-nm chips produced through DUV with multiple exposures must reach around 70-80% before it becomes profitable. However, Beijing could be considering the issue from the national security perspective, rather than cost-effectiveness.

Liu Pei-chen assessed that China is now "at the end of its rope" in terms of advanced processes and what it can use to produce 7-nm chips. It may take at least five years to catch up with the world's leading chip processes.

Meanwhile, Sergelen Rocky Uriankhai thinks that it is uncertain how long China will take to be on par with the US in terms of chip technology because the semiconductor industrial chain that produces chips is long and complex. Faced with the US's intensifying tech blockade, China has to ensure that it can be self-reliant in every node of the semiconductor industrial chain if it wants to catch up. "It has to take into consideration how much it is lagging behind in each node. That is, it cannot have a single shortcoming," he noted.

Uriankhai also pointed out that China is currently lagging furthest behind in its access to the most advanced extreme ultraviolet (EUV) lithography machine, which is required to produce 5-nm, 3-nm or even 2-nm chips for the most high-end smartphones. As China tries to catch up, the US and its allies are also advancing in technologies such as advanced packaging, "which adds to the uncertainty".

China-US tech war intensifying

Clearly, China is hitting back harder in the tech war this year. In May, Beijing authorities cited national security concerns to ban the use of products made by US memory chip maker Micron in critical information infrastructure projects in the country.

Though the Chinese market accounted for only 11% of Micron's total revenue last year, news of the ban still caused the company's stock to drop by 6.8% at one point, the biggest decline since November last year.

In August, China hit back in the chip war by imposing restrictions on the export of gallium and germanium, both key raw materials for manufacturing semiconductors.

Liu Pei-chen opined that we are now in the next stage of the China-US chip war, from the US imposing suffocating sanctions on China over the past four years, to Beijing's increasingly evident counter moves against the US now.

She added that the biggest bargaining chip that China has is its huge market demand, which accounts for more than 30% of global demand for semiconductors. But with no substitute product, this card could not be played in the past four years.

With the emergence of the Huawei chip, Liu noted that Beijing is starting to pluck up the courage by banning the use of Apple's iPhones for government officials. While the ban will have limited impact, it is a symbolic move in situating China in competition against the US.

Huawei's smartphone capabilities is not far behind that of Apple's iPhone, and thus Beijing's ban at this point in time would not cause too much public dissatisfaction - which could be a reason why it dared to play this card in the first place. - Zhu Feida

In a Wall Street Journal article published on 6 September, an insider was quoted as saying that China banned the use of iPhones for government officials, and Apple stock fell 6% after the news broke, losing about US$190 billion.

China is Apple's third largest market, accounting for 19% of total revenue last year, at US$394 billion. Investment firm Oppenheimer's analyst Martin Yang estimates that Huawei's new phone release would drive down shipment of Apple's iPhones by at least 10 million units in 2024.

Zhu Feida opines that at present, Huawei's smartphone capabilities is not far behind that of Apple's iPhone, and thus Beijing's ban at this point in time would not cause too much public dissatisfaction - which could be a reason why it dared to play this card in the first place. The move is also a show of the Chinese market's significant impact on US companies; by making Apple stocks take a tumble, China is "giving the US a taste of its might".

Meanwhile, Zhu Feng cautioned that if both China and the US become overly protective over normal business relations, this would cause tensions to rise, and the China-US conflict could spiral out of control. He added that Beijing is facing a big challenge in avoiding the excessive implementation of overly protectionist measures. In the face of US pressure while trying to stabilise market investment, China must also maintain an open and cooperative attitude towards world markets.

Failure of US export sanctions?

On the heels of Huawei's sudden release of the "most powerful smartphone in the Mate series", the US Congress immediately called for investigations on whether US chip sanctions have been violated. The US Department of Commerce also announced that it would launch official investigations into Huawei's smartphone chips, and could possibly further tighten tech restrictions on Huawei and SMIC.

The Chinese foreign ministry stated on 8 September that "sanctions and curbs will not stop China's development. They will only strengthen China's resolve and capability to seek self-reliance and technological innovation."

Sergelen Rocky Uriankhai believes that the US had consistently dialled up the pressure against China for the past four years, but nevertheless, this did not prevent China from producing its 7-nm chip. Not only is this a blow to the Biden administration, it also points towards a "failure" at this stage in the US's strategy to keep China in check through export sanctions.

However, both Zhu Feng and Zhu Feida pointed out that the US chip war against China "cannot be deemed a complete failure". The strategy to restrict exports in the past four years clearly stalled Beijing's development in artificial intelligence and high-end chips, and caused Huawei to drop out of the top eight smartphone brands globally, while other Chinese smartphone producers also faced a chip shortage.

If the US tightens export restrictions, chip manufacturers such as Qualcomm would surely be impacted even further...

Zhu Feng stated, "Quite frankly, China is feeling the effects of US salvos in the tech industry. We must face up to this fact."

US 'small yard, high fence' strategy

The US tech containment strategy of "small yard, high fence" against China recently reignited doubts from Western think tanks and corporations. Jim Lewis, an expert at the Washington-based think tank Center for Strategic and International Studies, pointed out that "if a total ban was implemented, it is uncertain if this would buy the US a couple of years to widen the tech gap. But this would not stop Huawei from seeking alternative plans."

Peter Wennink, CEO of Dutch semiconductor equipment manufacturing titan ASML, stated in a televised interview this month that tech restrictions on China by the West might be futile, as "there is no way to wholly isolate China. If we don't share technology, they would simply conduct their own research."

Zhu Feida opines that the US does not have many cards left to play in the chip war against China, and the restrictions might have hit a bottleneck. If the US tightens export restrictions, chip manufacturers such as Qualcomm would surely be impacted even further, as profits would decline without access to the Chinese market and there might be a surplus in production capacity.

Kuo Ming-Chi, TF International Securities analyst, posted on X (formerly Twitter) that Qualcomm is the main loser from Huawei's estimated adoption of Kirin 9000S chips next year, as "Qualcomm's SoC [systems on chips] shipments to Chinese smartphone brands in 2024 are expected to be at least 50-60 million units lower than in 2023". Qualcomm has been supplying 4G chips to Huawei, with 60% of its revenue coming from the Chinese market.

... the trump card for the US is the fact that it still controls the most important factors of global semiconductor production, which is why the US is effective in gathering allies to clamp down on China. - Liu Pei-chen, researcher, Taiwan Industry Economics Database, Taiwan Institute of Economic Research

US still in control

Zhu Feida pointed out that the US opened the "Pandora's box" of export restrictions during the Trump era, and there is no going back when it comes to China-US mutual dependencies in technology. Even if the US loosened restrictions on export, China would not stop its own research and development, making it quite meaningless for the US to adjust its strategy now.

Even so, Zhu Feida predicts that amid mounting pressure by US corporations towards the Biden administration, the US would be hard-pressed to significantly increase pressure on China, and could even move slowly towards loosening restrictions in the future.

Liu stated that in the chip war against China, the trump card for the US is the fact that it still controls the most important factors of global semiconductor production, which is why the US is effective in gathering allies to clamp down on China.

She pointed out that to mitigate the damage towards the interests of domestic semiconductor firms, the US has been adjusting its pressure on Chinese exports accordingly for the past few years. Certain Western equipment, materials and technologies have flowed towards China through loopholes such as black markets and reinvestments.

The Biden administration is expected to conduct a comprehensive review and strengthening of the export restrictions that it has implemented towards China over the past few years, while also continuing to rally allies to collectively stand against China. Liu added, "The central focus of US strategy against China would largely remain the same, but the speed and strength of moves made against China would increase."

Zhu Feng opines that with the birth of the Huawei chip, US tech restrictions against China would most likely intensify, possibly changing from "small yard, high fence" to "big yard, wide fence", with high-tech export restrictions on China to gradually widen in scope.

This article was first published in Lianhe Zaobao as "中国突破7纳米芯片技术 中美科技战进入2.0阶段?".

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)