China's new export controls on rare metals for chipmaking: Latest tit-for-tat in US-China tech war

The China-US tech war has heated up again as China imposes export restrictions on two rare metals widely used in strategic emerging industries. Lianhe Zaobao correspondent Yang Danxu notes that this is a tit-for-tat move against the US for its export restriction of advanced chips and chipmaking technology to China. How will this latest move in the tech war affect the semiconductor industry and China-US relations?

On the eve of US Treasury Secretary Janet Yellen's trip to China, Beijing announced new export controls on raw materials on the grounds of national security, heating up the China-US tech war. Two metals that are crucial to parts of the semiconductor, telecommunications and electric vehicle industries are on the restricted list.

Protecting 'national security and interests'

The Chinese Ministry of Commerce and the General Administration of Customs said in a notice on 3 July that China will impose export restrictions on industrial products and materials containing gallium and germanium from 1 August to protect its "national security and interests".

According to the notice, exporters will now be required to apply for export licences with the Ministry of Commerce through provincial commerce authorities to export these materials, and provide proof of the end users and their uses. Approval from the State Council will also be required for the exports of listed items with a major impact on national security.

Playing on China's strength

Gallium and germanium are niche and crucial metals widely used in strategic emerging industries. In China, gallium is even called the "new sustenance of the semiconductor industry". Gallium arsenide, which is listed under China's export controls, can be used to manufacture high-performance chips. The United States Geological Survey (USGS) reports that there is no effective alternative to gallium arsenide for this purpose. Meanwhile, gallium nitride is one of the most representative third-generation semiconductor materials widely used in 5G communications, new energy vehicles and even military radars.

Considered an important strategic resource by many countries, germanium is used in infrared optics, fibre optics, solar cells, polymerisation catalysts, healthcare and other high-tech fields. It also has great potential in chips, solar cells, biotechnology and weapons manufacturing.

Based on a 2020 European Commission report, China produces 80% of the world's supplies of gallium and germanium. However, China's strength is in upstream production, mainly exporting primary goods to developed economies. In the downstream applications of these raw materials, such as the manufacturing of chips and other high-tech products, China has no upper hand and is even trapped in a chokehold.

Clearly, Beijing is now targeting the US, using raw materials as a "weapon" in a reverse "chokehold": choke me out of high-end chips, and I will cut off the raw materials for chip manufacturing.

Retaliating against restrictions with restrictions

After restricting US enterprises from supplying technology and products to Chinese companies such as Huawei, the US further restricted US enterprises from exporting advanced semiconductor equipment to China in October last year. In January this year, it secured a deal with the Netherlands and Japan to restrict the export of advanced chipmaking machinery to China.

Before China announced export control orders on gallium and germanium, the Netherlands on 30 June announced new export restrictions on some advanced semiconductor equipment starting 1 September. This means that semiconductor giant ASML will need to apply for a licence before it can export its most sophisticated lithography machine to China in future.

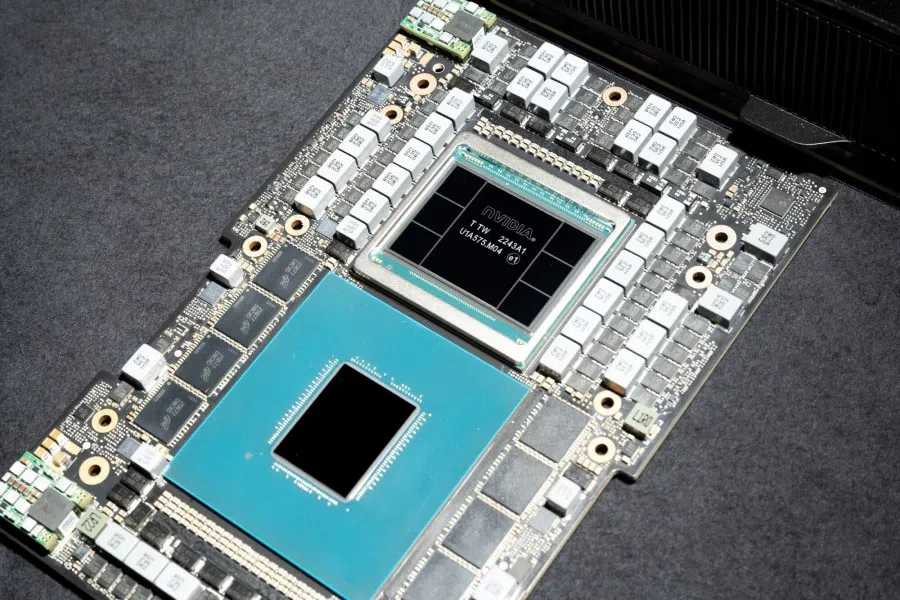

It was also reported last week that Washington is considering additional measures to restrict China's access to key technologies, including restricting the sales to China of advanced chips made by companies such as Nvidia, Advanced Micro Devices and Intel, that are needed to drive artificial intelligence development.

Although restricting the export of strategic raw materials and protecting limited resources is a way to uphold national security and interests, these raw materials have become a new battleground in the China-US competition, because they have a hold over emerging strategic industries. Clearly, Beijing is now targeting the US, using raw materials as a "weapon" in a reverse "chokehold": choke me out of high-end chips, and I will cut off the raw materials for chip manufacturing.

Gaining the upper hand?

Given China's advantage in the production of these rare metals, once this export control measure is implemented, it will inevitably have an impact on downstream semiconductor industries, especially in the production of high-performance chips. Some industry players expect that it may affect the production of all third-generation semiconductors.

It remains unclear how China will enforce the export controls, to what extent the restrictions will affect the high-tech industry in the US, and whether it will prove to be China's "killer move" in the tech war. Undoubtedly, it will strengthen the US's determination to reduce its reliance on China and further "de-risk" when it comes to critical commodities.

The tech war against China was initiated by the US during then President Donald Trump's term. Right now, the core strategy for both Washington and Beijing is implementing specific export restrictions under the pretext of protecting national security, to slow down their opponent's progress in the tech field. Beijing's decision to impose export restrictions on raw materials for semiconductors, solar cells and military weapons before Yellen's visit to China is to gain greater leverage before the bilateral talks.

For Beijing, it must hit back through market size and its advantages in niche raw materials in the face of US pressure. In the long run, China must also strive for breakthroughs and self-reliance in core technologies.

Escalating tech war

China and the US are both engaged in a hot battle in the tech arena; both sides have their own interests to protect, and neither is willing to show weakness.

Washington has said that it does not seek to "decouple" from China, but when it comes to technology, which will directly determine the military strength of both countries in the future, the US will not just sit back. For Beijing, it must hit back through market size and its advantages in niche raw materials in the face of US pressure. In the long run, China must also strive for breakthroughs and self-reliance in core technologies.

Given the complexity of high-tech products such as semiconductors, and the global span of their industrial and supply chains, China and the US are closely tied to each other, from raw materials to technology and the market. Any unilateral restrictions, supply cuts or market blockades by either side in the industrial and supply chains could impact the development of a technology field resulting in a lose-lose situation, and may even impede the overall progress of human technology.

No one wants to see a "new Cold War", but as this tech war continues to escalate, with no sign of how far it will go before it ends, it is hard not to feel a chill.

This article was first published in Lianhe Zaobao as "中国反向"卡脖子"".

Related: America turning to state intervention to win US-China tech war | Technology and innovation race: US losing edge to China? | China's going full speed ahead on technology innovation. Will it work? | China's chip industry 'Big Fund' crackdown: Corruptions or failed investments? | No funding, no market. What now for China's tech companies?

![[Big read] Paying for pleasure: Chinese women indulge in handsome male hosts](https://cassette.sphdigital.com.sg/image/thinkchina/c2cf352c4d2ed7e9531e3525a2bd965a52dc4e85ccc026bc16515baab02389ab)

![[Big read] How UOB’s Wee Ee Cheong masters the long game](https://cassette.sphdigital.com.sg/image/thinkchina/1da0b19a41e4358790304b9f3e83f9596de84096a490ca05b36f58134ae9e8f1)