[Big read] When will the Chinese stock market thrive again?

Even with the efforts of the Chinese government to revitalise the stock market, investors and shareholders seem to be unconvinced and hesitant in putting in funding, which in turn is not helping the market to recover as fast as would be hoped. What else can be done to bring back the good days?

"You have to learn how to lose money before you can make money on stocks."

On the first day that the market opened in 2024, Chinese shareholders consoled themselves with this line from the popular TV drama, Blossoms Shanghai (《繁花》).

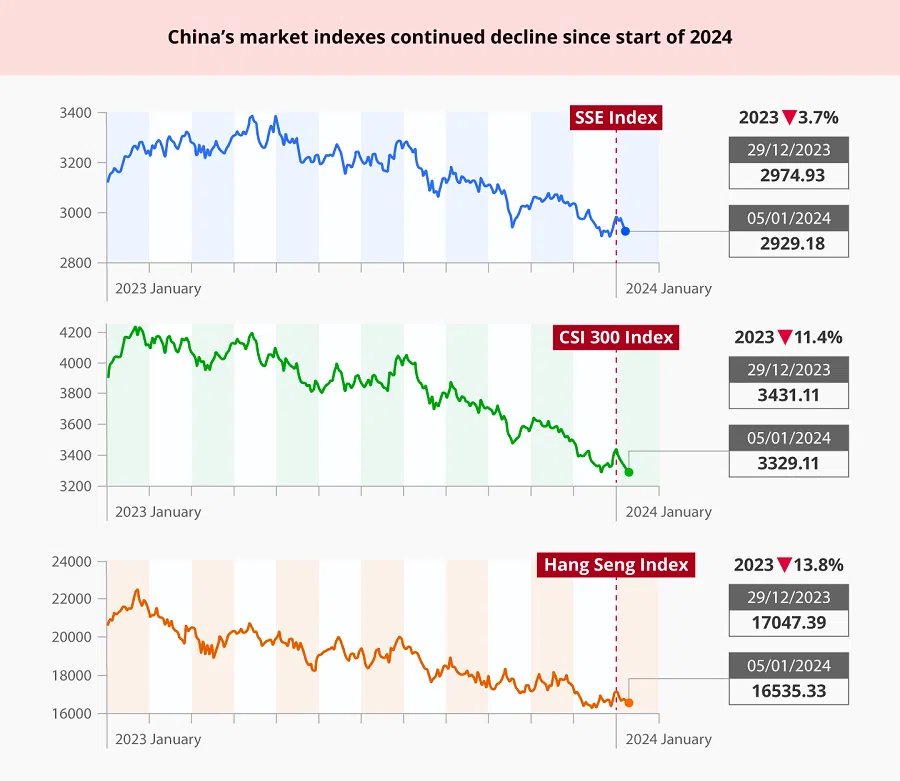

That day, the SSE Composite Index did not maintain its rise from the last week of 2023, falling from 2,974.93 down to 2,962.28, a step back from the 3,000 mark.

Falling stocks

"A-shares" once more made the list of top searches on Weibo. A netizen self-deprecatingly commented: "I was thinking of making money on the first day of 2024. But on the second day, I only wanted my money back."

Others noted that, in the previous three bull markets, A-shares all declined once the market opened; going by this logic, this year will definitely see a shift from a bear to a bull market.

Will the turbulent Chinese market see better prospects in the coming new year as shareholders hope, or will last year's poor performance drag on, leading to new lows?

In early 2023, investors were full of confidence in China's market, hoping that the lifting of pandemic restrictions and the reopening of borders would help both the market and the economy rebound with a vengeance.

They did not expect that by the end of 2023, China's market would be the worst performer in the Asia-Pacific region. The three main indexes for A-shares all dropped, with the CSI 300 Index dipping by more than 11% - the third consecutive year it has experienced a decline - while Hong Kong's Hang Seng Index recorded a slump of 14%.

The market trend for 2023 generally matched China's economy. Take the SSE Index for example, in the first half of the year, economic recovery was rapid, the positive outlook drew a large amount of foreign investments into the market, and the market responded in kind with the SSE Index hitting the 3,400 mark twice in April and May 2023.

But in the second half of 2023, China's deflation risk rose and the property market became sluggish, while local debt was high and the renminbi's depreciation intensified; under pressure from multiple sources, the SSE Index plunged to below 3,000 points in October 2023, even cracking the 2,900 mark at one point in late December 2023.

Based on assessment of price-to-earnings (PE) ratio and price-to-book (PB) ratio, China's stock market valuation is currently at its lowest in ten years, and the risk-reward ratio for investing in Chinese stocks has its appeal. - Ma Lei, Chief Investment Officer for Hong Kong and China, Invesco

Unfriendly external environment

At the same time, the external environment was also unfriendly towards the Chinese market. The US Federal Reserve hastened the hiking of interest rates, which led to capital from emerging markets being drawn back to the US, putting constant pressure on A-shares.

The continued escalation of China-US competition also increased the speed of foreign capital flowing out of China. Foreign investors trading RMB shares through the "northbound investment" channel of the Shenzhen-Hong Kong Stock Connect programme led to a total net inflow of 43.7 billion RMB - a new low in the seven years since the launch of the programme.

An optimistic analysis would view the Chinese stock market as having hit rock bottom, now being a prime opportunity to buy low.

Ma Lei, Invesco's chief investment officer for Hong Kong and China, pointed out that the MSCI China Index was around 45% lower than the MSCI USA Index. Based on assessment of price-to-earnings (PE) ratio and price-to-book (PB) ratio, China's stock market valuation is currently at its lowest in ten years, and the risk-reward ratio for investing in Chinese stocks has its appeal.

Statistics from financial data company FactSet show an average forward PE ratio of 8 for the Hang Seng Index, near the lowest it has been in almost 20 years.

A survey of 417 investors in late December 2023 by Bloomberg revealed that low stock prices have increased the attractiveness of the Chinese market for investors. Nearly a third of respondents said they would increase their China investments over the next year, a huge step up from 19% in August 2023.

However, investors last year who harboured the same hopes whilst entering the market did not hit it big, and were instead left licking their wounds. Compared to last year, what major changes will there be in China's stock market in 2024?

China-US relations are expected to be warmer after a meeting between the leaders of both countries, which would help boost China's imports and exports. There is hope that the Chinese market this year could rebound from its lowest valley.

Economic and geopolitical factors affecting the market

A research paper by CSC Financial noted that at least two major factors will improve this year. Firstly, the global liquidity condition is expected to improve as the Fed approaches the end of its rate hike cycle. Secondly, as China ramps up its macroeconomic policy mix, the contraction in the property market has slowed and consumer and business confidence has improved.

With these factors, it is expected that incremental funding for A-shares would first stabilise before increasing, leading to a bull market in the second half of 2024.

The macroeconomic research team at China Minsheng Bank felt that the trillion-yuan special treasury bonds and special refinancing bonds issued late last year will enter a phase of spending and using the funds, favouring an overall easing of the liquidity environment. More real estate policies could also be put forth to spur a "mini spring" of the property market.

On the global front, China-US relations are expected to be warmer after a meeting between the leaders of both countries, which would help boost China's imports and exports. There is hope that the Chinese market this year could rebound from its lowest valley.

Unlike the largely positive outlook from Chinese researchers, international investment firms held diverse views. Goldman Sachs predicted that the CSI 300 Index could rise by 16%, while UBS predicted that the MSCI China Index could rise by 15%. Morgan Stanley was more cautious in its prediction that the MSCI China Index could rise by 5% and the CSI 300 Index by 7%.

Analysts at Morgan Stanley felt that China's economic recovery was still sluggish and insufficient to restore market confidence, predicting that the market would continue to decline in the next few months.

Saxo's market strategist Redmond Wong also pointed out that China needs more time to reorganise the real estate market and tackle issues of local government debt, predicting that the Chinese stock market, which includes Hong Kong, will bottom out in 2024.

"We predict that China's GDP growth in 2024 will slow to 5%. The authorities would need to come up with more fiscal and monetary policies, as well as policies to ease the real estate market, in order to support growth." - Eli Lee, Head of investment strategy, Bank of Singapore

The outlook for the economy remains bleak, while geopolitical uncertainties persist. Lorraine Tan, director of equity research in Asia for investment research and fund rating agency Morningstar, analysed in an interview with Lianhe Zaobao that the heightened Israel-Hamas conflict could lead to a rise in fuel prices, and have an impact on the growth of the global economy, adding that political manoeuvres leading up to the US elections, could give rise to more policies to suppress China, keeping geopolitical risks high.

Eli Lee, head of investment strategy at the Bank of Singapore, said when interviewed that China's GDP growth rate for 2023 could hit 5.4%, but market confidence continues to be low, especially for the real estate market which remains sluggish, while exports could be hampered by the slowing of the global economy. He added: "We predict that China's GDP growth in 2024 will slow to 5%. The authorities would need to come up with more fiscal and monetary policies, as well as policies to ease the real estate market, in order to support growth."

Market sentiment is a direct reflection of investors' trust in the economy. For China, this trust is often closely linked to its macroeconomic policies. But the market did not seem to buy into the favourable policies put forth by the authorities in 2023.

Following the Politburo meeting in July 2023, Chinese officials introduced intensive stimulus policies targeting areas such as the property market, foreign investment and the private economy.

Take the stock market as an example, the China Securities Regulatory Commission implemented a series of measures in August 2023, including reducing stamp duty, tightening the pace of IPOs in stages, and regulating stake reductions made by principal shareholders. But the stock market rebound that official statements or relevant measures had been able to drive was just a flash in the pan, recording just a brief rebound before swiftly falling again.

On the other hand, policy uncertainty is becoming a risk that investors are increasingly worried about. Following crackdowns on the internet and private tutoring sectors, gaming stocks have also been shaken up by a new draft regulation for online games released in December 2023. Hong Kong-listed Tencent saw HK$367 billion (roughly US$47 billion) in stock value evaporate in a day, while NetEase shares plunged over 24%.

"Policymakers should suitably disperse power to allow the private sector to be revitalised from the bottom up." - Associate Professor Fu Fangjian, Lee Kong Chian School of Business, Singapore Management University

Stimulus policies lack coordination

Associate Professor Fu Fangjian of the Lee Kong Chian School of Business at Singapore Management University said in an interview that while a slew of stimulus policies have been rolled out over the past six months, they are just "patches and tweaks". Coupled with the fact that the policies lack coordination, they can hardly create synergy. He said, "Purchase restrictions could be relaxed today, but gaming restrictions are tightened tomorrow, offsetting the boost to market confidence."

He thinks that excessive central government control over the economy will increase the industries' need for stimulus and weaken their ability to withstand pressure. "Policymakers should suitably disperse power to allow the private sector to be revitalised from the bottom up," he noted.

The Central Economic Work Conference held in December 2023 stressed the need to strengthen the consistency of macroeconomic policy orientation and coordination on fiscal, monetary, employment, industrial, regional, sci-tech and environmental policies, and include non-economic policies in the assessment of macroeconomic policy consistency to ensure that the "policies create synergy".

With the start of the new year, investors are turning their attention to the Two Sessions (两会, annual meetings of the National People's Congress and the Chinese People's Political Consultative Conference) and the long overdue third plenum of the 20th Central Committee, eagerly anticipating clues to economic growth and stimulus policies. Tommy Xie, head of Greater China Research & Strategy at OCBC Bank, pointed out that official efforts in fighting deflation is an important point to watch.

Xie said in an interview that while China's real economic growth last year was not low, due to the failure of reflation, nominal GDP growth was lower than real GDP growth, dealing a blow to market confidence. This is partly due to policy mismatches, where money goes to the supply side but not to the demand side, and thus while employment improved, domestic demand did not expand effectively.

"Whether this year's policies address the issues and lead China out of the shadow of deflation is important for overall confidence," he said.

The TV drama Blossoms Shanghai is set in 1992 Shanghai. That year, China's stock market entered its first-ever bull market. The narrator says at the beginning of the drama series that the century-old Dow Jones was only at about 3,300 points at the time, but the SSE Composite Index, which was just a year old, was already at nearly 1,000 points. "Everyone has an equal chance and seizing it is potentially life-changing," the narrator said.

Thirty-two years later, the Dow Jones has cracked 37,000 points but the SSE Composite Index is still struggling at around 3,000 points. Entering a new year, the Chinese stock market is still awaiting a chance for a comeback.

Property sector expected to be biggest drag on market

The property sector, which was stuck in a slump last year, is still expected to be the biggest drag on the Chinese stock market this year.

Statistics from Wind show that out of 24 A-shares industry indexes, 22 had fallen last year. The best-performing communications industry rose over 23%, while the beauty and retail sectors fell over 30%. The property sector also plummeted by over 26%.

Taking into account Hong Kong-listed mainland Chinese property companies, the decline in the real estate sector is even more pronounced. Statistics from real estate consultancy firm CRIC (克而瑞) showed that as of 18 December 2023, the total market capitalisation of 181 real estate stocks listed on both the mainland and Hong Kong shrank by 27.75% compared with the beginning of the year. The Hang Seng Mainland Property Index dropped 40% for 2023, the worst-performing in the Hang Seng Index. The Hong Kong-listed Evergrande Group sank 86%, while Country Garden slipped 71%.

While the central government and local governments have repeatedly rolled out numerous stimulus policies to revive the property market since the second half of 2023, the willingness to purchase homes has not been significantly boosted so far. Goldman Sachs, Morgan Stanley, UBS and other investment banks and securities firms generally predict that the property sector will shrink for the third year in a row this year, a record streak.

Bloomberg reported Ned Davis Research Chief Economist Alejandra Grindal as saying, "The number one household asset is houses - that's where the majority hold their wealth. If it is not increasing, that acts as a drag on confidence."

... the new draft regulation for online games released in late December last year, which greatly affected gaming stocks, is another reminder for investors that China's private enterprises, especially emerging ones like internet enterprises, face great policy uncertainty.

Tech stocks looking up

On the other hand, the technology sector, which was also on the decline last year, is seen as a high-growth sector by several institutions this year. The Hang Seng Tech Index slipped 8.8% in 2023, with the shares of Hong Kong-listed Alibaba falling over 12% and Tencent shares down by nearly 7.5%.

In its 2024 strategy report, UBS cites the internet sector as most likely to perform well in 2024: whether in terms of depth or breadth, compared to their US peers, the relative valuation of Chinese internet companies is low.

Morgan Stanley pointed out that owing to support measures such as cost efficiency and buyback, the earnings resilience of the internet sector has improved significantly, with actual performance outperforming market expectations for three consecutive quarters.

Eli Lee from the Bank of Singapore predicts that the onshore A-share market will benefit more from policy easing this year, with the technology, communication services and consumer sectors performing best.

However, the new draft regulation for online games released in late December last year, which greatly affected gaming stocks, is another reminder for investors that China's private enterprises, especially emerging ones like internet enterprises, face great policy uncertainty. At the same time, intensifying China-US tech competition also puts Chinese tech players, from semiconductors to the internet, under immense geopolitical pressure that cannot be ignored.

This article was first published in Lianhe Zaobao as "跌势难逆 中国股市何时繁花似锦?".

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)