China's efforts to internationalise RMB gaining a foothold in SEA

Over the past decades, China has made great efforts to promote the internationalisation of the renminbi (RMB), that is, to increase the use of RMB internationally as a unit of account, medium of exchange, and store of value. As a result, the role of RMB has been strengthened across the board, from international payment and settlement, to investment and financing, reserves and pricing.

According to data from The People's Bank of China (PBOC), the country's central bank, nearly half of all cross-border transactions are settled in the RMB currently. And China's cross-border RMB receipts and payments in non-banking sectors have risen by 15.2% year-on-year from January to August 2022, reaching 27.8 trillion RMB (about US$3.91 trillion). Furthermore, the share of securities investment in cross-border RMB receipts and payments increased from about 30% in 2017 to around 60% in 2021.

In addition, the International Monetary Fund (IMF) added the RMB to the basket of currencies that make up the Special Drawing Rights (SDR) in 2016, reflecting the great progress of the internationalisation of RMB. The SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries' official reserves. Recent data show that the share of RMB in the basket rose from 10.92% in 2016 to 12.28% in May 2022.

Last month, the PBOC published an article saying it will steadily advance the currency's internationalisation by strengthening coordination between domestic and foreign currencies, facilitating market entities to use the RMB more and promoting innovation in RMB cross-border investment and financing. Given the current complex international environment, what are the implications of increasing the international use of RMB on China and the world?

The use of RMB among global payment currencies experienced a slight increase at the beginning of 2022, but remains at around 2% currently.

China's incentive to push ahead

Greater RMB internationalisation is driven by both China's rapid rise and today's changing international environment.

China has emerged as an economic and financial powerhouse quicker than anticipated, becoming the second-largest economy in the world. But the internationalisation of the RMB has been relatively slower than expected. The use of RMB among global payment currencies experienced a slight increase at the beginning of 2022, but remains at around 2% currently. It indicates a huge room for China to promote the use of RMB internationally.

The benefits of internationalising the RMB are obvious. It not only decreases the exchange rate risks in cross-border trade, investment and financial transactions but also reduces the reliance on foreign currencies such as the US dollar (USD). China's international trading settlement will be less affected by the shortage of the USD or any other currencies. It also reduces the risk of speculative attacks that may result in the bankruptcy of firms due to the sharp depreciation of the RMB.

The dollar can be a weapon against any country in the world. The financial sanctions by the US on Russia is a good example. In particular, tensions between China and the US have escalated over the past years. The likelihood of the US imposing new financial sanctions on China is increasing.

The difficult situation faced by Russia has issued Beijing an alert that China would be in the face of similar sanctions in the future, hastening its de-dollarisation and RMB internationalisation efforts to protect China from possible attacks in the future.

... a strong dollar will land emerging economies into trouble, making it more difficult for developing countries to pay USD-denominated debt.

A good opportunity for China

Evidence has shown that the dollar's dominant position may hurt many countries whose international trade is mainly invoiced in USD. Especially in 2022, US inflation reached above 8%, which is far beyond the target 2% inflation. The Federal Reserve has had to tighten its monetary policy to combat inflation. The federal fund rate has been raised from near zero at the beginning of 2022 to between 3.75% and 4% in November. The rising interest rate tends to make the dollar stronger as the higher yields attract capital from international investors seeking higher returns on financial assets.

The greenback has climbed dramatically in 2022. However, a strong dollar will land emerging economies into trouble, making it more difficult for developing countries to pay USD-denominated debt. In addition, it pushes up the bills for other countries' manufacturers and businesses that need imported goods, worsening these countries' inflation problems and slowing down their economic recovery.

These countries will start to rethink their reliance on the dollar and seek an alternative international currency or international payment system to hedge the risk of the rising dollar. The situation indeed provides a good opportunity for China to advance the process of RMB internationalisation.

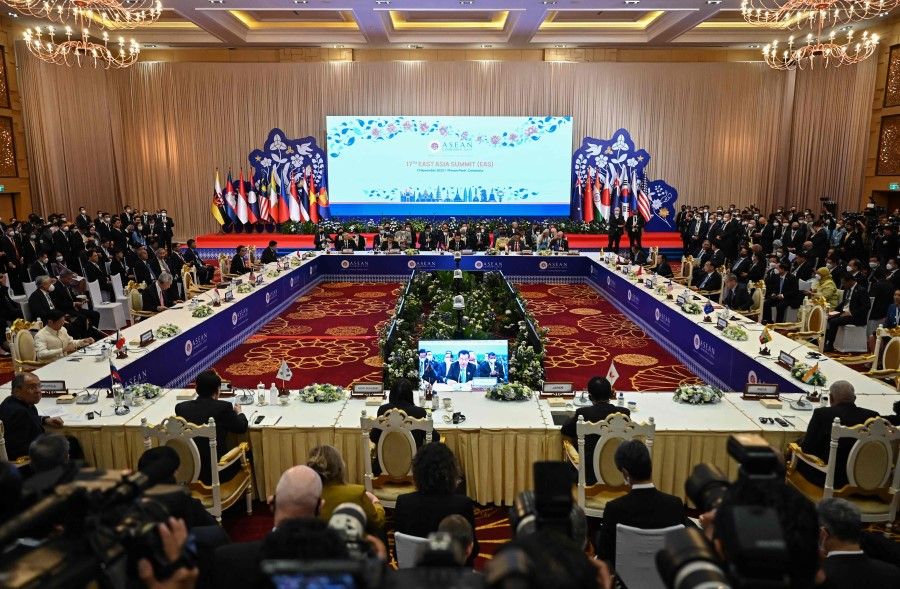

Impact on ASEAN countries

Earlier in 2019, China published a five-year blueprint to enhance economic and financial integration between southern Guangxi province and Southeast Asia, aiming to promote the widespread use of the RMB in cross-border trade.

China-ASEAN cross-border RMB settlement volume has surged nearly 20-fold in a decade.

Furthermore, the government greatly supports RMB-denominated lending to projects in the region, seeking to build offshore RMB markets and promoting financial investment, according to Reuters. It has shown Beijing's determination to internationalise the RMB.

Given the significant trade ties between China and ASEAN countries, the cross-border usage of RMB continues to grow. Data show that China-ASEAN cross-border RMB settlement volume has surged nearly 20-fold in a decade.

Furthermore, because of the Regional Comprehensive Economic Partnership (RCEP) agreement signed in 2020, we can anticipate that China and the neighbouring countries will have greater economic integration and the RMB will play a more important role in regional economic activities in the future.

Curbing dollar reliance is another reason for ASEAN countries to increasingly use the RMB in intra-regional trade payments. Southeast Asian countries have tried to avoid using dollars as an intermediary in cross-border payments.

... building mature financial and legal systems are prerequisites for internationalising the RMB.

On the one hand, they are reluctant to be negatively affected by the US tightening of monetary policy. On the other hand, recent sanctions on Russia have also raised their concern about the high usage of USD. They are actively searching for alternative financial channels to circumvent the potential sanctions to transact with their trading partners. The fast-growing RMB Cross-Border Interbank Payment System (CIPS) could be one of the options.

China, however, still has a long road to go before successfully internationalising the RMB. To achieve its goal, the country will have to improve the liquidity of RMB-denominated assets and simplify the process for foreign investors to enter the Chinese market. It means China should further relax capital control, liberalise its financial market and establish more offshore RMB centres. In addition, building mature financial and legal systems are prerequisites for internationalising the RMB.