Chinese fast fashion platforms could be next US target

Although Chinese fast fashion platforms such as Shein and Temu are gaining pace in the US, they could be the target of stringent US regulations over a variety of concerns such as personal data risks and trade loopholes.

(By Caixin journalists Sun Yanran, Bao Hongyun and Mo Yelin)

As Chinese fast fashion platforms gain pace in North America they look set to hit a familiar snag - worsening US-China relations.

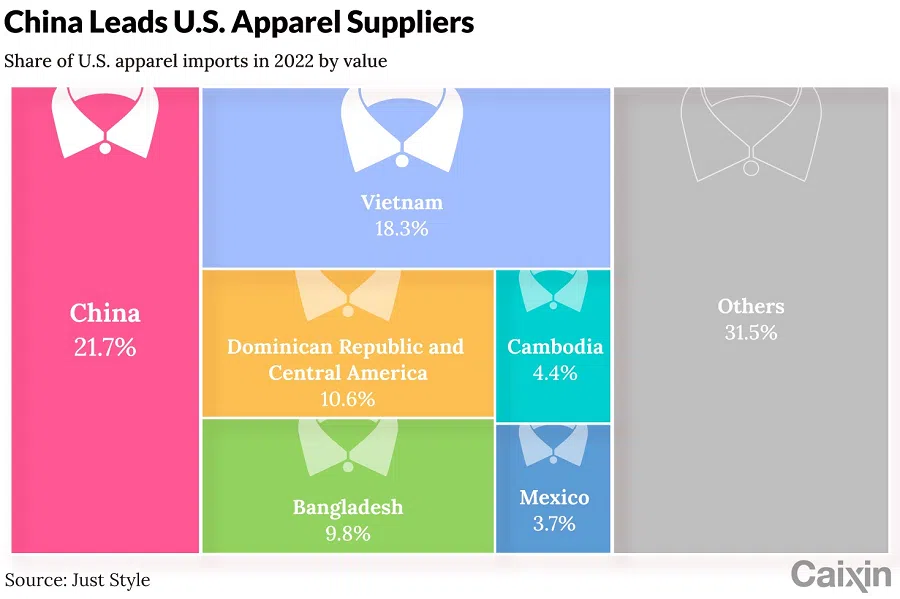

In the US, lawmakers and policy boffins are talking up the risks they say are posed by the rapid expansion of e-commerce companies like Shein Group Ltd. and PDD Holdings Inc.'s Temu. China remained the US's largest apparel supplier in 2022, accounting for 21.7% of its clothing imports by value, according to data from the US Office of Textiles and Apparel cited by trade site Just Style.

One concern involves the personal data of customers. It comes as China and the US continue to tighten regulations to restrict the cross-border movement of what has emerged as a strategic digital resource.

In mid-April, the US-China Economic and Security Review Commission (USCC), a US government agency that advises the Congress, issued a scathing report on the local development of Chinese fast fashion e-commerce firms. The output of the Commission, whose chair Carolyn Bartholomew was hit with reciprocal sanctions by China in 2021, is closely watched for signals about upcoming regulatory action.

The unapologetically fast fashion-geared platform emerged at a time when Western competitors like Zara and H&M were seeking to rebrand as more socially conscious in response to criticism about their environmental and social impact.

Personal data risks were among a series of issues highlighted in the report as "posing risks and challenges to US regulations, laws, and principles of market access".

Other issues cited include exploitation of trade loopholes, concerns about production processes - including sourcing relationships, product safety and the alleged use of forced labour - and violations of intellectual property (IP) rights.

The report could augur more stringent US regulations towards Chinese e-commerce firms operating in the US, said Leslie Weihua Zhang, a cross-border compliance expert who works as general counsel for United Energy Group Ltd. Such firms could even find themselves under investigation and hauled before Congress in the same manner as ByteDance CEO Shou Zi Chew.

Shein's success is partly attributed to its capacity to anticipate fast-moving fashion trends by analysing vast quantities of consumer data.

Spotlight on Shein

The USCC report focuses mostly on Shein, which it describes as a successful "first mover" in Chinese export-oriented apparel that other firms are now trying to ape.

The online clothing retailer, founded in 2008, has come from nowhere in recent years to penetrate almost every major market around the globe. In the four years through 2022, the company's gross merchandise value grew 40%, 140%, 208% and 98% respectively, according to data acquired by Caixin.

The unapologetically fast fashion-geared platform emerged at a time when Western competitors like Zara and H&M were seeking to rebrand as more socially conscious in response to criticism about their environmental and social impact.

Shein overtook them both as the largest fast fashion brand by sales in mid-2021 with a 28% share of the fast fashion market, according to a report from Earnest Research.

Shein's success is partly attributed to its capacity to anticipate fast-moving fashion trends by analysing vast quantities of consumer data. Over the years, the company has built up a business model that leans heavily on collecting the data and search history of shoppers and turning it into insights aided by machine learning algorithms. These insights help Shein manufacture and deliver clothes to market ahead of competitors.

The USCC stopped short of saying the collection of US users' data itself is a concern - the practice is a core part of the e-commerce business model - but accused Shein of lacking a sound protection system to ensure data safety, as well as inappropriate behaviour in the way it collects data.

In a pre-emptive move similar to that of other scrutinised Chinese technology firms, Shein has initiated a partitioning system to wall data within local users' national borders, according to a source close to the company.

The company has long faced accusations that it exploits this dominant position in the supply chain, including by violating labour laws and by contracting suppliers that do so.

Another major factor behind Shein's success is how it has built up and exerted market pressure on a strong network of suppliers and manufacturers, mostly based on the Chinese mainland. The network has guaranteed stable supply, while an integrated supply chain enables it to bring clothes to market quickly at low cost.

The company has long faced accusations that it exploits this dominant position in the supply chain, including by violating labour laws and by contracting suppliers that do so. The USCC cited findings from several third-party investigations that showed labour violations of worker rights were common at some of Shein's supplier factories, including poor working conditions and extended working hours without overtime pay.

Shein has acknowledged some of these issues. The firm has pledged to spend US$15 million over three to four years upgrading hundreds of factories after an investigation found that two of its suppliers' warehouses were flouting local working-hour regulations. It came after a UK television documentary crew found that employees at two factories in China were working 18-hour days and were fined for making mistakes.

A Shein spokesperson declined to comment on the USCC report when contacted by Caixin.

Temu charges in

The rise of PDD in the US - under the banner of its local brand Temu - is a newer phenomenon. Temu, launched in September 2022, has quickly become one of the most downloaded apps in US app stores. The shopping site topped the US app store charts for all of the first three weeks of March, according to data from Sensor Tower.

While the platform has been branding itself as a North America competitor to Shein, it sells a range of other low-cost goods, which could see it compete against US e-commerce giant Amazon.com Inc.

Temu's rapid expansion was supported by extravagant ad spending. In February, Temu sponsored two advertisements that aired during the 2023 Super Bowl at an estimated cost of about $14 million. They led to a 45% surge in downloads of its app and a daily active user jump of 20% on the day of the event, according to the USCC report, which cited third party data.

[Temu's] ultra-low prices are partly down to a clever business model that exploits the glut of non-branded third party merchants' stock that built up during the Covid-19 pandemic...

PDD, better known by its old trade name Pinduoduo, has injected the app with its pioneering "group buying" marketing technique that helped it challenge industry leader Alibaba Group Holding Ltd. at home. Users are encouraged to invite others into a social media group in order to get better deals, effectively marketing the app to their peers.

The Temu platform helps China-based merchants handle logistics, delivery and aftersales and connects them with buyers in overseas markets. Its ultra-low prices are partly down to a clever business model that exploits the glut of non-branded third party merchants' stock that built up during the Covid-19 pandemic, industry experts and executives told Caixin.

Chinese clothing merchants filled overseas warehouses during the pandemic years as many consumers bought products online, and once pandemic restrictions were lifted in the second half of last year, inventories piled up, said Li Mingtao, chief expert of e-commerce at China International Electronic Commerce Center.

"It is very effective to use Temu to clear warehouse inventories, but the profit from domestic shipments is low, and product returns create additional costs. It's hard to make money [on Temu]," said Yang Rong, founder of Shenzhen Fly International Logistics Co. Ltd., a freight forwarder that works with Alibaba.

Heavy reliance on non-brand merchants creates risk. It could call into question the quality of its products, as well as exposing it to the kinds of IP questions regularly faced by fast fashion firms.

Temu's image in the US was not helped by news in March that Google had taken the rare step of halting downloads of PDD's Chinese app, Pinduoduo, and had told existing users to uninstall it.

The USCC report cited a customer survey conducted by US nonprofit the Better Business Bureau, which suggested Temu received 235 complaints mostly on product quality and deliveries in the past 12 months, earning a 2.1 out of 5 stars customer rating as of April.

PDD did not immediately reply to Caixin's request for comment on the USCC report.

Temu's image in the US was not helped by news in March that Google had taken the rare step of halting downloads of PDD's Chinese app, Pinduoduo, and had told existing users to uninstall it. Google said the app was "harmful" and warned that it could allow unauthorised access to a user's data or device. PDD rejected accusations that its app was "malicious".

Tax loopholes

The USCC report also raised concerns about Chinese e-commerce firms exploiting a loophole in US trade policy that exempts shipments worth less than US$800 in value from import duties.

The exemption, called de minimis import exemptions, is used extensively by Chinese merchants selling on e-commerce platforms like Shein and Temu, said Li Hao, a cross-border e-commerce business veteran. The under-market low pricing strategy adopted by Chinese players has met resistance from American retailers, who have lobbied the US government to create a fairer tax environment, said another cross-border e-commerce law expert.

Some industry experts said that if the US government opts to change the de minimis rule, it could have a major impact on Chinese e-commerce firms operating in the US, subjecting them to tariffs that they do not currently face.

Shein clothing and accessories average about US$11 per item, according to the USCC report. Such pricing means the firm is mostly exempt from the standard 16.5% import duty and 7.5% tariff specific to China, the commission found. It said that the use of de minimis packaging rules also allow Shein to be exempt from customs inspections.

Some industry experts said that if the US government opts to change the de minimis rule, it could have a major impact on Chinese e-commerce firms operating in the US, subjecting them to tariffs that they do not currently face.

Last January, Democratic Congressman Earl Blumenauer introduced the Import Security and Fairness Act, which aimed to prohibit "goods from non-market economies, such as China, from benefitting from de minimis treatment". The bill was never brought to a vote.

The USCC report contained new calls for the US government to address various gaps in policy including the trade loophole with de minimis packages, claiming that "current customs and tariff levels disproportionately benefit Chinese e-commerce firms".

This article was first published by Caixin Global as "In Depth: Chinese Fast Fashion Platforms Could Be Next U.S. Target". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] China’s 10 trillion RMB debt clean-up falls short](https://cassette.sphdigital.com.sg/image/thinkchina/d08cfc72b13782693c25f2fcbf886fa7673723efca260881e7086211b082e66c)