Chinese financial institutions drawn to Singapore and Southeast Asian markets

Chinese-funded financial institutions (FIs) have existed in Singapore since the 1930s, serving Chinese immigrants who were sending money home to their families in China.

The Bank of China (BOC) was the first bank from China to set up a branch in Singapore, even taking on the role of a diplomatic bureau in the early days, providing consular services such as issuing visas for visitors to China.

As economic ties between Singapore and China deepen, an increasing number of businesses from China are using Singapore as a base to expand in the region. As a result, Chinese FIs have broadened their services to include commercial banking, investment banking, private banking, insurance, securities and investment.

In addition to providing loans, Chinese financial firms also offer a one-stop centre for the issuing of bonds, currency hedging, and underwriting for initial public offerings. Individuals can also look to wealth management and estate planning services. Chinese FIs have also started to vie for a share of the personal finance market.

The draw of Singapore and Southeast Asia

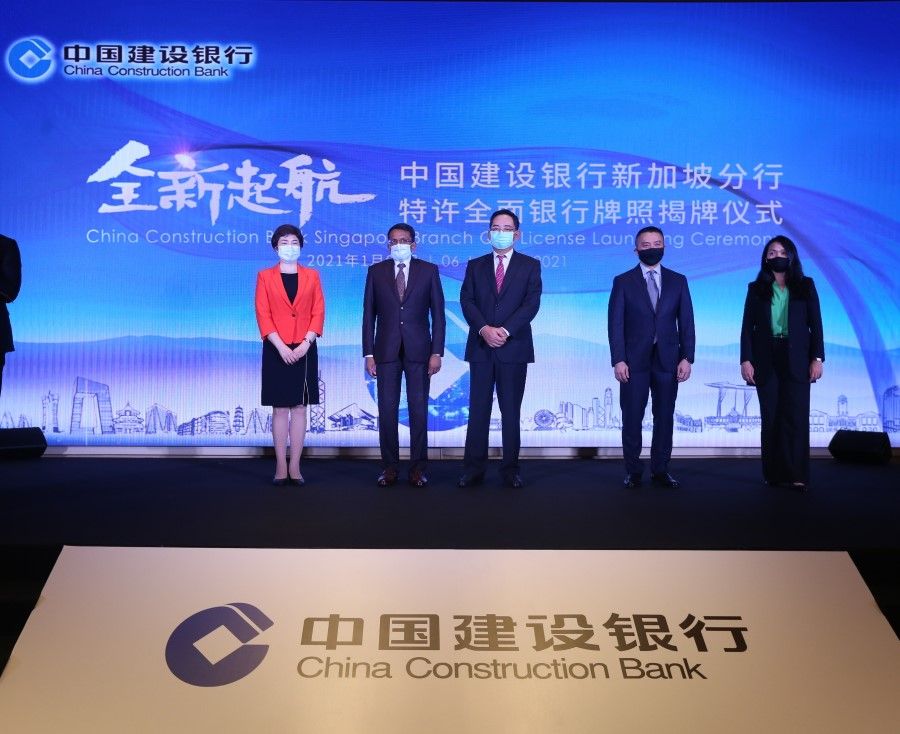

Last year, China Construction Bank (CCB) became the third Chinese bank to be accorded the Qualifying Full Bank (QFB) status by the Monetary Authority of Singapore (MAS). It was also the first foreign bank in eight years to receive QFB approval.

To date, MAS has awarded the licence to only ten foreign banks, with the highest number going to banks from China. The other two Chinese banks with full bank status are the BOC and the Industrial Commercial Bank of China (ICBC).

Other than banks, several insurance companies, securities firms, and fintech companies are also looking to use Singapore as a launchpad to the rest of the ASEAN markets. With the signing of the Regional Comprehensive Economic Partnership (RCEP) and China's Belt and Road Initiative, a growing number of Chinese businesses are setting up outfits in Singapore, creating more opportunities for financial services providers from China.

Singapore's small market size may not be the ultimate prize of the Chinese financial firms. Instead, their focus is on serving Chinese businesses and China's strategy with regards to the internationalisation of the yuan. - Liang Hao, associate professor of finance, Singapore Management University

Liang Hao, associate professor of finance at the Singapore Management University (SMU), said Singapore has many advantages that draw these firms. The two countries share similarities in language and culture, as well as close economic and financial ties. Singapore's bid to establish itself as a fintech hub fits in with Chinese fintech firms' internationalisation goals.

But Singapore's small market size may not be the ultimate prize of the Chinese financial firms, said Dr Liang. Instead, their focus is on serving Chinese businesses and China's strategy with regards to the internationalisation of the yuan.

With Southeast Asia one of the world's fastest-growing regions, and Singapore a key gateway to the regional markets, Chinese FIs thus see setting up a branch here as a strategic step. It is also close to Indonesia, a key fintech market in Southeast Asia, with young consumers and a high smartphone penetration rate.

Thio Tse Gan, financial services industry leader at Deloitte Southeast Asia, said Singapore is commonly regarded as an important springboard to the Southeast Asia market. First, because the country's advanced regulatory framework makes it a good place for technology test-bedding.

Second, Singapore has the necessary infrastructure and a complementary network of professional services - such as trustees, legal and accounting professionals - to support complex financial and insurance products. Third, there is a growing wealth management and retirement planning sector, driven by an ageing population and high concentration of high net worth individuals.

"Singapore is not only open to foreign investment, it has also integrated finance and technology successfully, promoting a higher level of cooperation and integration," said Mr Thio.

Ho Hean Chan, partner specialising in financial services at PwC Singapore, said Singapore is viewed as a stable place for doing business amid global uncertainty.

Singapore's digital banking is one of the sectors that present opportunities. China's Ant Group and a Greenland Financial Holdings-Linklogis consortium were each awarded a digital bank licence to operate in Singapore. Other markets in the region have also set up regulatory frameworks that allow foreign-funded banks and tech companies market access.

Another promising sector is insurance, fuelled by a rapidly growing middle class, rising wealth, and a tech-savvy population in Southeast Asia.

As competition intensifies in China, Southeast Asia's significance to Chinese FIs and fintech firms will continue to grow, said Mr Thio. "However, their success in Southeast Asia may depend on their ability to execute localised development strategies, and the local strategies they set for each of the highly diverse and distinct markets."

Chinese banks

The BOC Singapore branch obtained QFB status in 2012, and since 2011, has set up a commodities desk, a trade finance unit, a card unit, a wealth management centre, and other regional platforms. In November 2015, it added a global energy commodities business centre and a global commodities repo centre.

CCB's Singapore branch set up an infrastructure service centre, private banking centre, and a CCB International Singapore subsidiary in 2017.

Ren Dongyan, general manager of the CCB Singapore branch, told Lianhe Zaobao that ASEAN member countries are accelerating the construction of rail, roads, ports, telecommunication facilities and other infrastructure, and a large capital gap exists for the financing of these projects. The Singapore office of the Asian Infrastructure Investment Bank was officially established in 2018, with the aim of boosting the participation of Singapore enterprises and FIs in the financing of infrastructure projects in Asia.

Shanghai Pudong Development Bank (SPDB) opened its Singapore branch in 2017, at a time when the RMB was experiencing volatility after liberalisation, and Chinese enterprises' foreign investments were subjected to greater scrutiny. SPDB decided to capitalise on Singapore's position as a commodities trading hub to develop its commodities business, setting up a commodity centre in October 2018.

There are currently more than 7,500 Chinese-invested companies in Singapore across almost all the major industries.

Chinese banks including CCB, China Merchants Bank, BOC, and ICBC have also set up private banking units here.

The biggest Chinese private bank, China Merchants Bank, started its private banking business in Singapore in 2017. As of the end of last year, the compound annual growth rate of the number of customers and the value of assets managed had grown 101.7% and 245.5% respectively. This is because more high net worth individuals are choosing Singapore as a base for personal wealth management, said Du Jing, general manager of China Merchants Bank Singapore branch.

Chinese insurers

The China Taiping Insurance Group set up its first Singapore branch back in the 1930s. Yang Yamei, chief executive at China Taiping Insurance Singapore (CTIS), said that with the implementation of the Belt and Road Initiative, more Chinese enterprises have set up regional headquarters in Singapore. There are currently more than 7,500 Chinese-invested companies in Singapore across almost all the major industries.

CTIS has been providing insurance services for such firms, including foreign workers, performance bond, construction, property, public liability, shipping, credit insurance and employee medical insurance.

Mr Yang said CTIS saw total premiums reach S$421 million last year, an increase of 57% over the previous year, while total value of assets grew 55% to S$939 million. Over the past five years, premiums and asset value respectively grew at an average of 56% and 31% annually.

In August 2018, CTIS received its MAS composite insurer licence, and started offering life insurance products in January 2019. Mr Yang said with its favourable tax regime and robust legal framework, more wealthy individuals and families will pick Singapore for setting up family offices.

China Life Insurance had a relatively late start in Singapore, setting up a branch only in 2015 as its base for expanding across Southeast Asia.

Lin Xiangyang, chief executive of China Life Insurance Singapore, thinks there remains a lot of room for development. "Insurance penetration rate in Southeast Asia is still lower than the global average," said Mr Lin. "Because of the difference in economic and technological development, the insurance market in each country is different.

"The demand for insurance also differs because of varying income levels, and this means a need for more diverse insurance products."

He cited the example of Indonesia and Malaysia, where insurance coverage is generally inadequate. As more foreign-funded insurers enter Southeast Asia, and with the push into the use of insurance technology and applications, insurance products and payment modes will become more diverse.

China Life Insurance Singapore has forged strategic partnerships with two banks to build a network of bancassurance sales and service points in 22 branches, and also entered strategic partnerships with more than 19 brokers, to offer 24 types of product.

In recent years, insurers have also partnered tech companies to develop new solutions for their business. ZhongAn, a Chinese online-only insurance company, is one such example, working with Grab to launch an insurance platform through the ride-hailing company's mobile application targeting the Southeast Asian market.

Investors from Singapore and the region - especially the younger generation - are Internet-savvy. Coupled with the pandemic, which led to an accelerated digitalisation wave, the ground was sweet for the entry of fintech players.

Investment opportunities abound amid thriving capital markets in region

More deal participants are drawn to the mergers and acquisitions trail here, amid thriving capital markets in the region.

Citic Securities operates in Singapore through its wholly-owned subsidiary CLSA. Acquired by Citic Securities in 2013, CLSA had established a branch in Singapore in 1987, offering services such as equity financing, debt financing, and M&A consulting for the last 34 years. It was the underwriter for a number of high-profile transactions including the initial public offerings of Sea Group in 2017 and Nanofilm Technologies in 2020.

CLSA has branches in Malaysia, Thailand, Indonesia, and the Philippines. A CLSA spokesperson said countries in Southeast Asia use different languages, and have varying political conditions and business environments. In Thailand, for example, debt financing costs less while Singapore has a more mature equity financing market, and each market requires its own tailored strategy.

The Singapore branch of CLSA will continue to mine pan-regional opportunities between Singapore, Southeast Asia, and China, while also continuing to develop derivatives, fixed-income products, equity and debt financing, and other services, to seize the new opportunities that would come with closer cooperation between the Singapore Exchange and the two exchanges in Shanghai and Shenzhen.

Investors from Singapore and the region - especially the younger generation - are internet-savvy. Coupled with the pandemic, which led to an accelerated digitalisation wave, the ground was sweet for the entry of fintech players. Tiger Brokers and Futu are two such companies that have launched digital investment platforms in Singapore.

Eng Thiam Choon, CEO of Tiger Brokers Singapore, pointed out that Singapore's digital economy holds huge potential, with the number of active users growing continuously since the launch of Tiger's platform in February last year. The company saw transaction volume in the third quarter of last year grow 540% over the previous quarter. Mr Eng noted that 30% of local customers comprises Gen Z investors.

Futu's online investment platform, moomoo, was launched in Singapore in February this year. Gavin Chia, director of Futu Singapore, said there was a growing number of "digital natives", users who are comfortable with internet and technology from an early stage. Futu saw the number of its fee-paying customers grow seven-fold in the first quarter of 2021, with 70% of the new customers hailing from Singapore, Hong Kong, and the US.

Mr Chia said the young generation of investors enjoy sharing their insights, which explains why platforms that feature investors' discussion forums are popular.

Lu International, a unit of China's Ping An Group, was registered in Singapore four years ago and launched its online wealth management platform Lu Global in 2018. Lu Global and Thailand's Kasikornbank have also teamed up to launch FinVest, an online investment platform, in November last year.

Joanna Tang, CEO of Lu Global, said the company is planning to bring in investment and financial planning products from China and offer them to investors through the variable capital company (VCC) structure.

Launched by the Monetary Authority of Singapore in January last year, a VCC can be made up of a single fund, or two or more funds, with separate holdings of assets and liabilities, which provides greater flexibility in the management of assets and risks.