Chinese investment and diversion of investment from China: Opportunities abound for Vietnam

Bordering China's southern frontier and sharing some common cultural heritage, Vietnam has been China's largest trade partner in Southeast Asia since 2018. Despite what might appear as a "brotherly" relationship, Sino-Vietnamese ties have not always been smooth.

Any contemporary tourist strolling around the museums of Hanoi and Ho Chi Minh City would be hard-pressed to ignore the stories of Trần Hưng Đạo and the Trưng Sisters in pushing back imperial China's military campaigns. In more recent decades, there was the intense weeks-long battle of 1979, which took place in Vietnam's northernmost provinces. Although Sino-Vietnamese relations were normalised in late 1991 and exchange has generally been cordial since, the two nations have yet to properly resolve their territorial disagreements.

Growing economic relations with China

Notwithstanding the occasionally tense politics, economic relations between both countries have definitively blossomed. This is reflected in their trade and investment networks. As mentioned above, Vietnam in 2018 surpassed Malaysia to become China's largest trading partner in Southeast Asia. It has continued to hold the top spot within the region.

Some economists, however, note the growing trade deficit incurred against China - especially in the import of intermediary goods such as machinery, electrical and electronic products, textiles and fabrics, base metals and minerals, and chemicals.

However, others offer a more sanguine perspective. For instance, the import of intermediary goods, which usually implies a competitive threat for domestic producers of equivalent products, has been turned into upgrading opportunities in several key industries. One of the clearest manifestations of this is the Vietnamese motorcycle industry, in which local producers engage in a variety of innovative responses, such as improving product quality, developing better product designs, and reducing costs.

One of the most strategic measures the Vietnamese government can undertake is to uplift the productive capabilities of the country's small and medium enterprises (SMEs).

Mirroring Sino-Vietnamese trade ties are foreign direct investment (FDI) patterns. Although in 2011 China ranked only 14th out of 94 countries investing in Vietnam, by 2022 it had reached the fourth place, according to statistics provided by Vietnam's Ministry of Planning and Investment.

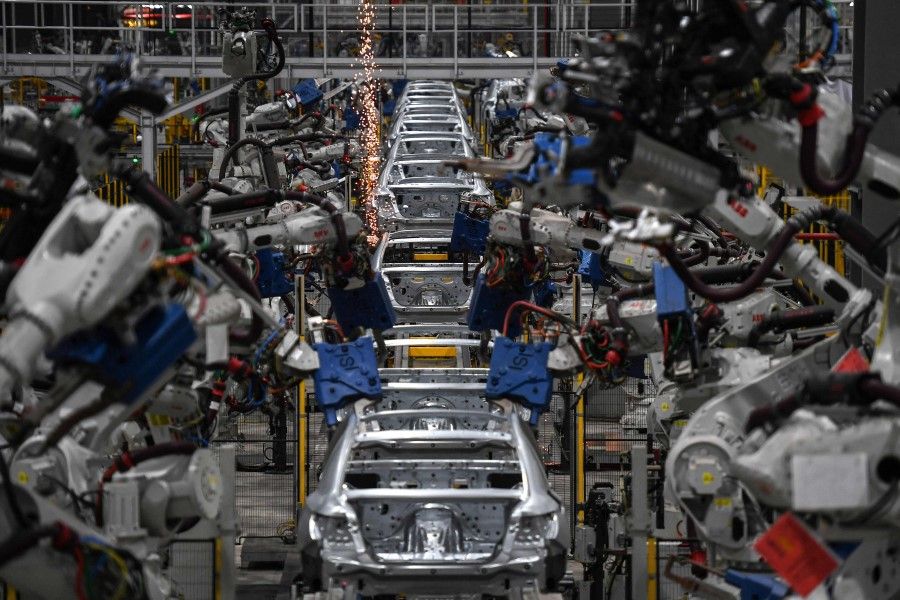

Injecting US$2.52 billion into Vietnam, Chinese investors trail only those originating from Singapore, Korea, and Japan. The majority of Chinese FDI entering Vietnam goes to manufacturing and processing, especially in the labour-intensive industries. Other areas of investment include the production and distribution of electricity, gas, and water; air conditioning; and real estate.

Vietnamese SMEs harnessing Chinese investment

One of the most strategic measures the Vietnamese government can undertake is to uplift the productive capabilities of the country's small and medium enterprises (SMEs). Unlike their state-owned counterparts, Vietnamese SMEs are not subjected to administrative prerogatives and other "social functions", meaning that they are more flexible and responsive to market forces. Nevertheless, they typically lack capital and technology. On certain occasions, they have also been overlooked by well-meaning, albeit poorly planned, policies.

Notwithstanding these challenges, SMEs have still made their presence felt in the Vietnamese economy. A recent journal article by Vietnamese academics notes that, during 2010-2017, SMEs accounted for about 98.1% of the total number of operating enterprises in Vietnam, contributed about 45% of the gross domestic product and 31% of the total state budget revenue, and created jobs for more than 5 million employees.

Owing to their rather low-end technical, organisational, and learning capabilities, these firms realised that it was far more practical to manage and operate Chinese technologies than the more sophisticated Japanese ones.

As mentioned earlier, the Vietnamese motorcycle industry has bucked common stereotypes surrounding prickly Sino-Vietnamese ties and benefited from Chinese investment.

While there was some initial unease about the lower standards of Chinese technologies relative to those offered by Japanese firms, Vietnamese motorcycle SMEs eventually found it easier to collaborate with their Chinese counterparts. Owing to their rather low-end technical, organisational, and learning capabilities, these firms realised that it was far more practical to manage and operate Chinese technologies than the more sophisticated Japanese ones.

In the apparel industry, where Vietnam has gained an international reputation, the SMEs have similarly exploited the opportunities brought in by Chinese transnational corporations. In addition, as noted in a Reuters report, Vietnam's trade agreements with external partners such as the EU require apparel manufacturers to source their materials locally or from their respective trade blocs. As such, Chinese investors have been incentivised to invest in Vietnam's supply chains so as to gain access to trade agreements that China is not currently a part of.

...the intensifying US-China geoeconomic competition has also contributed to the greater willingness of transnational corporations and their core suppliers to diversify production away from China to buffer themselves from any potential fallout.

US-China trade war benefiting Vietnam

While the Vietnamese growth story begins to take on a different tone when one considers the wider geopolitical factors at play, the intensifying US-China geoeconomic competition has also contributed to the greater willingness of transnational corporations and their core suppliers to diversify production away from China to buffer themselves from any potential fallout. One of the most notable examples is the August 2022 move by Apple to manufacture its famed Apple watches and MacBooks in Vietnam for the first time.

For the optimists, the influx of investments and businesses triggered by the US-China rivalry represents a timely shot in the arm to continue and even deepen the reforms initiated in 1986. In economic parlance, such a development will create opportunities for domestic players to acquire more modern products and process techniques, amongst other things. However, all of these do not account for much if conscious efforts are not made to harness these favourable tailwinds.

Supportive government policies needed

All this suggests that potentially more upgrading avenues are likely to be stimulated if Vietnamese SMEs are better integrated into the production networks of transnational corporations relocating their facilities from China. It is thus imperative that they receive more targeted policy support - including but not limited to financial and technical assistance - from the Vietnamese government.

...there is no lack of encouraging signs - from the growing demand by Vietnamese workers and businessmen to learn Putonghua to the Chinese investors' public promise to separate politics from commercial dealings.

A related policy measure involves expanding the supply of skilled labour, not least in engineering and science subjects. The improvement of specialised technical colleges and expansion of science and technology faculties in major universities should move in tandem with Vietnamese ambition to not only elevate the SMEs' industrial capacity, but also help Vietnam navigate the uncertainties of great power geopolitical tussles.

Ultimately, no amount of politicking can truly replace the on-the-ground livelihood improvement that economic opportunities bring about. While sentiments might yet change as China-US relations continue to be in flux, and Vietnamese response to global happenings and ever-present Chinese influences remain challenging to forecast, there is no lack of encouraging signs - from the growing demand by Vietnamese workers and businessmen to learn Putonghua to the Chinese investors' public promise to separate politics from commercial dealings.

Indeed, there is hope that things are slowly turning for the better.