Chinese investments are increasing across sectors and regions in Thailand

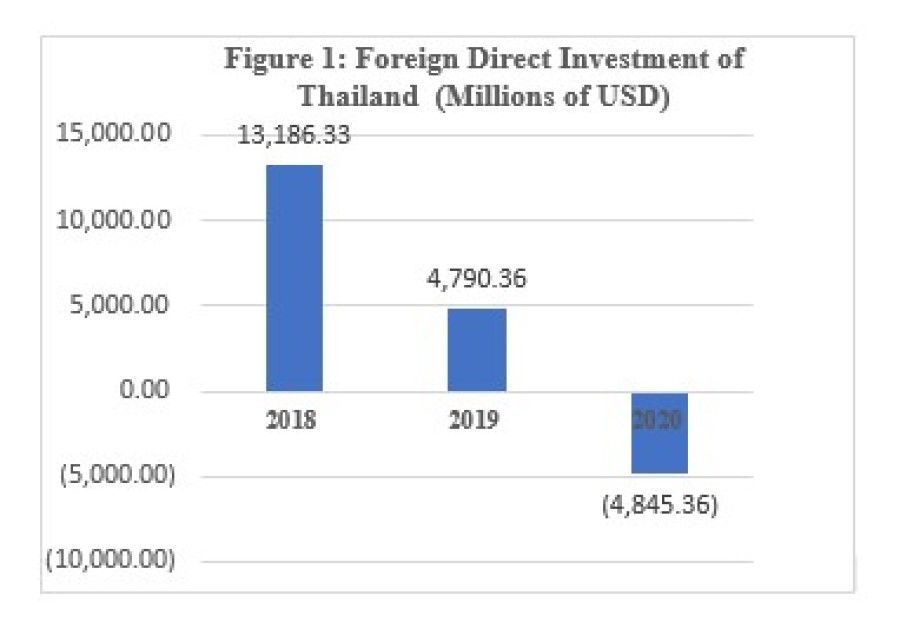

According to the Bank of Thailand, foreign direct investment (FDI) in Thailand declined drastically as a result of the Covid-19 pandemic. Between 2018 and 2019, FDI plunged from US$13.18 to US$4.79 billion. In 2020, it fell to minus US$4.84 billion (see Figure 1). Since 2019, FDI outflow has been higher than incoming foreign investments.

The decrease in FDI inflow appeared to be mainly from investors from Europe, especially the UK, Denmark, Netherlands and Belgium. Only Japan, Singapore, China and Hong Kong remain the core investors in Thailand.

At a time when others have been pulling out, China's investments into Thailand have been steadily increasing throughout this pandemic period. Notably, in 2019, China's investment applications surpassed Japan for the first time - with an investment value of US$8.723 billion under 203 approved projects, dwarfing Japan's investment value of US$2.436 billion (277 projects) and third-ranked Hong Kong's investment value of US$1.210 billion (64 projects).

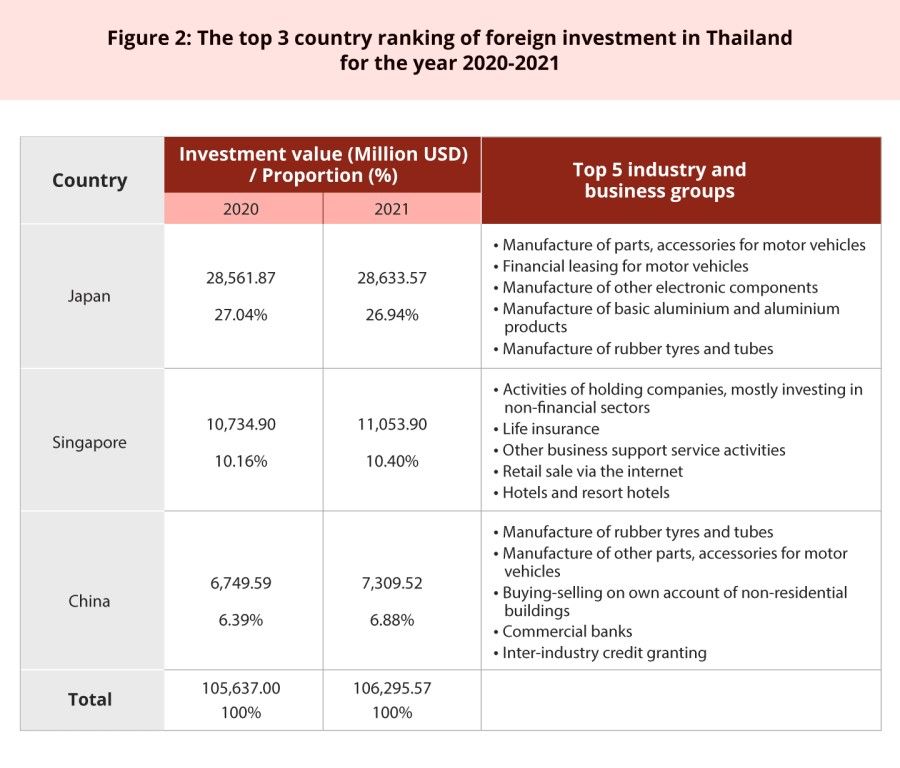

In terms of total FDI stock (see Figure 2), Japan unsurprisingly remains Thailand's core investor, since several large-scale Japanese companies established production bases in Thailand well before the pandemic. Japan also remains a keen and active investor in Thailand - as reflected by the Thailand Board of Investment (BOI)'s 2020 ranking which saw Japan regain the top ranking, with an investment value of US$2.531 billion with 211 approved projects. China's level of FDI into Thailand ranked second in 2020 - with an investment value of US$1.048 billion with 164 approved projects.

...while Japanese companies have kept their well-established production bases in Thailand to maintain their investments in core industries, Chinese investors are shifting their attention to new growth areas, focusing their investment in Thailand to connect with Belt and Road Initiative (BRI) opportunities.

The patterns of Japan and China's FDI are distinct in two aspects. Firstly, while Japanese companies have kept their well-established production bases in Thailand to maintain their investments in core industries, Chinese investors are shifting their attention to new growth areas, focusing their investment in Thailand to connect with Belt and Road Initiative (BRI) opportunities. Rather than viewing Thailand as a traditional export manufacturing hub, Chinese investors now see the potential of Thailand's strategic location, as an international-oriented business hub to expand their market outreach within ASEAN and beyond.

Secondly, the acceleration of Chinese investors' interest also stems from their interest in various industrial sectors and regions across Thailand. For example, Chinese investment ranks first in at least four special economic zones (SEZs) along the Thai borders. Nong Khai SEZ and Mukdahan SEZ in the northeast, Chiang Rai SEZ in the north, and Kanchanaburi SEZ in the west.

In the northeastern region, Chinese investors are involved mainly in the business of real estate, building construction, goods logistics and transportation. In the Chiang Rai SEZ, businesses tend to be related to general goods wholesaling, jewellery, agricultural supplies and material, goods logistics and transportation. In the west bordering Myanmar, Chinese investors are engaged in mining and metal business or real estate. While Chinese investment in both Songkhla SEZ of the south and Sa Kaeo SEZ of the east focus on manufacturing rubber goods and products, clothes and bedding material and real estate business, Chinese investment in Tak SEZ of the west and Nakhon Phanom SEZ in the northeast invest in manufacturing of electric equipment, real estate and building construction.

The wide scope of Chinese investment across various industrial sectors and regions underscores the popularity of Thailand as an investment location among Chinese investors. They have probably been attracted by various internal and external factors; infrastructure support, tax incentives and cheap labour rates.

The Thai government should seize the opportunities afforded by keen Chinese investment interest to further develop the Thai border economies and help connect the Upper Mekong region to BRI opportunities.

Thai officials, especially BOI analysts are expecting the Chinese FDI inflows to increase steadily by early 2022, and are hopeful that Chinese investments will remain an instrumental source of FDI for Thailand over the next five to ten years. According to a Siam Commercial Bank survey conducted in May-June 2020, 22% of 170 Chinese investors in Thailand expect to maintain their existing levels of investment, and 66% of foreign investors plan to increase investment in Thailand over the next two years.

The Thai government should seize the opportunities afforded by keen Chinese investment interest to further develop the Thai border economies and help connect the Upper Mekong region to BRI opportunities. In particular, new industries supporting environmentally-friendly and innovative technologies and services could be enlarged today by leveraging Chinese FDI with mutual gains for both countries.

This article was first published by ISEAS - Yusof Ishak Institute as a Fulcrum commentary.

Related: China-led Mekong project terminated as Thais protest: Participatory diplomacy in action? | Thai military deepens engagement with China amid pandemic | China's Belt and Road Initiative faces huge challenges in Southeast Asia | Wake-up call for ASEAN countries: Curb over-reliance on China and seize opportunities of global supply chain restructuring