Cut-throat competition for world-class chips: The end of Huawei?

The chip is a crucial hard power that will determine the winner in China-US strategic competition. It is the cornerstone of the most cutting-edge technology of today, and decides if various information technology - such as computers, artificial intelligence, 5G, autonomous vehicles, and surveillance tools - can take on a lead role. From cryptography, hypersonic weapons to the latest nuclear weapon designs, supercomputers have become indispensable, with chips being the source of their power. Chips also play a central role in next-generation advanced weaponry.

Whoever holds the chip is in possession of the key that determines who has the upper hand in the hard powers of technology, economy, and the military. Because of the chip's core strategic value, the US has to maintain a firm grip on it to contain China in the China-US strategic competition. During the China-US trade war, the US cut off supplies to Huawei; during the Covid-19 outbreak, the US released the "United States Strategic Approach to The People's Republic of China", which affirmed that they would be adopting a policy of "strategic competition" against China in response to "the CCP's direct challenge". This accounts for the reason why the US has been laying out a chip control policy against China since the trade war began.

When the chips are down

Firstly, the US has directly cut off chip supplies to China through export control. On 15 May 2019, Trump signed an emergency executive order that bans American companies from using telecommunications equipment produced by companies that pose a threat to national security, laying the path for the banning of business relations with Huawei, a Chinese enterprise. Following this, various US enterprises have cut their supplies of key software and parts to Huawei, with the highlight of this move being the cutting off of Huawei's chip supply.

On 15 May 2020, the US Department of Commerce's Bureau of Industry and Security announced a new regulation that requires manufacturers to first obtain a license from the US government before exporting semiconductors and chipsets that use American technology or designs to Huawei. This new regulation also applies to manufacturers outside of the US. This implies that as long as a product used American technology - regardless of whether it was manufactured by a US company - a license must be obtained if it is to be exported to Huawei. For example, the US would now be able to ban the Taiwan Semiconductor Manufacturing Company (TSMC) from supplying Huawei-owned HiSilicon.

According to the new regulations, HiSilicon's two sources of US technology would be cut: US suppliers of chip design software such as Cadence Design Systems, Inc. and Synopsys, as well as foundry manufacturing capabilities spearheaded by the TSMC. TSMC is the world's largest chip manufacturer and also manufactures the chips designed by HiSilicon.

Secondly, putting pressure on countries that provide chip manufacturing equipment to China. The Semiconductor Manufacturing International Corporation (SMIC) is China's largest chip manufacturer. The most advanced chip it produces is the 14nm chip. Presently, TSMC is able to produce 5nm chips. There are still many missing nodes between the 14nm chip and the 5nm chip. In particular, the 9nm chip is a hurdle that is hard to cross. The extreme ultraviolet (EUV) lithography machine is the crucial equipment that could reduce the gap between 14nm and 5nm, and the small and medium enterprises of the US, Netherlands and Japan control over 90% of the world's semiconductor manufacturing equipment.

The Netherlands' ASML is the world's only enterprise that produces EUV lithography machines. These machines can be used to produce faster and more powerful microprocessors, memory chips and other advanced parts. An exclusive report by Nikkei Asian Review published on 6 November 2019 said that ASML had delayed its supply of 7nm and below lithography machines to SMIC as "it does not want to make the US government upset". The US has been trying to persuade the Netherlands government to cut its supply of lithography machines to SMIC since 2018.

US Secretary of State Mike Pompeo urged Netherlands Prime Minister Mark Rutte to stop this transaction during the former's visit to the Netherlands in June 2019. On 18 July, US deputy national security adviser Charles Kupperman presented Dutch officials with an intelligence report on the potential repercussions of China acquiring ASML's technology. The Trump administration also pressurised the Netherlands based on the Wassenaar Arrangement as lithography machines are included in the Wassenaar Arrangement control list. The Wassenaar Arrangement, known in full as the Wassenaar Arrangement on Export Controls for Conventional Arms and Dual-Use Goods and Technologies, imposes export restrictions on so-called "dual-use" technologies for commercial and military purposes. (NB: The Wassenaar Arrangement currently includes 42 countries such as the US, the UK, most EU countries, Australia, India, Japan and South Korea.)

Thirdly, being in control of the TSMC is equivalent to controlling China's chip supply. A research report from Boston Consulting Group released in March 2020 expressed the view that the US is the global leader in various chip-related fields such as chip design, talent, integrated circuit design, and semiconductor equipment. Intel, the world's largest integrated chip manufacturer, is also headquartered in the US. Yet, the US is weakest in the chip foundry business, and TSMC, the enterprise with over half of the world's chip foundry production capacity, is the main supplier of most American integrated circuit design enterprises. Thus, whether the Trump administration wants to block the external threat of Huawei or rebuild its internal semiconductor manufacturing self-sufficiency rate, TSMC is the key.

TSMC was able to continue its supply to Huawei after the US imposed a ban on Huawei in May 2019 because it was able to prove that its chips did not contain 25% or more of US-origin content by value.

According to industry statistics from CINNO Research, TSMC's chip output occupied over 50% of the global market share in 2019. TSMC and Samsung are the world's only two enterprises that produce 5nm chips. Intel was already lagging behind when it produced the 7nm chip and was forced to exit the foundry business. Henceforth, TSMC's unique status in chipmaking was established. It became a strategic asset for the US to control China's chip supply, and was involuntarily embroiled in the China-US tech war.

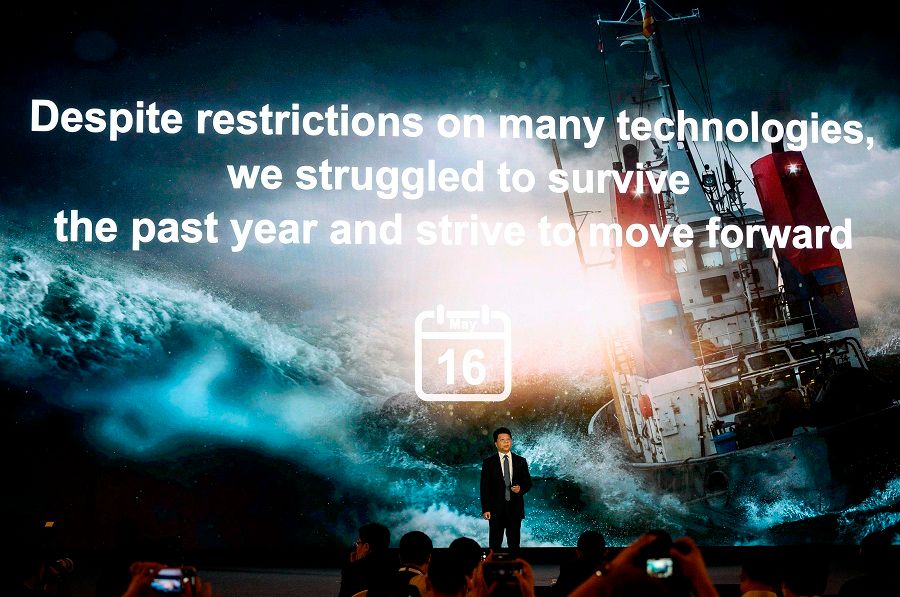

On 15 May, the same day that the US imposed tighter Huawei controls, TSMC announced that it would be building a 5nm chip factory in Arizona. A report published on 20 May by Taiwan's Business Weekly said that TSMC was able to continue its supply to Huawei after the US imposed a ban on Huawei in May 2019 because it was able to prove - based on its comprehensive database built on strict compliance with regulations - that its chips did not contain 25% or more of US-origin content by value. This was crucial to Huawei's survival over the past year amid tough measures imposed.

A month later, Dr Mark Liu, chairman of TSMC, was invited by the US Department of Commerce to attend a forum with the commerce department and the semiconductor industry as a distinguished guest. This forum is also closely related to the factory that TSMC is looking to build in the US. Following TSMC's announcement of a new factory in the US, Pompeo said in a statement that "the TSMC deal is a game-changer for the US semiconductor industry that will bolster American national security and our economic prosperity".

The US is able to provide TSMC with the latest, highest quality, and most sustainable technology research to help the latter maintain its leading position in the industry.

Japan media reported on 18 May that TSMC has stopped accepting new orders from Huawei because the US has formalised a de facto ban on Huawei on 15 May. The 5nm chips produced by TSMC's new factory in the US would also have to follow the US government's export restrictions. The US is able to provide TSMC with the latest, highest quality, and most sustainable technology research to help the latter maintain its leading position in the industry. TSMC's Arizona 5nm chip factory is slated to begin production in 2024. It is expected that TSMC would already have acquired the production technology of 3nm or 2nm chips then, but it would not be shared with China.

The US's containment of China via chip control would only ignite a spirit of self-reliance in the Chinese people. China will have to work very hard to break the containment. Only when China's domestically-produced chip technology reaches world-class standard, can America's plot to contain China be crushed.

Note:

Huawei has stockpiled up to two years' worth of crucial American chips, according to the Nikkei Asian Review. The report said that the stockpile mostly includes "central processors made by Intel for use in servers and programmable chips from its peer Xilinx. These are 'the 'most essential components' for the company's base station business and emerging cloud business." Analysts interviewed assessed that such measures would lower the company's competitiveness in the long run.

In the UK, the National Cyber Security Center (NCSC) has launched an emergency review of Huawei's role on 24 May after the US announced new sanctions on the company. According to the Daily Telegraph, Prime Minister Boris Johnson has asked officials to make plans to reduce China's involvement in British infrastructure to zero by 2023, in a change of course from its decision for Huawei to have a limited role in its 5G network earlier in the year.

In Canada, a Vancouver judge ruled on 27 May that the case to extradite Huawei's chief financial officer Meng Wanzhou to the US on fraud charges will go ahead. In the meantime, Meng will have to live in Vancouver under strict bail conditions.

In response to US sanction measures, Chinese state media Global Times said that China stands ready to "take a series of countermeasures" such as imposing restrictions on or launching investigations into US companies such as Qualcomm, Cisco and Apple.