Is the Greater Bay Area still China's answer to Silicon Valley?

The Greater Bay Area (GBA), frequently hailed as China's answer to Silicon Valley, has been envisioned as the next global powerhouse since the inception of this ambitious concept almost a decade ago. Following the launch of Beijing's "Made in China 2025" initiative in 2015, the GBA - China's manufacturing vanguard comprising nine cities (Dongguan, Foshan, Guangzhou, Huizhou, Jiangmen, Shenzhen, Zhaoqing, Zhongshan and Zhuhai) and two special administrative regions (Hong Kong and Macau) - emerged naturally as a frontrunner in the project. Yet recently the Chinese technology sector is facing increasing pressure from the US while encountering significant domestic challenges.

Resilience amid adversity

The trade war between the US and China commenced in 2018 when President Donald Trump charged China with "unfair trade practices" and "intellectual property theft". This economic dispute escalated into a comprehensive technology war, with Trump's successor, President Joe Biden, exacerbating the tensions by implementing technology export restrictions and investment bans. Subsequently, some US allies echoed these measures, intensifying pressure on China's technology sector. Additionally, disruptions to global supply chains caused by the Covid-19 pandemic have introduced further obstacles impeding China's technology industries.

Global companies Huawei, ZTE, and DJI, which are headquartered in the GBA, have faced significant challenges as a result of the ongoing technology war. Electric vehicle (EV) companies like Xpeng in Guangzhou have also been adversely affected by a widespread chip shortage. Similarly, BYD, a leading EV manufacturer, although self-reliant in chip supply, had to curtail its production last year as the pandemic impacted its workforce. Confronting the obstacles, these companies turned to domestic suppliers, encouraging the country's R&D on advanced technology.

Domestically, China recently concluded a comprehensive two-year "rectification" campaign, which targeted the country's online platforms. Led by the People's Bank of China (PBOC), this initiative focused on the burgeoning financial businesses operated by 14 private internet corporations. Market giants like Alibaba, Tencent, Baidu, JD.com, ByteDance, and Meituan, which either have their headquarters or a significant presence in the GBA, were all impacted. With companies consequently paying billions of dollars in fines, this effort appeared to dent the market's enthusiasm for business innovation and may have contributed to China's economic slowdown.

Nevertheless, it is improbable that China will persist in this control on the technology sector. First of all, the primary goals of the campaign were proper regulation of emerging financial businesses and enhanced information security for Chinese citizens and companies, and the government has claimed that it had achieved these goals. At the same time, the Chinese government recognises the importance of technological competitiveness and has been consistently working on improving the country's technological capabilities. This could explain why China has been moving up on the Global Innovation Index rankings for ten consecutive years.

Boosting technological capabilities

In recent decades, China largely leveraged strong government support to navigate technological containment efforts. A notable example is the "Two Bombs and One Satellite" project, initiated soon after the founding of the People's Republic of China. China is not alone in using national resources for technological advancements. The swift progress of military technology in both the US and the former Soviet Union during the Cold War exemplifies the potential for states to effectively boost their technological capabilities through focused efforts.

From 2016 to 2019, nearly 80% of Chinese students studied abroad returned to China, most of them entered IT industries.

Facing challenges from the US, China, again, reacted by consolidating the nation's technological leadership under the Communist Party of China (CPC), which essentially functions as the country's governing body. Since May 2021, Beijing has been stressing "the party's overall leadership over science and technology". This effort will probably enhance the technology sector as before.

The Chinese government also explicitly emphasises the development of talent and has set a goal to "enter the forefront of innovative countries" and "develop a quality workforce" by 2035. This objective is reinforced by the recent trend of Chinese graduates returning from abroad. From 2016 to 2019, nearly 80% of Chinese students studied abroad returned to China, most of them entered IT industries. Surveys show that most students who studied abroad prefer living in most developed cities like Beijing, Shanghai, Shenzhen, and Guangzhou. These people, more than 70% of whom possess graduate degrees, have the potential to further energise the country's technology and innovation-driven pursuits.

Furthermore, a stable domestic environment will enable China to execute its plans smoothly. A key aspect of stability is societal order. In 2021, Gallup ranked China third globally in safety as perceived by its citizens. Another factor that affects stability is policy predictability. Despite occasional criticisms of the inconsistency of some business regulations, the Chinese government has persistently exhibited its commitment to strategic policies, such as "reform and opening up".

The GBA also hosts BYD and Xpeng, giving it the world's most comprehensive electric-car supply chain.

GBA to continue to push ahead on innovation

Considering these factors, it is likely that Chinese technology and innovation will continue to advance. Consequently, central government support will create a more favourable environment for technology and innovation development in the GBA, currently the country's hub for these sectors. Simultaneously, GBA cities - with their dense concentration of technology companies, exceptional expertise in science and technology, and strong manufacturing capabilities - will remain at the forefront of China's technological innovation and entrepreneurship.

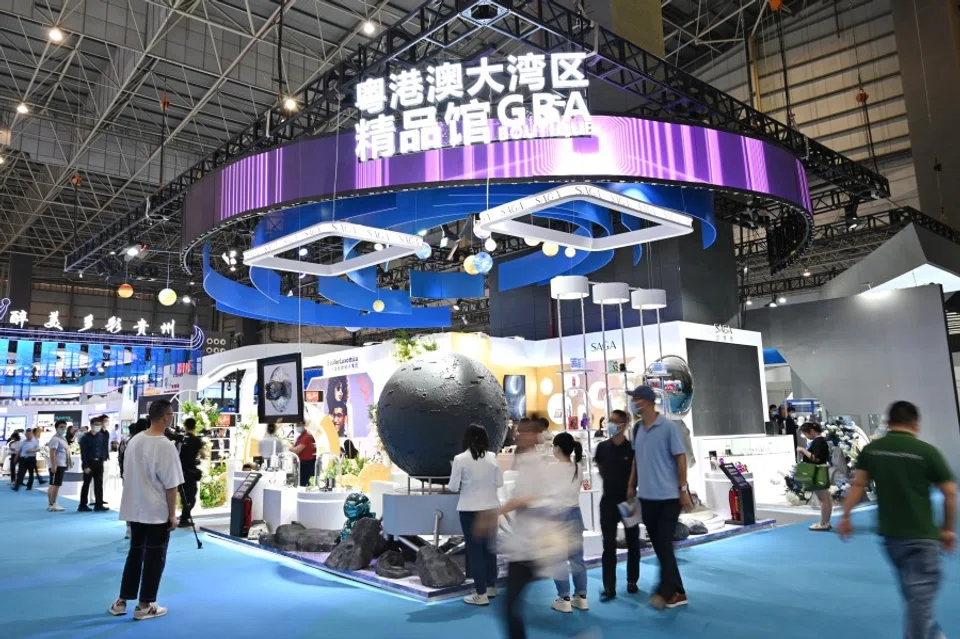

According to a HSBC article, the GBA accounts for 35% of exports and 11% of the combined GDP of mainland China, Hong Kong and Macau. The GBA not only houses the headquarters of renowned technology corporations such as Huawei, ZTE, Tencent, and DJI but also AI unicorns such as SenseTime, Zhuiyi Technology, SuperD, and UBTECH Robotics. The GBA also hosts BYD and Xpeng, giving it the world's most comprehensive electric-car supply chain. As Chinese electric vehicles surpass foreign competitors domestically, these Chinese automakers are well-positioned to lead the global market.

At the end of 2022, the total economic output of the GBA reached almost 13 trillion RMB, up from 12.6 trillion RMB in 2021 and 11.5 trillion RMB in 2020.

Several factors contribute to the high concentration of technology companies in Guangdong. Primarily, the "reform and opening up" policy and proximity to Hong Kong have made this region the country's wealthiest. Additionally, the province is China's foremost manufacturing base. With China being the world's largest manufacturing country, the GBA ranks fifth globally in manufacturing value-added. Furthermore, the presence of business-friendly local governments enhances the region's appeal to entrepreneurs and, consequently, to talents seeking employment opportunities.

The resilience and dynamism of the GBA were demonstrated by its steady economic expansion over the past three years, even amidst the pandemic. At the end of 2022, the total economic output of the GBA reached almost 13 trillion RMB, up from 12.6 trillion RMB in 2021 and 11.5 trillion RMB in 2020.

The region's flourishing technology sector is further reinforced by its research and development (R&D) capabilities, while company investments strengthen the area's R&D expertise. Four of the top 100 global universities operate in Hong Kong. Guangdong has the highest number of full-time R&D personnel, patent applications, patents in force, and new products in mainland China.

Renowned for its substantial R&D investments, Huawei significantly increased its R&D efforts after the U.S. imposed technology sanctions. In 2021, it invested US$22.1 billion in R&D, or 22.4% of its revenue, surpassing Meta's 20.9% and nearly doubling Microsoft's, Alphabet's, and Amazon's R&D revenue shares. The 2021 EU Industrial R&D Investment Scoreboard ranked Huawei as the world's second-largest R&D investor

The key to overcoming these challenges lies in Beijing's ability to fulfil its commitment to let the market "play a decisive role in resource allocation" under the supervision of the government and improve market policy consistency.

Improvements

In spite of its strengths, the GBA must cover significant ground before it can compete directly with Silicon Valley, as the US remains the global technology development leader. Furthermore, concerns about industrial policy predictability can lessen the aspiration of investment. Foreign investors are still cautious after experiencing China's Covid-19 policy.

Additionally, centralised technological leadership, despite its benefits, may impede business development agility if the government misapplies its power. The key to overcoming these challenges lies in Beijing's ability to fulfil its commitment to let the market "play a decisive role in resource allocation" under the supervision of the government and improve market policy consistency.