Has China done well in its vaccine diplomacy in Southeast Asia?

Southeast Asia is a primary region for China's vaccine diplomacy. Chinese-made Sinovac and Sinopharm are by far the most available Covid-19 vaccines in the region, with 190 million doses having been delivered, the bulk through commercial channels. While most regional governments adopt the policy of diversification to obtain as many doses as possible amid the severe global shortage, they have to take public opinion towards the various vaccines into account in their procurement and deployment decisions.

Several polls undertaken since late 2020 paint a mixed picture of public perceptions towards China's vaccines in these countries. These polls were conducted by different organisations at different periods of time, with different sampling methods and questionnaires. Therefore, straightforward comparative conclusions cannot be easily drawn from the data. Moreover, the fluidity of the pandemic and people's shifting reactions may result in some inconsistencies and contradictions between the various survey results.

Recognising that each survey represents a particular time-specific context, the analysis of the survey data in this article is not for the sake of accurate statistical measurement, but for the purpose of parsing the thematic issues surrounding public perceptions of Chinese vaccines in the region.

Indonesia

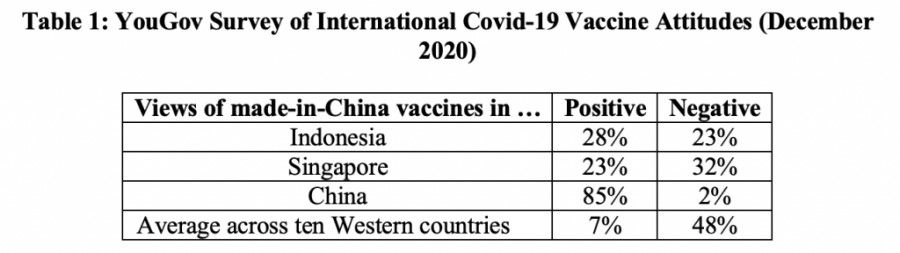

A December 2020 survey indicated that 28% of respondents in Indonesia viewed Chinese vaccines positively against 23% with negative views, while in Singapore the ratio was almost inverse (23% positive versus 32% negative). (See Table 1 for comparisons of such perceptions in China and in the West).

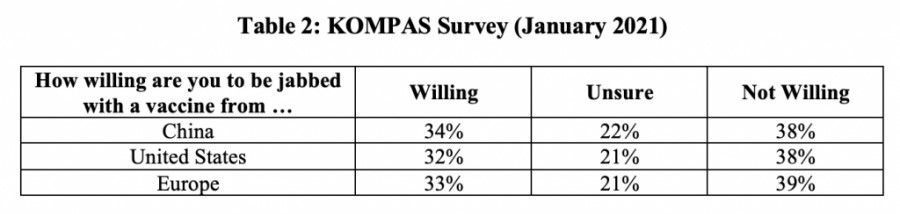

Further surveys conducted in Indonesia between late 2020 and early 2021 suggest that the Indonesians did not necessarily have a bias for or against any specific vaccine on the basis of its origins. A KOMPAS survey in January 2021 showed that respondents did not favour any particular vaccine over another - the rates of acceptance and rejection of vaccines produced in China, Europe and the US were generally similar (Table 2).

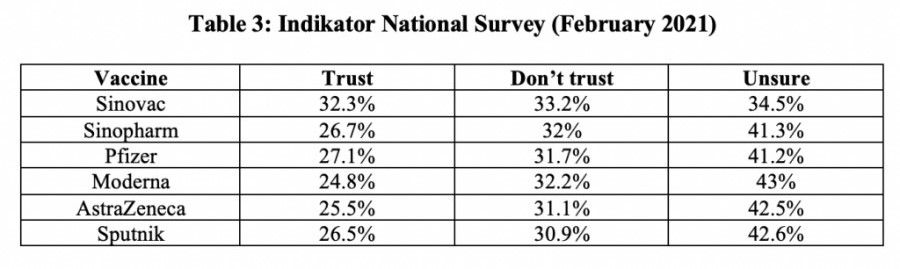

This finding appears corroborated by a more granular survey done by Indikator in February 2021 (Table 3), which examined trust levels in specific vaccine brands. Though the survey reveals that trust in Sinovac, the most commonly-used vaccine in Indonesia, was higher than trust in other vaccines (32.3%), it was also the most distrusted brand (33.2%).

Thailand and the Philippines

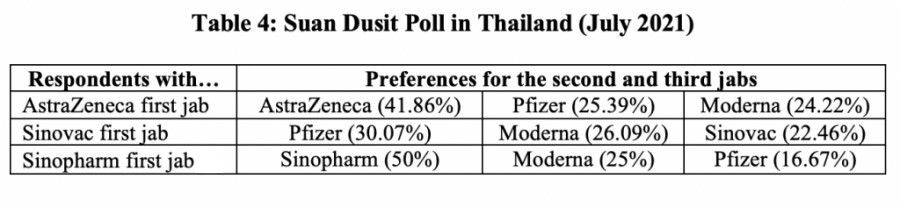

In Thailand, a Suan Dusit poll in May 2021 (which did not include the Sinovac and Sinopharm vaccines in the mix) suggested a prevailing preference for Pfizer (75.1%) and Moderna (72.1%), followed by Johnson & Johnson (68.5%), AstraZeneca (65.9%) and Sputnik V (61.9%). Another Suan Dusit poll in July 2021 suggests greater acceptance of Sinopharm vis-à-vis low trust towards Sinovac among the Thais, when they were asked about their preferred brand for the second and third jabs (Table 4).

In the Philippines, a few polls were conducted since early 2021 in different localities with different samplings, offering some converging and diverging results. A survey by the OCTA Research Group in January-February 2021 indicated that only 15% of Filipinos trusted vaccines from China; 41% trusted vaccines from the US, followed by the UK (25%), Russia (20%) and India (17%). Similarly, the Social Weather Station (SWS) poll in May 2021 found that 63% of respondents preferred made-in-America vaccines versus 19% favouring Chinese ones.

However, in terms of vaccine brand preference, 39% chose Sinovac, followed by Pfizer (32%), AstraZeneca (22%) and Johnson & Johnson (10%). A higher level of brand recognition for Sinovac among Filipinos could explain this seeming contradiction, given that Sinovac was the dominant vaccine deployed in the country at the time of polling.

Considerations regarding Chinese Covid-19 vaccines

Public perceptions of Chinese vaccines in the select Southeast Asian countries are influenced by many considerations, including the severity of the pandemic outbreaks at the local or national levels, the impact of government vaccine awareness programmes versus vaccine misinformation campaigns, and the accessibility to Chinese vaccines vis-à-vis other vaccines at a given point in time.

This article focuses on some key common factors that can be identified in two or more of these countries. These factors are grouped in three categories: (i) general Covid-19 vaccine hesitancy; (ii) specific concerns about the efficacy and religious permissibility of Chinese vaccines; and (iii) political factors, namely public mistrust of national governments and/or China.

These factors are not equally salient across the countries. As the subsequent section will illustrate, general scepticism of vaccines and worries about Sinovac's halal status are most responsible for the selective hesitancy against Chinese vaccines in Indonesia. For Thailand, the impetus is more political: Popular distrust of the government and, to some extent, of China, negatively colours the public perception of Chinese vaccines. In Vietnam, the dim reception of Chinese vaccine offerings can mostly be put down to the public's prevalent distrust of China.

General Covid-19 vaccine hesitancy

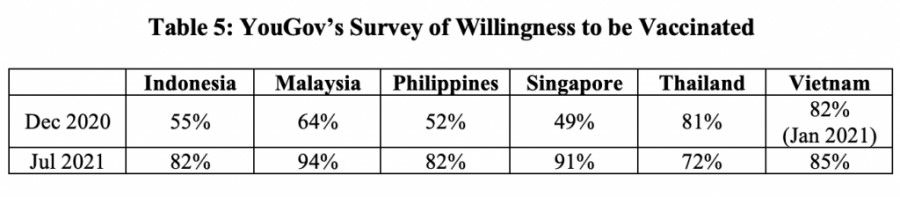

YouGov's data revealed a shifting trajectory of Covid-19 vaccine acceptance in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. Between December 2020 and July 2021, vaccine acceptance levels sharply increased across these countries, save for Thailand (Table 5). Vietnam is the only country where the rate of vaccine confidence remained consistently high. Another survey conducted between October and December 2020 saw Vietnam leading the world in terms of the share of the population willing to be vaccinated (98%).

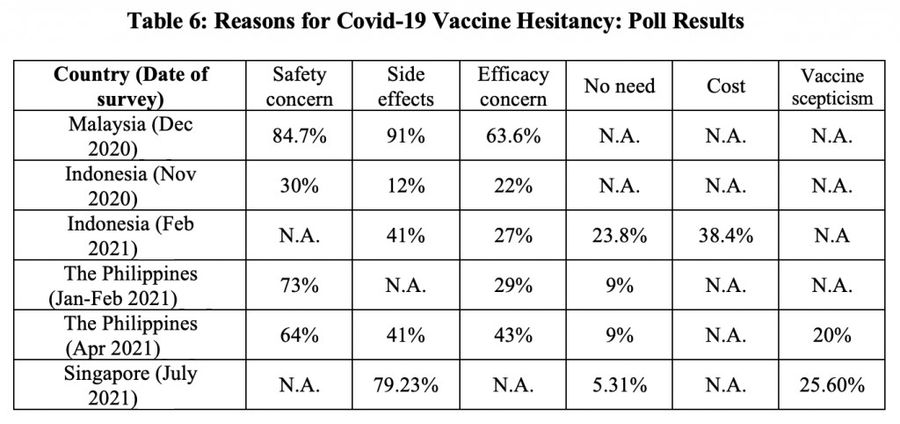

The pandemic is still in a very fluid situation and massive Covid-19 outbreaks in most of these countries over recent months have driven, and will continue to drive further vaccine willingness among the public. However, there remains a considerable minority who resist Covid-19 vaccines, regardless of their origins. A number of surveys in the region indicate that general vaccine hesitancy is largely attributed to concerns about vaccine effectiveness, safety and fears about side effects (Table 6).

Some of the hesitancy towards Covid-19 vaccines can be attributed to the low health literacy about the virus in certain segments of the population, partly due to government failures in communicating relevant information about the virus and their response. This situation is most extensively reported in Indonesia.

For instance, 25 out of the 30 participants interviewed for a study in September 2020 expressed their "disbelief" about Covid-19, describing it as "a common cold, flu, and cough" that "has been blown out of proportion by the government" - even though Indonesia was then recording 4,000 new cases and 100 deaths daily. This has prompted the Covid-19 vaccine to be construed as an unnecessary risk.

Another study of 50 Indonesian women with certain vulnerabilities (HIV patients, pregnant women, frontline health workers) in early 2021 revealed their vaccine hesitancy to be partly due to the belief that Covid-19 is not a severe health threat and can be mitigated by other means.

Public scepticism about the existence and severity of Covid-19 feeds into vaccine hesitancy, especially in the wake of anti-vaccine disinformation campaigns.

In the Philippines, anti-vaccine theories peddled by US-based evangelical Christian groups have filtered into local church networks and Facebook discussion groups.

In Malaysia, a "Covid Research Centre" has contributed to fearmongering about the Pfizer vaccine, while promoting "herbal and other natural treatments" as a means of preventing Covid-19. Even politicians are not averse to indulging in such anti-vaccine rhetoric. In December 2020, Tengku Razaleigh Hamzah, Malaysia's longest-serving parliamentarian, repeated the claims of anti-vaxxer Michael Yeadon that vaccines are unnecessary because "people around the world are acquiring the natural herd immunity".

Another reason for vaccine hesitancy in the region could be the lack of trust in government vaccination programmes. This is salient in the Philippines and Indonesia, both having recently mismanaged vaccination campaigns involving children.

In April 2016, the Philippines introduced a plan to vaccinate all nine-year-olds with the dengue vaccine Dengvaxia. A public furore erupted in 2017 when Dengvaxia's manufacturer revealed that this caused those who were dengue-naïve to be more susceptible to more severe dengue infection in future. The Dengvaxia controversy drove vaccine confidence in the Philippines to plummet from 93% in 2015 to 32% in 2018.

Similarly, Indonesia's campaign in 2018 to inoculate children against measles and rubella faltered after it was revealed that the vaccine contained "negligible traces of pork gelatin".

The trauma of these botched vaccine rollouts perhaps accounts for the initial reticence in both countries to get the Covid-19 vaccine: in December 2020, only 55% in Indonesia and 52% in the Philippines were willing to be vaccinated.

Selective hesitancy towards Chinese vaccines

The selective hesitancy towards Chinese-made shots in the region is partly an extension of the general vaccine hesitancy due to the considerations above. Apart from vaccine-related factors such as efficacy and religious permissibility, political factors also drive selective hesitancy towards Chinese vaccines, especially in countries where members of the public do not trust their national governments and/or China.

Sceptics of Chinese-made vaccines also look to Singapore's reluctance to fully integrate Sinovac into its national vaccination programme.

Vaccine-related factors: efficacy and religious concerns

A major factor behind selective hesitancy of Chinese vaccines among Southeast Asians is widespread concerns about their reliability. As a July 2020 study in Indonesia noted, acceptance of a particular vaccine hinges on its effectiveness: While 93.3% of respondents would get a Covid-19 vaccine with an effectiveness of 95%, this drops to 67.0% for a vaccine that is 50% effective. Thus, in the absence of clarity about their efficacy rates, public confidence in China's homegrown vaccines is likely to take a hit, especially when real-world developments suggest that these vaccines may not offer robust protection against newer Covid-19 variants.

For example, Sinovac's effectiveness remains mired in doubt, compounded by the company's reluctance to promptly publish their trial data or actively address the diverging efficacy results. According to separate clinical trials, Sinovac's protection rate varies between 50% to 90% - the vaccine was 83.5% effective in a Turkish study, but data from Indonesia and Brazil placed it at only slightly above 50%. Moreover, a 27 July pre-print paper from a Chinese lab disclosed that the amount of Covid-19 antibodies from Sinovac decreased "below a key threshold" after six months.

Sceptics of Chinese-made vaccines also look to Singapore's reluctance to fully integrate Sinovac into its national vaccination programme. Health regulators had requested for additional clinical data from Sinovac in March 2021, but this was only submitted in July. As a result, even though a shipment of 200,000 shots had arrived since February, Sinovac was only released through a select number of private clinics in June.

Those interested in Sinovac were however warned by a senior health ministry official about the "significant risk of vaccine breakthrough". Moreover, recipients of Sinovac were not regarded as being properly "vaccinated" until early August, when the Singapore authorities decided to recognise all vaccines approved by the World Health Organization for emergency use.

Public confidence in the Chinese vaccines is unlikely to improve with the reports of Covid-19's resurgence in countries that had primarily relied on either Sinovac or Sinopharm. This includes Indonesia, where Sinovac's early success story is turning awry.

In May 2021, the Indonesian health ministry announced that a study of 130,000 Indonesian healthcare workers showed Sinovac was at least 90% effective in preventing symptoms, hospitalisation and death. However, the emergence of the more infectious and vaccine-resilient Delta variant has pushed Indonesia's Covid-19 tally to almost double over two months (from 1,837,126 cases on 3 June to 3,496,700 cases on 3 August), with around 48,000 deaths. These figures include a growing number of Indonesian healthcare workers who died from Covid-19 despite being fully vaccinated (often with Sinovac).

Similar sentiments can be found in Vietnam and Thailand, where Chinese products - including its vaccines - are seen as lacking "a good reputation for quality" or being "second-rate".

Similar doubts about the reliability of Chinese vaccines against the Delta variant have emerged in other countries around the region.

A group of doctors in Thailand have protested the government's decision not to prioritise medical personnel for a Pfizer booster shot as worries grew after 618 Thai healthcare workers were infected between April and July despite being double-jabbed with Sinovac.

In Malaysia, director-general of Health Noor Hisham Abdullah's assurance that both "Sinovac and Pfizer are equally effective against Covid-19" was greeted with a measure of incredulity, with some taking to his Facebook page to accuse him of cherry-picking the data and ignoring Sinovac's weaker performance against newer variants.

It was reported that many Filipinos skipped their appointments at vaccination centres that were using Sinovac, while a crowd formed at another centre offering Pfizer shots. Similar sentiments can be found in Vietnam and Thailand, where Chinese products - including its vaccines - are seen as lacking "a good reputation for quality" or being "second-rate".

To assuage these worries, religious authorities in both countries have taken pains to assure that Sinovac was indeed halal.

For the Muslim-majority countries of the region, a religious element drives Covid-19 vaccine hesitancy in general and reluctance towards Chinese vaccines in particular. Studies have indicated that religious concerns motivated 20.8% and 8% of vaccine hesitancy in Malaysia and Indonesia respectively.

For one, the Chinese provenance of Sinovac has generated misgivings about its halal status, especially in Indonesia after the measles-rubella vaccine fiasco. To assuage these worries, religious authorities in both countries have taken pains to assure that Sinovac was indeed halal. Politicians, including Indonesian President Joko Widodo and Malaysian vaccine minister Khairy Jamaludin, also did their part to convince their citizens by taking the Sinovac jabs themselves.

Intertwining concerns about the reliability and religious permissibility of Chinese vaccines may explain the relatively lower vaccination rates in southern Thailand. In the Muslim-majority provinces of Pattani, Yala and Narathiwat, those who have taken the jabs tended to be Buddhists. Many locals doubted the Sinovac's efficacy and subscribed to the misinformation-driven religious fear that "Islam did not allow such medical measures". These objections to Sinovac are also informed by the region's deep-seated mistrust of the Thai state following decades of secessionist struggle, a factor that will be explored further in the next section.

Political factors: distrust of national governments and China

Misgivings about their reliability aside, public perceptions of the Chinese vaccines in some Southeast Asian countries have also been affected by domestic politics and popular suspicions of China.

This selective hesitancy against Sinovac signals both a rejection of Prime Minister Prayut Chan-o-cha and Thailand's increasing tilt towards China under his leadership.

This is particularly true of Thailand which saw a sharp decrease in public willingness for vaccination in recent months, bucking the region's trend. Thailand has had to rely on Sinovac for the early phase of its vaccine rollout, primarily due to the lack of alternatives.

According to Tita Sanglee, "widespread distrust of the Prayut government is aggravating Sinovac hesitancy in the country" and "Sinovac faces politically motivated problems". This selective hesitancy against Sinovac signals both a rejection of Prime Minister Prayut Chan-o-cha and Thailand's increasing tilt towards China under his leadership.

Major opposition parties such as Pheu Thai and Move Forward Party have raised questions about the safety and efficacy of the Sinovac vaccine, while the pro-democracy movement demanded that the government drop Sinovac in favour of Pfizer and Moderna when they took the streets in mid-July 2021.

Moreover, those who espouse pro-democracy leanings (especially younger Thais) generally view Beijing with askance due to the latter's perceived support for Prayut. The dependence on Sinovac is also seen as yet another sign of Thailand being further beholden to China.

Such anti-China feelings, seemingly ingrained among the Vietnamese public as an almost unconscious bias, explain the largely negative reaction to China's donation of 500,000 Sinopharm doses in June 2021.

In the case of Vietnam, it is popular distrust of China, rather than lack of confidence in the government, that affects public perception of Chinese vaccines. Prior to the latest Covid-19 outbreaks, the Vietnamese government enjoyed approval ratings of above 90% for its pandemic management.

Hanoi remains reluctant to buy Chinese vaccines, except in limited numbers for emergency situations. Apart from concerns about efficacy, this decision is likely due to the prevalent public wariness of Beijing - China' trust deficit in Southeast Asia is most pronounced in Vietnam. Pew's polling data from 2017 showed that only 10% of Vietnamese respondents had a favourable view of China (against 88% who viewed it negatively), a sentiment also reflected in the annual State of Southeast Asia Surveys by the ISEAS - Yusof Ishak Institute.

Such anti-China feelings, seemingly ingrained among the Vietnamese public as an almost unconscious bias, explain the largely negative reaction to China's donation of 500,000 Sinopharm doses in June 2021. On local mainstream and social media, many rejected the vaccine outright, either out of visceral anti-China attitudes or an entrenched distrust of made-in-China products.

An overwhelming majority were willing to wait and pay more to get their top vaccine choices of Pfizer and Moderna, while some would rather choose AstraZeneca, Russia's Sputnik V or Vietnam's homegrown vaccines. However, public acceptance of Chinese vaccines could grow since alternatives remain in short supply while new infections are sweeping across southern Vietnam.

The authorities of the badly-hit Ho Chi Minh City (with 8492 Covid-19 deaths as of 30 August 2021) recently allowed the import of five million Sinopharm doses, and long queues have formed at some vaccination sites. Some, however, reportedly left upon knowing that they would receive a Chinese vaccine.

Sporadic support for Chinese vaccines

Despite the above-mentioned factors undermining public trust in Chinese vaccines among Southeast Asians, there remain pockets of enthusiasm for Chinese vaccines. Among Singaporeans doubtful about the newer mRNA-based vaccines, Sinovac and Sinopharm have some appeal since they rely on the "more established" technology of using an inactivated virus.

In Singapore-based vaccine-sceptical channels on Telegram, a recurring topic of discussion revolves around Sinovac and Sinopharm as less risky alternatives to the Pfizer and Moderna shots. Those enquiring were more concerned about the vaccines' relative safety rather than their efficacy, driven by fears about the supposed hazards of mRNA vaccine technology.

Sinovac and Sinopharm are also attractive options for those with extensive links or travel plans to China. In March 2021, Beijing announced that "it will simplify visa applications" for foreigners immunised with a Chinese vaccine. Chinese embassy officials have also hinted that recipients of Sinovac would find it "very convenient" when applying for a visa.

Immigration considerations also underlined the agreement between Vietnam and China to reserve the 500,000 Sinopharm shots for Chinese nationals living in the Vietnam, Vietnamese citizens heading to China for work and study, and those living in the border areas.

China has its work cut out to improve public confidence in its vaccine offerings and made-in-China products more generally.

Public reactions to Chinese vaccines, which largely trend negative, suggest a non-linear relationship between China's vaccine diplomacy and its soft power in the region - especially at the popular level. Support for Chinese vaccines appears sporadic compared to the widespread doubts on the ground about their reliability (be it scientifically-informed or misinformation-fuelled).

China has its work cut out to improve public confidence in its vaccine offerings and made-in-China products more generally. Furthermore, with populist anti-China narratives against reliance on Sinopharm and Sinovac emerging in some parts of the region, it remains to be seen whether Beijing will succeed in projecting an image of a more "reliable, loveable and respectable China" among ordinary Southeast Asians.

Given the ongoing surge of infections in the region, the counsel by Indonesia's health minister that "a good vaccine is the one that is available" still holds true.

Going forward, public opinions of Chinese vaccines in Southeast Asia will be subjected to the pandemic's unpredictable trajectory. For some Southeast Asian countries, Chinese vaccines may be the only viable choice for large-scale vaccinations if other vaccine manufacturers are not able to provide prompt and sufficient supplies.

Given the ongoing surge of infections in the region, the counsel by Indonesia's health minister that "a good vaccine is the one that is available" still holds true. The emergence of newer variants and the need for booster shots could also change how the various vaccines are perceived. Furthermore, the "mixing and matching method" of different vaccines, pioneered by Thailand and under consideration by the Philippines and other countries, suggests a pathway where Chinese and other vaccines could be deployed in a complementary rather than mutually exclusive way.

Another potential game changer is China's venture into mRNA-based Covid-19 vaccine development. If successful, this will significantly improve the appeal of China's future vaccine offerings in the region. The game of vaccine diplomacy is not over yet.

This article was first published by ISEAS - Yusof Ishak Institute as ISEAS Perspective 2021/115 "Understanding the Selective Hesitancy towards Chinese Vaccines in Southeast Asia" by Khairulanwar Zaini and Hoang Thi Ha.