Metal magnate's fall from China's rich list to bankruptcy

(By Caixin journalists Yu Ning, Luo Guoping and Denise Jia)

Liu Zhongtian, who founded Zhongwang Group and built it into Asia's biggest maker of aluminium extrusion products while launching himself onto the Forbes list of China's richest billionaires, now finds himself under legal restraint with his company in bankruptcy and much of his wealth evaporated. What went wrong?

Shell companies and shady transactions

Zhongwang was set to file a reorganisation plan on 20 June, nine months after creditors applied for a bankruptcy restructuring of the manufacturer's hundreds of subsidiaries and affiliates.

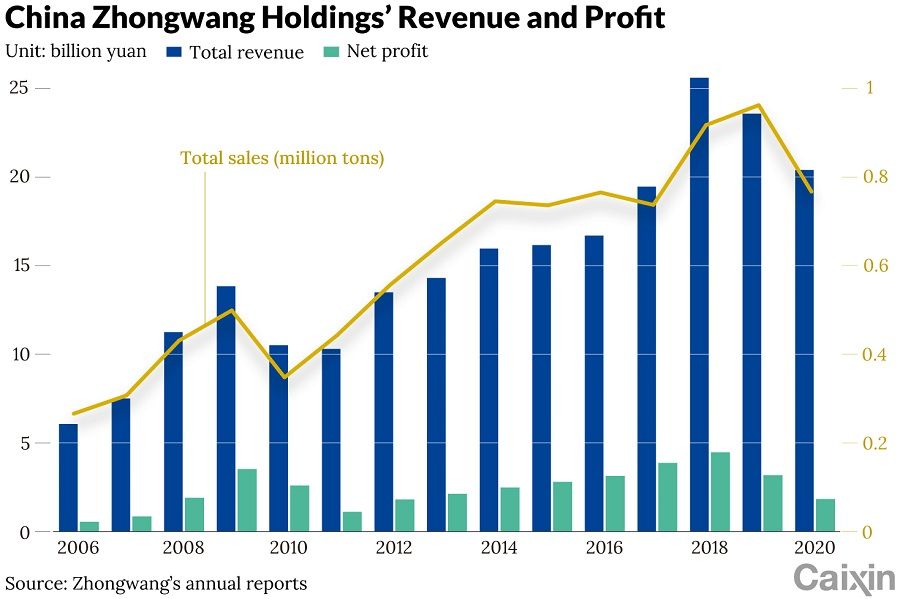

Creditors are eager to find out what assets remain for the conglomerate, which is based in Liaoyang city in China's northeast province of Liaoning. At its peak, the company had 50,000 employees and assets exceeding 500 billion RMB (US$69 billion). Its main unit, China Zhongwang Holdings Ltd., has not reported financial results since 2021, resulting in its delisting from the Hong Kong Stock Exchange on 13 April 2023.

People close to the company estimate that creditors are exposed to about 200 billion RMB of risk to Zhongwang through financing to its numerous shell companies and investment affiliates. It is also unclear how much off-the-books assets and liabilities are tied to the 59-year-old Liu.

In September, a Shenyang court ordered a merger and restructuring of Zhongwang's 253 subsidiaries and affiliates. During the bankruptcy process, many fraudulent transactions surfaced, raising doubts about how much of the group's business is real and about Liu's credibility.

Many of the subsidiaries are shell companies that appear to be unrelated to Zhongwang, but had billions of RMB of fraudulent transactions with other affiliates in order to obtain bank financing or inflate the parent company's financial results.

Liu, who ranked eighth on the Forbes 2009 list of China's richest billionaires, has dropped off the list. He told Caixin in June 2020 that he owned 4 million tons of aluminium ingots detained by Vietnamese customs worth more than 60 billion RMB. He said he also owned land in China valued at 75 billion RMB. Liu has pledged to sell his overseas assets to repay bank debt.

"Zhongwang is not insolvent," he told Caixin. "In the worst scenario, we go for bankruptcy, and divide the assets to everyone."

But Liu has never sold any overseas assets. He later said these businesses were handled by his nephew, but now he couldn't find his nephew.

Self-made billionaire

Liu started in business at age 17 by selling lumber, soybean and steel scrap. Many people who know him describe Liu as a fearless, smart and shrewd man. He founded Zhongwang in 1993 as a maker of aluminium alloy doors and windows. Demand for construction materials during China's real estate boom in the 1990s propelled Zhongwang among the country's top 500 companies. In 2001, US aluminium giant Alcoa offered to buy Zhongwang for US$65 million. Liu rejected the bid.

Meanwhile, Zhongwang switched its focus from aluminium construction materials to industrial aluminium extrusion products as Liu saw greater potential and higher margins for the latter. In 2008, sales for the new business line accounted for 55.3% of company revenue, up from 26.6% in 2006.

The IPO's success was fuelled by two appealing stories: Zhongwang role as a main supplier to the nation's high-speed railway network and the company's outlook as an exporter, primarily to the US.

As Liu's success and ambition swelled, he considered making an offer to buy Alcoa, which had earlier sought to acquire his company, according to a person close to the him.

Zhongwang went public in Hong Kong in 2009, raising US$1.3 billion in the world's largest IPO that year, following the global financial crisis. Liu, owning 74.1% of the company, briefly climbed onto the Forbes China billionaires list.

The company delivered impressive results in the first two years as a listed company. In 2010, it reported net profit of 2.6 billion RMB with a gross margin of 40.6%, dwarfing its peers and rare for any manufacturer.

Indicted in the US

The IPO's success was fuelled by two appealing stories: Zhongwang role as a main supplier to the nation's high-speed railway network and the company's outlook as an exporter, primarily to the US.

Since 2005, Zhongwang has supplied aluminium products to a number of state-owned enterprises affiliated with the Ministry of Railways for the manufacture of train frames and conductive rails. But some industry participants said that Zhongwang's market share in the high-speed railway network wasn't high and it relied on low prices to gain orders.

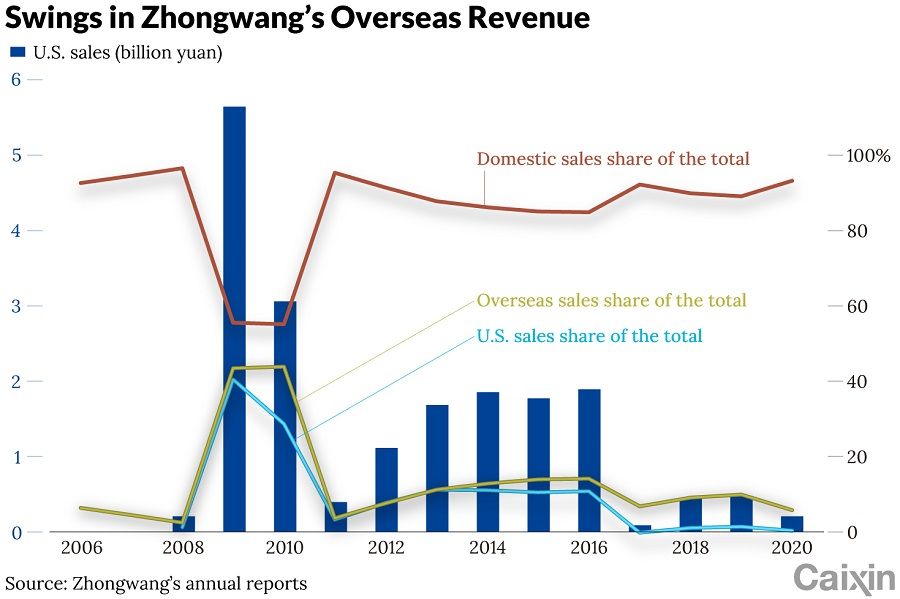

Before the IPO, the company mainly sold products domestically. In 2008, exports represented just 3.3% of sales. The next year, US shipments jumped to 41% of total revenue, Liu said. Zhongwang was beating local rivals with lower prices and higher quality, he said.

Underlying the company's advantage were export tax rebates by China. The incentives were established after the financial crisis in 1998 to encourage exports and stimulate the economy. The 11% to 17% export tax rebates covered three categories of aluminium products.

In response, the US began in 2011 to apply anti-dumping duties on certain aluminium products from China, citing harm to domestic producers caused by China's tax rebates. That year, Zhongwang's exports to the US plunged 90%.

Zhongwang attempted to sidestep the punitive duties by shipping "highly processed products". But a US Justice Department investigation concluded that the company was disguising aluminium exports by making them appear be functional pallets exempt from the anti-dumping tax.

A US federal judge in 2022 fined six Southern California-based companies controlled by Liu US$1.83 billion for a conspiracy to evade customs duties. Liu, who also faced charges including conspiracy, wire fraud and money laundering, didn't appear in court. He denied the accusations and distanced himself from the six companies.

Intertwined businesses

Zhongwang came under a liquidity crunch in 2021. In October of that year, the company said two of its major production units were in "severe difficulties" and it was seeking outside assistance. The government of Liaoning province stepped in to help relieve the debt crisis.

The previous year, Liu told Caixin the company's assets included 60 billion RMB in aluminium ingots detained by Vietnamese customs, ten warehouse in California valued at US$2 billion, and factories in Germany, Australia, Canada, the US and Mexico worth 20 billion RMB, as well as 1 billion RMB of investments in mines in Guinea.

To support funding to Zhongwang and his own trading business, Liu built up a financing network based in Liaoyang and spreading across Northeast China that included banks, insurers and factoring companies.

Financial dealings between Zhongwang subsidiaries and between affiliates and the company's founder or businesses he controls personally have attracted attention. An investigation in 2018 by the National Audit Office spotlighted a relationship with an aluminium trading company owned and managed by Liu.

"Zhongwang's business and my personal trading business are completely independent, and there's never financial connection between them," he said.

However, the investigation found a commercial note issued by a Zhongwang affiliate involving more than 10 billion RMB that was allegedly used to purchase aluminium ingots overseas. Chen Yan, Zhongwang's non-executive director who was widely seen as Liu's successor, acknowledged that the company and Liu's personal aluminium trading business would often buy materials together because the large size of Zhongwang's orders could lower the costs. Chen didn't comment on whether the commercial note was used for Liu's personal business.

A hand in banks, insurers and factoring companies

To support funding to Zhongwang and his own trading business, Liu built up a financing network based in Liaoyang and spreading across Northeast China that included banks, insurers and factoring companies.

The above-mentioned commercial note was issued to Zhongwang's affiliate by Liaoyang Rural Commercial Bank Co. Ltd., a rural lender controlled by Zhongwang. The company held an 85% stake in the bank, according to Liu. Zhongwang borrowed over 50 billion RMB from Liaoyang Rural Commercial Bank and another local lender, Bank of Liaoyang, Liu personally borrowed over 40 billion RMB from them, he said.

Liaoyang Rural Commercial Bank went into bankruptcy in 2022 after the bank's former head, Jiang Dongmei, was accused of corruption and illegally issuing loans involving huge sums of money. Regulators found more than 90% of the bank's loans was lent to Zhongwang and its affiliates.

Zhongwang also controls or holds investments in multiple banks in the northeastern region. In addition to banks, Zhongwang also obtained funds from insurer J.K. Life Insurance Co. Ltd., in which it owns close to a 90% stake.

J.K. Life deposited nearly 80 billion RMB of premiums at banks controlled by Zhongwang, including Liaoyang Rural Commercial Bank. Lu Changqing, former president and chairman of Zhongwang, became J.K. Life's chairman, who then appointed multiple Zhongwang executives to key positions at the insurer.

Under Lu's direction, J.K. Life channelled 120 billion RMB of funds to Zhongwang and its affiliates through illegal related-party transactions and guarantee arrangement, the China Banking and Insurance Regulatory Commission (CBIRC) found in inspections in 2019.

The regulator directed J.K. Life to rectify its embezzlement misconduct and stop depositing money into banks controlled by Zhongwang. But Lu continued to transfer 7.5 billion RMB to Zhongwang, according to an insider at the insurer. Lu told other J.K. Life executives that he had to transfer the money, "otherwise Zhongwang would go bust", the insider said.

In December 2020, the CBIRC removed Lu as J.K. Life's chairman.

Some Chinese buyers were interested in buying part of Liu's 4 million tons of aluminium ingots purportedly held by Vietnamese customs...

Meanwhile, Zhongwang and its affiliates faced more than 100 creditor lawsuits. In October 2021, Liu was placed into restraint by the authority. Lu and Chen were also taken away by the authority the next year.

The Liaoning provincial government has sent a working group to take over Zhongwang and try to maintain the company's operations. Caixin learned that the Shenyang Intermediate People's Court and the government working group sent a large number of personnel across the country to freeze Zhongwang's property, aluminium and other assets and conduct auctions.

As of October 2022, 5.3 billion RMB of Zhongwang's aluminium assets have been sold to repay bank debt, according to court records.

Some Chinese buyers were interested in buying part of Liu's 4 million tons of aluminium ingots purportedly held by Vietnamese customs, according to people familiar with the matter. But these assets are still subject to judicial rules to determine whether they are owned personally by Liu or were purchased by Zhongwang using embezzled bank loans, they said.

This article was first published by Caixin Global as "Cover Story: Metal Magnate's Fall From China's Rich List to Bankruptcy". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.