Rethinking China's property market meltdown

The market for Chinese developers' dollar-denominated bonds has seen a meltdown over the past two years, losing 87% of its value, sparking renewed calls for a fresh approach to stimulating the property market.

(By Caixin journalists Chen Bo, Niu Mujiangqu, Liu Ran, Huo Kan and Han Wei)

The downward spiral of China's ailing property sector shows no sign of abating despite the government's rollout of a seemingly endless series of supportive but as yet ineffective measures, with the crisis stretching for over three years.

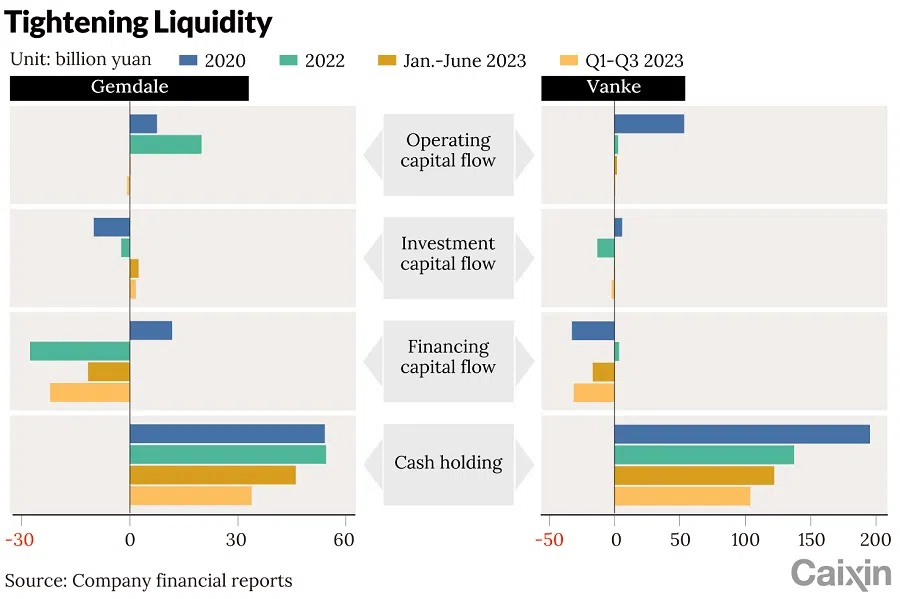

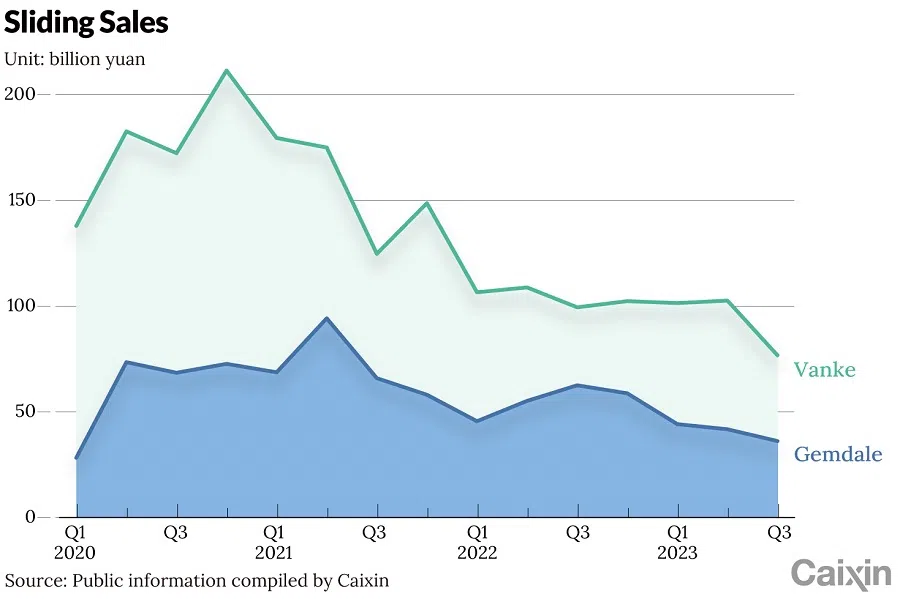

Now, some of the industry's top performers such as Gemdale Corp. and China Vanke Co. Ltd., who thus far had been weathering the storm, are teetering under massive maturing debts, spooking investors and sending the value of the latter's dollar bonds plunging more than 30% last month.

Uncertainty over market recovery

Indeed, the market for Chinese developers' dollar-denominated bonds has seen a meltdown over the past two years, losing 87% of its value. The rout has wiped out US$135.5 billion of value from US$154.9 billion of outstanding notes, according to analysis by Debtwire.

This has sparked renewed calls for a fresh approach to stimulating the property market including the government-funded construction of affordable housing.

"The real estate market's decline has exceeded expectations, and even with strong administrative and financial relief policies, it remains challenging to stimulate a market recovery," said Li Yujia, chief housing policy analyst at Guangdong Urban & Rural Planning and Design Institute. "This indicates that traditional real estate management models must undergo reform and innovation."

The idea isn't new. The central government has since 2021 emphasised a new development pattern for the property industry is required, but this push has been given new impetus since the summer after Country Garden Holdings Co., the former top developer by sales, last month logged its first ever default on a dollar bond.

This came after state-backed Sino-Ocean Group Holding Ltd. in July rattled the market by announcing that it was seeking an extension to repay its debts.

The weakened industry fundamentals are expected to continue to drag down the credit quality of rated developers over the next 12 to 18 months, ratings agency Moody's said in a 3 November report, highlighting the uncertainty hanging over China's real estate market recovery.

Contagion spreads

Risks in the real estate industry have started spreading from private firms to companies with mixed-ownership, with the contagion now poised to reach state-owned builders if the weak market condition persists, a property industry analyst at a securities firm told Caixin.

The risk appetite at financial institutions is expected to further decrease, which will in turn worsen the financial woes of developers, said the analyst.

Chinese developers' fundraising through bond sales totalled 587.5 billion RMB (US$110.2 billion) in the first ten months, down 8.9% year-on-year, according to data compiled by China Index Academy.

Of that total, 364.8 billion RMB was raised by state-owned developers, while builders with mixed-ownership and privately owned status only accounted for 41.3 billion RMB of the funding, the data showed.

"In such a market, only state-owned companies can secure financing to maintain normal pace of land acquisition and sustaining sales," said an executive at a Hong Kong financial institution.

... in its latest attempt to pull out of this vicious cycle, the government appears to be going back to the drawing board.

Authorities across China have stepped up issuance of policies to prop up the sector since the summer, including measures to support developers' financing and encourage homebuying. However, market sentiment remained weak as home prices fell the most in eight years in October, National Bureau of Statistics figures showed.

Now, in its latest attempt to pull out of this vicious cycle, the government appears to be going back to the drawing board.

Minister of Housing and Urban-Rural Development Ni Hong said in a 11 November interview with Xinhua News Agency, that creating a new model for real estate development is a fundamental solution to address challenges and promote stable growth in the market.

The core of the new development model includes construction of affordable housing (保障性住房) and urban renovation projects (城中村改造), said Ni.

A State Council document viewed by Caixin showed that the cabinet plans to support major cities with over 3 million residents to accelerate affordable housing construction.

A source close to the Ministry of Housing and Urban-Rural Development said that local authorities are still assessing the potential scope of affordable housing projects and regulatory authorities have not directly assigned specific construction indicators and requirements.

"The size is determined by local governments based on their circumstances after research," said the person.

Analysts said that the addition of affordable housing will primarily focus on first and second-tier cities, whose populations are experiencing a net influx of people and robust demand.

Zhong Zhengsheng, chief economist at Ping An Securities estimates that there is 1.34 billion square metres of area in big cities that require renovation, which will involve investment of over 8.2 trillion RMB.

Immediate impact

Such projects not only contribute to the long-term transition of the property market towards new development patterns, but it will also have an immediate impact on overall demand, said Citic Securities in a research note in early November.

China is eyeing the system in Singapore, which relies on affordable housing to meet people's basic residential needs, while demand for improved housing will be met primarily through commercial housing, said a person close to policymakers.

This could prove crucial in turning things around in China.

"The primary focus of the current real estate development pattern is addressing issues from the supply side rather than the demand side," said Li from the Guangdong Urban & Rural Planning and Design Institute.

But prior to any implementation of a new policy, many are holding their breath as they watch to see how former market stars Gemdale and Vanke deal with their financial difficulties.

In the one month since mid-October, Gemdale's dollar bond plunged to under 30% of its face value after its chairman Ling Ke resigned, intensifying investor concerns about its financial sustainability in the face of more than 10 billion RMB of maturing debt.

Both companies are known for their business prudence over the past decade of the property boom in China that fuelled the rise of companies such as China Evergrande Group, Country Garden and Sunac China Holdings Ltd., through highly-leveraged expansions.

All three of these companies have since become the most high-profile victims of the debt crisis, having experienced a mix of defaults and debt restructurings.

But the recent market turbulence has shown that even the most cautious operators are not immune.

Established in 1988 in Shenzhen, Gemdale was among the earliest players in China's commercial property market and was one of those first chosen to participate in a state guaranteed bond sales programme designed to expand developers' financing. It ranked tenth among Chinese developers in 2022 with annual sales of 221.8 billion RMB.

Today things are no longer so rosy. In the one month since mid-October, Gemdale's dollar bond plunged to under 30% of its face value after its chairman Ling Ke resigned, intensifying investor concerns about its financial sustainability in the face of more than 10 billion RMB of maturing debt.

Financial crunch

Compounding the financial crunch, Gemdale's sales have plunged, with contracted sales in the first ten months totalling 132.9 billion RMB, down 27.5% year-on-year, according to the company's latest financial report. The company has in recent months stepped up sales promotions by offering greater discounts in hope of spurring purchases.

A person close to Gemdale's management said the company's woes were partially triggered by Country Garden's debt crisis as it sparked investor doubts over similar companies such as Longfor Properties, China Vanke and Gemdale.

To defuse investors' concerns, Gemdale in September said that its state investor Futian Investment Holdings planned to guarantee to Gemdale's future bond sales. In October and November, Gemdale made timely repayments to three bonds worth over 3 billion RMB.

Gemdale has a dispersed shareholding structure distributed among state and private investors. Private insurer Fude Sino Life is the company's largest single shareholder with a stake of 29.8%, followed by government-owned Shenzhen Futian Investment Holdings, with 7.79%.

But Gemdale's liquidity is tight, Caixin has learned. To ensure the recent bond payments, the company has suspended outlays to most suppliers, such as subcontractors and material vendors, a company source said.

An analyst at a brokerage house said Gemdale is running out of room to manoeuvre in its efforts to turn the situation around.

"The only thing they can bet on is whether policy measures can rescue market confidence and boost demand," said the analyst.

From January to April 2024, Gemdale will face public debt repayment obligations amounting to 10.6 billion RMB, with a particularly significant monthly payment of 6.1 billion RMB in March, its financial report showed.

"There will be another wave of bond payments at the end of the year. It should hold up until March of next year, but after that, it's hard to say," said the Gemdale employee.

... if [Vanke] were to be become embroiled in the debt crisis it would further undermine market confidence...

Vanke on the brink

And then there is China Vanke, one of the best performing developers with strong state backing. One of the country's few remaining investment-grade builders, Vanke had been known for its cautious business operations and strict risk control that helped the company to largely avoid the regulatory clampdown on excessive leverage.

But since late October, Vanke's onshore and offshore bonds have plunged. Vanke securities in a Bloomberg index of Asia investment-grade dollar notes lost 35% for all of October, the most in a year.

Vanke's third-quarter report revealed that as of the end of September 2023, the company holds about 103.68 billion RMB in cash and cash equivalents. This represents a net outflow of 18.5 billion RMB compared with the end of June.

"I didn't expect Vanke to reach this point," an executive at a mid-sized developer said, pointing to the shrinking financing inflows and cash holdings, which are very small for a company like Vanke.

Vanke's towering position in the sector as the country's second largest builder by contracted sales means it holds systemic and symbolic significance and if it were to be become embroiled in the debt crisis it would further undermine market confidence, numerous financial and property industry sources told Caixin.

The fear has been palpable. Between late October and early November, institutions with significant holdings of Vanke's bonds have rushed to sell, Caixin has learned. Some institutions have already liquidated their holdings.

To bolster investor confidence, Vanke in October named Xin Jie, chairman of Shenzhen Metro Group Co., as vice chairman, signalling greater support from the state-owned shareholder. The company also sent a notice to investors that its "fundamentals have not encountered any issues".

"Bond market fluctuations, akin to dominoes, draw attention to the funding of real estate enterprises when bond prices decline. If creditors react excessively, it intensifies liquidity risks for these enterprises," a property bond investor said.

Vanke is facing a looming wave of debt payments over the next six months, a key concern in the market. According to the bond database of DealingMatrix, by June 2024, Vanke has four domestic bonds maturing or eligible for call options, totalling 5.4 billion RMB. In addition, three overseas bonds totalling about 10.4 billion RMB will also mature.

That fact alone speaks to Vanke's status, as it is among just a few Chinese developers that are still able to secure financing from the domestic bond market amid the market downturn.

Vanke secured 82.7 billion RMB in new financing in the first nine months of 2023, Han Huihua, the company's chief financial officer, told Caixin.

Eager to prevent the market talisman from stumbling, in early November, Shenzhen's top state-owned asset regulator Wang Yongjian in a meeting pledged to help Vanke avoid extreme risks. Shenzhen Metro's Xin also promised to take over some projects from Vanke to inject 10 billion RMB of fresh capital into the developer.

The remarks led to a brief rebound in Vanke's bonds. However, they were not enough to dispel all market concerns, as investors doubt how much of the pledged funds will materialise, a bank executive said.

Betting on ownership

The outlook for lifelines for other developers, whose liquidity is held in the hands of financial institutions as the majority of their liabilities consist of bonds and bank loans, appears grim.

With the narrowing bond financing path, non-state builders are left only with bank loans to supplement funding. However, bank lending to developers is subject to tough restrictions.

Amid continued market turmoil and weakening confidence, financial institutions are increasingly weighing the developers' ownership structure when conducting their risk assessments.

"Institutions put their bets on state-backed investors, counting on their government shareholders," an industry source said.

With the narrowing bond financing path, non-state builders are left only with bank loans to supplement funding. However, bank lending to developers is subject to tough restrictions.

The prolonged downturn in the real estate market has significantly impacted the quality of assets for banks. While confidence in banks hasn't completely collapsed, they are very cautious about getting involved in real estate loans, a commercial bank executive said.

In November 2022, the central bank and industry regulator held a meeting with banks, encouraging them to provide credit support to developers. Subsequently, major banks announced various partnerships with developers including Gemdale and Vanke, involving hundreds of billions of RMB in credit lines.

But most of the promises have not been delivered.

"The credit lines obtained by developers are mostly indicative, and very few of them actually materialise," a Shenzhen bank executive said.

Market confidence has remained fragile as housing sales and prices continues sliding.

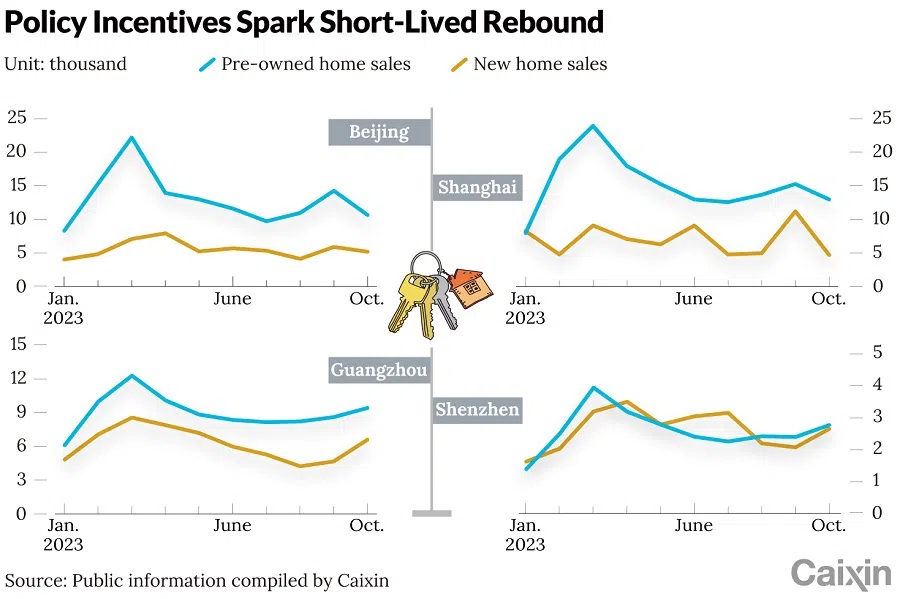

Since August, authorities at central and local levels have issued various rules to prop up sales, including easing mortgage requirements and lower down payments. The measures led to a sales rebound in many cities, but were short-lived.

In Beijing, a late August policy to expand the criteria of first-home buyers to allow more people to enjoy favorable loan terms pushed up sales of new homes by 42.9% in September, while sales of pre-owned homes surged 30%. But that petered out in October with sales of new homes dropping by 12.3% and those of pre-owned homes sliding 25.3%.

Some property and financial industry sources blamed the persistent housing market downturn to inadequate policy easing, pointing to continued restrictions on home purchase in the biggest cities such as Beijing and Shanghai. Both cities have limited who can purchase local homes and how many properties families can own.

"The policy measures lack strength, vacillating and exacerbating market hesitancy," said a property company executive.

But a person close to Ministry of Housing and Urban-Rural Development said there is little possibility that the purchase restrictions will be removed as regulators have doubts about the impact.

The root cause of the slow recovery of the property market lies in a significant change in market supply and demand, said the person close to the ministry. At present, there is a need to acknowledge the reality of market fluctuations and recognise that administrative power is relatively limited, he said.

"Relying on financial measures to rescue the market is not realistic, and restoring market confidence is the key to revitalising the real estate industry," a senior manager at a state-owned bank said.

This article was first published by Caixin Global as "Cover Story: Rethinking China's Property Market Meltdown". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)