Roaming China's "Manhattan" ghost towns

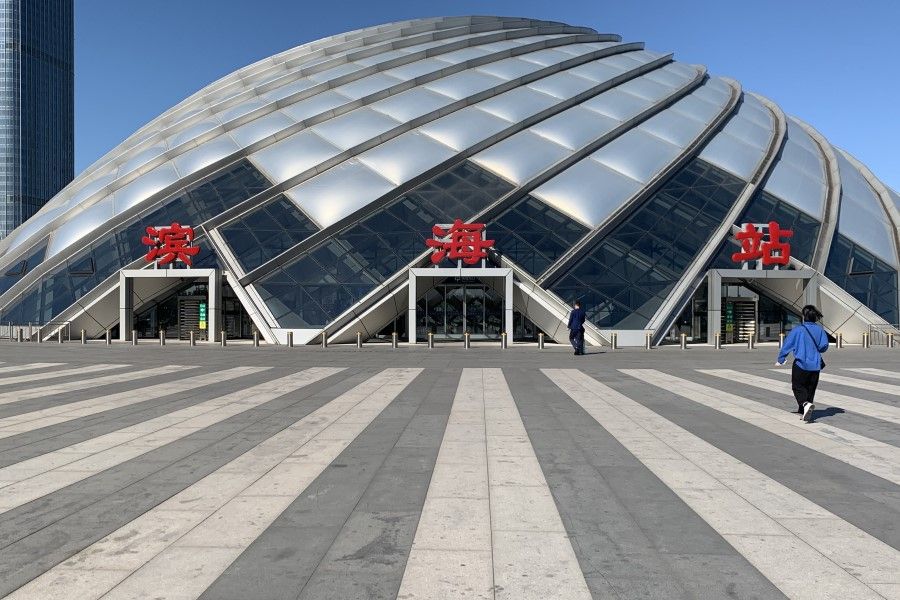

"There's just nobody here. It's like having a good-for-nothing child, or a child that's going through a phase of not wanting to study, of rebellion." Cab driver Mr Wu draws this analogy as scenes of concrete buildings roll by on the drive through Yujiapu Financial District and Xiangluowan Business District, in the Binhai New Area in Tianjin.

Mr Wu - who has driven a cab in Tianjin for over 10 years - sounds a little depressed. And that sentiment seems to pervade everything we see. Modern skyscrapers rise up to the sky, but in the evening there is no wave of people getting off work. At night, the roads and pavements are brightly lit, but many corners remain silent. Neon signs on the buildings scream out the emptiness and loneliness of the public square.

Search online for Yujiapu or Xiangluowan, once jewels in the crown of the Chinese government's Binhai New Area development project in Tianjin, and the terms "ghost town" and "empty city" will come up as well. While these districts are not exactly creepy or deserted, they have not been as vibrant as expected.

Yujiapu became operational in 2009. The original plan was to build a large-scale financial area within ten years. It would become a base for financial services and a centre for financial reform and innovation that would act as the economic centre of northern China. As for Xiangluowan, just across the river from Yujiapu, construction began in 2007. It was positioned as a centre where enterprises from other cities and the central government would have their offices, headquarters and research centres in Binhai New Area. During the planning stages, Yujiapu and Xiangluowan were called "China's Manhattan".

However, things have not turned out as planned. Growth in these two areas has been slower than expected, and after ten years, while the Manhattan-style skyline has been achieved, the high-end enterprises and talents have not come. On the contrary, the hollow shells have become a warning about the problems faced by "created" economic cities in Tianjin and elsewhere in China.

According to figures from property consultants First Pacific Davies, the unoccupancy rate of grade A offices in Tianjin in the third quarter of this year was a relatively high 36.4%, up by 6.6 percentage points year-on-year. The figure is likely even higher in some high-end offices in Yujiapu.

The 54-storey Huaxia Financial Center in Yujiapu, for instance, was initially branded as "Binhai's number one HQ-grade financial landmark". Today, its directory shows just 23 tenant companies and organisations. As for the other office buildings, many of the tenant companies have nothing to do with finance. Instead, they are in industries such as logistics, trade, and technology. And in New Financial Tower (新金融大厦), an entire floor has been converted into an "escape room" interactive game venue.

Today, businesses in Yujiapu are still waiting for the crowds. When I went to the Global Go shopping mall in the Tianjin free-trade zone (FTZ), the elegance and classy feel of the place was comparable to most middle- to high-end malls except for one thing: there were so few people, I heard my own footsteps as I strolled around in my soft-soled sneakers.

Ms Yuan Cuixia runs a store selling imported German products. She tells me that she came to Yujiapu to set up shop because it was planned as part of the Tianjin FTZ. "There is a national policy. We thought that as Tianjin is a major northern port, it would be able to ride on the national trend, plus we are in the trading business... it was a gamble."

She says frankly that Yujiapu is still very quiet, but adds that they were not expecting an influx of people either, "When we opened, we had planned on a waiting period of at least a few years, which we knew would not be easy. So it hasn't really impacted us too much mentally."

Ms Yuan feels the description of Yujiapu as a "ghost town" is exaggerated. "It's better than it used to be! You see people on the streets, and American takeout. A couple of years ago, there wasn't a single Mobike (bike sharing service bike) around." According to a report in March this year by Tianjin official media Meiri Xinbao (每日新报), Yujiapu sees a daily average of 100,000 people who work and live there.

As for the working people, most seem happy to work and live in a city with good infrastructure and few people. Twenty-six-year-old logistics worker Ms Liu says, "This place is developing quite slowly... but compared to when I was working in Beijing, the empty space here feels good. There are greenery and trees. I like it better here."

"Software" lagging behind "hardware"

The fact is, many business owners were attracted to Yujiapu and Xiangluowan by the low rents.

One owner of a technology company in Zheshang Building in Xiangluowan reveals that the office rent this year is much lower than last year. "The landlord had no choice but to rent to us." But despite the cost savings, he is still worried about his company.

His assessment of the business climate in Xiangluowan and Yujiapu: "The 'hardware' is good, but the 'software' is not fantastic. Business conditions do not match the hardware."

In his view, having few people is not just a problem in terms of manpower, it also affects the overall energy of the business environment. He had hoped to collaborate with a well-known cultural enterprise that had moved into Yujiapu, but several rounds of discussions had fallen through. According to him, the other party did not have its core team in Yujiapu, and the young university student in charge of operations here did not have the experience or drive to take on additional work, and there were no sparks of collaboration or innovation.

This business owner, who also has operations in Tianjin city and Beijing, sighs, "Life is getting tougher for private companies like us. There's not enough business to go around. We need to look elsewhere."

In another building nearby, a trading company has moved in. Its 100 square metres of office space can accommodate at least 10 people, at a monthly rent of 4,000 RMB (about S$776).

The person in charge says frankly that the company moved its operations from Shandong to Tianjin's Xiangluowan because of the cheap rent and because the owner hopes to get a household registration (or hukou 户口) in Tianjin, so that their child can have a better education and an edge in the university entrance exams, or gaokao (高考). The economic outlook here is a secondary consideration. "After all, our actual business and operations are not here."

However, she does feel it is a pity that Xiangluowan is so quiet. "Everywhere else seems to be enjoying rapid development, but here, confidence and morale are low. There is a sense that the best days are gone. It is a real waste having those buildings standing empty. Perhaps they could be converted for public use?"

A reflection of Tianjin's economic difficulties

To some extent, the difficulties faced by Yujiapu and Xiangluowan reflect Tianjin's economic difficulties in recent years.

Before 2018, Tianjin's economic growth was strong, at double figures several years in a row. In particular, since the Binhai New Area was included in the national growth strategy in 2005, the average annual growth in GDP for the area was above 20%, making it an important driver of Tianjin's economy.

However, last year saw a figurative storm break over Tianjin's economy. The central government declared a change in the reporting of cities' GDP. Last January, Binhai streamlined its GDP figures by excluding the production values of locally registered companies that had their production operations elsewhere. As a result, its 2016 GDP of over one trillion RMB shrank by a third to just 665.4 billion RMB.

This change in the figures showed that Binhai's growth was not as fantastic as previously thought. Coupled with limits on production volumes due to environmental considerations, as well as a weak service industry, Tianjin's GDP growth was seriously hampered. It plummeted from 9.1% in 2016 to 3.6% in 2017, the lowest in the whole of China. All this prompts the question: "Will what happened in northeast China happen in Tianjin all over again?"

Besides Tianjin's own problems, China's economy is facing growing downward pressure. Associate Professor Bo Wenguang of the School of Economics at Nankai University in Tianjin says when planning began on Binhai over ten years ago, China's economic growth was rapid and Tianjin's GDP growth was over 15%, and expectations of future growth were high. But ten years later, the current economy is not as good as expected, and many industries in Tianjin and China are in the process of restructuring and transformation.

Professor Liu Gang of Nankai University's School of Economics adds that when Binhai was being developed in 2006, Beijing was rapidly expanding. Some even predicted a tenfold increase in Beijing's GDP, as it had plenty of resources in technology and innovation to nurture many industries. Tianjin would play a key role in this expansion. However, looking at the development of Yujiapu and Xiangluowan, despite the government and property developers investing heavily to fast-track the building of the financial centre, the scale and speed of industries shifting over from Beijing have been far below expectations, leading to a significant gap between demand and supply.

Pu Yongjian, an economics professor at Chongqing University says China's economic slowdown will be a long-term trend, and the financial industry is expected to continue to decline, so it is not the right time to build up a financial centre.

He says, "The financial industry and its financial institutions are currently shrinking. Nobody will rent the buildings or open a business, investments are not making money, and debts are unpaid."

However, Prof Liu Gang thinks we should not be too quick to pass judgment on the prospects of Yujiapu and Xiangluowan. He feels that in the past five years, Binhai has taken on many of Beijing's non-capital city functions, and has contributed to coordinated economic growth. Its problem is with the overzealous reading of economic trends, resulting in overenthusiastic development and investment.

He says, in assessing economic growth, there should be more tolerance and long-term awareness. The investment structure of the Tianjin economy has changed in recent years, shifting from property and infrastructure to investments in technology. In terms of industry shifts, Tianjin is actively working to attract companies in artificial intelligence, aviation and aerospace, and high-tech industries. Prof Liu suggests that if Tianjin cannot be an alternative to Beijing as a financial centre, it can change how it positions itself. He proposes that the completed buildings be used for technology innovation. But things will not happen overnight, and the issues will take time to resolve.

Since taking office in September 2016, Tianjin party secretary Li Hongzhong has made it his political mission to revive the Tianjin economy following its fall off the proverbial cliff. Right now, Tianjin's economy is finding its way out of a trough by improving industry structure, developing smart technology, and boosting the private sector economy.

Tianjin's GDP growth for the first three quarters of this year has rebounded to 4.6% as compared to the same period last year. As for whether Tianjin's economy will recover further, Prof Bo Wenguang is cautiously optimistic.

He mentions two challenges. First, like most places in northern China, Tianjin's economic structure is made up of state-run enterprises and heavy industries. While it is now shifting to the new economy which is growing more rapidly than the old, the old economy prevails. This contributes to the slowdown in economic growth and makes transformation challenging. Second, Tianjin's private sector economy is weak. Foreign investments favour the manufacturing industry of low added value, and so Tianjin is less able to withstand external risks as compared to other places such as Zhejiang and Guangdong.

One thing is clear: Tianjin's long-term finances are at risk if Yujiapu and Xialongwan continue to be ghost towns.

One academic who declined to be named analysed that the local government put in good money to build Yujiapu's buildings, transport, and other infrastructure. Financial revenue aside, construction projects carried out with borrowed money has landed the local government in debt. "Of course, if development in Yujiapu was good, the return would be good. But the problem now is that the returns are worse than expected."

A report this April by Standard & Poor's warned that Tianjin has long been borrowing money to drive investment growth, with a debt-to-income ratio of 423.7%, the highest in China. This also points to an unsustainable model.

For Prof Pu Yongjian of Chongqing University, the crux is that building infrastructure and hardware to attract businesses and funds no longer works. He explains that as the whole world develops, there are more options where capital could go. Regardless of location, hardware alone is no longer competitive - software is key.

Prof Bo Wenguang of Nankai University added that the setbacks in Yujiapu's development send a signal for other projects that governments cannot make too many choices on behalf of the market. To borrow a quote from the movie Field of Dreams: "If you build it, they will come", simply does not hold. It is more important to respect market forces.

On the upside, new drivers and industries are constantly emerging in China, and Yujiapu and Xiangluowan are in a position to seize the opportunities. These two areas are also not as important as they used to be in the grand scheme of things. "With less pressure, it might be easier to let go and respect market forces."

A giant red flag now hangs on the wall of a skyscraper in Xiangluowan. On the flag is written in Chinese: "Don't be biased against good opportunities." This commercial city that has faced setbacks and mockery has been empty for a long time, but it has never really stopped. It is trying to change people's perceptions, biding its time for recovery.

(All photos by Lim Zhan Ting.)