From dazzling to dull: Are China’s drone shows losing altitude?

The drone industry in China saw a marked growth before the pandemic, but Lianhe Zaobao correspondent Daryl Lim notes that aesthetic fatigue is setting in for consumers. While the drone shows are growing bigger, they are lacking innovation in creativity and content.

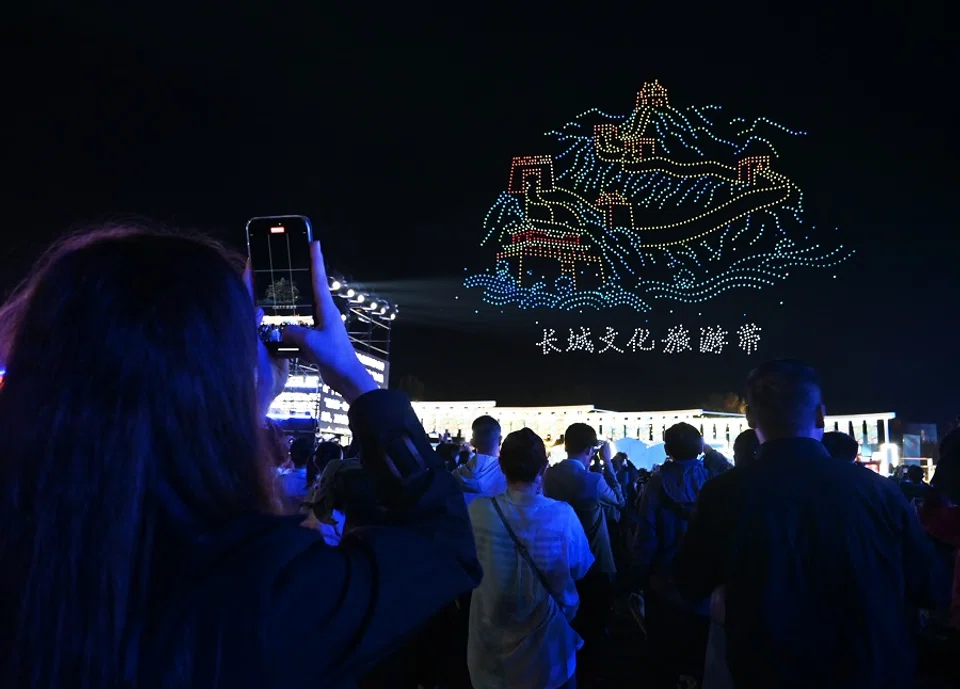

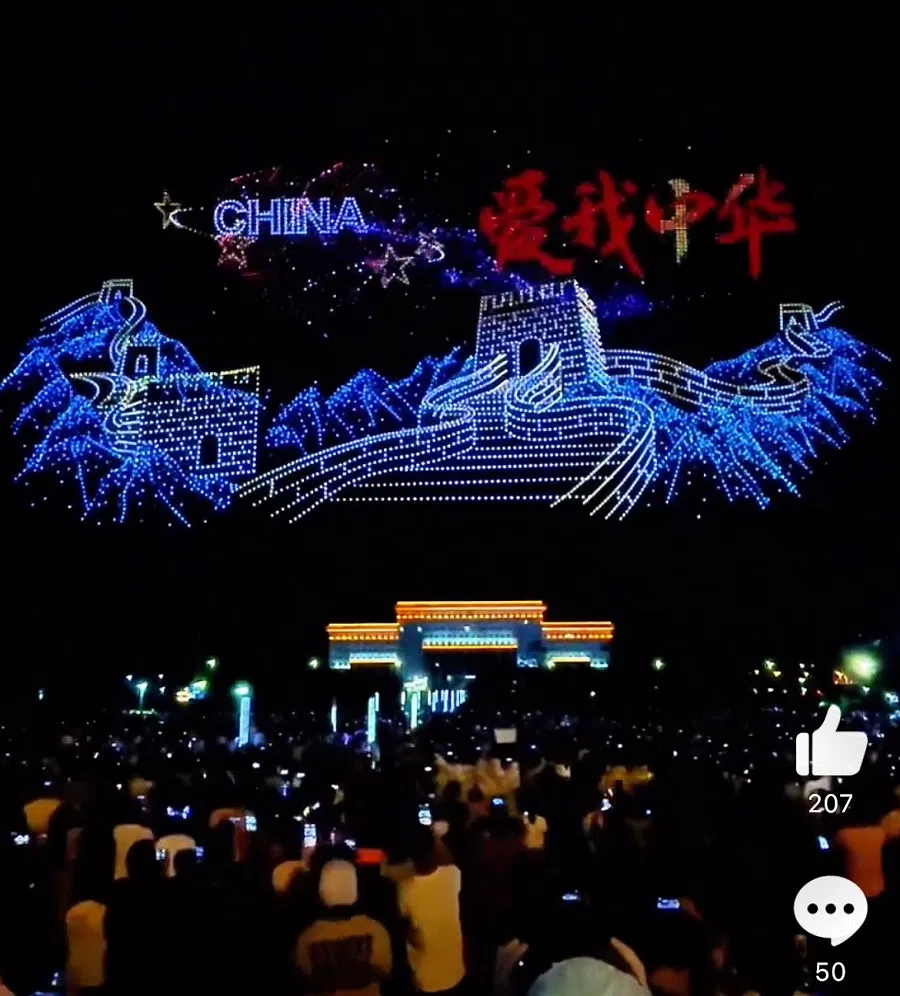

Days before China’s National Day, colourful lights illuminated the night sky of Shenzhen Bay Park, accompanied by the buzzing sound of drones.

Leading drone show company Shenzhen DAMODA Intelligent Control Technology Co Ltd deployed over 10,000 drones to create aerial patterns ranging from aircraft carriers to Shenzhen landmarks. It broke the Guinness World Record for “most drones forming an aerial image” and even earned praise from Tesla founder Elon Musk.

However, this record may not last for long. After all, less than a month ago, DAMODA had set the same world record with nearly 7,600 drones in the show at Yanbian, Jilin province.

The day after the show in Yanbian, another drone show giant from Shenzhen, Highgreat Technology Co Ltd, broke the world records for “largest image of a light source formed by a drone” and “largest number of drones flying simultaneously” in two separate drone shows.

Battle for reputation

Drone show companies are locked in fierce competition, successively breaking records in a short period, showcasing the robust capabilities of drone formations and injecting new vitality into an industry experiencing slow growth.

According to the 2022 insight report on drone formation performances in the cultural and tourism industry (《2022年文旅行业无人机编队表演数据洞察报告》), the drone show market experienced rapid growth before the pandemic; even in 2021, there were 7,228 drone shows in China.

... once the number of drones reaches a certain threshold, adding more drones would be less effective at enhancing the visual effect.

Zeng Yong, project manager of Guangzhou-based drone show company Kong Zhong Yi Xiang (空中亿象), told Lianhe Zaobao that notwithstanding the strong growth of the drone show market in recent years, increased competition has led to a noticeable decline in enthusiasm in the first half of this year.

He said, “The entire industry was quite sluggish in the first half of the year, with few events taking place. But right after the show in Yanbian, the number of inquiries significantly increased. Now, we typically have about 10 to 20 events each month, which is considered relatively stable.”

However, some industry insiders think that the relentless competition among major companies to increase the number of drones highlights the industry’s intensifying “involution”. This type of project focused on “gaining face” not only lacks substantial technological advancements but also hinders the healthy development of the industry.

Wang Liang, co-founder and general manager of Shanghai-based Zhong Niao Fei Intelligent Technology (众鸟飞智能科技), said in an interview that the competition between DAMODA and Highgreat Technology is well known in the industry. He believes that the two companies are engaged in a reputation battle.

Through cutting-edge wireless communication and positioning technology, drones can precisely execute formation changes and create complex patterns. This process is similar to how digital cameras work: the more drones there are, the denser the equivalent pixel points, allowing for more vivid, detailed and clear images.

However, once the number of drones reaches a certain threshold, adding more drones would be less effective at enhancing the visual effect.

Wang likened this to a car that can carry an additional two tonnes of cargo if two more wheels are added to it; adding another two wheels might enable it to carry a bit more. But if the car were equipped with 100 wheels, the practical significance becomes negligible.

He said, “From a technical standpoint, there aren’t many breakthroughs left; it’s merely a matter of piling up numbers.”

Increasing affordability

In the early stages, clients for the drone show market mainly came from government-related activities. However, along with the drop in the cost for such performances, clients have gradually expanded to include businesses and the average consumer in recent years.

Kong Zhong Yi Xiang’s Zeng recalled that he and his team planned a drone show for a dog in Hangzhou last year. He explained that the dog owner wanted to celebrate his pet’s birthday, and the design team carefully incorporated dog-related elements such as images of the dog and bones.

“Last year, a drone show involving 500 drones cost 120,000 to 130,000 RMB (US$16,860 to US$18,260). This year, you can get it for around 80,000 to 90,000 RMB.” — Zeng Yong, Project Manager, Kong Zhong Yi Xiang

Zeng said, “I’m not sure if the dog knew what was going on, but the important thing is that the client was satisfied.”

He pointed out that compared with the research and development of drone technology, the barriers to entry for performance and formation were relatively low, leading to increasingly intense competition in the field. Under the pressure of price competition, the price of single-drone shows has continued to decline, down 30% in the past year.

Zeng commented, “Last year, a drone show involving 500 drones cost 120,000 to 130,000 RMB (US$16,860 to US$18,260). This year, you can get it for around 80,000 to 90,000 RMB.”

Industry insiders generally believe that drone show prices would continue to decline. At the same time, as drone shows become increasingly common, the novelty could die off for the audiences, and they might even experience aesthetic fatigue. This will lead to a shrinking survival space for drone shows that lack differentiation.

Zhong Niao Fei’s Wang said, “Looking at the domestic drone show market, the industry is already saturated, and it may be starting to decline. This is why we are not willing to invest more energy to compete or make major breakthroughs.”

Obstacles to overseas market

The person-in-charge at DAMODA, which has a market share of over 60% in the drone cultural tourism industry, pointed out when interviewed that future drone shows would rely on creativity and content.

The person added, “As the number of drone shows increases year after year, people will expect to see more creative, visually stunning and content-rich performances that are eye-catching. The main arena of competition for the industry will shift towards design.”

Kong Zhong Yi Xiang’s Zeng felt that to stand out from other companies, drone shows must incorporate different elements, creating more diverse performance styles. This could include integrating cold fireworks, Kongming lanterns or phoenix-shaped drones.

... due to challenges related to transporting and operating drones internationally, the cost of performances overseas is about ten times higher than in China. — Wang Liang, Co-Founder and General Manager, Zhong Niao Fei Intelligent Technology

In the face of intensifying competition in the Chinese market, increasingly more drone show companies have shifted their gaze to overseas markets with greater growth potential. However, due to a variety of restrictions on the imports and exports of drones, resulting in high performance costs, expansion overseas faces many obstacles.

Zeng, who is planning a December drone show in Thailand, has seen a 20% increase in overseas inquiries over the past two years, but few have converted to actual orders. He attributes this to the cumbersome import and export process for drones, which are considered sensitive items and often face logistical roadblocks.

He said, “To handle this, we pre-position equipment abroad for overseas orders, so we can deploy it quickly without shipping from China.”

Zhong Niao Fei’s Wang pointed out that due to challenges related to transporting and operating drones internationally, the cost of performances overseas is about ten times higher than in China.

He said that the company would typically collaborate with local agents to provide technical support for their business operations. However, due to limited equipment, rapid overseas expansion has not been easy.

This article was first published in Lianhe Zaobao as “中国无人机表演出现审美疲劳 热潮减退”.