US legal battle exposes Temu and Shein's questionable business practices

Chinese e-commerce giants Temu and Shein are currently locked in a heated battle for the US market and Chinese supply chain. As both sides are digging in their heels and accusing the other side of unsavoury business practices, who will emerge victorious?

Chinese cross-border e-commerce unicorns Temu and Shein have recently been engaged in fierce competition for a share of the US market, with the two embroiled in a barrage of legal battles amid their profit-making.

Temu and Shein's legal battles

Shein fired the first salvo in December 2022, filing a lawsuit against Temu in the federal district court in Illinois. The company alleged that Temu contracted social media influencers to make "false and deceptive statements" and defamatory remarks against Shein in promoting Temu's website (Temu.com).

According to Shein, Temu also impersonated Shein by creating three fake Twitter accounts. Users were sent to Temu's website or app when they clicked on the links provided by these accounts. Shein further alleged that Temu used Shein's trademark without permission and placed false advertisements on Temu's website.

Even before the first legal battle between Temu and Shein ended, on 14 July, Temu filed an antitrust lawsuit against Shein in the federal district court in Boston.

Shein told Lianhe Zaobao, "We believe this [Temu's] lawsuit has no legal basis, and we will actively defend ourselves."

Temu accused Shein of using its market dominance to force around 8,338 Chinese clothing manufacturers to sign exclusive-dealing agreements, preventing them from cooperating with Temu and sellers on the Temu platform. Temu further alleged that Shein threatened to impose fines and other penalties on manufacturers that choose to work with Temu.

Temu also claimed that Shein sent false infringement notices in an attempt to take down certain products from Temu's platform. Some clothing manufacturers have requested Temu to withdraw their products in order to appease Shein.

In an interview with MIT Technology Review, Temu said, "For a long time, we have exercised significant restraint and refrained from pursuing legal actions. However, Shein's escalating attacks leave us no choice but to take legal measures to defend our rights and the rights of those merchants doing business on Temu, as well as the consumers' rights to a wide variety of affordable products."

Shein told Lianhe Zaobao, "We believe this [Temu's] lawsuit has no legal basis, and we will actively defend ourselves."

While both companies are locked in legal battles in US courts, they are also competing in China to attract workers and suppliers, so as to continue providing inexpensive products that appeal to the cost-conscious American consumers.

Rising Chinese unicorns in the US market

Shein and Temu share similar backgrounds - both startups were founded in China and have made a splash in the highly competitive US e-commerce market by offering affordable products.

Shein entered the US market in 2017 and quickly gained popularity nationwide with its low-priced fast-fashion products, such as tank tops for as low as US$5 and sandals for US$6. Shein achieved US$1 billion in sales in its first year of operation in the US and grew tenfold to US$10 billion within just three years. The number of Shein's monthly active users also rocketed from 2.88 million in January 2021 to 7.5 million in January 2022.

Shein ranked as the fourth largest unicorn company globally, with a market value of US$65 billion.

According to Statista, from March 2020 to March 2022, Shein's market share in the US more than doubled, from 18% to 40%. According to the 2023 Global Unicorn Index by Hurun, Shein ranked as the fourth largest unicorn company globally, with a market value of US$65 billion. Shein also claimed that its goal was to achieve US$58.5 billion in revenue by 2025.

However, the good times didn't last, as Shein's shining moment was quickly interrupted by Temu's entry into the US market in September 2022.

As of June this year, Temu had captured 51% of Shein's market share in the US.

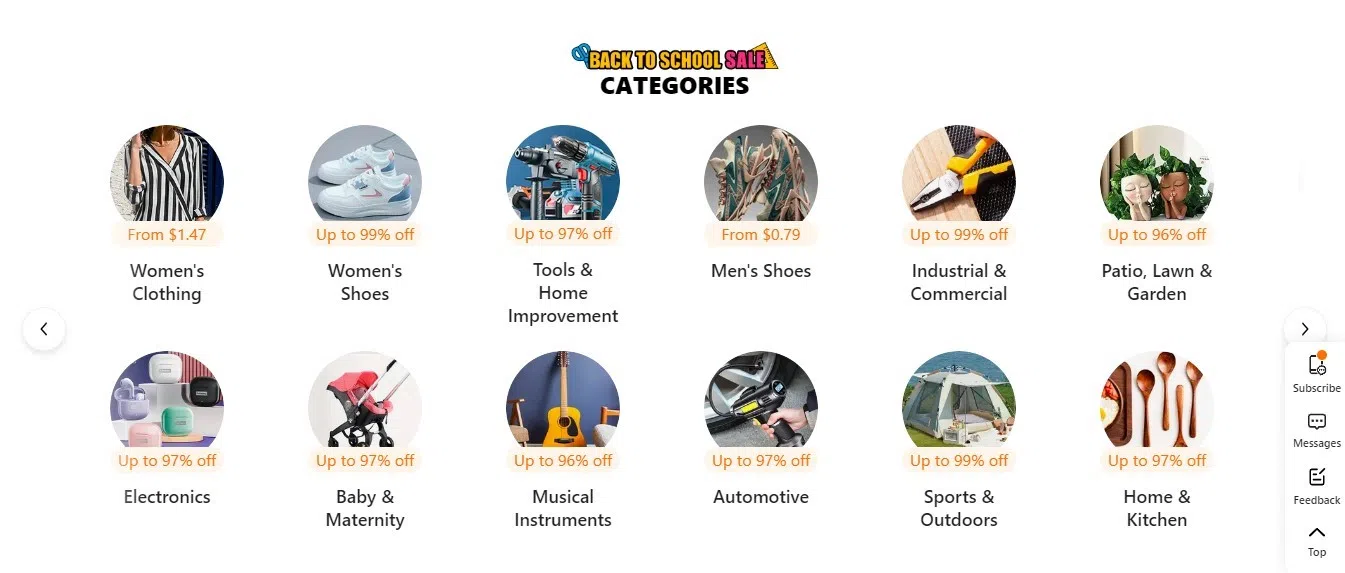

Temu is an overseas e-commerce platform under the Chinese e-commerce giant Pinduoduo. Temu also focuses on a low-price strategy, but what sets it apart from Shein is its prices that are constantly getting cheaper, offering products such as accessories for as low as US$0.49, daily home goods for under US$10, and women's clothing priced between US$3 and US$20. Temu's prices are only 53% to 80% of Shein's prices for similar products.

Besides their "no-bottom" pricing, Temu's promotional activities, such as new user rewards and price slashing, have led to a viral effect and explosive growth in its user base.

Within just one month of its launch in the US, Temu surpassed apps like Amazon and Walmart to take the top spot in the Google Play shopping app downloads. As of the end of January this year, Temu's global downloads approached 20 million, with over 90% of users in the North American region.

Temu's rapid expansion has had a significant impact on Shein. According to data from Earnest Analytics, Shein's market share has been continuously eroded by Temu since the latter entered the US market. As of June this year, Temu had captured 51% of Shein's market share in the US.

Although Temu and Shein initially focused on home goods and fast-fashion products respectively, both sides are now attempting to encroach on each other's territory, leading to fiercer competition and turning these two Chinese unicorns into archrivals.

Shein moved its headquarters from Nanjing to Singapore last year - it changed its holding entity to a Singaporean company, while increasing the recruitment of Singapore employees.

Downplaying Chinese links while staying connected to China

Temu and Shein have been trying to downplay their Chinese links, to allay the suspicions of the US government.

In the hopes of going public in the US, Shein moved its headquarters from Nanjing to Singapore last year - it changed its holding entity to a Singaporean company, while increasing the recruitment of Singapore employees. Meanwhile, Temu established its headquarters in Boston and removed all content related to its Pinduoduo connection on its official website.

However, Temu and Shein have risen in the US market due to their winning strategy of selling cheap products. And to keep doing so without compromising profits, they rely heavily on cheap labour and supply chains from China.

As e-commerce platforms, Temu and Shein work with third-party merchants rather than having their own production facilities. The platforms would take care of the marketing and customer support after the merchants delivered their products to the platform warehouses.

Compared with other countries, China offers cheaper labour, materials and transportation costs, so over the years, both Shein and Temu have chosen to grow their supply chains in China. However, with the intensifying competition between cross-border e-commerce companies, competition for suppliers is unavoidable.

Shein currently subcontracts thousands of Chinese suppliers, some of whom claim that Shein's biggest advantage lies in its short time-to-market and high efficiency. To maintain its supply chain advantage over Temu, Shein signed a strategic cooperation agreement with China Southern Airlines Cargo Logistics in July 2022, aggressively expanding warehousing resources while at the same time, investing over 100 million RMB to expand and renovate supplier factories.

Many suppliers believe that Temu's approach essentially forces suppliers to bid against each other, indirectly pressuring them to accept lower prices and negligible profit margins for their products.

Meanwhile, Temu is sticking to its price barrier and using its low-price advantage to keep eating away at Shein's market share. To achieve this, Temu has to exert tight control over pricing power in its cooperation with suppliers, which is also one of Temu's most criticised practices.

Many suppliers believe that Temu's approach essentially forces suppliers to bid against each other, indirectly pressuring them to accept lower prices and negligible profit margins for their products. Temu can also terminate the cooperation at will when it finds cheaper suppliers.

China's cheap labour and supply chains have created substantial profit margins for Temu and Shein, and it is easy to see why they are willing to take legal action to protect their winning strategy. This shows that despite Temu and Shein attempting to downplay their Chinese roots, they are relying heavily on China's supply chain.

US politicians keeping close watch

Even amid Temu and Shein's high-profile competition for market share in the US, some American politicians are closely watching the two rising Chinese unicorns in the US market.

In June of this year, the US House of Representatives published an investigation report on whether the supply chains of the two companies involve forced labour, claiming that Temu and Shein exploited legal loopholes to evade US import duties and scrutiny of their supply chain sources.

Amid rising calls in the US for "de-risking" supply chains, it may not be wise for Temu and Shein to reveal each other's cards.

According to the report, more than 30% of the US-bound parcels sold by the two e-commerce companies were shipped as small packages to evade US customs inspection. Temu, in particular, has used it to bypass US supply chain scrutiny under the Uyghur Forced Labor Prevention Act, which violates US export laws for Xinjiang products and raises suspicions of forced labour issues.

Legislators from the US and other Western countries have also pressured Shein to respond to whether it purchases cotton from China's Xinjiang region.

Amid rising calls in the US for "de-risking" supply chains, it may not be wise for Temu and Shein to reveal each other's cards. The rise of these two e-commerce unicorns in the US market and their dependence on Chinese supply chains are realities that American hawks cannot ignore, and these bullets that they are firing at each other might one day ricochet back at themselves.

This article was first published in Lianhe Zaobao as "Temu对决希音 美国市场份额之争".

Related: Can Chinese e-commerce platforms Shein and Temu thrive in US and overseas markets? | Chinese fast fashion platforms could be next US target | Chinese e-commerce's growing markets in US and beyond: Opportunities and challenges | Once 'the world's factory', China now builds global brands | How China is tightening controls over cross-border data transfers

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)