Xiaohongshu's push to make users spend on its platform

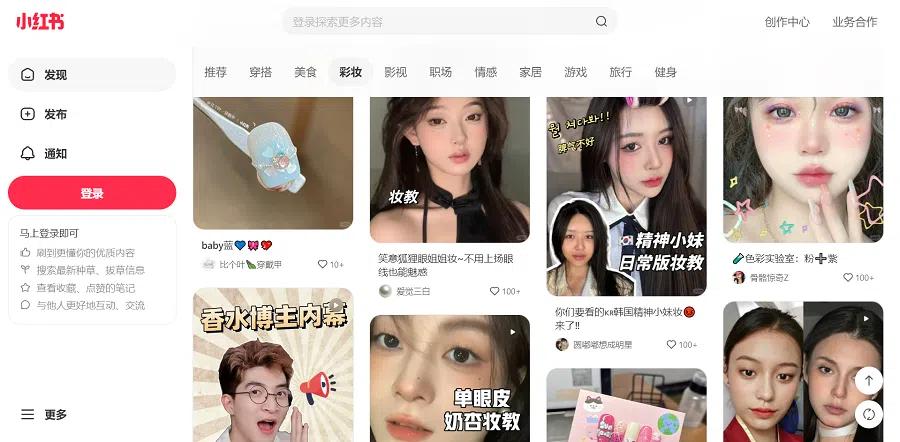

Launched in 2013 as a place for users to share things like travel and beauty tips, and acting as a conduit for lifestyle reviews, Xiaohongshu is again reshuffling its e-commerce ventures, hoping to transform into an e-commerce platform.

(By Caixin journalists Bao Yunhong and Anniek Bao)

Social sharing app Xiaohongshu has been talking a big game about its ability to transform into an e-commerce platform.

Last month it released its first ranking of 100 merchants and 100 brand ambassadors and key opinion leaders that are finding success on the platform, based on their growth, degree of investment and other metrics. Xiaohongshu said it will publish this "rise100" list every year.

It comes after news last year that the site was again reshuffling its e-commerce ventures, and reports that the privately held firm was expecting to turn a significant profit in 2023.

Pressure to make money has been ramping up for years on the Pinterest-like app, which launched in 2013 as a place for users to share things like travel and beauty tips, and acting as a conduit for lifestyle reviews.

Operated by Xingyin Information Technology (Shanghai) Co. Ltd., Xiaohongshu has grown into one of China's most successful tech unicorns, with user demographics that attract brands trying to tap into a high-spending consumer group.

Around 70% of Xiaohongshu's 260 million monthly active users are women, and they tend to be higher-earning urban women in their 20s or early 30s.

Many use it to find hip new restaurants and bars, quality clothes and make-up, and to work out where to vacation.

Instead, after discovering products and services [on Xiaohongshu], they tend to buy them on legacy shopping platforms like Alibaba's orange-branded Taobao app.

Xiaohongshu's problem has long been that those users do not open their designer wallets - at least not on the red-colored app. Instead, after discovering products and services there, they tend to buy them on legacy shopping platforms like Alibaba's orange-branded Taobao app. Insiders call the phenomenon "red in, orange out."

Whether that has changed is unclear, as Xiaohongshu does not need to publicly disclose its financial situation. The source of its rumoured 2023 profit is not known. But insiders say the firm is still struggling to convince its large and affluent user base to part with their cash on the app.

The problem of Alibaba poaching sales from other apps is not unique to Xiaohongshu, which has had its Hong Kong IPO plans up in the air since 2021, when it gave up on listing in the US amid Beijing's crackdown on data security issues that dried up overseas listings by data rich firms.

Xiaohongshu chief financial officer Yang Ruo's exit from the company after less than two years was seen as a sign the IPO was on ice, according to Chinese media DoNews. HongShan, formerly Sequoia Capital China, acquired a stake in Xiaohongshu from existing investors, The Information reported in September citing unnamed sources, at a 30% discount to its prior valuation of US$20 billion in 2021.

The leaking of financial details about the firm could suggest that IPO is back on the table.

Red 'shu' shuffle

While brands gravitate to Xiaohongshu for influencer marketing, many have made peace with the fact it is not the place to make their sales, online marketing industry insiders told Caixin.

Xiaohongshu has struggled to monetise its vast influence and keep users on the platform to make their purchases, they said. Attempts to overcome the "red in, orange out" problem have been marked by missteps and backflips.

Xiaohongshu in October shut down its outdoor and sports equipment shopping site "Little Green Oasis", which had hoped to capitalise on the glamping craze associated with the pandemic, after just two years of operation. It came after Little Green Oasis missed sales targets, Caixin learned.

That same month, "Welfare Club", known as Fulishe, launched in 2014 to tap user-generated content focusing on foreign brands, also stopped operating. In a notice, the platform said it would "merge into the broader Xiaohongshu e-commerce scene".

In a strategy led by chief operating officer Ding Ling, Xiaohongshu said it's ploughing 50 billion RMB (US$7 billion) into fostering this influencer-brand collaboration model.

Xiaohongshu was late to join the livestreamed-sales model in 2020, almost four years after short-video platforms Kuaishou and Douyin introduced livestreaming features. Hoping to catch up, Xiaohongshu collaborated with Alibaba Group Holding Ltd. and opened access to links that redirect users to Taobao's merchant page. One year later, it backflipped on the strategy, blocking Taobao links in a bid to keep users within its business loop.

Now it has found a new direction: turning influencers into brand ambassadors to promote products from third-party brands in return for a cut of the sales, encouraging their fans to use in-app links that take them straight to Xiaohongshu's checkout.

In a strategy led by chief operating officer Ding Ling, Xiaohongshu said it's ploughing 50 billion RMB (US$7 billion) into fostering this influencer-brand collaboration model.

In the past year, the number of merchants on its app increased ten times and shoppers making in-app sales were up 25 times, according to the company in a report. The number of merchants with annual transactions exceeding 100 million RMB increased by 500% year-on-year, it said.

It is too early to tell whether this new model will pay off in the long term. Xiaohongshu told investors it made more than 30 billion RMB in annual revenue in 2022, with 80% coming from advertising, 20% from e-commerce, Caixin has learned.

Like many platforms, the heavy reliance on advertising has left it vulnerable to deteriorating macroeconomic conditions during which companies tend to tighten their belts and cut ad spending. Bloomberg reported the platform is on track to book US$500 million in net income in 2023, citing unnamed sources. Representatives of Xiaohongshu did not immediately respond to queries about the figure.

It took Kuaishou and Douyin almost five years to build the livestreamers network that they have today, a former employee at Xiaohongshu's commercialisation team pointed out.

Some larger brands have also been cautious about Xiaohongshu's invitation to open virtual shops on the platform and redirect users to their on-app shops. That could be because of stricter rules about distribution channels, customer services, and quality inspections, one marketing manager at a multinational firm told Caixin.

"The whole business is at stake, it's not a one-off investment," she said. It might be more appealing to smaller, indie brands and startups to do so, she said.

The most pressing task for Ding is to make a decision about the business's medium-to-long term direction, a former mid-level Xiaohongshu employee said. The company was founded by graduates without a background in technology, and there was a high turnover of technical staff, with frequent changes in the head of e-commerce position, the former employee said. In early 2022, the former head of e-commerce Liu Huantong left Xiaohongshu after about two years on the job.

[Xiaohongshu's] content team tends to push back against strategies proposed by their counterparts in commercialisation...

Internal squabbles

Company sources told Caixin that one of the barriers to monetisation has been friction between Xiaohongshu's content and marketing departments, in a familiar story for many tech upstarts. As a community-based platform, its content team tends to push back against strategies proposed by their counterparts in commercialisation, worried that changes such as excessive advertising could compromise the user experience.

"It was almost impossible for the commercial team to convince the content team to push monetisation," said a marketing employee at a multinational tech company familiar with Xiaohongshu.

"Xiaohongshu's algorithm can be very centralised with content promotion and distribution," a brand ambassador on the app said. Content creators have to either pay to promote their posts, or cater to trending topics highlighted by the platform.

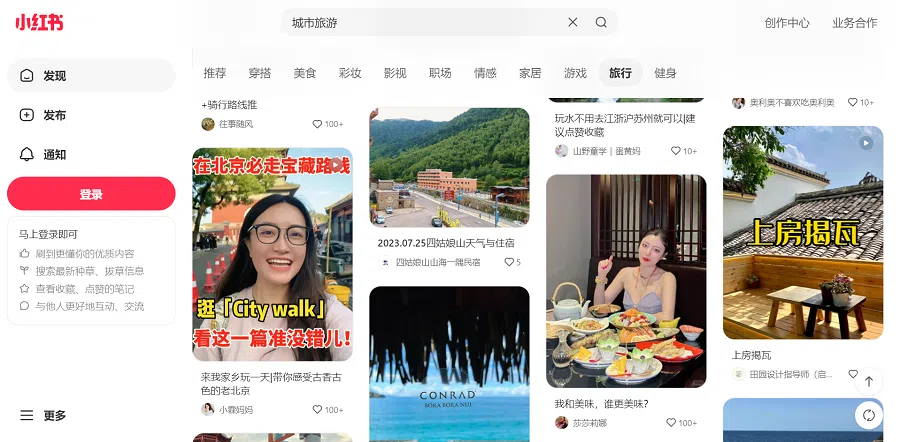

One example was the term "city walk", which was coined after cross-city tourism regained momentum in China and gained popularity. It refers to a low-cost, laid-back way of exploring cities, sharing routes and recommendations for restaurants and place to stop and rest. The number of such posts on Xiaohongshu grew 17 times during China's week-long national holiday in October, the company said, as operators of tourism sites, owners of brick-and-mortar shops and restaurants, and influencers scrambled to create relevant content to draw in followers.

"Xiaohongshu needs a game-breaking strategy," a former employee said. "Commercialisation's hands are tied if content team does not let loose some power."

This article was first published by Caixin Global as "In Depth: Xiaohongshu's Push to Make Users Open Their Wallets". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.