[Big read] Red-hot Spring Festival spending brings boom to China's economy?

Red-hot spending data over the recent Spring Festival in China caused the stock market in Hong Kong to rise three days in a row after it resumed trading first, with the country's A-shares following suit a few days later. How long will this recovery in spending and such positive market sentiments last? Will this allow the Chinese economy to shake off fears of deflation and get over its confidence crisis? What other stabilising measures will the authorities introduce?

If there was one holiday movie to sum up the recent Chinese New Year holidays in China, it would be YOLO (《热辣滚烫》). With box office takings in excess of 3 billion RMB (US$416.7 million), YOLO is a story about its female lead who lost 50 kg in a year to turn her life around dramatically.

During this year's Spring Festival holidays, tourist attractions and cinemas in China were thronged with people, propelling overall consumption during the festive season to a record high that well surpassed forecasts.

Booming figures

Figures from China's Ministry of Culture and Tourism indicate that both the total number of trips made and total spending in the country during the eight-day long Spring Festival break reached new highs, with 474 million domestic trips made, an increase of 34.3% as compared to the same period in 2023, and 19% more than over the same period in 2019 prior to the Covid-19 pandemic. At the same time, the accumulated spending for such trips reached 632.7 billion RMB this year, growing by 47.3% year-on-year, and 7.7% more than over the same period back in 2019.

Consolidating data from the country's State Taxation Administration and Ministry of Commerce, daily average sales for the service sector grew by 52.3% year-on-year during the Spring Festival holidays, while sales of key retail and F&B companies increased by 8.5% year-on-year.

Additionally, according to figures from the China Film Administration, the country's cinemas set new records with box office sales of 8.02 billion RMB and 163 million cinema-goers over the same period, an increase of 18.5% and 26.4% respectively over the same period in 2023.

Boosted by pro-travel government policies such as visa-free travel arrangements with numerous countries and the resumption of many international flights, overseas travel during the Spring Festival holidays was also red-hot. China's National Immigration Administration estimated the daily average number of travellers to be 3.3 times that in 2023 and similar to what it was in 2019. According to Chinese online travel platform, Fliggy, cumulative bookings for overseas travel during this year's Spring Festival holidays were the highest in the last four years, and grew by nearly ten times the figure in 2023.

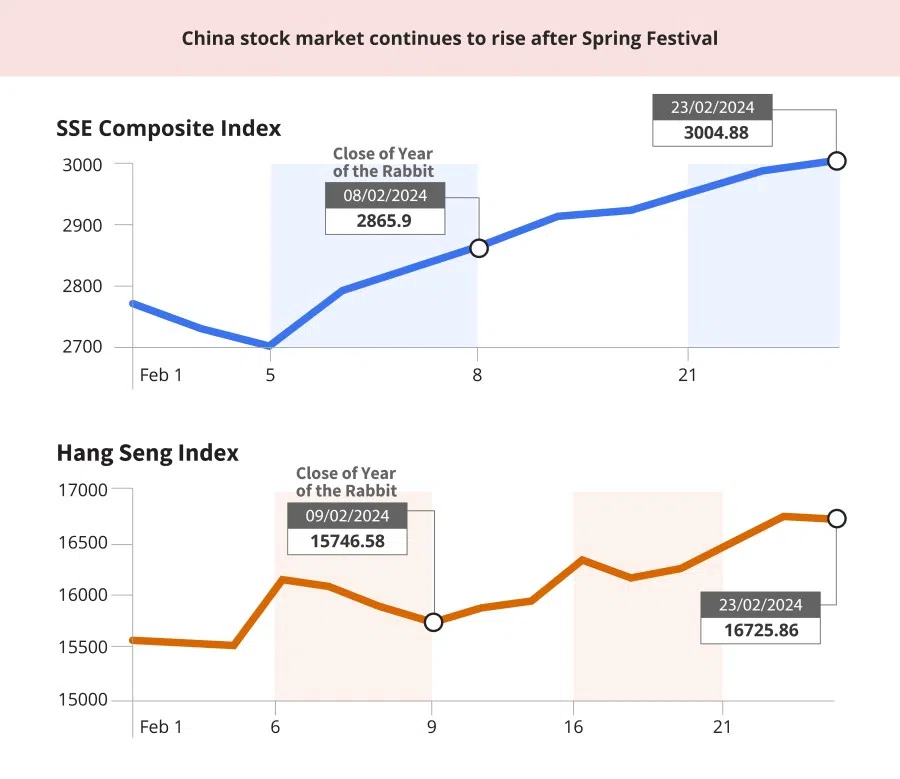

Buoyed by such fervid consumption, China's financial markets continued their eye-catching performances after the Chinese New Year holidays. The country's A-shares which bottomed out before the Spring Festival break continued its winning streak for five days in a row after stock markets reopened in the Year of the Dragon, and the SSE Composite Index climbed back above the 3000-point mark; over in Hong Kong, the Hang Seng Index also neared a two-month high with consumer and tech stocks performing outstandingly.

... while the total number of travellers grew by 19% this year, the increase in spending is far lower at 7.7%.

Lower tourism revenue per capita and consumption downgrade

Even though there were obvious signs of recovery in spending during the Spring Festival, doubts were quickly cast over its sustainability.

A quick comparison with the same period in 2019 shows that while the total number of travellers grew by 19% this year, the increase in spending is far lower at 7.7%. Using official data, Huatai Securities calculated that the average expenditure per capita during this Spring Festival fell by 4.3% and 2.1% as compared to that in 2023 and 2019 respectively. To illustrate, from the first to the seventh day of Chinese New Year, duty-free spending per traveller to Hainan decreased by 16% year-on-year.

Analysts from Nomura Holdings and Goldman Sachs estimated that tourism revenue per capita during this Spring Festival holiday fell by 9.5% as compared to the same period in 2019, indicating that consumption downgrade is still widespread. In a research report published recently, Lu Ting, Nomura's chief China economist, urged investors to remain cautious, and predicted that China's economic downturn may worsen further this spring.

In an interview with Lianhe Zaobao, Christine Peng, who heads the Greater China Consumer Sector at UBS, pointed out that two main factors were responsible for the boom in travel and spending during this Spring Festival - first, an extra day of holiday to bring the total to eight days; second, a release of pent-up demand over the last four years to return home. "Even though Covid-19 safety measures were lifted at the beginning of last year, the Spring Festival arrived very early in 2023, when many in China were down with their first Covid-19 infections and so were unable to travel."

As for the reduction in per capita spending, Peng's take is that "lowering prices to boost sales volume" is the trend in the last few years and a means for businesses to survive in the post-pandemic era. "These days, businesses are more concerned about whether their strategy to lower prices in exchange for higher sales volume will continue to be effective than about how to increase prices. As the more passive half of the equation, the fundamental reason for weak consumption is still a lack in consumer confidence."

In stark contrast to the explosive growth in spending during the Spring Festival holidays, China's latest consumer price index (CPI) which was announced before the Lunar New Year recorded its sharpest decline in the last 15 years. This marked the fourth consecutive month that the CPI has fallen, and the bigger-than-anticipated drop underlines that China remains under the spectre of deflation.

On the other hand, the foreign direct investment (FDI) portion (an indicator of investments by foreign countries in China) of China's balance of payments account turned negative for the first time in the third quarter of 2023. Even though total investment per annum (by foreign entities) still grew by US$33 billion, the rate of growth fell sharply by 82% year-on-year to the lowest on record since 1993, reflecting a lack of confidence by foreign investors in the Chinese market.

Property market woe hampering consumption

On the first working day in the Year of the Dragon, Chinese Premier Li Qiang, chaired the State Council plenary meeting, emphasising the need to do more to boost confidence and expectations, maintain consistency and stability in policy formulation and implementation, and take "pragmatic actions to boost the people's confidence".

... for a country like China in which housing properties are the main household assets and where home ownership is as high as 90%, a drop in property prices has a greater impact on the people's wealth than share prices. - Professor Tan Kong Yam, School of Social Sciences, Nanyang Technological University

Two days later, the Chinese central bank rolled out its first major policy stimulus in the Dragon Year - lowering its five-year Loan Prime Rate (LPR) by 25 basis points to 3.95%. This marked the biggest, single downward adjustment since the LPR reform in 2019. In a rare move, the Medium-term Lending Facility (MLF) rate was kept unchanged so the policy intent of this asymmetric lowering of interest rates is obvious: drive mortgage rates down to provide further support for the weak property market.

Prior to this, the Chinese property market was in the midst of a Spring Festival lull with strong wait-and-see sentiments. The real estate research agency, CRIC, which monitors 44 Chinese cities on its priority list, found that the number of transactions completed during this year's Spring Festival week fell by 40% year-on-year, with declines in excess of 80% in Beijing and Shanghai. At the same time, data from the China Index Academy showed that over the Spring Festival holidays, the daily average floor space of new homes transacted fell by around 27% in 25 representative cities when compared to the same period in 2023.

Tan Kong Yam, an economics professor at the School of Social Sciences, Nanyang Technological University (NTU), noted that for a country like China in which housing properties are the main household assets and where home ownership is as high as 90%, a drop in property prices has a greater impact on the people's wealth than share prices. This is the main reason for the slump in consumer confidence.

Tan estimates that a reduction in the household assets of a Chinese family from 100 RMB to 90 RMB would cause personal expenditure to drop by 15 to 20 cents. In other words, if property prices fall from one million RMB to 900,000 RMB, consumer spending will decrease by 1,500 RMB. At the same time that the Chinese government is mitigating risks in the real estate market through a series of measures, it is also speeding up the construction of affordable housing and the transformation of urban villages to meet the housing needs of its people. This is the right approach to stop losses and bolster confidence.

However, as the decline in the Chinese property market is difficult to reverse in the short term, Tan expects it to take a year or two more to consolidate, hence deflation risks will continue to buffet the Chinese economy throughout this year. "Falling property prices and the lockdowns during the Covid-19 pandemic have severely eroded consumer confidence. Like a wound, this takes time to heal."

... unlike developed countries in the West, China does not rely on cash handouts or vouchers to stimulate consumption. Instead, it allows the economic cycle to take its natural course... - Christine Peng, Head, Greater China Consumer Sector, UBS

Little government intervention to stimulate spending

The Chinese government has not tried to stimulate spending with the same intensity that it is using policy tools to stabilise the property market. Even though over 80% of the country's economic growth in 2023 was due to consumer spending, and the Ministry of Commerce pledged to promote consumption this year, the "cold, hard cash" its people anticipated has not come.

UBS's Peng explained that, unlike developed countries in the West, China does not rely on cash handouts or vouchers to stimulate consumption. Instead, it allows the economic cycle to take its natural course: as people find jobs and earn money, their spending power will be restored.

While this approach can avoid side effects such as acute inflation arising from cash handouts, its drawback is its slow transmission speed. If consumers feel lost and worried about the future, their first reaction would be to save instead of spend, which would worsen deflation.

Peng also feels that the record levels of spending during the Spring Festival shows that "the worst is over" for Chinese consumers. However, the Chinese government would need to be more specific in stimulating the needs of different groups of consumers to drive sustainable growth with their pent-up demand. For example, it can provide subsidies to low-income individuals who cannot keep up with their expenditures, assure the middle class that their income growth expectations would be met, and enhance the social welfare system.

"Only when people feel that their incomes would rise gradually, their home ownership needs would be met, they would be given proper care when ill, would they be confident and willing to spend money."

An auspicious stock market rally fuels hopes of economic recovery

Aided by the vigour in consumption, financial markets in China continued their stellar performances when trading resumed after the Spring Festival break, while better-than-expected financial data also strengthened investors' expectations of a recovery.

Between 9 and 16 February when the stock markets were closed in China, Chinese assets that were traded in overseas markets continued their rally which started before the Spring Festival. The top gainer was the NASDAQ Golden Dragon China Index which rose by 5.75%, while the FTSE China A50 Index gained a total of 1.82%. After the stock market in Hong Kong reopened on 14 February, it rose for three consecutive days, with consumer and tech stocks also very active.

At the same time, China's January economic data which was published on 9 February was also highly encouraging. In January, the amount of RMB bank loans increased by 4.92 trillion RMB, while total social financing (TSF) rose to 6.5 trillion RMB, both far exceeding market forecasts. Analysts interpreted this as a sign of renewed vigour in the real economy as businesses bring forward their investment and production plans, and opined that this would further boost confidence and social expectations.

However, Chen Shujin, who heads China financial and property research at Jefferies, told Lianhe Zaobao that part of the reason why TSF and new RMB loans in January exceeded expectations is due to the lower base of comparison in January 2023. Such loans may grow slower in February and March "due to limited room for major policy rates to be adjusted downwards even though the central bank could still lower key interest rates".

"There are many solutions for this, such as injecting helicopter money to the tune of 1.5 trillion RMB to make consumers more confident, but the likelihood of this happening is very low." - Chen Shujin, Head, China Financial and Property Research, Jefferies

Market interventions by the 'national team' not long-term solution

On the other hand, in its latest quarterly review, MSCI, the biggest index compilation company in the world, removed 66 Chinese companies such as Weibo and China Southern Airlines from its Global Standard Index. This is the biggest deletion in two years and the most from a particular country.

This caused funds tracking the index to sell their holdings in these companies, putting further pressure on their share prices. Hebe Chen, a market analyst with IG, felt that the development underlines a further erosion in the confidence of investors in such companies and reflects a bleak outlook for the Chinese stock market.

Fortunately, A-shares which bottomed out before the Spring Festival holidays continued their rally in the new year and crossed the 2,900 points mark on the first trading day of the Dragon Year. At the close of trading on 23 February, the SSE Composite Index had risen over eight consecutive trading days, surging from 2,702.19 to 3,004.88 points. It is trading at 3,052.54 points on 5 March.

Even as Chinese sovereign funds, the country's so-called "national team", are providing support to its financial markets with their market interventions, its financial regulatory authorities are also stepping up efforts to improve them.

After Wu Qing, dubbed the "broker butcher", was handed the reins of the China Securities Regulatory Commission (CSRC) on 7 February, the agency warned two brokerages, took action against a number of industry practitioners for illegal stock trading, and penalised fraudulent IPO behaviour during the Spring Festival. After the Spring Festival, the CSRC signalled its intent to stabilise the financial markets by organising a series of seminars at which it committed to taking all opinions and criticisms seriously.

Jefferies' Chen feels that following the change in command at the CSRC, there is a growing likelihood that more coordinated policies could be rolled out to boost China's capital markets. "Over the next two weeks, whether the CSRC and other departments can coordinate their efforts to come up with more policy support is crucial to the near-term performance of the stock market."

Traders are also looking forward to greater monetary and fiscal support from policymakers ahead of the Two Sessions meetings of the National People's Congress (NPC) and the National Committee of the Chinese People's Political Consultative Conference (CPPCC) scheduled for the beginning of March.

As the positivity from favourable policies is digested by the market, Chen expects that it will get harder to lift the stock market as investors demand tangible improvements in business profits. "There are many solutions for this, such as injecting helicopter money to the tune of 1.5 trillion RMB to make consumers more confident, but the likelihood of this happening is very low."

NTU's Professor Tan also feels that while interventions by the "national team" can improve market sentiments temporarily, they are unlikely to result in a prolonged uptrend in the stock market. "At the end of the day, the fundamentals of the Chinese economy need to improve to create growth that can provide concrete support to the market."

Tan added that following a year of post-pandemic recovery, the Chinese economy is at a crossroads of confidence. "If effective policy support is provided now, the market confidence accumulated up till now will revitalise the real economy, improve public expectations, and boost confidence further, thus forming a virtuous cycle. Conversely, a lack of timely and targeted support could see the fragile confidence quickly dissipate, and Chinese leaders would need to go back to the drawing board."

This article was first published in Lianhe Zaobao as "春节消费滚烫 中国经济就此红火?".

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)