[Big read] Why China will not be the next Japan

Recent economic indicators have signalled that China's economy is bottoming out, but many still believe that more needs to be done as the effect of government policies are still falling short of expectations. Lianhe Zaobao correspondent Chen Jing speaks with analysts and academics to find out what China needs to do to avoid economic stagnation or even a collapse.

Chinese diplomats, economic authorities and state media have taken turns this month to refute the "China collapse" theory, which has recently gained traction.

This comes amid the bleak predictions by numerous Western media outlets about China's economic outlook after the release of its weaker-than-expected growth data for the first half of the year.

Improved August economic data

In early August, US President Joe Biden called the Chinese economy a "ticking time bomb". Later that month, Australian Treasurer James Chalmers said that China's "concerning" signs of economic weakness could weigh on Australia's economy.

After Liu Pengyu, minister counsellor and spokesperson of the Chinese Embassy in the US, and Chinese foreign ministry spokesperson Mao Ning hit back at comments predicting the collapse of China's economy, Chinese state media published a series of three commentaries, asserting that the "China collapse" theory does not hold water.

Cong Liang, vice chairman of the National Development and Reform Commission, reiterated on 20 September at a regular press conference that "such arguments have never been realised in the past, and they will not be realised now or in the future".

He noted that China's economy is indeed facing a lot of difficulties and challenges, especially after the three-year-long pandemic, and that economic recovery is certainly not a linear process. However, Cong also pointed out that as government stimulus policies take effect, the economy is showing signs of recovery in August, with marginal improvements across most indicators, an increasing number of positive factors and an improvement in social expectations.

He [Morgan Stanley Chief China Economist Robin Xing] is optimistic that its economy will bottom out and begin to rise as China accelerates the issuance of special local government bonds.

Chinese officials have introduced a slew of economic stimulus policies in the second half of the year, from interest rate cuts and lowered reserve requirement ratios, to easing restrictions on home purchases, covering a wide range of areas including finance, consumption, real estate and private investment. China also experienced growth across major economic indicators in August, with industrial output and retail sales recording better-than-expected growth. The decline in exports also narrowed.

Based on China's August economic data, Morgan Stanley chief China economist Robin Xing said that China's travel consumption has maintained a strong recovery momentum, while the industrial sector has also seen the end of the six-month-long destocking phase of its inventory cycle. He is optimistic that its economy will bottom out and begin to rise as China accelerates the issuance of special local government bonds.

China's GDP growth is very likely to bottom out at 4.8% year-on-year in the third quarter and rebound slightly to 5.3% in the fourth quarter. - Tan Kong Yam, Economics Professor, Nanyang Technological University

Nanyang Technological University (NTU) economics professor Tan Kong Yam told Lianhe Zaobao that given the boost from recent policies, China's GDP growth is very likely to bottom out at 4.8% year-on-year in the third quarter and rebound slightly to 5.3% in the fourth quarter. Annual economic growth could reach 5.2%, beating the official growth target of around 5%. However, he also warned that the property slump will be the biggest uncertainty for future growth.

Avoiding negative feedback loop

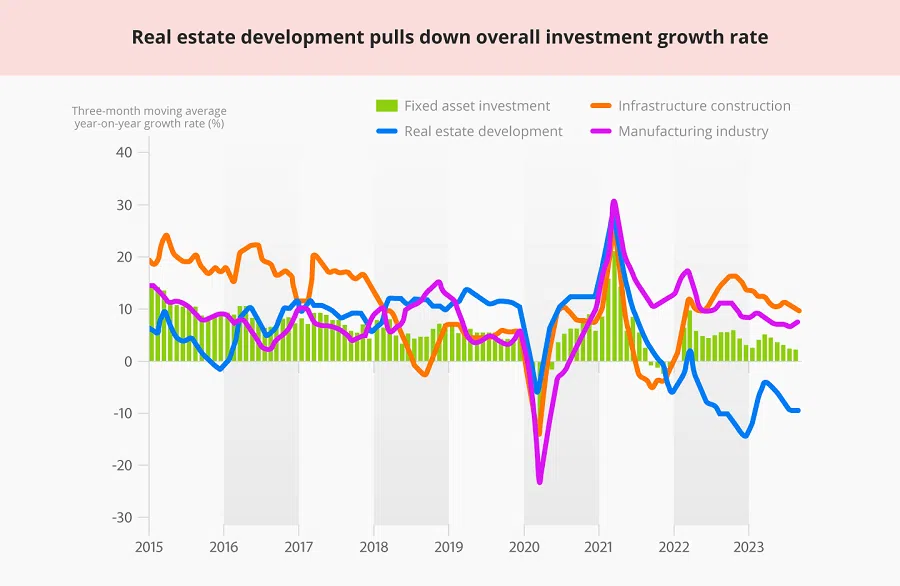

In the first eight months of the year, fixed asset investment expanded by 3.2% year-on-year as growth continued to decline. Amid a rise in both infrastructure and manufacturing investments, the decline of 8.8% year-on-year in real estate development investment became the main factor dragging down overall investment.

While officials ramped up the easing of housing restrictions since August, Tan believes that it would be difficult to alleviate the country's property slump this year, adding that "the best-case scenario is for the decline to narrow, reducing the drag on the overall economy".

... it is still too early to say that the Chinese economy has already bottomed out. - Lu Ting, Chief China Economist, Nomura

Apart from the worsening property slump, China's soaring youth unemployment rate, high local government debt and tense China-US relations are also major risks plaguing China's economy. Lu Ting, chief China economist at Nomura, believes that consumption growth will slow down again after the summer travel peak, while export and real estate investment declines will still hamper industrial value-added growth. Thus, Lu believes that it is still too early to say that the Chinese economy has already bottomed out.

During the China Macroeconomy Forum in September, Morgan Stanley's Xing also pointed out that the property market is still in the process of deleveraging, which could deepen the impact on the economy, affecting investments and household consumption. If a negative feedback loop of debt and falling prices develops, further deleveraging could lead to higher leverage ratios.

Looking back on how the Great Depression in the US and the bursting of Japan's economic bubble were handled, Xing believes that China should roll out a series of macroeconomic policy relaxations in a timely manner, especially the coordinated easing of fiscal and monetary policies, to adjust the economic structure, prevent financial risks and break the negative feedback loop.

Pursuing high-quality development

In a commentary published in the Chinese People's Political Consultative Conference Daily (《人民政协报》) on 20 September, Yi Gang, former governor of the People's Bank of China, pointed out that China's economic recovery has slowed since the second quarter of the year as the economy lost momentum and market confidence remained weak. He suggested that China could "appropriately increase macroeconomic policy adjustments, effectively support the expansion of domestic demand and promote a virtuous economic cycle".

"It is now difficult to boost investor confidence by relying on policies alone. People need to see real improvement in the situation before entering the market..." - Tommy Xie, Head of Greater China Research & Strategy, OCBC Bank

Compared with the US's debt-to-GDP ratio of nearly 100%, China's fiscal condition remains healthy, with a debt-to-GDP ratio of just 20%, highlighting plenty of room for policy efforts. But aside from the minor cuts to interest rates and reserve requirement ratios, the government has yet to initiate large-scale stimulus measures that the market expects. With policies repeatedly falling short of expectations, the Chinese stock market and RMB exchange rate are trapped in a persistent slump.

Tommy Xie, head of Greater China Research & Strategy at OCBC Bank, said in an interview that the forward-looking function of China's financial market has been greatly weakened due to the lack of confidence. He noted, "It is now difficult to boost investor confidence by relying on policies alone. People need to see real improvement in the situation before entering the market, which somewhat drags the economic recovery process."

Pei Sai Fan, adjunct professor at the National University of Singapore and director of Lee & Pei Finance Institute, believes that in the face of the present short-term pains, China's decision makers have so far shown "considerable determination". He explained, "It signals that they are no longer looking to rapidly boost GDP through strong stimulus measures but are instead pursuing long-term, high-quality development."

"The reality is, China's era of rapid economic growth is over. In the process of transitioning to high-quality development, a growth rate of 4% to 5% is acceptable." - Pei Sai Fan, Adjunct Professor at the National University of Singapore

Pei said in an interview that putting aside the impact of the three-year-long pandemic, long-term trends such as the ageing population and growing geopolitical risks have already forced the Chinese economy to shift from being labour intensive to innovation driven, while gradually reducing its reliance on the property sector.

"The reality is, China's era of rapid economic growth is over. In the process of transitioning to high-quality development, a growth rate of 4% to 5% is acceptable," he noted.

Homebuyers still wary

Amid the bottoming out of various economic indicators in August, China's lacklustre property data seem especially jarring and concerning.

Latest statistics released by China's National Bureau of Statistics on 15 September showed that property investment further declined in August, with new home prices across 70 medium-sized and large cities falling for the third consecutive month, and existing home prices sliding 0.48% month-on-month, the most since 2014.

As the property sector, which accounts for 17% of the country's GDP, slightly rebounded at the start of the year before fizzling out soon after, Chinese authorities have ramped up efforts to rescue the ailing sector since the latter half of the year, announcing a series of new policies in August.

This included reducing the down payment ratio for first-home purchases, lowering the interest rates for existing home loans, and allowing households in four first-tier cities to be treated as first-time homebuyers for loans regardless of their mortgage record, as long as they do not now own another home in the city. On 20 September, Guangzhou even removed purchase restrictions for several districts, further signalling the easing of housing curbs.

But the market is worried that if these measures still fail to boost home sales, the liquidity crisis of property developers will worsen. Following Evergrande's debt crisis, Chinese state-linked developer Sino-Ocean Group Holding announced the suspension of payment on all its offshore debts. And while Country Garden received approval from creditors to extend nine domestic bonds after several rounds of creditor voting, it is still unable to fundamentally alleviate the pressure of debt default.

On 14 September, international ratings agency Moody's downgraded China's property sector outlook from "stable" to "negative", forecasting a 5% decline over the next 6 to 12 months on contracted sales. A Moody's analyst opined that although the Chinese government had recently stepped up policy support for the property market, the effects are "short lived", and the sluggish economic growth continues to impact homebuyers. The Country Garden debt crisis is also making them more wary of risks.

Getting the property sector back on track

Xu Gao, chief economist at Bank of China International, stated that the policy of allowing homebuyers to enjoy preferential loans for first-home purchases regardless of previous mortgage record does not deal with the core issue currently plaguing the property market - with a tight capital chain for real estate firms coupled with high credit risk, it is difficult for the industry to break free from this vicious cycle.

He pointed out in an article in September that since the implementation of the "three red lines" that restricted liquidity for real estate firms two years ago, banks are wary of the risk of bad debt and are unwilling to provide loans for real estate firms.

"... the impact of these policies would not reach the supply side any time soon. Investment figures in real estate development would still see a decline this year and only stabilise next year." - Yan Yuejin, Director of the E-House Real Estate Research Institute

Worried about uncompleted housing projects, homebuyers are also avoiding off-plan properties, causing an even greater strain to the capital chain for the property sector and further heightening credit risk.

Without breaking this cycle, it is difficult to spur the property sector solely on the basis of demand-side policies, and could instead lead to higher property prices. Indeed, in the weeks since the aforementioned policy was implemented, real estate sales in the 30 major cities did not see any significant improvement but the resale property prices in some cities such as Beijing had spiked.

Yan Yuejin, director of the E-House Real Estate Research Institute, said optimistically in an interview that with increased motivation to buy homes in several areas, the sales figures would rebound strongly in September and October. However, he pointed out that at the same time, the impact of these policies would not reach the supply side any time soon. Investment figures in real estate development would still see a decline this year and only stabilise next year.

He added that currently, the most important factor to analyse the real estate industry is "the major changes to the supply-demand relationship", especially in major cities with a high rate of property ownership, leading to reduced demand for investment and speculation, and the perception that property prices have peaked.

Moreover, concerns about income stability have also swayed homebuyers' decision to purchase property. "It will be a while before the macroeconomy takes a turn for the better, and everyone has cash to spare," Yan said.

Zhang Xiaoduan, deputy director at the Cushman and Wakefield Research Institute, opined that with the negative population growth and the deceleration of urban population growth, the basis for a rebound in property prices and for the sector to get back on track quickly has changed. The key goal of this round of policy adjustments would be to stimulate rigid demand and demand from households looking to change or upgrade from their current homes, and various regions are expected to implement policies to follow suit.

'Japanification' of the Chinese economy?

"Will China become the next Japan?"

This issue has been raised in both Chinese and foreign papers over the past few months, and has become a topic of discussion among the public. Since the second quarter of this year, China's economic growth as well as the property sector has been sluggish, and the number of households paying off mortgages early has increased.

Along with other medium- and long-term trends such as the ageing population, China's current state reminds many economists of Japan three decades ago.

Towards the end of the 1980s, Japan's stock market and property bubbles burst, causing many corporations and families to accrue high debts. As a result, businesses and individuals diverted funds towards paying off debts to address their negative balance sheet and be debt-free, and held back from investing or spending for consumption. This caused the Japanese economy to stagnate in the following decade or so.

Richard Koo, chief economist of the Nomura Research Institute, described the aforesaid state as a "balance sheet recession" and is one of the first economists to warn of a "Japanification of the Chinese economy". At the Soochow Securities Forum in Hong Kong in June, Koo pointed out that China could experience a burst of the real estate bubble and fall into a balance sheet recession.

Although the Chinese government could avoid an economic recession by implementing large-scale fiscal stimulus measures, Koo believes that in addition to dealing with internal issues such as the declining real estate market and shrinking population, China would also need to address external risk factors such as China-US decoupling, as well as the impact from unexpected events such as the Covid-19 pandemic. He added, "China could be facing a challenge even more daunting than what Japan experienced 30 years ago."

New York Times columnist and economist Paul Krugman stated in his article in July that there were some obvious similarities between China now and Japan 30 years ago, i.e., "too little consumer demand, kept afloat only by a hypertrophied real estate sector, and its working-age population is declining."

However, amid economic slowdown, high youth unemployment rate and "an erratic authoritarian regime", Krugman questioned whether China can "replicate Japan's social cohesion - its ability to manage slower growth without mass suffering or social instability".

China's greater autonomy over policies

Experts told Lianhe Zaobao that there are core differences between China now and Japan then, and that the former would not repeat the mistakes of the latter.

OCBC's Xie pointed out that the increase in the number of Chinese households paying off their mortgages early is mainly a result of the mortgage interest rate being higher than the deposit interest rate. Hence, clearing mortgage loans early is a rational choice to maximise financial gains.

On top of that, credit and investment in China's corporate sector are on an uptrend, in stark contrast with the stagnation experienced by the Japanese economy during the economic recession.

China's GDP per capita and the proportion of its middle class are lower than that of Japan then, so the bursting of the asset bubble would not have widespread impact. - Tommy Xie

Xie opined that looking at the medium- to long-term trends, China differs from Japan 30 years ago in three ways. First, on the one hand, the sharp rise in the yen was a key reason behind Japan's asset bubble; on the other hand, the Chinese RMB is still facing depreciation pressures, and the government has control over the exchange rate. Second, China's GDP per capita and the proportion of its middle class are lower than that of Japan then, so the bursting of the asset bubble would not have widespread impact.

Third, Xie noted that "China's big government and large market have major influence over the allocation of resources." Furthermore, the Chinese economy is not as closely linked with the US, as was the case for Japan at the time. Hence, China has "greater autonomy over its policies, and can do much more than Japan could".

NTU's Tan pointed out that land prices in Japan reached 560% of its GDP in 1990, while stock market capitalisation was 142% of GDP in 1989. China's real estate value is currently at 260% of GDP, and stock market capitalisation at 67% of GDP - much smaller than that of Japan then. Moreover, Japan's urbanisation rate was already at 78% in 1990, whereas China is only at 65% in 2022. Clearly, China has much potential to increase productivity and economic growth.

He added, "Most importantly, when the bubble burst in Japan, it only had mature industries such as automobile, consumer electronics and steel. It completely missed the Internet revolution of the 1990s." Meanwhile, China now holds key leadership positions in emerging industries - such as electric vehicles, batteries, clean energy and artificial intelligence - which would be "the key points for growth and pillar industries in the coming two decades".

Tan noted that although the reduced labour force due to an ageing population is a big challenge, China can alleviate this issue using robotic automation. "Some estimates show that China can increase GDP growth by 0.5 to 1 percentage point through robotic automation," he said.

This article was first published in Lianhe Zaobao as "中国经济谷底寻出路".

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)