Can commercial space programmes take off in China?

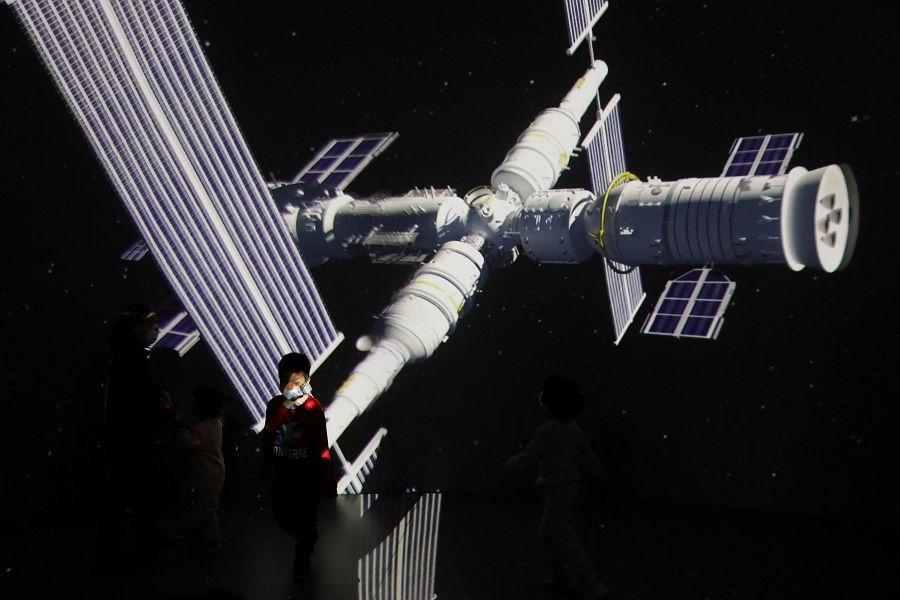

In recent years, China has become a major space power. In 2020, China completed its BeiDou Navigation Satellite System (BDS), an alternative to the US government-owned Global Positioning System (GPS). While the US sent more spacecraft and satellites into space, China led the world in terms of orbital launches in 2021. By the end of 2021, China ranked second in the world after the US in terms of the total number of operating satellites. In 2021, China launched its first space station and two crewed missions.

One important shift in China's space policy in recent years has been to let private companies enter the arena and promote commercial space programmes. In December 2021, Galactic Energy, a start-up based in Beijing, launched its Ceres-1 rocket with five satellites. In February 2022, a Long March-8 rocket carrying a domestic record 22 satellites was launched in Hainan. 18 out of the 22 satellites were made by privately-owned companies.

For a long time, China's space industry has been dominated by state-owned enterprises (SOEs). Two major SOEs in the aerospace industry, namely, the China Aerospace Science and Technology Corporation (CASC) and the China Aerospace Science and Industry Corporation (CASIC), were set up in 1999. CASC primarily focuses on space launch vehicles, while CASIC designs and builds satellites as well as guidance systems. Also, research institutions under the Chinese Academy of Science, SOEs and military-industry research labs made up the core of the Chinese innovation system in the space industry.

...letting private companies enter the arena and promoting commercial space programmes is likely to improve efficiency and reduce the cost of space programmes.

Towards greater innovation and efficiency

Since 2015, China has initiated policies and regulations to encourage the development of commercial launch vehicles and the microsatellite market among others. China also lifted restrictions against private companies' involvement in the space industry.

This development is expected to channel more resources to the space industry and, more importantly, promote innovation and enhance efficiency. First, letting private companies enter the arena and promoting commercial space programmes is likely to improve efficiency and reduce the cost of space programmes.

The experience of the US's space agency National Aeronautics and Space Administration (NASA) is instructive. NASA was the primary customer of and had a long-term exclusive partnership with its contractors. NASA owned the technology and was granted the privilege of selecting contractors. While the space shuttle was the flagship project of NASA, this NASA-centred system was considered to be less efficient and not innovative enough.

Technology developed in the private sector can have a spin-off effect to improve the innovative capacity of the public sector.

Since the 2000s, NASA has been delegating some of its control rights to the private sector in selected areas (e.g. transportation to low earth orbit). As a result, the efficiency in the design and provision of cargo transportation services has been improved. A NASA Kennedy Space Center engineer estimated that the all-in cost to deliver a kilogram of cargo to the international space station is about US$89,000 for SpaceX, one of the most valuable private companies in the US, whereas it would have cost US$272,000 under the space shuttle.

Secondly, the entry of new entities is likely to encourage innovation in the space industry. Under the market mechanism, start-ups that are engaged in research and development (R&D) activities can bring new technology and new solutions to the space industry. SOEs or government-linked organisations are usually bureaucratic and slow to respond to technological changes. Technology developed in the private sector can have a spin-off effect to improve the innovative capacity of the public sector.

Emerging players and more SOE investment

In recent years, new players have emerged in the Chinese space industry. Privately owned firms in the industry include iSpace, a start-up which launched Hyperbola-1 from Jiuquan Satellite Launch Centre in July 2019. It is the first start-up in China that launched a rocket that put satellites into orbit. In November 2020, Galactic Energy, another start-up, did a first launch of its Ceres-1 rocket, making it the first domestic private firm to send a satellite to a 500-kilometre Sun-synchronous orbit.

There has also been an uptick in state-owned enterprises' investment in commercial space programmes. In August 2019, Jielong-1 rocket developed by China Rocket Co Ltd, a commercial spin-off under CASC, was launched for the first time. Another major spin-off from a heavyweight research institute under the China Academy of Science, Chang Guang Satellite Technology (CGSTL), has 41 operating satellites as of February 2022. CGSTL is expected to be the first commercial space company to have an initial public offering (IPO).

Also, private sector participation is likely to promote innovation in the Chinese space industry. A 2019 study by the Institute for Defense Analyses based in Virginia interviewed founders of start-ups in the space industry in China. Many of these founders turned out to be former employees of CASC and CAS. Their major motivation in venturing into start-ups was to promote their innovative ideas.

From the demand side, the growth of commercial space programmes in China is going to be supported by government initiatives to build the satellite internet. Considered what is termed "new types" of infrastructure, the satellite internet can provide internet access anywhere on the surface of the planet and significantly improve internet access in China's hinterland. It is estimated that the market size of the satellite internet in China could reach over 100 billion RMB by 2030.

...there is a conflict of interest between policies encouraging the entry of the private sector and policies supporting leading firms which are most likely policy-supported state-owned firms.

However, there have been issues from the supply side and China's commercial space programmes are not very competitive in the international market. The payload cost of the US's Spacex Falcon 9 is as low as US$2,700 per kilogram, while that for Kuaizhou-1A developed by China's leading state player CASIC is now quoted at US$20,000 per kilogram. The payload cost for Kuaizhou 11, a follow-up model, is quoted at US$10,000 per kilogram.

Managing conflicts of interest

One supply-side reason behind the Chinese space economy's lack of competitiveness is the private sector's business environment. As SOEs are considered "national champions" or leading companies in strategic emerging industries such as the space industry, there is a conflict of interest between policies encouraging the entry of the private sector and policies supporting leading firms which are most likely policy-supported state-owned firms.

Also, China's private aerospace companies generally have weak financing capabilities. These companies require huge investments as the risk of space activities is high and it takes time to generate profits. The financing channels are limited to a small group of venture capitals and many of them have a shorter investment horizon compared to those in developed countries.

In recent years, the Chinese government has initiated policies to address supply-side constraints. In 2019, a government document issued by the State Administration of Science, Technology, and Industry for National Defence and the Equipment Development Department of the Central Military Commission allowed some collaboration between SOEs and private enterprises in the area of commercial space programmes.

Regarding the coordination between the public and private sectors, how to allocate the ownership of the innovative outputs is another issue.

According to this document, with some contractual arrangements, private enterprises can access state-owned enterprises' infrastructure and other resources. For example, spaceports, owned by the state, are open to private companies for commercial rocket launches.

In January 2022, the State Council published a white paper outlining future plans for China's space programmes. The document states that China will continue to support the entry of the private sector in government procurement, giving them access to major scientific research facilities and equipment, and supporting them to participate in the R&D of major engineering projects. To further promote competition, the Chinese government will "establish a negative list for market access to space activities, to ensure fair competition and the orderly entry and exit of participating enterprises".

Several challenges remain after these recent initiatives. How to design contracts for government procurement to balance the objectives of cost reduction and service quality is a major issue. Also, the underdevelopment of the financial capabilities of private space companies is a major constraint. Regarding the coordination between the public and private sectors, how to allocate the ownership of the innovative outputs is another issue.

Related: India-China space race: The role of the private sector | Elon Musk and the new China-US space race | From earth to space: India and China's space programmes gear up for intense competition ahead | Will the US be left out of China's space station projects? | China's strides in technology good for US and the world