China's EV battery boom goes bust

(By Caixin journalists Lu Yutong, Qu Yunxu and Bonnie Cao)

Yang Ming, an employee of CALB, China's third largest power battery producer, was confused and surprised by the company's sudden pay cuts, layoffs and reduction in output.

"I don't know what happened this year," Yang, in his early 20s, told Caixin in mid-March. "The entire industry has few orders. Nearby factories are all laying off people, and any production line without orders may cut jobs."

Based in Changzhou, Jiangsu province, CALB started to cap work hours and cut compensation late last year, according to Yang. The company froze hiring in February, while the number of employees plunged to 1,000 from a peak of 8,000. Yang and his colleagues had no expectation of an industry downturn, he said.

"In the first half of 2022, with surging sales of electric vehicles (EVs), the entire upstream power battery industry was in a state of supply shortage," he said.

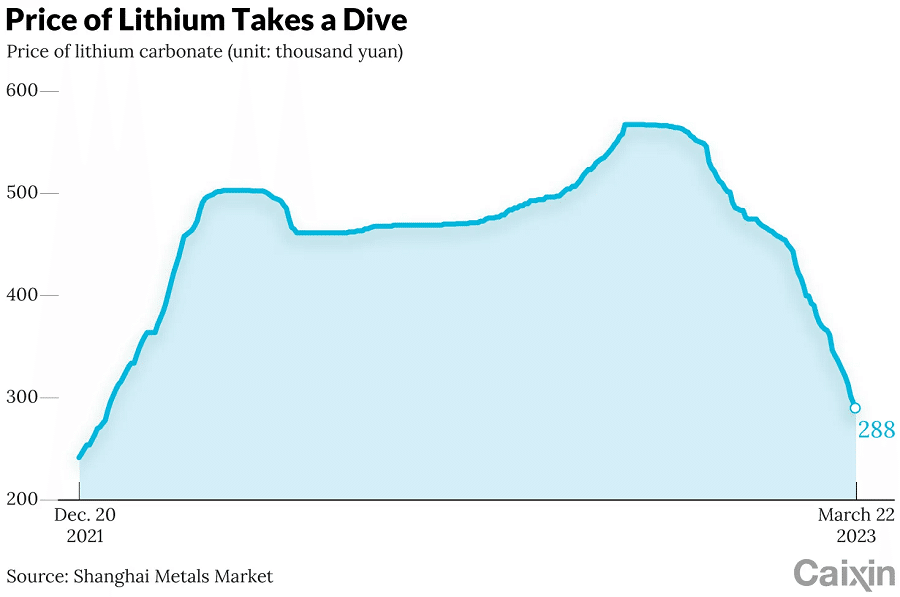

Hiring and production expansions were in full swing. In November 2022, the price of lithium carbonate reached a record 600,000 RMB (US$8,722) per tonne, compared with around 100,000 RMB per tonne just two years earlier.

One of the reasons for the slowing business was oversupply after last year's battery investment frenzy amid a market boom...

Other factories in major EV supply chains in Changzhou also slashed production. Changzhou, a production hub for EV batteries, accounts for a third of China's total annual EV battery shipments and hosts plants of leading battery makers such as CALB, BYD and SVOLT Energy Technology.

One of the reasons for the slowing business was oversupply after last year's battery investment frenzy amid a market boom, several people in the industry told Caixin. Slowing auto sales since late last year led to a widening gap between battery demand and supply.

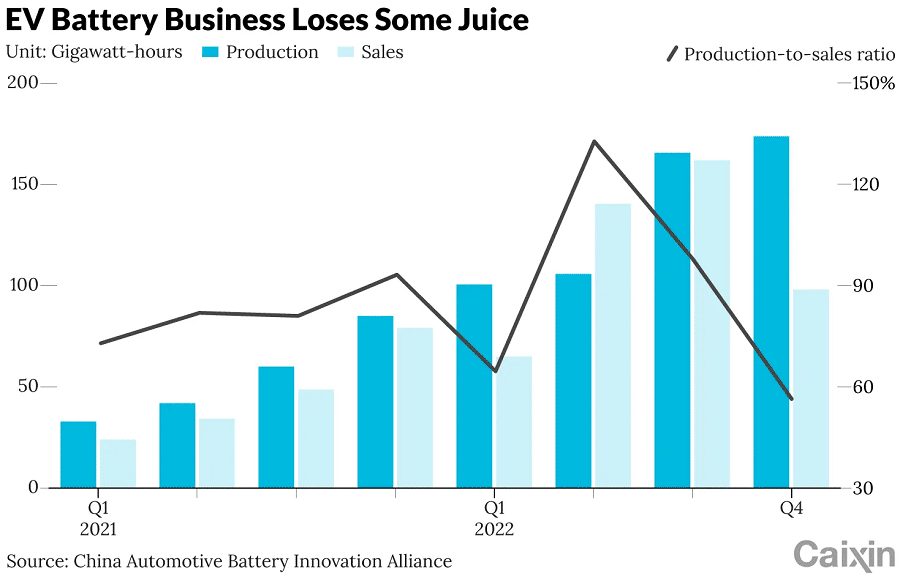

The ratio of sales to production in China's EV battery industry surged to 132.7% in the first quarter of 2022, indicating short supply, according to China Industry Technology Innovation Strategic Alliance for Electric Vehicle (CAEV). But in the fourth quarter, the ratio fell to 56.4%. During the period, battery production increased 4.8% month-on-month, but sales declined by nearly 40% month-on-month, CAEV data showed.

According to research institution Rystad Energy, battery factories and EV manufacturers in China experienced varying degrees of battery overstock in 2022. Battery makers have 80 gigawatt-hours (GWh) of battery inventory, and automakers have 103 GWh. The combined inventories are about double the stockpiles in the previous year and amount to 62% of the total annual EV battery installation of 295 GWh.

Sales of EVs have plunged since a government subsidy expired at the end of last year and as consumers remain hesitant about spending.

"The battery overcapacity is very obvious this year," an investor in a lithium battery maker told Caixin, attributing the changing market dynamics to weaker EV sales.

China's auto market has been rattled by a brutal price war since late last year amid slowing sales. Sales of EVs have plunged since a government subsidy expired at the end of last year and as consumers remain hesitant about spending.

Weakening demand has transmitted upward along the supply chain. The price of lithium carbonate, the key raw material for power batteries, has fallen by half over four months to trade below 300,000 RMB per tonne since late March, data from metal industry information provider Shanghai Metals Market showed.

The price of the metal was 219,000 RMB per tonne in China on 4 April, down 56.4% year-on-year, data from metal industry information provider SMM Information and Technology Co. Ltd. showed.

To stave off growing competition and secure orders, Contemporary Amperex Technology Co. Ltd. (CATL), the world's largest battery maker, in February offered automakers steeply discounted prices in exchange for sourcing the vast bulk of their power cells.

CATL's move underscored the pressure of overcapacity and the sluggish market. It also signals that the decline in lithium price may continue, an executive of a smaller rival told Caixin.

Changing dynamics

"The entire industry chain, from raw material producers to battery makers and EV manufacturers, is waiting for orders," ZE Consulting said in a report.

Many power battery makers have slashed production in hopes of reducing inventories, an industry source said.

Only BYD and CATL may have had more than half of their production capacity running during the first two months of the year, an analyst said. An executive of a leading lithium producer said a revival of new orders may not be expected until the second quarter.

The sluggish demand and low production rates reflect battery manufacturers' investment frenzy over the past two years.

Many other Chinese cities besides Changzhou have unveiled ambitious plans over the past few years to develop lithium and battery-related businesses in hopes of riding the lithium boom, offering heavy subsidies and incentives to attract investments.

More than 40 domestic battery projects were announced in 2022, with a planned total production capacity exceeding 1,200 GWh and planned investment of 430 billion RMB, the Ministry of Industry and Information Technology said in February.

While the investment rush was mainly caused by industry leaders, smaller rivals have been catching up this year, racing to add new capacity, according to industry research institute GGII.

That has led to a surge of supply that outpaced demand. In November 2022, Liu Jincheng, chair of EVE Energy, predicted that the entire lithium-ion battery industry would experience overcapacity by 2024 at the latest. By 2023, the effective production capacity of industries such as lithium iron phosphate and negative electrode graphite will be less than 70%. At that time, only products with high quality and low cost will retain orders, Liu said.

During the industry boom, the lithium price was driven up by demand, with profits per tonne of lithium reaching as high as 250,000 RMB to 350,000 RMB.

Battery price war

Discounts offered by CATL in February unleashed a price war in the battery industry, sending jitters to upstream mining companies.

The price of battery-grade lithium carbonate dropped from its peak of nearly 600,000 RMB per tonne in November 2022, falling at a daily rate of 10,000 RMB per tonne in recent months. It has now dropped below 300,000 RMB per tonne, erasing the price gains of 2022.

During the industry boom, the lithium price was driven up by demand, with profits per tonne of lithium reaching as high as 250,000 RMB to 350,000 RMB. Many battery and car manufacturers told Caixin that their future expectations for lithium prices are around 200,000 RMB per tonne.

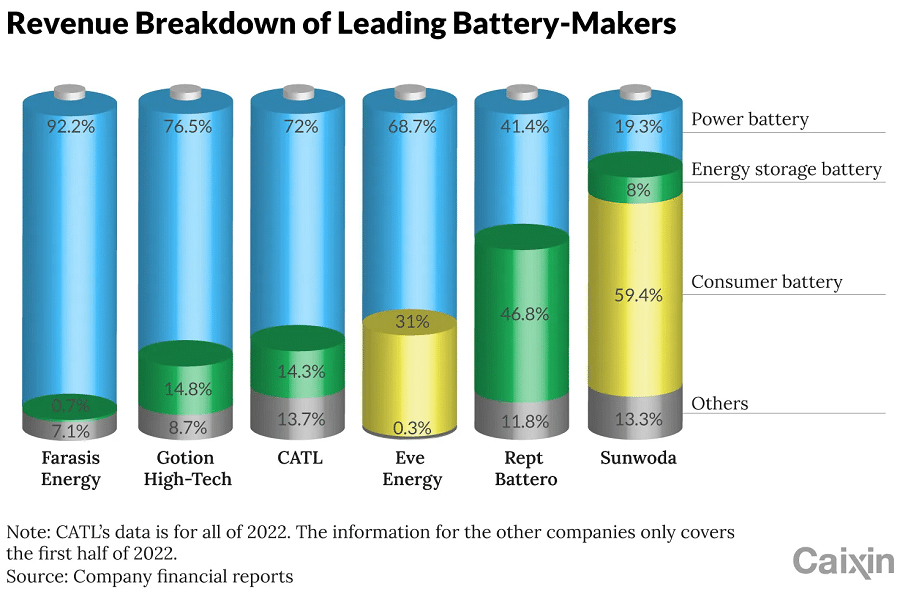

Competition among battery makers is fierce. In 2022, CATL's domestic market share fell 3.9 percentage points to 48.2% from a year earlier, while BYD's battery market share rose 7.25 percentage points to 23.45%, according to data from CAEV. The gap in battery shipments between the two companies has narrowed to less than 10 percentage points as of February. In addition, the domestic market share of smaller battery companies has increased slightly.

The ownership of resources is the decisive factor for cost control amid the brutal competition of battery makers this year, a battery company executive said.

Major Chinese battery makers have been actively seeking lithium deposits at home and abroad. In January, a consortium led by CATL won approval from the Bolivian government to invest upwards of US$1 billion in developing local untapped lithium deposits, with the ambitious goal of producing lithium batteries in the country by 2025.

To survive the competition, all lithium battery companies are expanding financing channels as much as possible. In 2022, Chinese lithium power plants became the most active companies in issuing global depositary receipts (GDRs) on the Swiss exchange in Zurich. Battery maker Gotion High-Tech Co. raised US$685 million from GDR sales, and Sunwoda Electric Co., US$440 million.

CATL is reportedly planning to raise at least US$5 billion by offering GDRs in Switzerland as early as May, which would be the largest such Chinese offering by far. But due to the large size of the planned issuance, there are still regulatory uncertainties, a market investor said.

Seeking new markets

As competition intensifies at home, Chinese battery makers are more motivated to make forays abroad. CATL, SVOLT Technology, EVE Energy and Envision AESC all announced overseas projects in 2022, making it the most active year for Chinese battery companies going overseas.

Most of the battery projects are in Germany, Hungary and some Southeast Asian countries. Power battery locations are usually chosen to be either close to the end market or close to raw materials. Europe and the US both have large EV markets by sales, trailing only China. However, due to restrictions imposed by the US, most Chinese companies are still taking a wait-and-see position on placing factories there. Currently, only Envision AESC and Gotion have built lithium projects in the US.

CATL and Ford Motor Co. in February announced a battery plant in Michigan with a novel ownership structure under which Ford would own 100% of the plant, including the building and the infrastructure. CATL is to "license its intellectual property for battery technologies to Ford". Some analysts were concerned about the model of "technology in exchange for orders".

Europe is likely to be an easier option for Chinese battery companies. CATL, SVOLT Technology, EVE Energy and Gotion have unveiled plans to build five factories in Germany with a total planned capacity of 74 GWh. In Hungary, CATL said it plans to invest about 7.3 billion euros (US$7.9 billion) to build a 100 GWh production line.

Europe will be the most important region for Chinese battery companies going global as many large European automakers are seeking suppliers, Teng Yong, a global partner at consulting firm A.T. Kearney, told Caixin.

Compared with building factories overseas, the risk of entering the energy storage business is relatively small, with a clearer industry policy outlook.

As geopolitical tensions intensify, Chinese battery companies are slowing the pace of going abroad. Some of the projects were just announced but haven't started construction, said a person who's in charge of a Chinese battery company's overseas business.

Compared with building factories overseas, the risk of entering the energy storage business is relatively small, with a clearer industry policy outlook. China's top ten domestic power battery suppliers have all laid out plans to tap into the energy storage business.

"Some energy storage projects overall have an economy of scale, but the specific profit is currently difficult to calculate," said an analyst who closely follows energy storage investment. "Energy storage equipment vendors are very active, but the same enthusiasm is not seen in the actual operating companies."

This article was first published by Caixin Global as "In Depth: China's EV Battery Boom Goes Bust". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.