Chinese firms flock to Saudi Arabia in Middle East gold rush

(By Caixin journalists Zhai Shaohui and JZhang)

Saudi Arabia is quickly rising on a list of hot investment destinations for Chinese companies, as the country goes through what many local Chinese residents have dubbed its "reform and opening up".

Since Mohammed bin Salman became the crown prince in 2017, Saudi Arabia has undergone unprecedented change. Following the 2016 launch of "Vision 2030" - a plan for promoting private business, encouraging foreign investment and driving social change - the country has rolled out supportive policies for start-ups, boosted tourism, eased religious restrictions, and for the first time allowed women to drive.

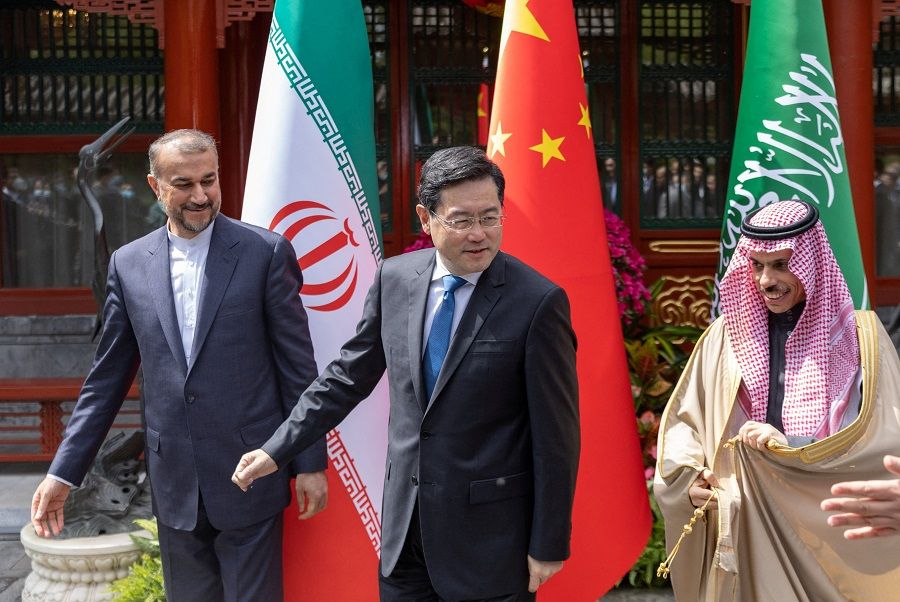

China has tightened its business and political connections with Saudi Arabia during the period. In March, Beijing brokered a peace agreement between Saudi Arabia and Iran, while in December 2022 President Xi Jinping visited Riyadh for the China-Gulf Cooperation Council Summit and the first China-Arab States Summit.

During the historic summit, Saudi and Chinese companies signed 34 investment agreements spanning sectors such as green energy, information technology, cloud services, transportation, logistics, medical care, and construction, according to the official Saudi Press Agency.

In the eyes of some Chinese companies, Saudi Arabia's transformation has unleashed huge demand not only in the country, but also in the broader Gulf region.

Among the Chinese businesses capitalising on the Gulf country's "reform and opening up" are the cloud services units of tech giants Alibaba Group Holding Ltd., Tencent Holdings Ltd., and Huawei Technologies Co. Ltd., as well as artificial intelligence developer SenseTime Group Inc. and logistics firm S.F. Holding Co. Ltd.

In the eyes of some Chinese companies, Saudi Arabia's transformation has unleashed huge demand not only in the country, but also in the broader Gulf region.

Bilateral investment gains momentum

Venture capital investor eWTP Arabia Capital, which is backed by Saudi sovereign wealth giant Public Investment Fund (PIF) and Alibaba, is one of the first institutions with Chinese backing to have set up shop in Saudi Arabia. Opened in 2019, the outfit specialises in helping Chinese companies expand to the Middle East and North Africa, and has made at least 16 investments totalling US$320 million in the cloud and digital sector, according to its website.

In 2022 alone, the firm said it had met with more than 500 Chinese companies and investors, reflecting an increasing interest in the Saudi market.

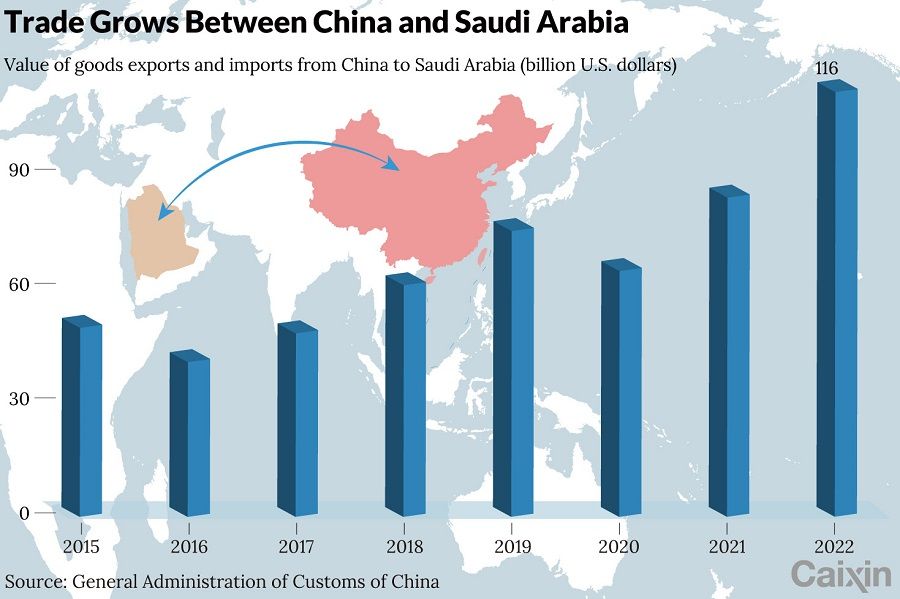

Saudi Arabia has been China's largest trading partner in the Middle East since 2001, and China has been Saudi Arabia's largest trading partner for a decade. Last year, trade of goods between the two countries increased 32.9% to $116 billion, according to China's Ministry of Foreign Affairs.

Saudi investment in China is also gaining momentum.

In March alone, state-owned energy giant Saudi Aramco announced two investment projects in China, totaling 50 billion RMB (US$7.2 billion). One includes a plan for Aramco and its Chinese partners to build a large refining and petrochemical plant in Panjin, Liaoning province, with a total investment estimated at 83.7 billion RMB. The world's largest oil refiner has also agreed to buy a 10% share of privately controlled Rongsheng Petrochemical Co. Ltd. for 24.6 billion RMB.

Investment from US dollar funds in China has fallen rapidly and as a result, some Chinese investment funds and businesses seeking to raise capital have suggested that Middle Eastern capital could help fill the hole.

Saudi Arabian firms have been investing in China for decades. Ajlan & Bros Holding Group was one of the earliest Saudi private enterprises to invest in China, establishing its first textile factory in Suzhou, Jiangsu province, in 2002.

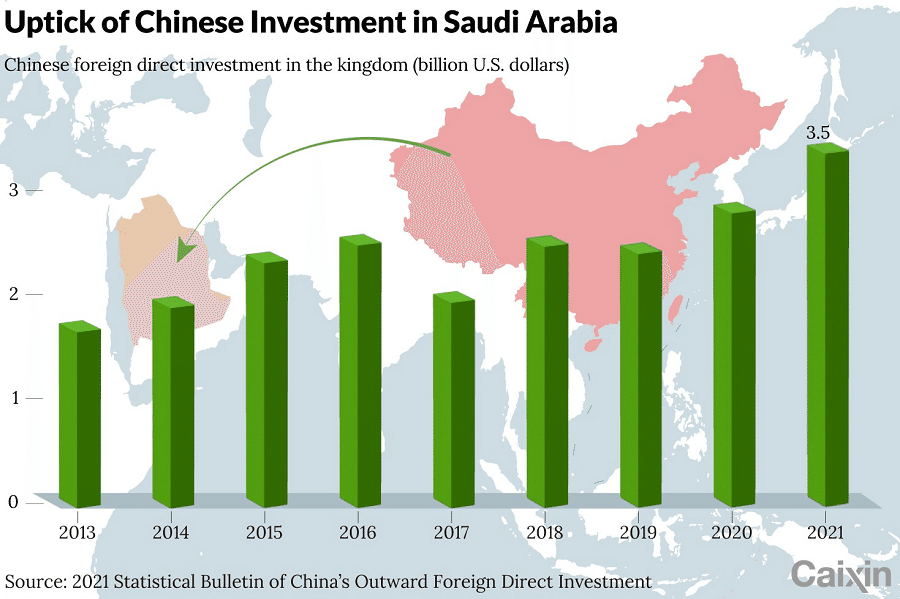

The uptick of Chinese investment in Saudi Arabia is more recent, but the country is potentially ideal for companies looking at the Middle East market.

"We have no tariffs with many African and Arab countries, which should be helpful to Chinese investors and enterprises who want to enter this market," Mohammed Bin Abdulaziz Alajlan, deputy chairman of the company and chairman of the Saudi-Chinese Business Council, told Caixin. "Saudi Arabia is a gateway connecting the East and the West."

Jessica Wong, also a founding and managing partner of eWTP Arabia Capital, predicts that traditional sectors like energy, infrastructure and trade will continue to dominate economic exchanges between China and Saudi Arabia.

But the growth of the digital economy like artificial intelligence (AI) and cloud computing will improve existing industries. "Cloud and AI may sound high-tech, but they ultimately help upgrade a country's industries in the digital direction," she told Caixin.

Meanwhile, there is a growing gap in China's capital markets as tensions between the US and China worsen. Investment from US dollar funds in China has fallen rapidly and as a result, some Chinese investment funds and businesses seeking to raise capital have suggested that Middle Eastern capital could help fill the hole. Many Saudi funds have already set up offices on the Chinese mainland, according to a person from a private equity fund.

Another private equity expert pointed out that compared to simply "investing in China", Middle Eastern investors think more about "investing locally", meaning that projects need to be able to find application scenarios in both China and the Middle East.

Why Saudi Arabia?

SenseTime, a leading Chinese AI software developer, entered the Saudi market in 2018 and spent a year or so testing the waters. By 2020, despite the uncertainties caused by the pandemic, market demand had clearly increased, according to Ding Yungui, head of presales and operations at SenseTime MEA, its joint venture with PIF in Riyadh.

The firm has already started doing business in smart buildings, smart parking lots, and intelligent offices in the capital's King Abdullah Financial District.

The office of eWTP Arabia Capital is also based in the central Riyadh district. Wong began expanding her firm's business to the Middle East in 2018. She decided to make Saudi Arabia her primary market in the region as the most profitable companies in her portfolio at that time had about 60% to 70% of their revenue coming from the Saudi market. Gaming, mobile advertising, and online entertainment are hot sectors in the Middle East, performing better than in other emerging markets, Wong discovered.

Saudi Arabia has the largest consumer market in the Middle East and its infrastructure - road, rail, and port - are rapidly improving.

In the cloud services space, Tencent Cloud is one of the major Chinese tech players that has moved into the Saudi market, in February establishing a partnership with Mobily, Saudi Arabia's second-largest telecommunications service provider.

Hu Dan, vic-president of Tencent Cloud International for Middle East and North Africa Region, said the firm hopes to optimise Mobily's IT architecture and help it provide cloud solutions and services to third-party clients, many of which are local enterprises and governments.

Meanwhile, SF Express has partnered with Ajlan & Bros to form joint venture AJEX Logistics Services. Nathalie Amiel-Ferrault, AJEX's chief marketing and customer experience officer, told Caixin the firm had chosen to establish its headquarters in Riyadh because Saudi Arabia has the largest consumer market in the Middle East and its infrastructure - road, rail, and port - are rapidly improving.

"The entrepreneurial environment [in Saudi Arabia] is now similar to that of Hong Kong." - Billy Tea, co-founder and CEO of Reelsights

New frontier for start-ups

Developing an ecosystem for small and midsize enterprises (SMEs) and attracting more entrepreneurs is considered a key element of Saudi Arabia's "Vision 2030" plan.

In 2016, the Saudi government established the General Authority for Small and Medium Enterprises (Monsha'at) with the aim of boosting the productivity of Saudi SMEs.

Saud Alsabhan, deputy director for entrepreneurship at Monsha'at, said that a start-up in Saudi Arabia could receive support from government-run investment institutions, in addition to what it gets from angel investors. "Government investment institutions have a higher risk tolerance and therefore will not set too many requirements for startup projects," Alsabhan said in a 11 March interview with Caixin.

A Saudi-based SME can also enjoy preferential corporate tax policies, according to Alsabhan. These perks are "quite important for start-ups", said a founder of a Hong Kong start-up considering entering the Middle East market.

Billy Tea, co-founder and CEO of Reelsights, an AI video marketing start-up based in Hong Kong, told Caixin that he would consider expanding into the Saudi market, including setting up an office in the country, because he believes it is able to provide strong support for startups in terms of capital and networks. The entrepreneurial environment is now similar to that of Hong Kong, he added.

Venture capital (VC) investment in the country is rapidly increasing, having increased by 72% and reaching $987 million in 2022, according to data provider MAGNiTT. Vijay Tirathrai, managing director of Middle East-focused VC firm Techstars, believes the scale of Saudi Arabia's VC investment could surpass that of the United Arab Emirates (UAE), the leading country in the region's VC market for the past decade.

Saudi Arabia has achieved in the past three years what other regions might take ten years to accomplish in terms of fostering an entrepreneur-friendly business environment, Tirathrai said. One major reason for this is the direct involvement of the state, which has invested billions of dollars itself, he added.

But an entrepreneur from the Chinese mainland, who declined to be named, cautioned that VC investment in Saudi Arabia is still in its early stages and that the pace of investment is slower compared to Asia and North America. He warned that companies should not have high expectations for the speed of receiving Saudi capital.

The lack of talent, especially in IT-related sectors, also poses a big challenge for Saudi Arabia in developing its entrepreneurial environment, said Alsabhan of Monsha'at.

"Some of the factors that influence their [many local workers'] choices are not related to the work environment or the type of business, but rather simpler issues, such as difficulty in applying for credit cards at small companies," he said. "We are addressing these 'very small' issues so that talent can make job choices based solely on career development considerations, without having to worry about loans, car purchases, credit cards and other issues."

... a large proportion of the Saudi population uses cash on delivery, due to low credit card penetration and the lack of a prevalent payment platform like China's Alipay or WeChat Pay.

Doing business in Middle East

The hottest industries in Saudi Arabia today, according to Alsabhan, are "e-commerce, fintech, and 'last-mile' delivery", which booked rapid growth in the past two years, fueled by the pandemic.

Wong recalled that when she first arrived in Saudi Arabia, the penetration rate of e-commerce was extremely low. "The pandemic really gave e-commerce a big boost," she said.

In 2022, eWTP Arabia Capital helped J&T Express Co. Ltd., a Chinese logistics and express delivery company, enter the Saudi market. Its Middle East team has since expanded to 3,000 people.

Meanwhile, SF Express-backed logistics firm AJEX started operating at the start of last year.

But adapting to Saudi Arabia is not simple. Chinese companies have to deal with significant market and cultural differences. Zhang Tianfang, AJEX's chief of express logistics, told Caixin that it took her team nearly two years to reconfigure its system in order to tackle the way delivery addresses are used in Saudi Arabia, which still doesn't have a standardised address system.

Also, a large proportion of the Saudi population uses cash on delivery, due to low credit card penetration and the lack of a prevalent payment platform like China's Alipay or WeChat Pay. Some independent sellers on social media platforms find that almost all customers choose to pay with cash on delivery, according to Zhang, who said that IT teams from both AJEX and SF Express spent lots of time adjusting their systems to adapt to such local practices.

To help navigate entry into the Saudi market, joint ventures have become a common business model for Chinese tech companies entering Saudi Arabia, which poses challenges ranging from culture and language to the legal and financial systems.

To succeed in the Saudi market, local knowledge and a supply chain on the ground are crucial, said Alajlan.

Qu Yunxu and Zhang Erchi contributed reporting.

This article was first published by Caixin Global as "In Depth: Chinese Firms Flock to Saudi Arabia in Middle East Gold Rush". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: Symbiosis: China the leading customer and Saudi Arabia the vital oil supplier | Not just the economy: China's growing cyberspace influence in the Middle East | Differences between the US and China in Middle East peace advocacy | Saudi-Iran deal: Diplomacy with Chinese characteristics gaining ground | China's entry into the Middle East: Beginning of China-US full-scale confrontation