Chinese internet giants gear up for global e-commerce push

(By Caixin journalists Shen Xinyue, Guan Cong and Qu Yunxu)

Pinduoduo Inc., once China's hottest internet newcomer, is tapping the US market with its first cross-border e-commerce platform, leading a new wave of Chinese tech companies going abroad.

The company's Temu platform launched 1 September sells goods from US$2 Bluetooth earphones to US$4 sneakers with free shipping for orders totalling US$29. It adopts the same low-price marketing strategy that Pinduoduo is known for in China. Temu's downloads ranked No. 15 among all shopping apps in the US as of 11 September.

The Chinese internet industry is picking up the pace of internationalisation, an executive from a large domestic private equity fund told Caixin. The enterprises are going abroad for similar reasons as they all face sluggish user growth, slowing revenue, Covid-19 disruptions and weakening consumption at home.

As the Chinese mobile user base plateaued, companies are competing for existing users, whose spending weakened amid the slowing economy. In addition, government policies favourable to internet companies started to fade out in 2021 as regulators tightened scrutiny of the sector's freewheeling growth.

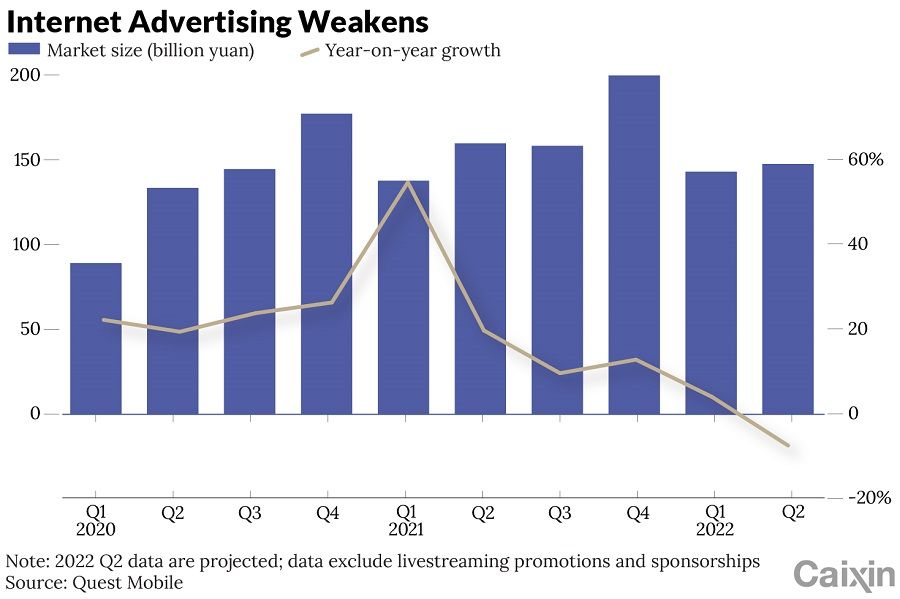

Advertising, the most important source of revenue for internet companies, has been weak for more than a year.

Advertising, the most important source of revenue for internet companies, has been weak for more than a year. The internet advertising market expanded by 54.6% in the first quarter of 2021, but growth rates plummeted to 9.5% in the third quarter and 12.7% in the fourth, data from Quest Mobile show. The market contracted 2.3% year-on-year in the first half of 2022.

"If a company doesn't have an overseas development plan, we don't think it has a strategy," the same private equity executive said.

Amid tightening Covid-19 controls in the second quarter, companies suffered logistics disruptions, increased order cancellations, lower advertising spending by brands and weakening consumer income.

A must-make move

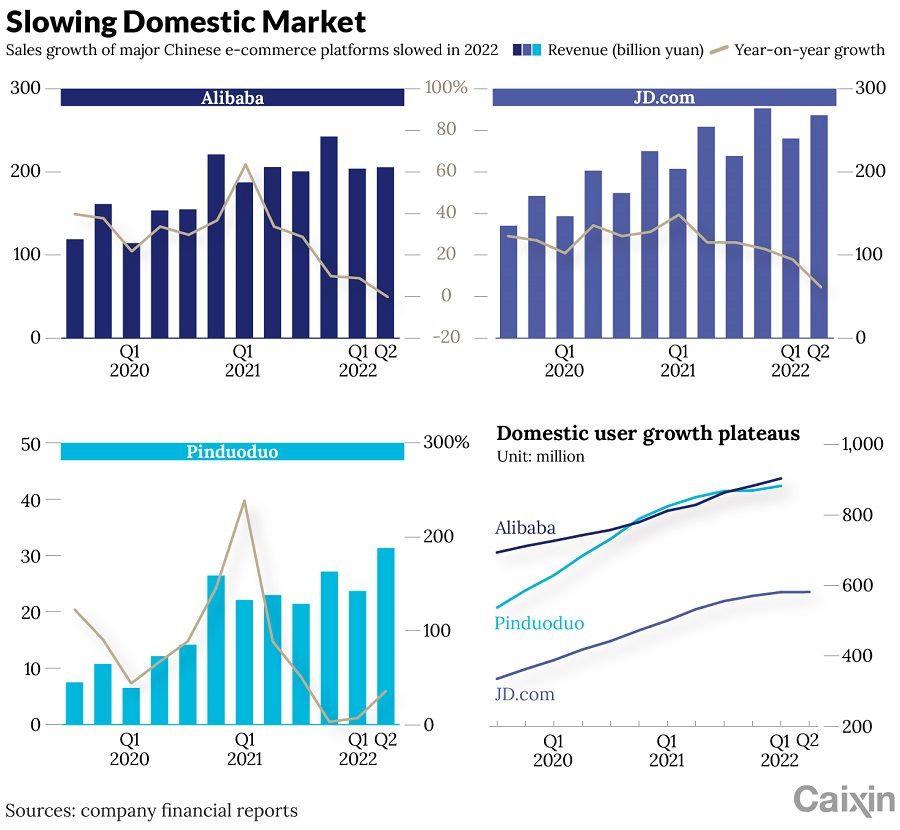

China's internet industry is having a rough year. Earnings growth for Alibaba Group and JD.com Inc., the two major e-commerce platforms, fell to record lows. In the first quarter, Alibaba's revenue growth hit the lowest level of 9% as gross merchandise value of its e-commerce sites Taobao and Tmall dropped for the first time. While JD.com's 19% revenue growth in the same period was higher than the market estimates, it was also the company's record low.

Amid tightening Covid-19 controls in the second quarter, companies suffered logistics disruptions, increased order cancellations, lower advertising spending by brands and weakening consumer income. JD.com CEO Xu Lei called it the most challenging period since the company's US IPO in 2014.

China's e-commerce user base plateaued in 2020. The number of online shoppers stood at 842 million as of December 2021, up only 60 million year-on-year, according to the China Internet Network Information Center.

"Everyone has to turn their attention overseas," a retail industry equity analyst said. This person said room abroad for growth by Chinese e-commerce companies is still big. "The growth rate of China's total retail sales of consumer goods is lower than 5%, but it's near 20% in the cross-border e-commerce sector. Pinduoduo will definitely not let go of the opportunity."

Besides Pinduoduo, short-video platform Kuaishou this year also stepped up efforts to sell overseas in the face of setbacks internationally. Kuaishou almost disappeared in Europe and the US after a few rounds of management reshuffling in its international division since 2019. Its major global products Kwai and SnackVideo focused on Latin America, the Middle East and Southeast Asia.

Kuaishou's global expansion stalled as it disclosed in the 2021 interim report, with a loss of 6.4 billion RMB (US$892 million) from overseas business. The loss narrowed to 3.4 billion RMB in the first half of 2022, but foreign revenue of 150 million RMB contributed less than 0.5% to the company's total. In August, the company adjusted its management structure again and raised its overseas marketing budget.

"Kuaishou is gaining momentum in Brazil, similar to its domestic strategy," said a person familiar with the company. "It focuses on the lower-tier market, and game developers cannot bypass Kuaishou in South America for ad placement."

New players in town

Pinduoduo's overseas foray is viewed by many as aimed at taking on the Chinese fast-fashion brand Shein.

"Shein basically shows a recipe for Chinese cross-border platforms: getting core suppliers, selling cheap goods to developed countries and competing for the price-sensitive consumers," the retail equity analyst said. "And it worked."

Temu is leveraging the white label or house brand products for which Pinduoduo is known as American consumers have a higher demand for such products during the economic downturn, the analyst said.

What sets Temu apart from Shein is that it invites merchants across all categories. Temu prefers suppliers and factories with cross-border e-commerce experience that can provide mainstream, top-selling products at low prices. Branded items need to offer price reductions on Temu's channel.

Temu generally doesn't want to accept products from suppliers that are pricier than 100 RMB (US$14) and has a low markup on wholesale prices, a strategy that doesn't aim for immediate profit...

Many goods-makers say they worry about thin profit margins on Temu. They play a role simply as suppliers rather than as merchants as on traditional retail platforms such as Amazon. Temu handles operations, sales and customer service and pays suppliers strictly for their products without commissions.

Pinduoduo started in China by leveraging the vast user base of the social network app WeChat, a growth model that will be hard to replicate in the US. It may be able to capitalise on the current situation of high inflation and reduced spending in foreign markets by leveraging the advantages of Chinese supply chains and cost-effective products, analysts said.

Without mentioning Shein as a target, Temu's main advertising space on its home page is in the apparel category. Shein responded by issuing an exclusive "two-for-one" cooperation request to some large Temu suppliers, Caixin learned from several sources. Shein will fine them if they are found to be selling the same products on Temu, people familiar with the matter told Caixin.

Temu generally doesn't want to accept products from suppliers that are pricier than 100 RMB (US$14) and has a low markup on wholesale prices, a strategy that doesn't aim for immediate profit, a home-products supplier to Temu told Caixin.

Foreign strategies

Chinese internet companies have been going abroad for more than a decade, but in the past two years, the international business has played a much bigger role in their strategies. More and more startups are putting almost equal weighting on international and domestic businesses.

Alibaba has been targeting the export trade since its inception in 1999. In 2010, Alibaba launched its business to consumer (B2C) cross-border e-commerce business, Sizzle, which quickly became the industry's No. 1 player in Russia and Brazil. It then rapidly expanded its footprint by acquiring Southeast Asian e-commerce company Lazada. In 2019, Alibaba bought e-commerce businesses Trendyol in Turkey and Daraz in South Asia.

Alibaba is setting up its overseas business to be as important as its domestic retail and cloud businesses.

Alibaba's overseas retail business generated 42.7 billion RMB of revenue in the 2022 fiscal year, contributing about 5% of the group's revenue. Together with the wholesale business, its total overseas revenue reached 61.1 billion RMB, about 7% of total revenue.

Alibaba is setting up its overseas business to be as important as its domestic retail and cloud businesses. Alibaba aims to reach 1 billion overseas users in 14 years, compared with almost 1 billion users today in China. The company had 305 million foreign annual active users as of the end of the first quarter.

"In the next five years, it is expected that the global e-commerce market excluding China may have room for growth of $3 trillion to $5 trillion," an employee of Alibaba's overseas operation told Caixin. "Based on China's current share in the world, Chinese sellers can grow about $2 trillion overseas." That suggests that Alibaba's future e-commerce growth will rely on overseas markets.

However, Alibaba's cross-border e-commerce business has faced difficulties for more than a year. In 2021, the EU removed the value-added tax exemption for cross-border packages of less than 22 euros (US$21.35), dampening the company's B2C business. In 2022, Russia's war in Ukraine disrupted logistics, and the significant devaluation of the Russian ruble hurt Sizzle's results, dragging down Alibaba's overall foreign retail business by 3% year-on-year in the second quarter.

"Affordable alternative product is an opportunity amid the high inflation and reduced spending overseas." - Zhang Kuo, president of Alibaba's international operation

The EU tax changes won't directly depress the industry but will cause headaches for small merchants, squeezing profit margins, the Alibaba employee said. "We see sales growth of products with technology elements, such as drones and solar energy products this year," the employee said. "Clothing sales are also rising."

"Affordable alternative product is an opportunity amid the high inflation and reduced spending overseas," said Zhang Kuo, president of Alibaba's international operation.

Support facilities

Infrastructure, including logistics and warehousing, data centres and cloud services, are also going global with Chinese internet companies.

JD.com, which started its international strategy five years later than Alibaba, focuses on warehousing and distribution, quality control, maintenance and a series of other after-sales services. In Europe, for example, JD.com cooperates with the European lingerie brand Hunkemöller, undertaking warehouse distribution of orders in four countries including the Netherlands and France, accounting for a third of its total European online shopping parcels.

In the US, JD Logistics opened its first overseas maintenance centre in May to provide a basket of after-sales services for merchants. In June, it started an automated warehouse in Los Angeles, helping merchants to cut order fulfillment time to two to three days from seven. As of 30 June, JD Logistics operated 90 bonded warehouses, international direct mail warehouses and overseas warehouses, an increase of more than 70% year-over-year in term of total area.

"JD.com lacks the support of a large number of white label manufacturers in China," an independent cross-border e-commerce person told Caixin. "It also doesn't have a supply chain and price advantage for oversea retail sales."

"It is too costly for JD.com to establish the same distribution facilities in Europe and the US as in China," he said. "The integration of small offline logistics companies is difficult to manage."

Data solution and cloud service companies are also taking domestic competition abroad, building business and bringing investments into Hong Kong, Singapore and Japan. In late September, Chinese tech giants including Huawei and Alibaba announced a series of plans in the race for global expansion.

The new wave of Chinese internet companies going abroad faces two major market uncertainties: the post-pandemic era and anti-globalisation.

Huawei plans to expand its cloud service to 170 countries and regions by the end of 2022, connecting 1,700 operation networks, Huawei Cloud CEO Zhang Pingan announced to clients in Southeast Asia.

Meanwhile, Alibaba Cloud said it will invest 7 billion RMB over the next three years to build an international localisation ecology and six more overseas service centres in locations including Porto, Portugal; Mexico City; Kuala Lumpur; and Dubai. It currently covers 28 regions in 200 countries.

Uncertainties abroad

The new wave of Chinese internet companies going abroad faces two major market uncertainties: the post-pandemic era and anti-globalisation. Amid rising geopolitical risks, businesses face stiffer regulatory headwinds on national security grounds.

For example, TikTok was kicked offline in 2020 in India, a country with 600 million internet users, amid growing political tensions between China and India. In Europe and the US, authorities are imposing restrictions on online platforms as politicians focus on antitrust, youth protection and short-video addiction.

For Chinese e-commerce platforms such as Pinduoduo, overseas business compliance is another steep challenge. "Traditional internet platforms such as Amazon, Facebook and Google are becoming very demanding in terms of compliance for sellers this year," said Liu Huadong, director of B2C business at TikTok advertising agency Beijing Chenggongyi. "Some customers turn to TikTok because Google often blocks their accounts."

"In the last six months, e-commerce companies' global foray faced two major uncertainties," said Cheng Xin, global partner and chairman of Bain & Co.'s Greater China High Tech Practice. "First, European and American consumers spent less amid high inflation. Second, geopolitical conflicts increased supply chain costs and prolonged delivery times."

This article was first published by Caixin Global as "In Depth: Chinese Internet Giants Gear Up for Global E-Commerce Push". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: Newcomers Douyin and Kuaishou takes on tech giants to refresh the face of e-commerce | No funding, no market. What now for China's tech companies? | China's burgeoning e-commerce cyberspace and its ever more complex regulations | China's livestreaming e-commerce: The million dollar business fueling product innovation | How China is leading in the livestreaming e-commerce world