China's private sector has continued its rise against all odds

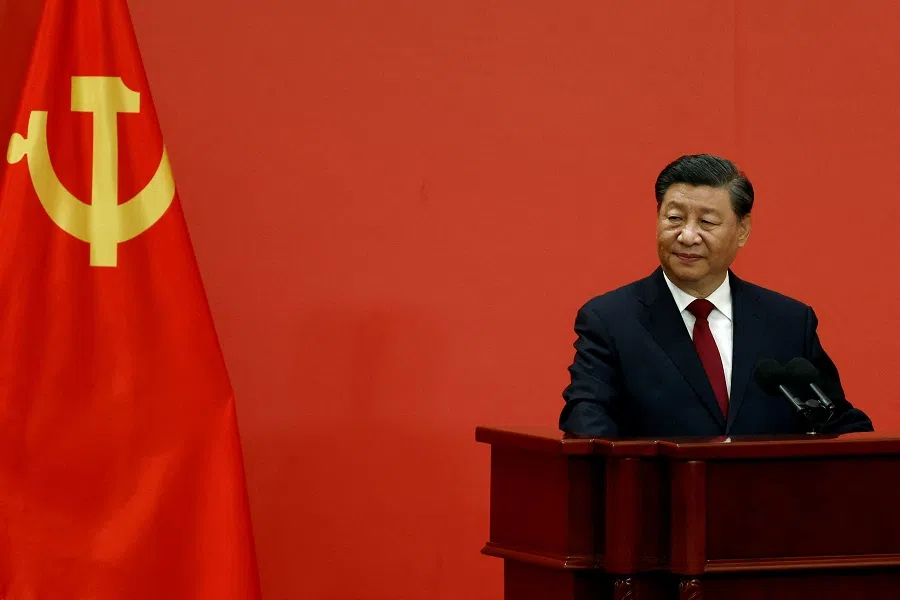

Peterson Institute of International Economics researchers Tianlei Huang and Nicolas Véron analyse the seeming anomaly that an increasingly statist policy environment in China has not prevented a rapid rise of the private sector. While various factors have paused this rise, will the upward trajectory likely resume in President Xi's third term?

While Chinese elites were gathering in Beijing for the twice-in-a-decade Chinese Communist Party Congress last month, the private business community across the country was watching closely for signs of any policy shift in the party-state's stance towards the private sector. But they found nothing to be cheerful about.

China's growth miracle would not have been possible without market reforms and the rise of the private sector. But under President Xi Jinping's reign, China has been experiencing a trend back towards greater state power over its economy, dragging growth down.

Despite Xi's statist policies and frequent harassment of private enterprises and entrepreneurs, private firms in China have found a way to grow. Their internal dynamism, which is in sharp contrast to the state sector, has led to a near-continuous rise of private-sector ownership among China's top-ranked corporations for more than a decade. Recently, that rise has been brought to a standstill, but the trend from there is still unclear.

State industrial policy increasingly tries to influence private investment decisions and encourage more private capital to enter strategic sectors and deal with what the state views as the nation's technological bottlenecks.

Increase in top-ranked private companies despite policies

Since he came into power in 2012, Xi Jinping has repeatedly emphasised the importance of making the state sector stronger, better, and bigger. As a result, credit allocation in the formal financial system has tilted in favour of the state sector, forcing private companies to rely more on shadow banking institutions to get external finance. But that channel of financing for private firms also got restricted later with the government's crackdown on the less-regulated shadow banking system. Consequently, private investment growth in China has slowed substantially since 2015.

In the meantime, the Chinese state has exerted greater direct influence over the private sector through various means. One of the latest and most striking manifestations of this is the state's harsh interventions through the campaign-style regulatory crackdown that culminated in the summer of 2021 and wiped off hundreds of billions of dollars from the market value of some of China's most prominent private companies.

State industrial policy increasingly tries to influence private investment decisions and encourage more private capital to enter strategic sectors and deal with what the state views as the nation's technological bottlenecks. In the media sector, the party-state makes sure that it is in firm control of everything ideology related, including by creating the special management share (or golden share) scheme, which can give a minority state shareholder an outsized governance power.

...the changing political economy in China during the Xi Jinping era has not prevented a rapid rise of the private sector among the country's top-ranked corporations.

Despite the increasingly statist policy environment under Xi, however, the research we published in March this year found a near-continuous increase in the private-sector share among China's largest companies that have made the Fortune Global 500 rankings between 2005 and 2020 and were among the 100 most valuable publicly traded Chinese companies between end-2010 and end-2021. In other words, the changing political economy in China during the Xi Jinping era has not prevented a rapid rise of the private sector among the country's top-ranked corporations.

Some may think the rise of the private sector in China is entirely a story about the rise of Big Techs like Alibaba and Tencent. While the Big Techs once played a dominant role among the largest private companies in China, sectoral diversity has been growing over time and non-tech companies are now the overwhelming majority of private-sector companies among China's largest. CATL, for example, is now the world's largest lithium-ion battery manufacturer, holding one-third of the global electric-vehicle battery market. LONGi Green Energy, as another example, is the world's largest solar company and the top solar-panel supplier to the US.

According to our research, among China's top 100 listed companies by market value, the share of internet platforms has been on the decline ever since it peaked in 2016 and as of the end of the third quarter of 2022, only nine among the top 100 are platform companies, out of 44 private-sector firms in that group. This is confirmed by data compiled by the All-China Federation of Industry and Commerce which shows among China's 500 largest private companies by revenue in 2021, only 12 are internet platforms; over 60% are manufacturing firms.

This finding is somewhat counterintuitive: how could the private sector continue its rise under Xi who is clearly in favour of the state sector?

For private companies, their retained earnings have become a major source of investment funds given the difficulty of financing through both banks and nonbanks.

In fact, despite its slowing growth, private investment still forms over half of all fixed-asset investment in China. For private companies, their retained earnings have become a major source of investment funds given the difficulty of financing through both banks and nonbanks. Since private companies are more efficient than their state-run counterparts, they have been able to grow more rapidly and gain market value and revenue at a faster pace than state firms. If private firms were to compete with state firms on an equal footing, they would play an even more prominent role in the Chinese economy now.

Private sector's share of revenue dropped, but trend unclear

Since mid-2021, the Chinese private sector has gone through some of its biggest challenges in decades. The sweeping regulatory crackdown, alongside the troubles in real estate and Covid lockdowns, has made a perfect storm for the Chinese private sector. The decade-long rise of the private sector among China's largest companies has therefore been forced to pause more recently.

In terms of revenue, the private sector's share among all Chinese companies included in Fortune Global 500 rankings dropped from 19% in 2020 to 17% in 2021. Measured in market value, with a higher frequency of observation, the private-sector share among the country's top 100 listed companies dropped from 54.4% at the end of 2020 to 40.8% at the end of the third quarter of 2022.

Some private firms in industries like electric vehicle manufacturing and batteries, renewables, and consumer products have managed to keep growing...

Despite the private sector's visible declines, several parallel events, beyond China's turn towards state dirigisme, were behind the drop. These include global commodity price increases and the ongoing crisis in the Chinese property sector, together with Beijing's crackdown on internet platforms.

Moreover, the drop was far from across the board. Some private firms in industries like electric vehicle manufacturing and batteries, renewables, and consumer products have managed to keep growing, thanks to the country's ongoing green transition, its growing middle-income group and vast consumer market. Whether the recent drop in the previous private-sector advance is just the beginning of a new trend of continuous decline is not clear, at least for now.

Related: Can private Chinese enterprises truly 'develop boldly and with confidence'? | Private enterprises in China feel the heat of government influence | China's distrust of private enterprises goes back a long way | Why China is cracking down on big capital | Ten years of political intervention: China's economy at a crossroads

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)