Food delivery giant Meituan's foray into Hong Kong: Getting ready for internationalisation

Meituan, mainland China's food delivery giant, made its first foray outside the mainland to Hong Kong recently, under the brand KeeTa. It faces stiff competition from incumbents Foodpanda and Deliveroo, amid a strong sense of local identity among Hong Kong residents which may affect take-up rates to some extent. Nevertheless, this is a testbed for Meituan's internationalisation plans. Lianhe Zaobao journalist Tai Hing Shing reports.

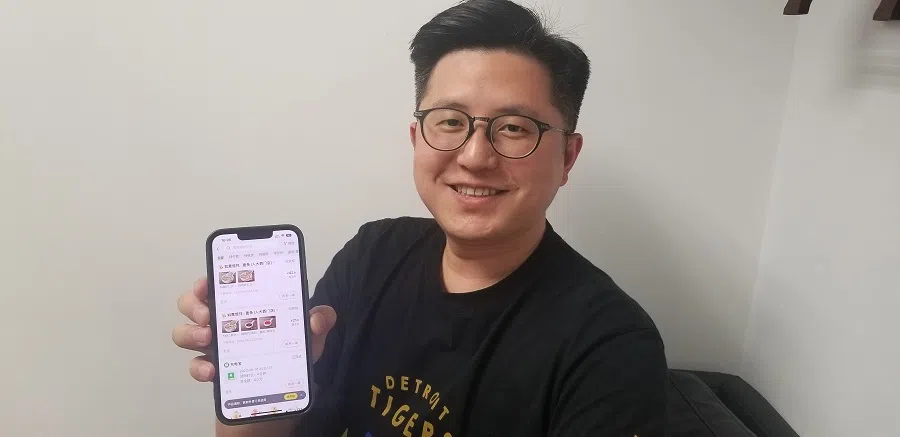

Since the Hong Kong-mainland border reopened early this year, 33-year-old Jingle Lee who works in new media, has been returning to his hometown in Guangdong every weekend.

He told Lianhe Zaobao that when he is in Guangdong, he would order food using the food delivery platform Meituan every day.

Lee said, "Some of the best eateries are too far away so ordering in is most convenient. I only have to pay 4 or 5 RMB extra. It's a good deal."

Meituan's KeeTa joining the competition

After Meituan expanded to Hong Kong on 22 May under the brand KeeTa, Lee immediately signed up and started using the platform. On the whole, he is happy with the user experience and thinks that KeeTa's services in Hong Kong are not bad.

Chan On-kat (pseudonym), a Hong Konger who often uses food delivery services, told Lianhe Zaobao that she was "pleasantly surprised" by KeeTa's service when she used it recently for the first time.

She said, "The delivery service was quick and my food was delivered within 20 minutes from the time I placed my order. The food also came hot and fresh."

With the rise of the internet, food delivery platforms in Hong Kong have gained popularity in recent years. Germany's Foodpanda was the first to land in Hong Kong in 2014, followed by the UK's Deliveroo in 2015, and the US's Uber Eats in 2016.

After a chaotic and competitive race, Uber Eats was the first to bow out, announcing its withdrawal from the Hong Kong market at the end of 2021. Now, Hong Kong's food delivery market is mainly dominated by Foodpanda and Deliveroo.

Three years ago, strict social distancing measures were imposed in Hong Kong due to the Covid-19 pandemic. But this also opened up opportunities for Hong Kong's food delivery market.

It has recently expanded to Sham Shui Po, Tsim Sha Tsui and Hung Hom, and plans to cover the whole of Hong Kong by the end of the year. This is also the first time that Meituan has stepped out of the mainland Chinese market.

Data portal Statista estimates that the total revenue of Hong Kong's online food delivery market is expected to reach US$3.61 billion in 2023 and further climb to US$5.13 billion by 2027.

When it entered the Hong Kong market in May, Meituan initially offered its services in the densely populated Mong Kok and Tai Kok Tsui areas. It has recently expanded to Sham Shui Po, Tsim Sha Tsui and Hung Hom, and plans to cover the whole of Hong Kong by the end of the year. This is also the first time that Meituan has stepped out of the mainland Chinese market.

In a bid to attract new users, Meituan launched a HK$1 billion (US$128 million) rewards programme as soon as it went online, "burning money" to compete with the two other players in the food delivery market.

KeeTa offers dining discounts, delivery fee waivers and coupons for new users, attracting many Hong Kongers to sign up. KeeTa also introduced an "on-time promise" policy, which promises free delivery for late deliveries. Meituan described this service as an industry-first, with no other platforms offering this commitment at the moment.

On the first day of its launch, KeeTa received its first order just six minutes after it launched at 8 am. It was reported that the whole journey from picking up the order to delivering it to the user only took 14 minutes and 32 seconds.

When a Hong Kong media platform put KeeTa's services to the test, they found that they not only received the order promptly, but only paid HK$51 for the food, saving around HK$24 compared with the roughly HK$75 they would have spent dining out.

... the total delivery transactions in Hong Kong account for only 8.3% of the overall food and beverage market, a great distance away from the mainland's 21.9%.

Three-way battle

Hong Kong's food delivery market is currently dominated by Deliveroo and Foodpanda. However, the total delivery transactions in Hong Kong account for only 8.3% of the overall food and beverage market, a great distance away from the mainland's 21.9%. After Meituan entered the Hong Kong market, a chaotic three-way battle reemerged.

As it has only been around two months since KeeTa entered the Hong Kong market and it is still attracting users with value-for-money deals and various incentives, the platform's impact on the market remains to be seen.

KeeTa has yet to offer self-pick-up services. Based on Measurable AI data, KeeTa took up around 20% of the market share in Mongkok and Tai Kok Tsui in its first month in Hong Kong in terms of delivery-only order volume, while Deliveroo and Foodpanda claimed around 36% and 44% respectively.

Deliveroo and Foodpanda are unfazed by Meituan's fierce arrival. Foodpanda said that it is pleased to see the food delivery industry blossoming, giving consumers and delivery men more choices. Meituan entering the market at this juncture also reflects the potential of delivery platforms in Hong Kong.

A Deliveroo spokesperson for Hong Kong said that the company has been developing in Hong Kong for over seven years and has always been optimistic about the future of the food and lifestyle products delivery industry. It considers competition as a driving force for innovation, and aims to strengthen existing services to help restaurant and lifestyle partners expand their businesses.

Also, Hong Kong society generally welcomes the entry of new competitors into the food delivery industry as it believes that healthy competition that stimulates demand and further expands the industry would benefit the industry, practitioners and consumers.

... a delivery man working at Meituan could earn up to HK$35,000 a month if he delivers 500 orders a month and meets other performance targets.

Meituan's battle to recruit talent

During the preparatory phase of Meituan's entry into Hong Kong, it attempted to recruit talent with above-average salaries. According to Hong Kong media reports, based on the industry standard of delivering about two orders per hour, a delivery man working at Meituan could earn up to HK$35,000 a month if he delivers 500 orders a month and meets other performance targets.

Wong Si-lok, chairman of the freelance workers' branch of Hong Kong's Service Industry General Union, believes that delivery men will benefit from this wave of competition in the industry. Taking KeeTa's initial rollout in Mong Kok and Tai Kok Tsui as an example, Wong noted that the overall salaries of delivery men in the region have risen 20-30%.

She noted that delivery fees for Foodpanda and Deliveroo were previously reduced to between HK$20 and HK$30, but now Meituan KeeTa charges over HK$50 for a single order in Mong Kok, leading Foodpanda and Deliveroo to immediately increase their delivery fees, with an additional HK$10 per order during peak periods for deliveries to Mong Kok.

Following its official launch in Hong Kong at the end of May, KeeTa's initial partner restaurants include popular brands such as McDonald's, Maxim's MX, KFC, hana-musubi, Hung Fook Tong and Nam Kee Noodles.

Hong Kong's local herbal tea brand, Yeung Woo Tong, is also one of Meituan's partners. The company's CEO, Cheng Man-wing (郑文荣), said initially they only collaborated with Foodpanda, but later joined Meituan, hoping to expand their consumer base through another channel. On the first day of partnering with Meituan, they received around four takeaway orders through the platform, with an average order value of approximately HKD100, which exceeded expectations.

She said that "joining a delivery platform is like opening a branch with minimal cost". Even if there were few orders, there would be some publicity.

... food prices on delivery platforms are expected to decrease.

Simon Wong Ka-wo, president of the Hong Kong Federation of Restaurants & Related Trades, told Lianhe Zaobao that Foodpanda and Deliveroo used to charge partner restaurants a commission fee of approximately 30%, leaving little profit for small and medium-sized restaurants. Exclusive contracts were also signed, including restrictions to collaborate with only one platform, which limited the restaurants' choices.

He said with Meituan coming in, major delivery platforms have recently reduced their commission fees, while the two leading delivery platforms Foodpanda and Deliveroo have lifted their exclusivity requirements.

Wong predicts that in these circumstances, food prices on delivery platforms are expected to decrease. "And with the recent heavy advertising and promotion by major delivery platforms, it indirectly increases the exposure of restaurants, which is beneficial for the entire food and beverage industry," he said.

On the consumer side, Chan believes that different delivery platforms have different delivery fees and platform fees. Compared with other platforms, Meituan is most attractive due to its lower delivery fees and platform fees, high cost-effectiveness, and the introduction of various discounts. She hopes that Meituan's entry will drive and improve the overall service quality of the delivery platform industry.

Hong Kong's excellent transportation network makes it easy for people to find nearby dining options, and it was only during the pandemic that people turned to food delivery.

Meituan may have missed the golden opportunity

The rise of Foodpanda and Deliveroo in Hong Kong in recent years can partly be attributed to the lockdown measures during the pandemic. Has Meituan missed the "golden opportunity" in entering Hong Kong after the pandemic?

Consumer Jingle Lee believes that the prospects of Meituan in the Hong Kong market are not very optimistic. He noted that Hong Kong has a high concentration of restaurants, and it is convenient to find a place to eat nearby no matter where you are. The high labour costs in Hong Kong also result in high delivery fees, which many people find difficult to accept.

He believes that the peak of the food delivery market in Hong Kong was during the pandemic, and the "golden opportunity" is past. Meituan missed a good chance for its entry into Hong Kong, and it may be difficult for them to significantly capture the Hong Kong market in the short term.

Simon Lee, a senior lecturer with the Chinese University of Hong Kong (CUHK) Business School, expressed his doubts about the prospects of KeeTa in Hong Kong, because Hong Kong's excellent transportation network makes it easy for people to find nearby dining options, and it was only during the pandemic that people turned to food delivery.

He said Meituan succeeded in mainland China due to its vast territory and the local population's reliance on food delivery and online shopping. Besides, mainland China has many delivery drivers who are allowed to use electric vehicles on pedestrian paths for food delivery. This is in contrast with Hong Kong, and after the initial promotions by Meituan during its early stages of operation in Hong Kong, it will be difficult for them to retain customers.

He believes that another reason Meituan will find it difficult to expand significantly in Hong Kong has to do with local identity among Hong Kong residents. Alipay and WeChat are good examples of this, as the political reasons are evident.

He also noted that this can be seen more prominently in the home appliance market. For example, refrigerators and washing machines are mostly manufactured in China, but they are more popular when they bear the names of well-known foreign brands. Conversely, while Meituan is well-known in mainland China, it still lacks recognition in Hong Kong.

However, Simon Lee believes that Meituan has two considerations in spending so much money to enter the Hong Kong market. First, Hong Kong is an international market, and Meituan hopes to use it as a springboard to enter the international market. Second, Hong Kong serves as a testing ground where Meituan can use the intensely competitive environment to test strategies for entering other fiercely competitive markets.

Mainland Chinese food and beverage brands struggle to adapt

In fact, in recent years, several well-known mainland Chinese food and beverage brands have not been able to adapt and ultimately failed in their attempts to enter the Hong Kong market.

Simon Lee's most memorable example is Heytea, a once-popular mainland Chinese chain of tea beverage stores that practically disappeared from Hong Kong after 2019. Also, while Haidilao is very successful in mainland China, the response to it in Hong Kong has been lukewarm.

The market size in Hong Kong is small and competition is fierce, making it challenging for mainland brands to establish a strong presence.

Analysing the reasons, Simon Lee said besides local identity among Hong Kong residents, it also has to do with the abundance of choices in the Hong Kong market. The market size in Hong Kong is small and competition is fierce, making it challenging for mainland brands to establish a strong presence.

He said, "For mainland brands to enter the Hong Kong market, good quality and service are still crucial, but it takes a long time to build that. Just like Japanese brands, which also took a long time to achieve their current status."

Testing ground for Meituan's internationalisation

Matthew Kwok, managing director of Anli Asset Management in Hong Kong, notes that Meituan has over 680 million users and 9.2 million active merchants in mainland China, while in comparison, the contribution of Meituan's food delivery business in Hong Kong is relatively small.

He said the market is not currently expecting KeeTa's food delivery business in Hong Kong to have a significant impact on Meituan's earnings or stock price. However, he will closely observe whether Meituan will expand its business to Southeast Asia in the future, because while Meituan has not expressed interest in overseas markets, the Hong Kong business can serve as a springboard for testing international operations.

This article was first published in Lianhe Zaobao as "美团进军香港 会否铩羽而归?".

Related: One country, two systems: Can Hong Kong hold on to its characteristics? | 25 years after the handover: The 'end for Hong Kong' or just the beginning? | Are mainland China tourists discriminated against in Hong Kong? | Beijing's 'cleansing' of Hong Kong industries: Who will be the next target?