How can China deal with deflationary pressure?

Although the Chinese economy showed some signs of recovery in 2023, prices have not improved in tandem, with key economic indicators signalling a persistent decline. This has served to deepen fears of deflation and sparked calls for more supportive policy measures.

(By Caixin journalists Yu Hairong, Wang Liwei and Han Wei)

China's economy ended 2023 having experienced a patchy post-pandemic recovery, albeit ultimately posting a slightly higher-than-expected growth rate of 5.2%. However, doubts over the world's second largest economy linger as deflationary pressures mount and murmurs of what may await quietly begin to dominate talk among economists and policymakers.

Deflation difficult to reverse

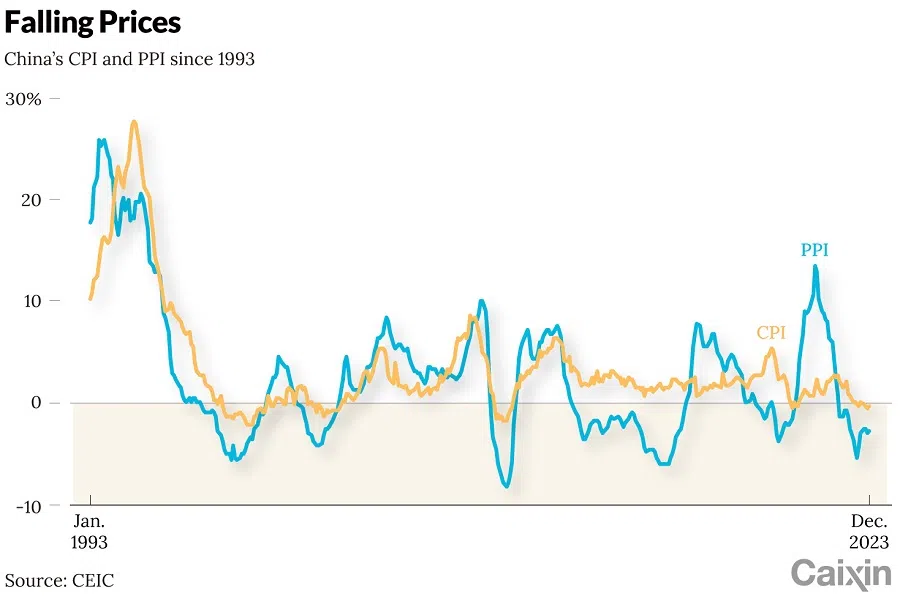

Although the economy showed some signs of recovery in 2023, prices have not improved in tandem, with key economic indicators signalling a persistent decline, such as the consumer price index (CPI) rising at the slowest pace in 23 years. This has served to deepen fears of deflation and sparked calls for more supportive policy measures.

"Deflation is very frightening," said Tatsuhito Tokuchi, a board member and research fellow at Tsinghua University's Center for Industrial Development and Environmental Governance.

Under deflation, residents and businesses tend to spend and invest less, which means they lack confidence in the economy, said Tokuchi. The experience of Japan over the past 30 years shows that if a country enters a period of sustained deflation, it is very difficult to reverse and return to relatively stable and moderate inflation, he said.

Deflation is dangerous for China as sustained price drops will lead to a downward spiral of consumption and business investment due to expectations of lower prices and weaker demand, damaging the momentum of future growth. Deflation can also make monetary policies aimed at stimulating the economy less effective as falling prices weigh on the performance of businesses.

"The persistent weakness in prices indicates that China is still in the economic bottoming-out phase, and the recovery stage of the economic cycle has not yet arrived." - Mao Zhenhua, Chair of China Chengxin International Credit Rating Co. Ltd.

China's CPI for the full year rose 0.2%, the slowest since 2010, and remained mired in negative territory throughout the fourth quarter, indicating falling prices, according to data from the National Bureau and Statistics (NBS).

Meanwhile, the producer price index (PPI), which measures price changes from the perspective of sellers, has remained negative for 15 consecutive months, with an annual decline of 3%.

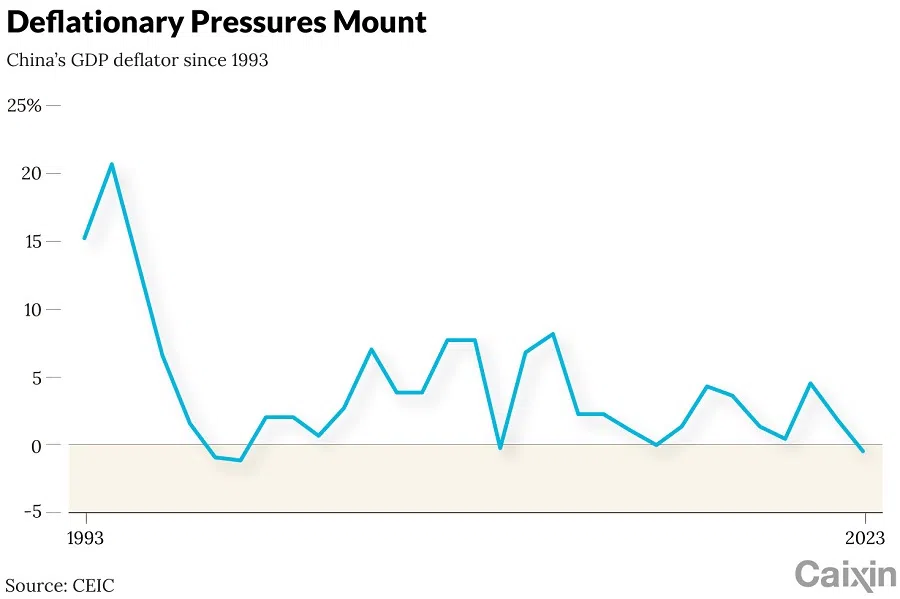

According to Ping An Securities, China's 2023 GDP on a nominal basis - unadjusted for inflation - grew by 4.6%, lower than the 5.2% of real GDP growth. The country's GDP deflator, the widest measure of prices across the economy, contracted by 0.8%.

"The persistent weakness in prices indicates that China is still in the economic bottoming-out phase, and the recovery stage of the economic cycle has not yet arrived," said Mao Zhenhua, chair of China Chengxin International Credit Rating Co. Ltd.

Discussions on whether China is sliding into deflation has swirled since the spring of 2023 after the country recorded lower-than-expected CPI growth for two consecutive months in February and March. But a consensus on the veracity of such claims is yet to emerge due to the use of different criteria and measurements.

In contrast to inflation, deflation refers to a general decline in the price of goods and services and is usually associated with a contraction in the supply of money and credit. China's central bank defines it as "primarily a sustained negative growth in prices, a decreasing trend in the money supply, and often accompanied by economic recession."

The last phrase in that definition is what has the world's economists in such a lather. China has underpinned the global economy over the last 15 years, accounting for 35% of world nominal GDP growth, with the US on 27%, according to the International Monetary Fund (IMF).

A deflationary spiral, marked by decreasing prices of goods and assets, leads to higher borrowing costs. This, in turn, results in reduced spending by consumers and businesses, further contributing to the downward pressure on prices.

China has encountered deflation several times over the past four decades, but each time quickly overcame it.

"The greatest threat facing the Chinese economy today is a fall into a debt-deflation trap," Wei Shangjin, a professor at Columbia Business School and a former chief economist of Asian Development Bank, wrote in a recent article posted on opinion site Project Syndicate.

"Although China is expected to remain the largest contributor to global GDP growth, it could underperform relative to its growth potential" in 2024, Wei wrote.

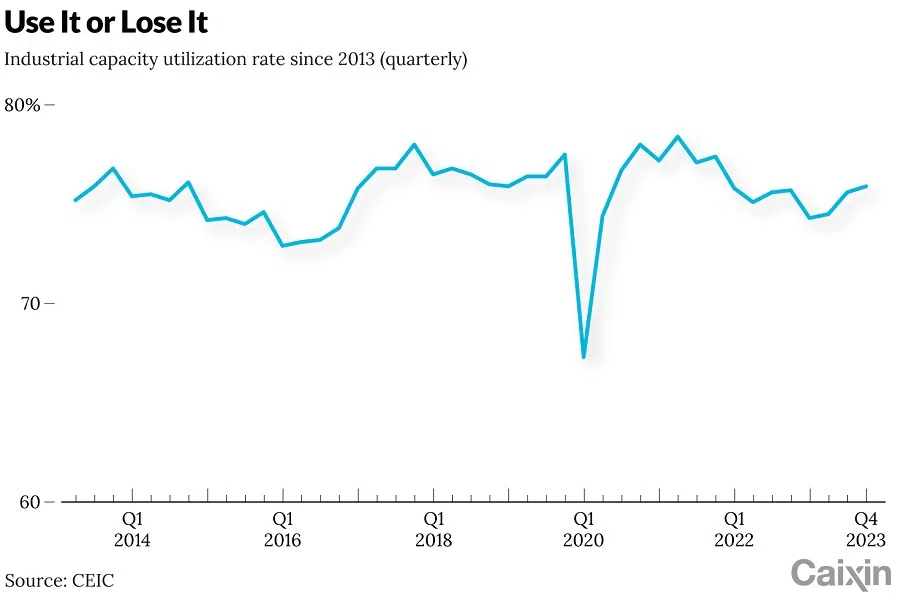

China has encountered deflation several times over the past four decades, but each time quickly overcame it. The most significant deflation risks occurred in 1998 after the Asian Financial Crisis and in 2015 when the economy faced serious overcapacity resulting from post-2008 financial crisis stimulus.

Globally, the most painful memories of deflation include the Great Depression in the US between 1929 and 1933 and Japan's three decades of stagnant economy beginning in the early 1990s.

Wei suggested that Chinese policymakers should urgently inject more liquidity into the economy to avoid a deflation-debt spiral. But for the lending channel to work effectively, China must reform its state-owned banks to ensure that financial institutions lend to the most productive firms, rather than creating artificial money flows.

Unfortunately, China is unlikely to undertake these critical reforms anytime soon, said Wei, adding that an alternative policy package for the short-term is to pair an aggressive fiscal policy with monetary policy.

Debating deflation

Economists and officials are still debating on whether China is already in deflation, as data offers a complicated picture.

The country's annual CPI reading last year indicated a slight rise in prices. However, while the index logged negative growth in July and the entire fourth quarter, the reading of core inflation - price change of goods and services excluding food and energy - remained positive. PPI, which has declined for 15 consecutive months, has posted narrower drops since the second half 2023.

... how low CPI must go to qualify as deflation? The answer is complicated.

Amid the mixed signals, authorities have attempted to appease the market. The central bank said in its monetary policy implementation report released at the end of November that the pressures are temporary. Prices are expected to remain low in the short term but will return to normal levels in the future, said the bank.

The stable core inflation index and improving PPI are signs of an economic recovery and a revival of demand, indicating that there is no foundation for sustained deflation or inflation in the medium to long term, said the People's Bank of China (PBOC).

So now the question being discussed by economist is how low CPI must go to qualify as deflation? The answer is complicated.

Some studies suggest that the CPI often overestimates the level of prices. According to a 2003 research report on deflation by the IMF, CPI readings across countries are based on a weighted average of sales of a basket of goods from a base period and do not take into account factors such as improvements in product quality or the introduction of new products.

The magnitude of the overall bias due to these three factors varies across countries, but is generally perceived to overstate price levels by 0.5 to 1 percentage point, said the IMF.

Zhang Bin, deputy director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences (CASS), said that if factors such as improved product quality are taken into account, an inflation rate below 1% would imply an overall decline in price levels.

China's CPI has consistently remained below 1% since February 2023, while core CPI has not exceeded 1% since April 2022, according to NBS data.

Economists also argue that more attention should be paid to PPI when assessing China's price changes as manufacturing and investment are bigger contributors to economic growth than consumption, unlike most developed countries.

Wang Tao, chief economist for UBS Securities China, told Caixin that since investment serves as the bigger contributor of China's economic growth than consumption, the PPI trend has greater implication for businesses.

"For an economy with a potential growth rate of over 5%, which is far higher than that of developed countries, China's inflation should not be at such a low level," said Wang.

Despite the positive headline number, there is a general consensus that the recovery of China's economy after three years of the pandemic has been disappointing and effective demand remains insufficient.

China Chengxin's Mao said that with the continuous fall in property prices, residents are more cautious when it comes to spending. People are unwilling and afraid to consume, and it is difficult for them to be optimistic about future income and asset price expectations, said Mao.

Time for 'vigilance'

In a bid to manage expectations, officials have emphasised that prices should rise moderately in 2024. But economists have warned that the risk of persistently low prices may continue if macroeconomic policies are insufficient or delayed.

Most forecasts released by institutions and government agencies expect China's CPI to rise modestly in 2024, with predictions ranging between 0.5% and 1.5%. But opinions diverge on whether the PPI will turn positive.

"The biggest issue at present is that if property prices continue to fall, it will drive down the prices of commodities further, and consumer confidence and willingness to spend could decline even more, potentially leading to a further decrease in core inflation," said UBS's Wang.

In 2023, the average price of pre-owned homes in 100 of China's largest cities dropped 3.53% from the previous year, according to industry information provider China Index Academy. Nationwide property sales declined 6.5% to 1.2 trillion RMB (US$169 billion), NBS data showed.

Deflation mainly causes lasting damage through its impact on business operations and investment, as well as employment opportunities for young people - Xiong Peng, an expert at Pangoal Institution

"It is time for heightened vigilance regarding the potential negative economic impacts of persistent price declines," she said.

Economists said that although short-term deflation can be seen as a minor disturbance, it can cause serious damage to the economy if it is not effectively curbed.

Deflation mainly causes lasting damage through its impact on business operations and investment, as well as employment opportunities for young people, said Xiong Peng, an expert at the public policy research organisation Pangoal Institution.

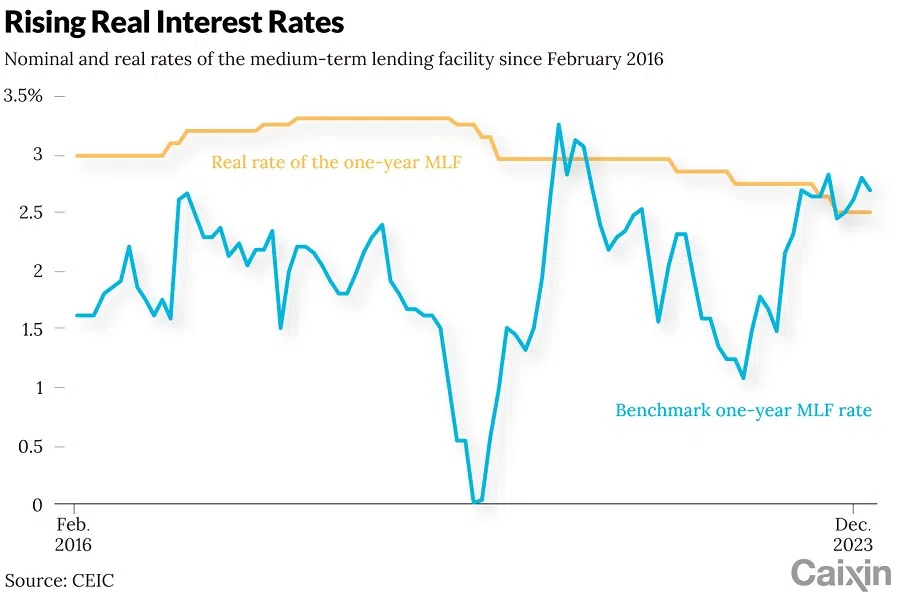

Mounting deflationary pressures have pushed up actual borrowing costs in China, although the PBOC has made several rounds of rate cuts of the loan prime rates (LPR) and the medium-term lending (MLF) facility over the past two years.

"China is caught in a dilemma of high real interest rates and low nominal interest rates," said Zhang Yu, chief macro analyst at Huachuang Securities Co. Ltd.

Elevated real interest rates directly impact corporate decision-making. For businesses, under the same nominal interest rate, deflation implies that the products manufactured will depreciate in value in the future, with costs rising relative to revenue. This leads companies to seek a higher safety margin for profits.

Finding countermeasures

Since December, Chinese policymakers have reiterated the importance of arresting price declines, underscoring concerns about deflation. However, economists and analysts have expressed different views on policy options and how intensively they should be applied.

Meanwhile others have suggested bolder monetary policies to slash interest rates, even as some have argued that fiscal policies would be prioritised to revigorate demand.

Zhang at CASS has called for more proactive moves to slash real interest rates. Only by reducing the real interest rate can a monetary policy environment be favorable to private sector investment and consumer spending, said Zhang.

But Wang warned that due to hurdles in China's mechanisms for formulating and implementing monetary policy, lowering policy rates while certainly helping to some extent, may not be significant, as increased liquidity may not be fully channeled into the real economy.

Amid the rising level of concern, Beijing hasn't been idle. In late October, the national legislature approved the issuance of an additional 1 trillion RMB in treasury bonds for the fourth quarter of 2023.

According to government records, over 80% of the funds raised from these bond sales had been allocated to specific projects by the end of December.

The central bank also resumed the Pledged Supplemental Lending (PSL) programme to add 500-billion-RMB worth of low-cost loan quota for policy-oriented banks to ramp up financing for housing and infrastructure projects.

The key to China's macroeconomic policy in 2024 should be to significantly increase the fiscal deficit ratio and expand the scale of government bond issuance, said Yu Yongding, an economist and member of CASS. This should be done while making monetary policy move in concert to play a supportive role to bring down government bond yields, said Yu.

The best policy choice at present is to increase residents' actual income by deepening reforms to expand consumption and enhance social equity - Lu Zhe, Chief Economist, Founder Securities Co. Ltd.

Some economists have said increased government expenditure should be invested in areas to improve public welfare and social equality instead of government-led infrastructure projects and industrial investment.

A priority is to resolve the issue of fair treatment of migrant workers, remove household registration restrictions, and provide equal treatment in areas such as social security, healthcare, children's education, and pensions for those who move to cities for work, they said.

Such arrangements will benefit millions of people and has long-term advantages to effectively stimulate overall demand and improve people's expectations for the future, they said.

The removal of household registration restrictions and providing fair access to urban public services for rural migrants will benefit 172 million migrant workers and unleash over 1 trillion RMB in additional consumption, according to Cai Fang, a member of CASS.

The best policy choice at present is to increase residents' actual income by deepening reforms to expand consumption and enhance social equity, said Lu Zhe, chief economist of Founder Securities Co. Ltd.

This article was first published by Caixin Global as "CX Daily: How Can China Deal With Deflationary Pressure?". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)