How many US companies will leave China?

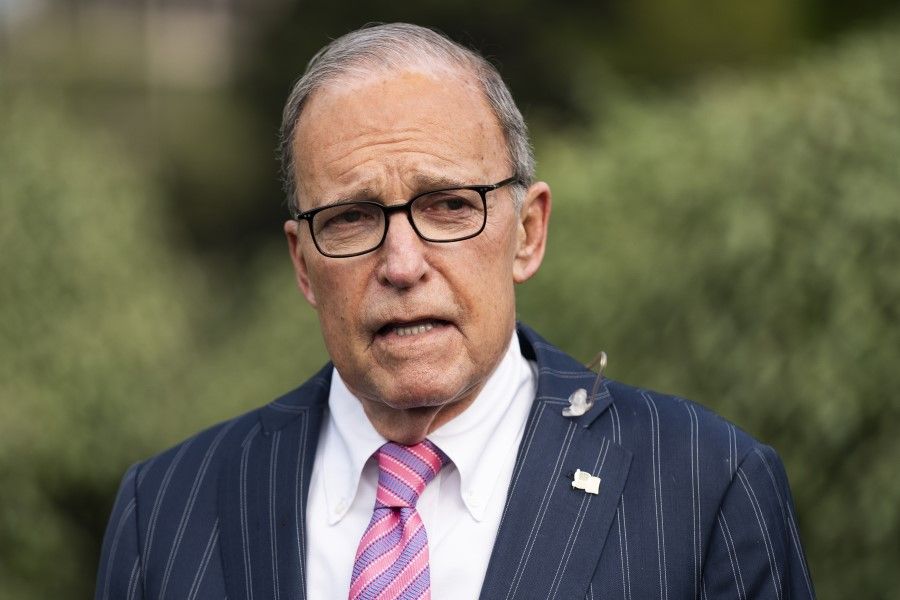

US National Economic Council director Larry Kudlow recently said that the US government will "pay the moving costs" of every American company that wants out of China, including expenses for plants, equipment, intellectual property, structures, and renovations. But how many US companies will heed the call of their government?

First, what Kudlow said was directed at an American audience; it would have a limited effect on the Chinese economy.

Globalisation has benefited US capital but damaged its labour force. The country is in a trade deficit, but it is showing a capital surplus.

US investments in China are not too crucial for China.

To soothe domestic unhappiness, some US politicians and media are telling the public that US production lines are moving to China and Chinese workers are stealing US jobs and technology, while most products from Chinese factories are sold to the US, leading to the US trade deficit.

Such comments gloss over the flaws of US capitalism, but are well-received in some quarters in the US.

In 2017 and 2018, China took in US$134 billion and US$139 billion in foreign investments, with the US accounting for US$3.13 billion and US$3.45 billion in those years, ranking only sixth and eighth among the top ten countries or regions with investments in China.

The bulk of foreign investments in China's high-tech manufacturing industry came from EU countries such as Germany, as well as Japan and South Korea.

But after US companies pull out, other factories are almost certain to be able to produce similar substitute products.

Of course, US investments are welcome in China, which is good for both parties. However, US investments in China are not too crucial for China. So, even if the Trump administration does manage to "recall" US companies, it will not have too much of an impact on China's economy.

The US has more to lose if American companies pull out of China

Second, what would it mean to US companies to pull out of China?

US salaries are higher than in China, and it would take time to rebuild the production chain in the US, while training and purchasing networks would also need to be rebuilt. Cost-effectiveness might go down, and US companies would become less competitive.

Also, even if production costs are the same as in China after rebuilding production in the US, there will be exports after domestic demand is satisfied. But after US companies pull out, other factories are almost certain to be able to produce similar substitute products, while increased operating costs such as shipping fees and customs taxes will lead to US companies losing the China market that they have been working in for so long. These companies will be limited in their economic scale, and their share prices will be suppressed.

Third, the US government can issue Treasury notes, but it cannot tell companies what to do.

The US budget deficit will be high this year, at least 20%, and bonds will need to be issued to fund such a big deficit. In recent years, there has been no increase in foreign central banks buying up the US national debt, and it might get even less, leading to the Federal Reserve buying it back. And so, whether the federal government uses fiscal or monetary policies, in the end, it will happen through increased currency supply.

With the US trade deficit, countries will be holding a large number of assets in US dollars, and an appreciating US dollar would make other countries more competitive and allow them to issue more local currencies. And given the coronavirus, the US dollar does not need to perform at the same pace as the US economy, which means the Trump administration can issue plenty of currency without devaluing the US dollar.

As such, Kudlow thinks the US government can lure back US companies with money, and is making it sound more and more real. However, the US is a capitalist society. Under normal circumstances, the US government would not be able to tell companies what to do, or get them to let go of the benefits that they should gain.

... it is not the first time US government officials have asked US companies to pull out of China.

Fourth, rehashing old lines shows that the White House is running out of ideas.

Trump's management team is made up of extreme right-wingers, and it is not the first time US government officials have asked US companies to pull out of China. Kudlow is just repeating old lines.

For neoliberals, companies exist to be accountable to shareholders, and they do not advocate government intervention in how companies operate. Kudlow, who does not have a background in economics, claims to be a follower of Reaganomics - reducing taxes, loosening regulations, and cutting welfare expenses.

At first, Kudlow's call for US companies to leave China seems absurd. But it is not surprising, because he is one person who wears his heart on his sleeve.

With China's current growing strength, if Kudlow and his ilk can't even vent their frustrations, what else can they do?