Inflation under control in China, but rising pork prices says otherwise

(By Caixin journalist Kelsey Cheng)

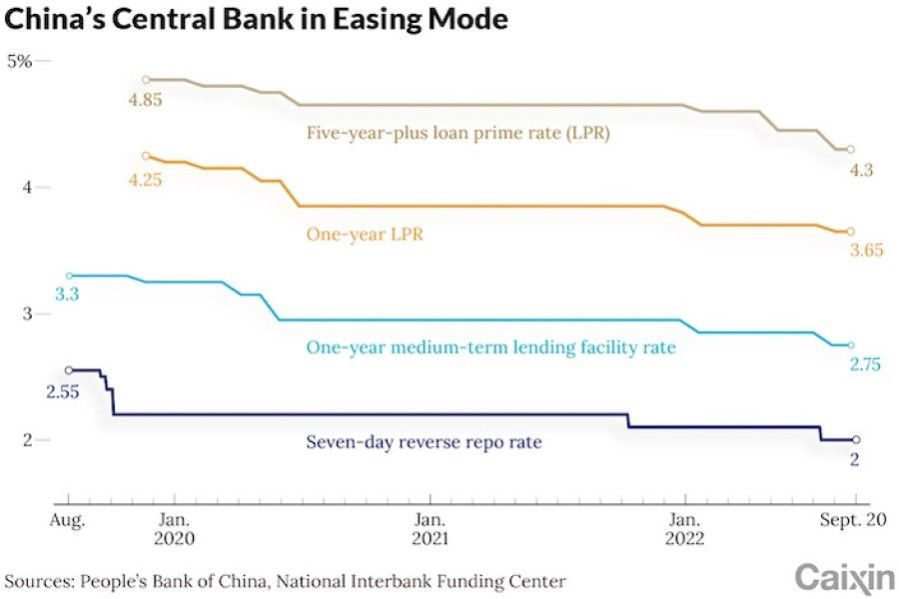

As major central banks around the world raise interest rates to rein in soaring prices, China is an outlier - consumer inflation is far less threatening, and the People's Bank of China (PBOC) has been cutting borrowing costs to support the economy. Yet residents are feeling the pinch of rising food costs.

Weak domestic demand

Zhao, 54, a housewife who lives in central China's Henan province, told Caixin on 3 November that pork prices at her local market in Zhumadian city jumped from 36 RMB (US$4.92) a kilogram to 44 RMB over the past month. But even at that level, she did not hesitate to buy extra to stock up in the expectation that prices will go even higher after a warning from the local government.

A notice issued by Henan's development and reform commission on 18 October noted that the average retail price of lean pork in the province increased by more than 40% year-on-year for two straight weeks.

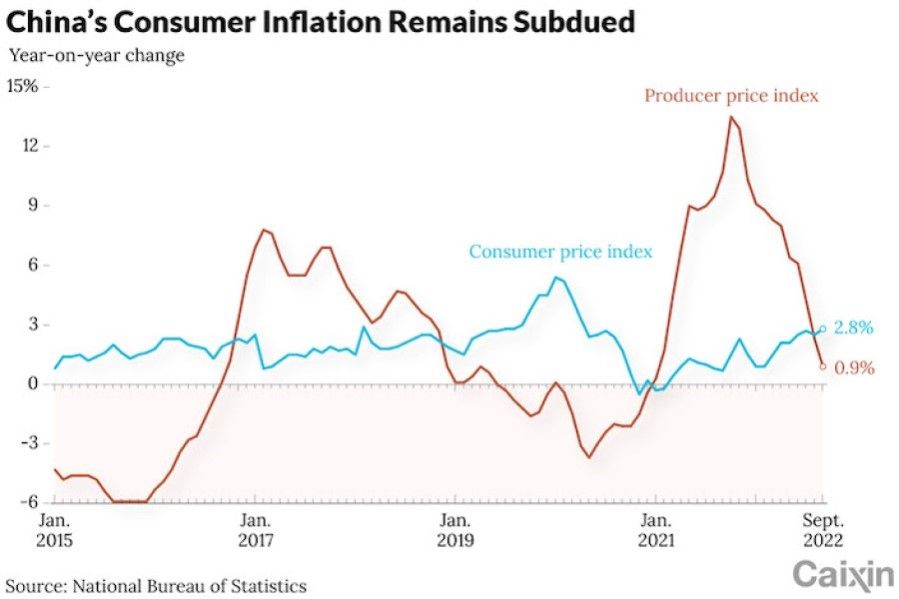

China's consumer price index (CPI) rose 2.8% year-on-year in September, compared with a 2.5% increase in August and the biggest jump since April 2020, National Bureau of Statistics (NBS) figures show. The increase was marginally weaker than the 2.9% average estimate in a Caixin survey of economists but still within a whisker of the inflation ceiling of around 3% set by the government in March.

But while the overall increase in the CPI is within the government's tolerance range, food prices are soaring. The food component of the index jumped 8.8% year-on-year in September, up from 6.1% in August and the biggest increase since August 2020. It was driven by a 36% surge in the cost of pork, the country's most-consumed meat, due to pig farmers holding back supplies, and a 12.1% jump in fresh vegetable prices, as high temperatures in parts of China hit crop yields, according to the NBS.

Core inflation, which excludes volatile food and energy costs, slowed to 0.6% year-on-year in September from 0.8% in August, the smallest increase since March 2021 and reflecting continued weak domestic demand amid ongoing Covid-19 restrictions and a crisis of confidence among consumers worried about jobs and wages.

Central banks have been hiking interest rates to rein in soaring prices... the PBOC has been going the other way.

China is one of the few major economies to have avoided an inflation surge. The US reported an 8.2% year-on-year increase in consumer prices in September, fuelled by gains in food, housing and medical care costs, although that was down from 9.1% in June, the highest since November 1981. In the UK, consumer inflation has hit 40-year highs this year and stood at 10.1% in September.

Central banks have been hiking interest rates to rein in soaring prices. This year, the US Federal Reserve raised borrowing costs six times - most recently on 2 November by 75 basis points, or 0.75 of a percentage point, taking benchmark interest rates to a range of 3.75% to 4%. The Bank of England has increased rates seven times, most recently on 3 November.

But the PBOC has been going the other way. Its easing measures, including reductions in policy rates such as the interest rate on its medium-term lending facility, have led banks to cut the national five-year-plus loan prime rate (LPR), the reference rate for home loans, three times this year, and lower the one-year LPR twice.

Global inflation will accelerate to 8.8% this year from 4.7% in 2021, the International Monetary Fund forecast in its World Economic Outlook report in October, driven by food and energy prices, although it sees the rate easing to 6.5% in 2023.

In comparison, China's inflation outlook is benign. Nomura Holdings Inc. forecasts the CPI in China will rise by 2.2% overall this year and in 2023, while analysts at China International Capital Corp. Ltd. (CICC) estimate growth in a range of 1.7% in 2022 and 2.2% in 2023, according to a 15 October report.

"Unlike the rest of the world, China is experiencing low inflation due to weak domestic demand stemming from its 'zero-Covid' strategy, crashing property markets and some other sector-specific policies." - Nomura Holdings 14 October report

While the CPI for the rest of the year may breach the government's ceiling of around 3% due to elevated pork prices, subdued consumer demand is likely to keep core inflation in check, some analysts say.

"Unlike the rest of the world, China is experiencing low inflation due to weak domestic demand stemming from its 'zero-Covid' strategy, crashing property markets and some other sector-specific policies," Nomura's economists wrote in a 14 October report. That leaves policymakers with more space for monetary and fiscal easing, they said.

Even so, the PBOC warned in August that inflation risks cannot be ignored.

"In the short term, structural inflation pressure may increase, and the pressure from imported inflation remains," the central bank said in its second-quarter monetary policy report released on 10 August. These factors will also drive inflation to rise in stages as will the recovery in consumption when the pandemic is controlled, a subsequent transmission of earlier increases in producer prices to consumers, and the start of a new pork cycle.

Things that have helped keep global inflation in check over the past 20 years, including the benefits of globalisation and a huge pool of labour, have started to reverse, the PBOC said. On top of that, unexpected events such as Covid-19 and geopolitical tensions could exacerbate uncertainties surrounding the supply and prices of goods.

China's heavy dependence on imported oil and natural gas could also pose fresh inflation threats as they feed through to transport costs, industrial supply chains and consumer goods, it said.

Rising pork prices

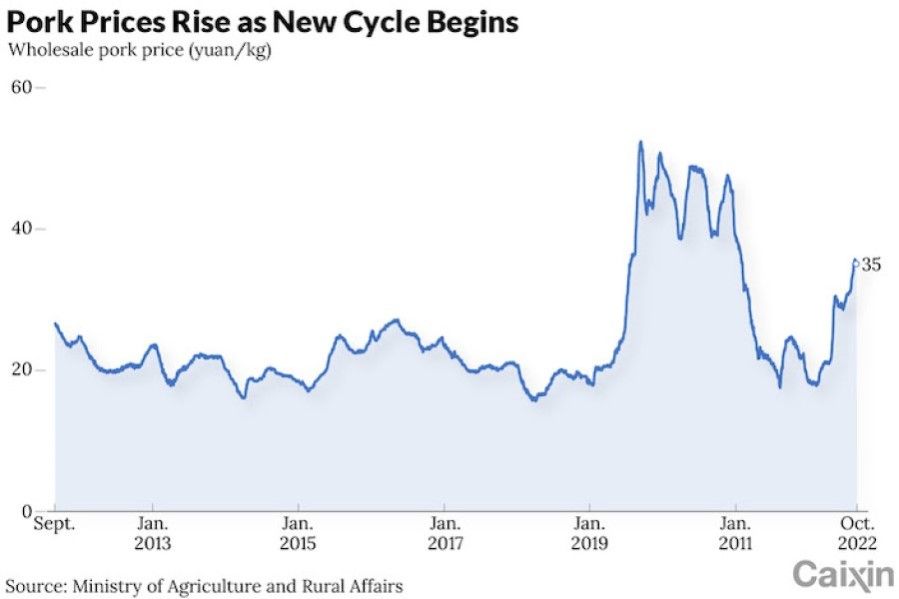

Hog cycles have a significant impact on inflation in China. Pork accounts for more than half of total meat consumption, government data show. It has a weighting of 1.5% in the CPI basket this year, down from 2.3% in 2021, according to estimates by analysts at Minsheng Securities Co. Ltd.

"With the pork cycle now turning up, the meat is expected to become one of the main drivers of inflation." - Luo Zhiheng, Chief Economist, Yuekai Securities Co. Ltd.

When demand for pork exceeds supply, prices increase, encouraging farmers to raise more hogs. Eventually, this leads to oversupply, which subsequently pushes prices lower as demand is stable. Price fluctuations are especially prominent in China, where pig rearing is dominated by smaller farmers, many of whom have little access to sufficient market data and information and are unable to make informed decisions to adapt to changing price trends.

With the pork cycle now turning up, the meat is expected to become one of the main drivers of inflation, Luo Zhiheng, chief economist at Yuekai Securities Co. Ltd., wrote in a report in September.

CICC's analysts said they expect that pork prices will continue to push up food inflation until the first half of 2023. They estimate that food prices will climb between 5.5% and 6% for the entire year.

The PBOC said in its report that the cost of pork started to rise in late April, when wholesale prices were 18 RMB to 19 RMB per kilogram. They climbed to 30 RMB at the beginning of September and jumped to nearly 36 RMB the following month, according to data released by the Ministry of Agriculture and Rural Affairs.

The jump was caused by farmers slaughtering fewer pigs as they waited for prices to rise, NBS Chief Statistician Dong Lijuan said on 14 October in a press release.

The number of live pigs started to drop around April as farmers became pessimistic about the outlook for pork prices, Galaxy Futures Co. Ltd. analyst Chen Jiezheng told Caixin. That led to a decline in pork supplies, which stopped prices from falling.

To keep prices under control, central and local governments have been releasing frozen pork from their reserves.

After April, when farmers saw pork prices increasing, they held off slaughtering hogs, hoping to sell them at even higher prices and at heavier weights, Chen said. "This drove a sharp rise in pork prices from June to July," he said.

To keep prices under control, central and local governments have been releasing frozen pork from their reserves. Some 200,000 tonnes were released in September, which the National Development and Reform Commission said was the most ever for a single month. Following an announcement on 19 October that it would release this year's sixth batch of frozen pork, the commission announced on 1 November the release of the seventh batch, saying that prices had failed to retreat to a reasonable range and gained more than 40% year-on-year between 24 and 28 October.

Analysts say they expect the period of rising prices in the current hog cycle to be shorter than in the past because of the changing structure of breeding, characterized by larger farms and greater efficiency. Farms have better access to market data, allowing them to gauge prices and trends more accurately.

Prices could fall back slightly in the fourth quarter but may stay high at the beginning of next year due to the Lunar New Year holiday, a period of peak demand, Galaxy's Chen said. He said he doesn't expect prices to come down until March 2023.

Hedging inflationary risks

Despite subdued overall inflation, analysts say the government should still prioritise the stabilisation of consumer goods prices and provide support to some low-income households to offset the impact of rising food costs.

"In addition to a prudent monetary policy, coordination of other policies is also needed," Yuekai Securities' Luo said. "The government needs to ensure stable domestic grain production, stable operations in the energy sector and sufficient pork supply to avoid price fluctuations."

The government does have ways to help low-income families. A subsidy mechanism created in 2011 can be triggered when the CPI or food prices hit certain thresholds.

Luo warned against the use of one-size-fits-all policies across industries and in Covid-19 prevention to avoid disruption to logistics and supply chains. He also proposed that the government offer subsidies to low- to middle-income groups to help them cope with rising living costs.

Officials said they have so far achieved stability in prices. Local authorities have "taken various measures to ensure the supply of important consumer goods and keep their prices stable," Dong from the NBS said in the 14 October release.

The government does have ways to help low-income families. A subsidy mechanism created in 2011 can be triggered when the CPI or food prices hit certain thresholds. Local governments set their own criteria based on a CPI threshold that was lowered to 3% from 3.5% in August.

More than 20 cities across China have handed out subsidies to low-income families to help with food and housing costs, multiple sources told Caixin in late September.

Fan Qianchan contributed to this report.

This article was first published by Caixin Global as "In Depth: Mild Inflation Hasn't Stopped Chinese Consumers Feeling Squeezed". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.