Overcoming uneven growth in China's poorer western provinces: Potential and challenges

China's central government and local authorities have continued to collaborate on infrastructure development of the western region, particularly in the improvement of the transportation system vis-à-vis rail development since the launch of the Western Region Development Strategy.

The 2,000 km Qinghai-Tibet railway, which began operation in the early 2000s, is the first railway to link the Tibet autonomous region with other provinces while the 1,786 km Lanzhou-Xinjiang passenger line is the longest in Northwest China. Most western provinces, including Tibet, Xinjiang, Sichuan, Chongqing, Guizhou, Inner Mongolia and Yunnan, have expanded the lengths of their railways to way above the national average.

High-speed (>=200km/h) rail, instead of conventional railway, has come to dominate rail transport linking the western region to the eastern and southern regions of China. The high-speed rail in the western region runs along the main cities of the New Western Land-Sea Corridor along the Belt and Road Initiative (BRI) route, from Chongqing municipality, Chengdu of Sichuan province, Xi'an of Shaanxi province, Guiyang of Guizhou province right up to Guangxi. Among them, the Chengdu-Chongqing high speed rail, Guizhou-Kunming section of Shanghai-Kunming high-speed rail, and Xi'an (Shaanxi)-Zhengzhou (Henan) high-speed rail are travelling at the full speed of 350km/h.

Apart from high-speed rail, other transportation infrastructures in the western region see robust fixed-asset investment. The western portion of the highway, waterway and other transportation infrastructure in terms of fixed asset investment has gradually increased from nearly 30% to over 40% since 2004. Among western provinces, Sichuan, Yunnan and Guizhou have made heavy investments in transportation infrastructure in recent years.

The developmental level of the western region seems tied to Sichuan province. The closer a province is to Sichuan, the better is its economic performance.

In its 14th Five-Year Plan (FYP), Sichuan has indicated its intention to spend 1.7 trillion RMB to enhance its transportation infrastructure, mainly to link with neighbouring provinces. It is set to become one of the most essential hubs linking east China and west China, and to play a vital role in terms of physical connectivity with the BRI.

A similar plan has been drafted in the 14th FYP of Shaanxi in which the high-speed rail centred on Xi'an connects to Chongqing, Baotou of Inner Mongolia and Shiyan of Hubei. As Yunnan has been assigned the special role of broadening China's connectivity with South and Southeast Asia, transportation infrastructure is hence one of the major items in the planning of Yunnan's 14th FYP.

Uneven urbanisation

The developmental level of the western region seems tied to Sichuan province. The closer a province is to Sichuan, the better is its economic performance. Considering the provincial GDP and per capita GDP together, only Sichuan, Chongqing and Shaanxi can make it to a highly competitive level. Yunnan and Guangxi have high GDP but low per capita GDP, while Inner Mongolia has high per capita GDP but average GDP.

According to the domestic 2020 Ranking of Cities' Business Attractiveness put together by The Rising Lab under Yical Media Group, main western cities Chengdu (100.0 point) of Sichuan province, Chongqing municipality (88.7 point) and Xi'an (79.9 point) of Shaanxi province are listed among "new first-tier cities". Kunming of Yunnan province, Nanning of Guangxi province, Guiyang of Guizhou province and Lanzhou of Gansu province are in the second tier, while Hohhot of Inner Mongolia Autonomous Region, Urumqi of Xinjiang Autonomous Region and Yinchuan of Ningxia Autonomous Region are in the third tier. Xining of Qinghai province and Lhasa of Tibet Autonomous Region are in the fourth tier (Table 1).

From the international perspective, according to data by the Globalisation and World Cities Research Network (GaWC) which measures a city's network connectivity or a city's integration into the world city network, the city rankings of the western region remain unchanged, although different categories are used. Chengdu, Chongqing and Xi'an are still the top cities of the western region classified under the Beta group, followed by Kunming in the Gamma group, and Nanning, Guiyang, Lanzhou, Hohhot and Urumqi in the Sufficiency group.

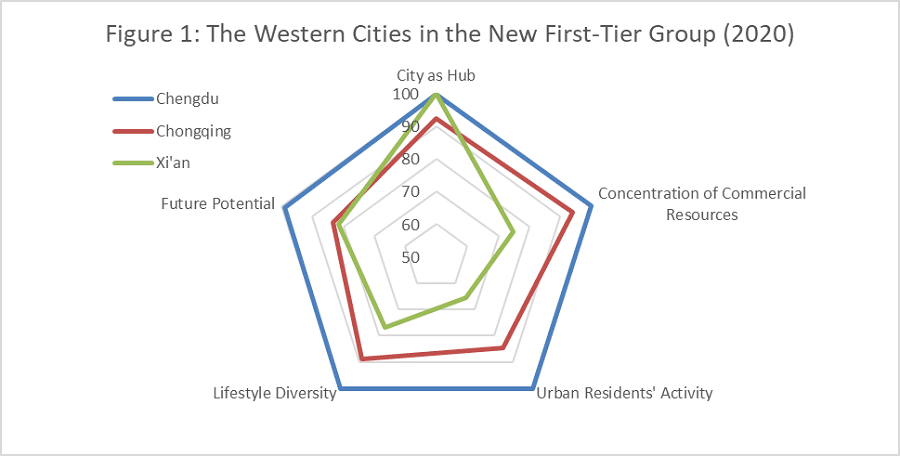

Among western cities in the New First Tier group, Chengdu performed well in all sub-indexes, especially in Concentration of Commercial Resources, Urban Residents' Activity and Lifestyle Diversity (Figure 1). Chongqing was a close second in all sub-indexes, followed by Xi'an, with moderate performance in most of the sub-indexes but did well in the City as a Hub Index and Future Potential Index. Xi'an is the only big city in the Guanzhong city cluster, making it a very important hub for the northwest region and for the BRI.

For the central-western region, the Chinese government planned to deepen city cluster development of the Greater Northeast region, Central Plains, Yangtze Mid-River Delta, Chengdu-Chongqing and Guanzhong. Some small and medium city clusters mostly in the western region, including Beibu Gulf, Central Shanxi, Hohhot-Baotou-Erdos-Yulin, Central Guizhou, Central Yunnan, Lanzhou-Xining, Ningxia along the Yellow River and the northern slope of Tianshan, were developed to support China's economic growth.

The western city cluster could also be divided into three groups based on population. Only Chengdu-Chongqing city cluster in the first group has a population of 57 million, a level that is similar to that of the Greater Bay Area city cluster (61 million) and Beijing-Tianjin-Hebei city cluster (54 million) in the eastern region. The second group includes Guangzhong city cluster and Beibu Gulf city cluster, both with a population of 17 million each. Other city clusters in the western region have a population of less than ten million; in particular, Ningxia along the Yellow River city cluster has a population of only three million.

In comparison, western city clusters can be clearly classified into three levels: the national level of Chengdu-Chongqing in Sichuan province, the regional level of Guanzhong in Shaanxi province and Beibu Gulf mainly in Guangxi province, and the local level of other city clusters. The classification is also supported by the synergy analysis of provincial performance: Sichuan is the best performer, followed by Chongqing, Shaanxi, Guangxi and Yunnan. The Guiyang of Guizhou province and the Hohhot of Inner Mongolia have competitive advantages; Guiyang, in particular, is the city with the highest economic growth rate after the Western Region Development Strategy was launched.

However, the fast-growing development of transportation infrastructure with higher fixed asset investment did not do a good job of mitigating the east-west development gap and in fact, enlarged the gap between provinces within the region.

Challenges and prospects

China has channelled great efforts into narrowing the development gap between eastern and western regions, particularly through enhancing the infrastructure on transportation connectivity between domestic networks and international linkages. The efforts have reaped certain gains, such as the China Railway Express that starts from Yiwu city of Zhejiang province through Chongqing municipality to European countries, which has become an important route that promotes western development.

However, the fast-growing development of transportation infrastructure with higher fixed asset investment did not do a good job of mitigating the east-west development gap and in fact, enlarged the gap between provinces within the region. The GDP of some western provinces such as Sichuan has reached top national level while nearly half of the western provinces have a GDP of under 1 trillion RMB after 20 years of economic development.

The lack of administrative coordination is slowing the progress of western region development among provinces, cities or city clusters. While the importance of city clusters has been emphasised in the recent 14th FYP, the Chinese central government is eager to break the administrative barrier by integrating the resources of some cities into a bigger agglomeration. In political reality, however, provincial economic performance rather than regional coordinated development is more important to an official's political career. As every province has its own FYP, there is a tendency for provinces to have the same targets for industrial development. Without the effective division of labour, it will result in wasted resources and unnecessary competition.

According to the guidelines of the 14th FYP, the Chinese government is also keen to adjust its factor market mechanism, including land, manpower, capital, technology and data, to enhance domestic circulation. The factor market reform is hence a relational adjustment between the government and the market. If the Chinese government allows more mobility for factors based on market principles, western provinces may receive more even development.