Tencent, ByteDance gut metaverse units in virtual reality check

Major staff cuts at the metaverse units of ByteDance and Tencent have highlighted the sometimes disorganised ways that big tech firms have handled investments in new businesses. Now, grand development plans have been shelved, not so much because of a looming regulatory risk, but because of the difficulties of navigating a vaguely defined sector with patchy overall demand.

(By Caixin journalists Ding Yi and Guan Cong)

They said it was the future of the internet.

Just months ago, China's big tech firms were talking up the potential of their shiny new "metaverse" units, which were set to cash in on an online revolution.

This latest attempt to wed virtual reality (VR) with things like shopping and social media was going to make holograms ubiquitous, spell the end of the office and reshape whole industries.ByteDance's and Tencent's downsizing of their metaverse units in recent months reflect the corporate cultures of such firms, and the sometimes disorganised ways they have handled investments in new businesses. Now, exciting ways of melding virtual reality (VR) with shopping and social media are shelved, not so much because of a looming regulatory risk, but the challenges of navigating a buzzy and vaguely defined sector with patchy overall demand.

So why have ByteDance Ltd. and Tencent Holdings Ltd. both turned around and gutted their metaverse units in recent months?

Insiders and experts told Caixin the answer was not some looming regulatory risk. They instead painted a picture of two software firms botching an expansion into a hardware-heavy business segment which remains buzzy and vaguely defined, with patchy overall demand.

The situation reflects the corporate cultures of firms like ByteDance and Tencent, and the sometimes disorganised ways they have handled investments in new businesses, insiders say.

But this time around, tech industry crackdowns and deteriorating economic conditions have forced a reality check. The firms lack the resources and appetite to invest what now seems required for a return.

As they tighten their belts, it has been a case of "last in, first to leave".

ByteDance had made a big bet on the metaverse in one of China's most closely watched deals of 2021, when in August it acquired Pico Interactive Inc., a developer of VR gaming headsets, for a rumored 10 billion RMB (US$1.5 billion).

Hype dashed

During an event held on 16 March to celebrate the firm's 11th anniversary, ByteDance CEO Liang Rubo reminded those present that e-commerce and information platforms - including TikTok and its Chinese sibling Douyin - were its bread and butter. He said the company would sharpen its focus on such mainstay businesses in the coming year. Implicit was that it would deemphasise its VR, gaming and education businesses.

It would have been little surprise to those present, given February's sudden staff cuts at Pico, ByteDance's main VR property. Those came after a hiring binge in 2022. The firm has also lowered its sales target for 2023 after its 2022 sales did not meet expectations, Caixin has learned.

ByteDance had made a big bet on the metaverse in one of China's most closely watched deals of 2021, when in August it acquired Pico Interactive Inc., a developer of VR gaming headsets, for a rumored 10 billion RMB (US$1.5 billion).

Some have seen the two giants' moves as a death knell for the metaverse frenzy that began in earnest when American social media giant Facebook Inc. rebranded as Meta Platforms Inc. in October 2021.

Tencent also began shedding staff from its metaverse-focused business division - the firm uses the term "XR", short for "extended reality" - early this year. It has since downsized the unit to a small team focused on VR content and related investment, Caixin learned from multiple company sources. Officially, the firm says it will continue to fund the development of XR devices.

Some have seen the two giants' moves as a death knell for the metaverse frenzy that began in earnest when American social media giant Facebook Inc. rebranded as Meta Platforms Inc. in October 2021. Facebook founder Mark Zuckerberg has sought to loudly signal that he is all in on the metaverse, with analysts pointing out that the flashy new direction came as the firm faced pressing issues like slowing earnings and a bruising congressional hearing about the effect of its apps on children.

Zuckerberg's bet has grown costlier for the San Francisco-headquartered firm, with its VR unit Reality Labs losing US$13.7 billion in 2022.

ByteDance and Tencent's metaverse divisions failed to achieve a major presence in a business widely hyped as the next phase of the internet, even after major investments as recently as last year.

As investors move on to the next thing, the metaverse hype has largely given way to hype over generative AI, embodied by OpenAI's ChatGPT program and its growing list of peers, including Baidu's Ernie Bot.

The pullback is also eroding the talent pool, explained Victor Yu, a partner at Shanghai-based headhunting firm Isaac&Kenneth Associates.

"The VR industry has cooled significantly, and demand for related talent is weak and uncertain," Yu said. There is now a concern among jobhunters that corporate metaverse units have an uncertain future. That means, for example, a hardware engineer who is weighing offers from an emerging carmaker and a top VR firm is more likely to choose the former than the latter, he said.

[Pico founder] Zhou adopted a cash-burning strategy entitling users to a refund worth half of what they paid for their headset if they used it for at least 30 minutes each day for 180 consecutive days.

Stumbles at Pico

After acquiring Pico, ByteDance put in a complex tripartite management system. Pico founder Zhou Hongwei was to oversee hardware and software algorithm development, marketing and branding, while Ren Lifeng, a founding member of Douyin, took charge of building a content ecosystem for its VR headsets. Ma Jiesi, a former head of Xiaomi Corp.'s VR business, led the team tasked with combining VR with social media.

In the middle of 2022, ByteDance significantly downsized its education and gaming divisions, which had been hit hard by Beijing's toughening regulations. Many affected employees were transferred to Pico, growing its headcount to around 2,000 people by September, from only 300 before the acquisition, Caixin learned.

Throughout the year, Pico invested heavily in marketing and expanding its content library to include things like concerts, films and TV shows in the hope of luring more consumers to buy its VR headsets. Zhou adopted a cash-burning strategy entitling users to a refund worth half of what they paid for their headset if they used it for at least 30 minutes each day for 180 consecutive days.

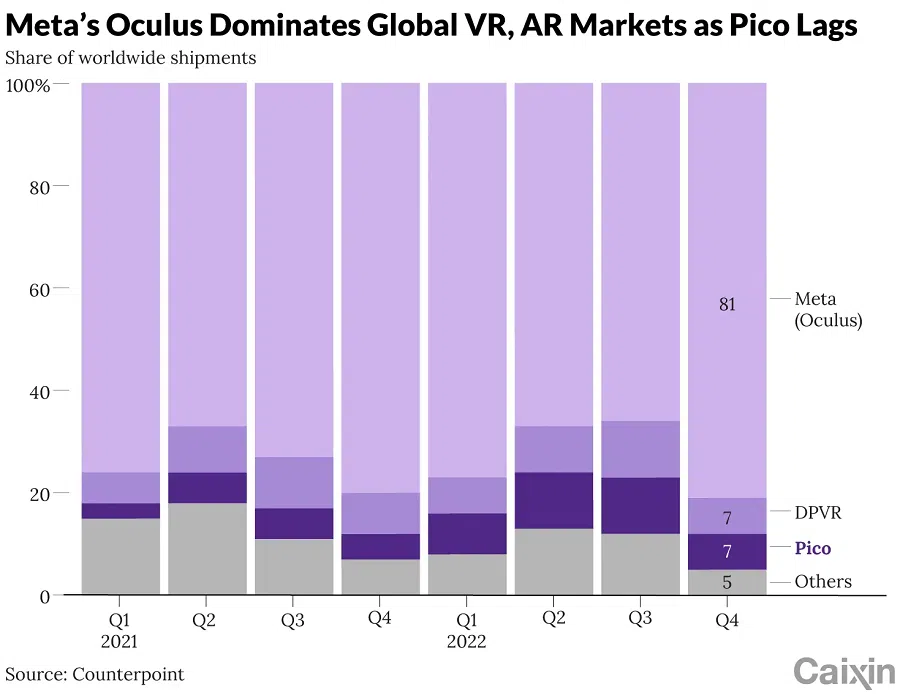

Another ambitious strategy put it head-to-head with Meta in overseas markets. At the end of 2021, Pico decided to pit itself against Oculus, the VR headset maker purchased by Meta in 2014. The goal was to boost Pico's overseas revenue to two or three times its domestic takings by the end of 2023.

In 2022, Pico sold approximately 700,000 VR headsets, falling significantly short of a target of 1 million, according to a source at ByteDance. But in a reflection of subdued general demand, the firm still took a 71% share of China's standalone VR headset market that year, according to market researcher IDC.

"In 2022, Pico indeed sold a lot (of VR headsets in China), but they lost money for every device they sold (because of the cash-burning strategy)," said an executive of a rival VR headset maker familiar with Pico's business.

Meanwhile Pico took just 9% of the global VR headset market in 2022, compared with Oculus' share of about 73%, according to market tracker Counterpoint Research. Pico's share was up from 5% the prior year.

At a recent annual staff meeting, Zhou acknowledged that Pico was struggling to compete against more mature products overseas, and said they needed to improve user experience and create more enriching content.

Uncertainty at Tencent

Over at Tencent, a similar shift has taken place. The firm established an XR team of 300 people in April 2022, with its senior vice-president and gaming tsar Steven Ma saying in June that the company would launch industry-leading VR hardware by 2026 or 2027.

It came four years after Tencent tested the waters with a VR headset named TenVR, which is now nowhere to be seen on the sales ranking lists released by major industry research firms.

A significant personnel change in November sparked concern among staff, when XR team chief Shen Li left Tencent. Shen was famed for leading the team that developed Tencent's VR poker game, which hit global gaming platform Steam in 2017.

Shen's departure came as Tencent took cost-control measures to maintain revenue and profit growth as it grappled with China's economic downturn, pandemic disruptions and regulatory scrutiny.

A key challenge for Tencent was how to integrate XR into its existing digital properties, such as WeChat, which has its own ecosystem.

Ma, who heads Tencent's Interactive Entertainment Group, remains bullish on the metaverse, according to a source with direct knowledge of his thinking. But whether the firm will pour more resources into it will depend on Tencent CEO Pony Ma. "Tencent does not see the metaverse as a central development direction," said the source.

A key challenge for Tencent was how to integrate XR into its existing digital properties, such as WeChat, which has its own ecosystem. An early plan had Tencent establishing a digital platform similar to Steam.

Tencent has made little progress in its attempt to acquire VR firms in order to build the platform, a person with knowledge of the matter said. That was partly because Tencent had failed to identify a suitable VR firm with the capacity to make its own VR hardware, the person said.

Industrial applications more promising

Despite the spate of pullbacks in China, there's no "concrete policy reason that's making companies think twice" about metaverse investment, said Tom Nunlist, a senior tech analyst at Trivium China, a consultancy.

Amid some eyebrow raising projections by local governments about the scale of their metaverse industries - the Shanghai satellite city of Suzhou has pledged its metaverse-related business will be worth 200 billion RMB by 2025 - policymakers at the national level have been "a bit more circumspect," Nunlist said, with a combination of supportive VR policies and occasional warnings about hype.

"Policymakers in China are much keener on the industrial applications of the metaverse than everyone else is." - Tom Nunlist, senior tech analyst, Trivium China

"National policymakers have tried to pour a little bit of cold water on local governments" by saying policy and goals need to be realistic and not just founded on hype, he said. But large firms pulling out of the space were more likely to be doing so for "idiosyncratic business reasons".

"In general, it reflects the optimisation of ByteDance and Tencent's business model," said Zhang Feng, a partner at V&T Law Firm who works with trade groups that focus on emerging technologies. Zhang said based on current technologies and market demand, both Pico and the XR team "may not have been able to identify sustainable and stable demand in the foreseeable future".

"Policymakers in China are much keener on the industrial applications of the metaverse than everyone else is," said Nunlist, giving the example of "digital twins" which can model real world systems such as a metropolitan rail network or an industrial production line, allowing planners to simulate tweaks to them.

"If that's what's being pursued, and entertainment and social media companies like Tencent or ByteDance leave [the space], it may not really matter," he said.

This article was first published by Caixin Global as "In Depth: Tencent, ByteDance Gut Metaverse Units in Virtual Reality Check". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: China's self-censoring chatbots face many challenges | Is a Chinese ChatGPT on the way? | China's growing digital economy does not guarantee a 'digital civilisation' | AI stars in China and the US lose their shine | Web3 with Chinese characteristics: Finding China's solution for regulators, developers and users | Tencent struggles to grow amid crackdowns and competition