[Video] Chinese brands making waves in Singapore's saturated beverage market

As I step into Singapore's Funan Mall on a regular Monday afternoon, I am greeted by a variety of stores displaying trendy merchandise, gaming equipment, bicycles and mobile phone accessories.

On the second floor, four Chinese characters stand out on a shopfront: "霸王茶姬" (bawang chaji). This is the first Singapore branch of the Chinese novel tea brand, ChaGee, set up in 2020. Currently, the franchise operates 12 stores islandwide.

Zhong Zhi Hong (钟志弘), general agent for ChaGee Singapore, opened the brand's first store in the midst of the pandemic. He said, "Funan is an excellent location, with a vibrant environment that is attractive to tech-savvy youths. Young white-collar workers, who love trying new things, occupy the co-sharing office space on the upper levels of Funan, and these people are our target customers."

ChaGee is one of the new coffee and tea brands from China entering the Singapore market as they expand their businesses to overseas markets. Other Chinese brands include HeyTea and Luckin Coffee. After gaining recognition after years in the Chinese market, these brands have chosen Singapore as their first foray overseas - what are the reasons behind this?

Digital transformation of a tradition

Firms such as Alibaba, Tencent and Baidu come to mind when one talks about China's internet sector. In fact, China's digital transformation has seeped into many traditional industries.

Be it in marketing, product development, choice of store location, or backend processes such as procurement and supply chain management, the use of technology has completely changed China's food and beverage industry. China has a long cultural history of tea drinking, but digitalisation and the mobile internet have brought about novel changes to this tradition.

The latest research from Momentum Works shows that Singaporeans top the list globally for per capita consumption of novel tea drinks, at S$87.26 (US$63.70) per year, roughly 16 cups each year.

This new generation of digitally-enabled companies grew from the highly competitive domestic Chinese market, and are now looking to gradually expand overseas. Many have chosen Singapore as their testing ground for overseas expansion.

Singapore currently has over 60 new tea and coffee brands, which satisfy an array of taste preferences and price ranges. Many consumers question whether Singapore would be able to house so many tea and coffee stores. Yet, industry sources reveal that there are still several Chinese novel tea brands that have their sights set on Singapore to expand their businesses.

Why is Singapore the first choice for various Chinese brands looking to go international? Vion Yau, head of insights at Momentum Works, pointed out that Singaporeans have very high spending power. Even though novel drinks are priced higher in Singapore than in China and other parts of Southeast Asia, Singaporeans are still fond of them, and would often patronise their favourite tea stalls.

Top per capita consumption globally

Furthermore, Singapore has a high percentage of ethnic Chinese, as well as new immigrants and Chinese nationals who are in Singapore long term. Along with the popularity of Chinese films, television dramas, online games and social media apps in Singapore, the locals have become more familiar with Chinese culture and brands. This makes it easier for novel teas and related products to be accepted by the Singapore public.

The latest research from Momentum Works shows that Singaporeans top the list globally for per capita consumption of novel tea drinks, at S$87.26 (US$63.70) per year, roughly 16 cups each year.

The consumer market in Singapore is open and diverse; locals are very receptive to new things, from American television dramas to South Korean girl groups and Chinese mobile games. Thus, the owners of novel tea brands believe that for each new flavour they introduce - no matter how quirky the combination - the market would welcome it.

For these businesses venturing overseas, what is even more valuable is Singapore's status as a cosmopolitan city with people from all over the world. For tea brands that want to continue opening stores in other parts of the world, Singapore would serve as a good testing ground for consumer preferences.

Leong Jia En, a 28-year-old engineer at Apple, makes frequent business trips to Shenzhen. She enjoys trying new tea brands in China and can't wait to do the same in Singapore. She remarked that Chinese consumers usually use mobile apps to place their orders in order to avoid long queues. The mobile app would also keep a record of their preferences, making their next purchase more convenient.

She added, "In China, there are more varieties of tea drinks to choose from compared with Singapore. I enjoy brands like ChaBaiDao (茶百道) and Ahma Handmade (阿嫲手作). The teas that contain ingredients such as mochi and yam paste make for a unique texture that is unexpected."

Luckin Coffee: using data to create new drinks

In China, the digitalisation of coffee and tea brands goes beyond building an app for advertising and drawing in members - it is deeply involved in the research and development (R&D) of new products, supply chain management, selection of store locations and other aspects of operations.

Luckin Coffee is a success story that stands out when it comes to using data to spur the development of new products. The coffee brand owns more than 10,000 stores in China, outnumbering the 6,500 stores that Starbucks has in the country.

In the past three years, Luckin Coffee has successfully launched at least one "wildly popular" drink each year in the Chinese market. In the process of R&D, they built a data-based digital system. For example, if the data show that a large portion of consumers prefer a chocolate coffee at 100% sugar level, it would be used as a reference for developing a new product, shortening the time-to-market for new products that they expect to be a hit.

Momentum Works' Yau said that Luckin Coffee uphold the dictum that data is king, digitally processing the information of various ingredients and flavours, and making use of quantitative tracking to record the drinks' popularity.

At the end of March this year, Luckin ventured overseas for the first time, landing in Singapore. In just over half a year, it set up 19 stores, and also released an app specifically for the local market. Even at the physical stores, customers can place orders through the app without needing to pay at the store counter. However, this also means Luckin is forgoing customers who want to make orders and payments via other methods.

HeyTea Singapore's head of brand Jonathan Chan said that since the use of smart equipment developed by the company, tea-making efficiency has doubled...

An advantage of making orders through the app is that Luckin would be able to capture all the data from their orders, while also collating data on consumer preference, the amount they spent, the time and location of their purchase, and other consumption information. The use of technology is not only limited to front-end sales and marketing, but can also be extended to supply chain, procurement and other processes.

HeyTea: quick and consistent tea-making

HeyTea was founded in 2012 in Jiangmen, Guangdong, and is a novel tea brand known for its drinks topped with a "milk cap" of salty, thick cream (奶盖茶). Toppings such as brown sugar pearls are also popular among customers. In 2017, the hype of HeyTea saw customers reportedly queuing for five hours.

HeyTea invests in the R&D of smart equipment, such as smart scales, tea-making machines, and automated grape peelers, to ensure that all their stores in China and overseas can churn out teas quickly while ensuring the consistent quality and taste of each cup.

HeyTea Singapore's head of brand Jonathan Chan said that since the use of smart equipment developed by the company, tea-making efficiency has doubled. A cup of tea could be made in 27 seconds, down from a minute, with even more precision.

For example, the smart equipment can chop fruit faster than a person, and the pieces would be of consistent size, ensuring that the texture of each bite is the same. The use of such equipment has allowed HeyTea to add on franchise stores without affecting the taste of their drinks, and the brand can expand even more rapidly in the future. Prior to using smart equipment, HeyTea insisted on only direct management of their stores.

Mixue created an entire line of products based off the "Snow King" character, and came up with a catchy song with just two lines - "you love me and I love you, Mixue Ice Cream & Tea, so sweet" (你爱我我爱你,蜜雪冰城甜蜜蜜)...

HeyTea developed and owns 70 patents, including a smart scale that can digitally manage a store's ingredients, using an algorithm to estimate how much of an ingredient a store would need to prepare at different times of the day, and remind store employees to promptly prepare the required ingredients in time via the ordering system.

This eliminates the need for humans to estimate with the eye how much ingredients to prepare, and the use of precise data also reduces wastage and the likelihood that a drink may sell out due to a lack of ingredients.

Mixue: 'Snow King' sweeps the region

A marker of success for a brand would be its ability to expand beyond its original scope of business. Mixue Ice Cream & Tea, which has over 22,500 stores in China, has had success with its social media marketing strategy, culminating in its creation of the "Snow King" IP. Not only did it give the brand a distinctive identity, but also attracted a host of Snow King fans.

Mixue created an entire line of products based off the "Snow King" character, and came up with a catchy song with just two lines - "you love me and I love you, Mixue Ice Cream & Tea, so sweet" (你爱我我爱你,蜜雪冰城甜蜜蜜) - which can be heard through the streets.

Fans from all over the world even came up with English, German, Korean, Vietnamese and other language variants. In August, Mixue also released a free-to-view 12 episode-long animated series called The Snow King Has Arrived on five Chinese online platforms, including Bilibili. Online rumours suggest that Mixue may someday construct a "Snow King" theme park, creating the Chinese version of Disneyland.

For an ice cream and beverage business to take the Snow King IP to such heights, where the popularity of Snow King goes beyond even that of the original scope of business, their online marketing strategy is indeed one for the books.

For such brands, a bigger challenge would be how to take the next step to expand into an even larger overseas market.

ChaGee: infusing youthful elements in traditional Chinese tea

In China, a drink from ChaGee called "Bo Ya Jue Xian" (伯牙绝弦, referring to a Chinese allegory about bosom friends) sold 20 million cups annually. Three years ago, ChaGee successfully expanded to Singapore, Malaysia and Thailand through franchise agents. The brand is centred around "national culture" and "tea", seeking to infuse youthful elements into traditional Chinese tea.

Tea originated from China and flourished in the Tang and Song Dynasty, making its way to the Western countries via the ancient Tea Horse Road and the Silk Road. ChaGee's Zhong views novel tea drinks as a renaissance for tea culture. He opined that coffee drinking only has a few hundred years of history, but it has already developed different brewing methods and ideas. That is all the more reason for tea, which has a history of 4,000 to 5,000 years, to be given a new form, be consumed in a different fashion, and spread to all corners of the world for more people to sample the joy of tea-drinking.

For such brands, a bigger challenge would be how to take the next step to expand into an even larger overseas market. HeyTea Singapore's Chan shared that they actively promote the superior ingredients in their drinks on social media sites and have received positive feedback from the Singapore and UK markets.

Momentum Works's Yau suggested that Singapore's food and beverage businesses can learn from the success stories of these brands, especially on the use of technology and the quick response to market demand.

She pointed out that China's novel tea and coffee businesses actively make use of technology and data to guide their marketing strategy and product development, which sets them apart in terms of their operating model when compared with traditional beverage companies. The data-driven strategy has allowed businesses to quickly understand consumer preferences, collate feedback and create popular products, while also managing inventory on the fly and procuring the necessary ingredients.

Compared with consumers in China, Singapore's tea drink enthusiasts lean towards low-sugar, low-calorie and guilt-free options.

How can novel tea and coffee drinks be healthier?

Coffee and tea brands that set up shop in Singapore must adjust to the various local requirements. This includes making freshly prepared drinks healthier and more in line with Singaporeans' demand for drinks with less sugar.

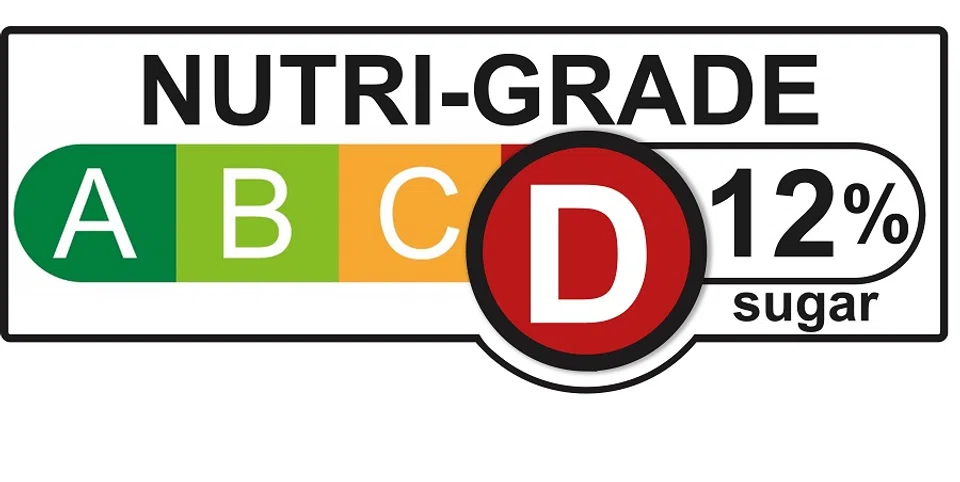

Singapore's Nutri-Grade labelling for nutrition will expand at the end of this year to include freshly prepared drinks, which must be labelled A, B, C or D, with A-grade indicating drinks with the lowest amount of sugar and saturated fat, and D-grade the highest.

Several tea brands such as HeyTea and ChaGee told Lianhe Zaobao that in order to adjust to this new labelling requirement, they have adjusted the recipes and ingredients used for their drinks, to ensure that their items sold in Singapore are healthier. HeyTea would use fresh fruit in their tea, with the sweetness level determined by natural fruit sugars. HeyTea had already observed that Singapore consumers prefer drinks with milder flavours or are less sweet, compared with Chinese consumers.

Drinks promoted by ChaGee both in China and overseas mainly use fresh milk and are low in sugar content. Compared with consumers in China, Singapore's tea drink enthusiasts lean towards low-sugar, low-calorie and guilt-free options. To ensure their products receive an A or B Nutri-Grade label, the ChaGee team in Singapore has been making improvements to their current line of products, such as changing the brand of fresh milk used in their drinks.

ChaGee's Zhong stated that with the implementation of the new scheme, consumers would be more health conscious and care more about the sugar and calorie content of drinks, as well as whether other ingredients are healthy. Such a change is both a challenge and an opportunity for businesses that build their brand on healthy tea drinks.

TCM physician: avoid cold drinks

Although drinking tea has health benefits, the different ingredients as well as the temperature of the teas would have different effects on a person. Traditional Chinese medicine (TCM) senior physician Li Bing Mei said that those with heat-deficient or cold physical constitution should avoid drinking cold beverages. According to TCM principles, different teas and fruits have either "cooling", "warming" or "neutral" properties, and have varied influences on the human body.

Li advised that those with a cold disposition can add herbs such as tangerine peel, ginger powder and cinnamon to their cold drinks to strike a balance. From the perspective of TCM, although a cold drink can have a temporary cooling effect, in the long run, it could be detrimental to the spleen and cause indigestion, pain from stomach bloating, or even diarrhoea. Hence, those with a weak spleen should avoid cold drinks.

This article was first published in Lianhe Zaobao as "新世代中国茶饮进驻狮城遍地香".