Will China's inward economic shift lead to a closed society?

On 1 September, at a meeting of the Central Commission for Comprehensively Deepening Reform, Chinese Communist Party (CCP) General Secretary Xi Jinping reiterated the need to promote deeper reform and greater opening up, to more rapidly build a new development pattern where domestic and foreign markets complement each other, with the domestic market as the mainstay.

"Domestic circulation" (内循环) has been a hot phrase in China's media in recent months. The first time it caught attention was when Xi used it during a Two Sessions meeting on 23 May when addressing financial sector members of the Chinese People's Political Consultative Conference, where he called for "steady progress in creating a new development pattern where domestic and foreign markets can boost each other, with the domestic market as the mainstay".

Since the China-US trade war began in 2018, China-US relations went from spiralling downwards to a total free fall.

Subsequently, Xi brought up the same concept at an entrepreneurs forum on 21 July, a CCP Politburo meeting on 30 July, and in speeches on 20 and 24 August. More careful observers would find that Xi's phrasing escalated from "steady" in May to "more rapid" on 30 July.

Now, domestic and external markets are set to be included in the 14th Five-Year Plan, leaving no more doubt. This target is suddenly urgent, and definitely has to do with growing US pressure on China over the past couple of years, and especially the past few months.

China relying on itself for an economic lifeline

Since the China-US trade war began in 2018, China-US relations went from spiralling downwards to a total free fall. From additional tariffs to restricting the export of chips, limiting the number of Chinese journalists in the US, tightening student visas, closing embassies, forcing the sale of TikTok, down to expressing intentions of restricting the activities of Chinese diplomats in the US, America has pressed its way forward, looking like it wants to cut itself off from China in terms of technology and trade. China cannot help but look to its domestic market to safeguard its economy.

In the 1990s, China became known as the "world's factory", but for many years remained stuck in an awkward economic model of having its markets and resources both overseas.

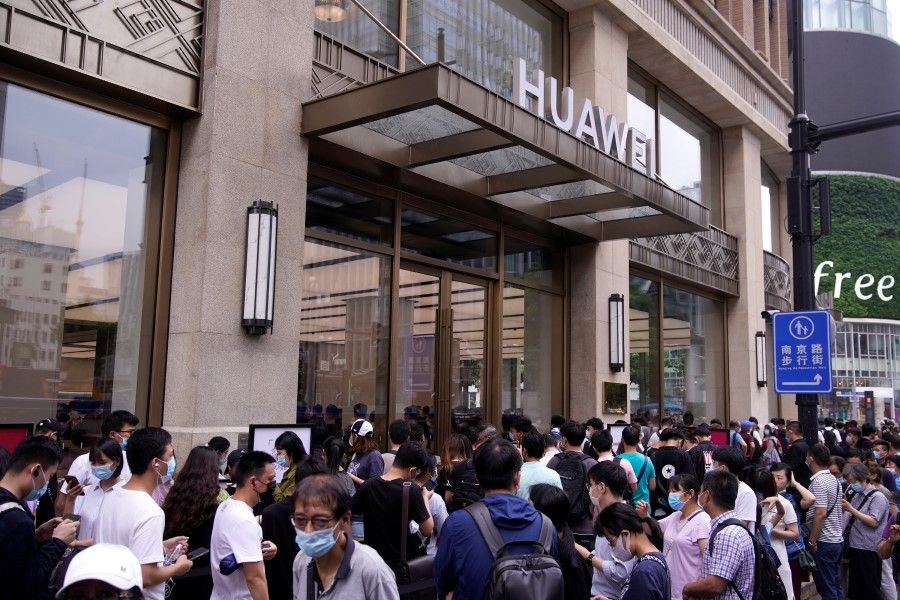

And with America's containment measures forcing successful Chinese tech companies to retreat to China, coupled with the latter's domestic political climate, the Chinese official line on domestic markets has stirred concerns that China might be forced to close itself off or even lock its borders.

From an economic perspective, this is worrying too much. It has been quite a while since China sought to strengthen domestic spending, and boost growth and reduce over-reliance on foreign markets through domestic demand. When reform and opening up began in the 1980s, a poor and backward China depended on cheap labour and low-end processing and trade - at the expense of the environment - to create an economic miracle and rapid growth that lasted for years. In the 1990s, China became known as the "world's factory", but for many years remained stuck in an awkward economic model of having its markets and resources both overseas. To put it simply, investments and core components came from overseas, and markets were also overseas, and China was only earning money from processing.

Statistics show that after joining the World Trade Organization (WTO), China's reliance on foreign trade has been growing, crossing 50% for the first time in 2003, and reaching 67% in 2006. In comparison, the reliance of developed countries like the US and Japan on foreign trade is less than 30%.

... many commentaries have mentioned the constraints on consumer spending due to low income and high property prices, and advocate pushing through village land reforms, property taxes, and urbanisation...

The authorities also recognise that this model is not sustainable and have been seeking to change, managing to bring reliance on foreign trade down to 50.1% in 2011, and 31.8% in the first half of this year. Last year, final consumption expenditure contributed nearly 60% to China's GDP. So, it has been years since China began reducing reliance on foreign markets.

Given that China wants to make its domestic market the mainstay, it will focus on raising people's incomes and spending. This is good news for the ordinary people. Over the past few days, many commentaries have mentioned the constraints on consumer spending due to low income and high property prices, and advocate pushing through village land reforms, property taxes, and urbanisation, to increase people's incomes so that they are able to spend on more products and services.

In terms of incomes in China, there is still a lot of room for improvement. According to official figures for 2019, China's per capita disposable income last year was 2,561 RMB (S$511). And at this year's Two Sessions, Chinese Premier Li Keqiang revealed that 600 million in China have a monthly income of just 1,000 RMB. These low figures show that ensuring a smooth "domestic circulation", would markedly raise incomes and relieve people of high property prices.

Besides, focusing on domestic markets will also help to boost the growth of the domestic market for modern services, for example industries such as leisure, education, and eldercare, and will also stimulate consumption.

Politically-motivated worries of China being 'closed' again

China's leaders emphasise that this new development is definitely not leading to a closed domestic market. In fact, this would be difficult, because China has what it takes and a strong motivation to participate in global competition. As long as the West cannot totally contain China, then China will not be "closed". On the contrary, with domestic and foreign markets complementing one another, China might achieve more balanced improvement of its people's lives.

Hence, the authorities need to watch for "domestic circulation" of viewpoints and thoughts after the economic part is achieved.

However, some people instinctively worry that having domestic markets as the mainstay means that China will go back to its old ways of being closed off. This concern does not stem from economic considerations, but vibes they get from taking in information and looking at the political situation.

All these years, China has moulded its bureaucracy, economy, media, and internet discussion to be focused on discipline, while encouraging technological innovation and lowering debt risks, and riding on that success to withstand the trade war and coronavirus. This has also contributed to a widening perception gap between China and the rest of the world. Hence, the authorities need to watch for "domestic circulation" of viewpoints and thoughts after the economic part is achieved. That is the main reason that concerns have arisen.