Beijing unrattled despite weak Q2

While China's housing market and exports are down, its consumption figures look to be improving and there are bright spots in the renewable energy and semiconductor sectors, says China research analyst Chen Long. A huge stimulus is unlikely to be in the offing, as Beijing still seems convinced that a more organic rebound, while slow and gradual, is better than a quick, policy-driven one.

Second quarter (Q2) economic data is out, showing that China's economy is facing greater challenges, from a faltering real estate market to falling exports. Meanwhile, consumer spending has stayed on a steady track to recovery. The government is moving cautiously to loosen policies on the real estate market, but the possibility of a major stimulus remains very low as officials believe that a return to confidence is just a matter of time.

The National Bureau of Statistics (NBS) reported 6.3% year-on-year (yoy) real GDP growth for Q2. This is well below expectations and implies just 3.3% two-year annualised growth. However, the NBS also reported higher-than-expected quarter-on-quarter real GDP growth at 0.8%. The two data points do not quite match each other, but the reason for the discrepancy is unclear; this has happened several times. In the first half, real GDP grew by 5.5% yoy, higher than the 5% growth target.

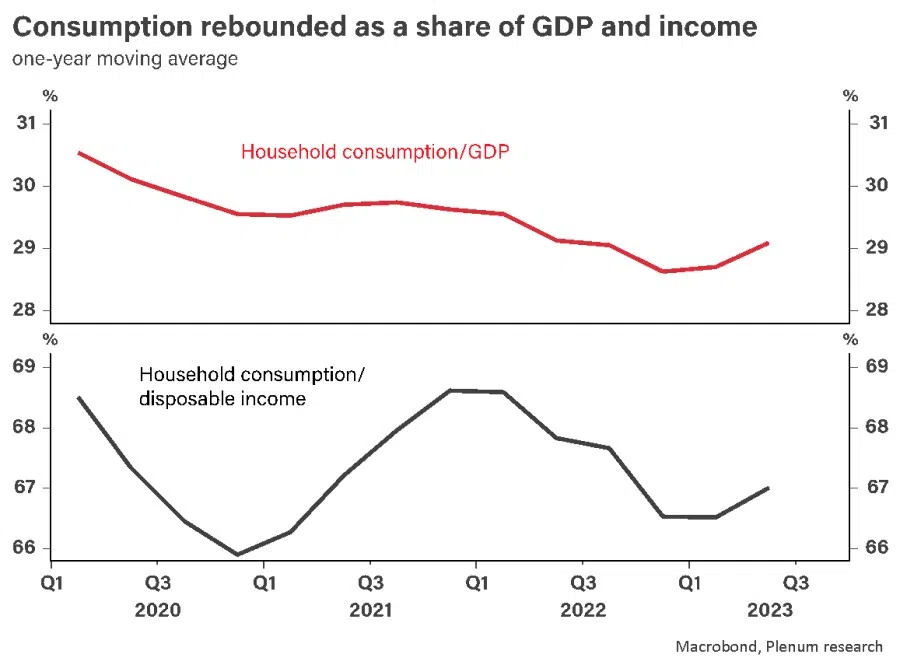

On a one-year moving average basis, household consumption also rebounded both as a share of GDP and as a share of disposable income. The trend of excessive saving appears to have finally turned the corner.

Housing sector and exports down

The biggest drag on the economy is still the housing market, and things grew grimmer in June. Published yoy growth of new home sales deteriorated further to -18%, but the reality may be worse, as the numbers may be artificially boosted due to the NBS's continued downward revision of last year's sales. If we compare this year's growth with the original data from last year, yoy growth would be -28%. Construction starts also fell by 31% yoy.

Exports fell 13% yoy in June, the worst since February 2020. The weakness is no longer limited to exports to developed markets; exports to emerging markets are now also suffering. Exports to ASEAN, a bright spot earlier this year, were down 16.9% yoy in June.

One relatively good piece of news is that domestic retail sales were slightly better in June, with headline growth of 3.1% yoy. This looks significantly slower than April and May, but that is just because of the base effect. From a two-year annualised perspective, June was the strongest month in Q2. In this category, catering continued to see the strongest improvement, while spending on consumer goods was mediocre.

Household consumption in general recovered faster in Q2. Nominal consumption per capita was up 11.9% yoy, much faster than nominal GDP growth (4.8%). On a one-year moving average basis, household consumption also rebounded both as a share of GDP and as a share of disposable income. The trend of excessive saving appears to have finally turned the corner.

Another positive surprise is that industrial value-added beat expectations with 4.4% yoy growth. Everything related to renewable energy remained extremely strong. Semiconductor output is on the way up from a cyclical bottom. Despite the housing market downturn, crude steel production has stabilised thanks to low inventory.

Looking forward, neither the housing market nor exports are expected to rebound in the third quarter (Q3). They both face a high base from last year, and demand does not seem to be growing very quickly. High frequency data show abysmal housing sales in the first half of July. Meanwhile, consumption, especially service consumption, should keep recovering as post-Covid normalisation continues.

... we do not think there would be a huge stimulus (despite the rumours to the contrary).

No big bazooka

Beijing has announced a few more easing measures since the ten basis points (bps) interest rate cut last month, including an extension of easier rules on bank lending to the real estate market as well as some subsidies on furniture purchases, but they are nowhere near as big as many had hoped. The People's Bank of China (PBOC) kept policy rates unchanged for July.

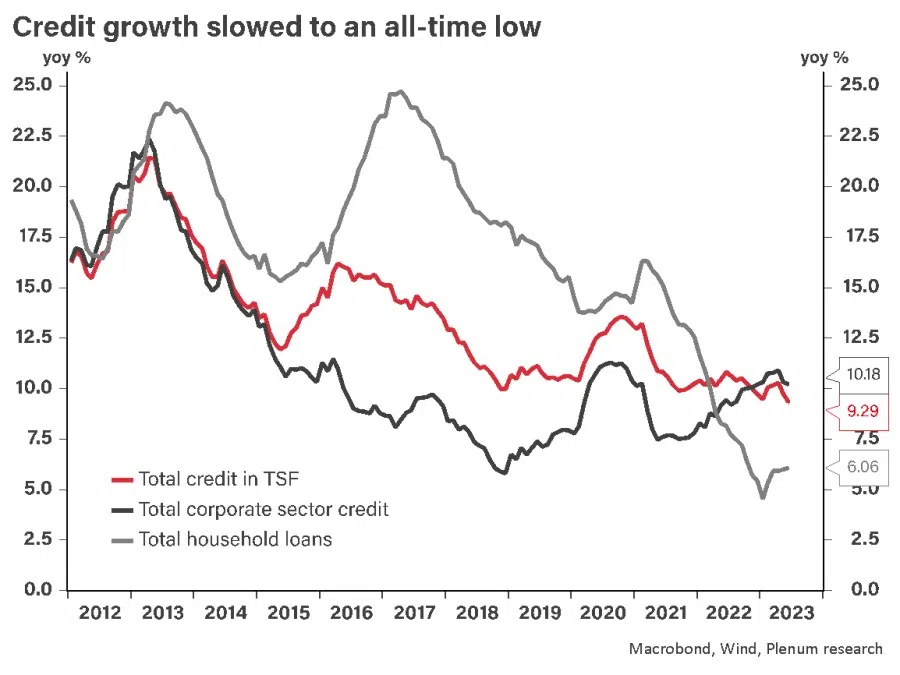

The limited policy easing has not delivered a turnaround in credit growth, which is one of the most important indicators for the economy. Although new credit in June beat expectations, total credit growth decelerated to 9.3%, the slowest it has ever been. Local government bonds and corporate bonds were both issued at a much smaller scale than a year ago, and shadow finance continued to shrink.

To be clear, we do not think there would be a huge stimulus (despite the rumours to the contrary). Beijing only has tools to stimulate three major types of domestic demand: infrastructure spending, consumption and housing.

Infrastructure spending is still rising, but growth is unlikely to accelerate much more after years of advanced construction. Local governments are also facing serious debt issues, restricting them from borrowing too much for new construction.

In terms of consumption, Beijing is very critical of the Western approach of cash handouts. It usually prefers targeted boosts for two main sectors: automobiles and home appliances. The auto sector enjoyed a tax cut in the second half of 2022, and another cut is unlikely to follow so soon. The performance of the home appliance market is largely dependent on housing sales, so sales will not recover much without a real estate boom.

This leaves the housing market as the only viable option for more policy support. However, we must stress that the best-case outcome would be that new home sales stay flat this year at about 1.1 billion square metres. It is unrealistic to expect Beijing to deliver a big housing boom like in the old days.

The primary reasons are structural. Changes in urbanisation, demographics and living space mean that China's new home demand has greatly fallen, projected at about 1 billion square metres per year in the next few years. A dramatic increase in sales this year would only be followed by a more dramatic decline in the next few years, which is not in Beijing's best interest. Stabilisation is a good outcome because it serves the short-term need to avoid a hard landing and means Beijing can avoid a more sudden decline in the future.

It is likely that consumer price index (CPI) growth will fall into negative territory in July before starting to bottom out after Q3, when the base effect fades. The producer price index (PPI) should also hit bottom in Q3.

But the measures so far are underwhelming even against our expectations. We expected some policy easing in tier-1 cities, such as lower down payments or looser purchase restrictions on housing, but even this has failed to materialise so far. At this rate, there is a real risk that the housing market will face another double-digit decline in sales this year.

Some recent remarks by officials have further convinced us that the easing measures will stay targeted and narrow, aimed at protecting the downside instead of delivering a big boom. The upcoming July Politburo meeting, where central officials usually hammer out economic policy for the second half (H2) of the year, is unlikely to deliver any huge surprises.

PBOC deputy governor Liu Guoqiang said at a press conference on Friday that it takes most countries about a year to fully normalise from Covid, and China is only halfway there, implying that the market should remain patient. He also refuted the chatter about deflation, claiming that the dip in the consumer price index (CPI) is just temporary.

We share his view on the CPI. While core CPI growth also softened slightly to 0.4% yoy, the main drag is still the price of energy, which has a high base from last year. It is likely that CPI growth will fall into negative territory in July before starting to bottom out after Q3, when the base effect fades. The producer price index (PPI) should also hit bottom in Q3.

Another senior PBOC official said at the same presser that the central bank has made huge efforts to stabilise the real estate market and that some policies aimed at curbing the housing bubble can be refined at the margin.

Beijing is also employing a soft approach to boost market confidence. Most recently, it is trying to encourage Chinese private firms after spending months reassuring foreign ones.

However, he refused to endorse a more forceful move such as a coordinated cut in interest rates of existing mortgages. Some were set at the Loan Prime Rate (LPR) plus a premium, so they are still high after the recent LPR cuts. Instead, he said banks are encouraged to renegotiate their contracts with individual borrowers, without specifying what incentives the PBOC will offer to make this happen.

Beijing still seems convinced that a more organic rebound, while slow and gradual, is better than a quick, policy-driven one.

Outside of hard policy, Beijing is also employing a soft approach to boost market confidence. Most recently, it is trying to encourage Chinese private firms after spending months reassuring foreign ones.

Premier Li Qiang chaired a symposium with Chinese platform companies to show his support last Wednesday. Four months into his tenure, this happened later than anticipated. Still, it is the highest profile event for private entrepreneurs this year so far. Senior executives from most major domestic tech firms attended, but the event did not include household names such as Jack Ma or Colin Huang.

The symposium took place just days after the punishment of Ant Group was announced. The timing suggests that Beijing's three-year rectification campaign against overly ambitious private business interests is finally coming to an end. Beijing wants people to know it is ready to turn the page and hopes that this will help bring confidence back.

Related: Politics a threat to China's economy | Dual circulation strategy revisited: China deepens integration with the global economy | Salvaging China's economy: Economic growth is meaningless if the society is ruined | Has the pandemic left a 'permanent scar' on the Chinese economy? | China needs to rethink its regulations and governance of the platform economy | China's burgeoning e-commerce cyberspace and its ever more complex regulations

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)