China's all-out effort to fund infrastructure and save the economy

Amid the economic slump due to the unpredictable Covid-19 situation, China is increasing its investments in infrastructure in efforts to jumpstart domestic demand and boost economic recovery. While profitable projects are hard to find, the renewables, technology and water management sectors are set to benefit from the government's push. However, the risk of inflation and rising cost of raw materials could limit the boost to economic growth.

(By Caixin journalists Luo Guoping, Chen Xuewan, Bai Yujie and Kelsey Cheng)

Renewable energy, technology and water management projects are set to be among the largest beneficiaries of China's latest infrastructure investment boom, the likes of which has not been seen since the global financial crisis.

Policymakers are doubling down on infrastructure in the second half of the year, putting more than 1 trillion RMB (US$149 billion) in additional funding to work as they try to revive the economy, which just recorded the weakest quarterly growth since early 2020 in the second quarter.

Few other options than infrastructure investment

Tough measures implemented in line with the country's "zero-Covid" policy have weakened consumption and slowed exports. Apart from small-scale handouts of consumption vouchers, policymakers have been hesitant to transfer cash directly to consumers, so to jumpstart domestic demand and hit the country's annual growth target of around 5.5%, there are few other options than infrastructure investment.

Local governments already printed special-purpose bonds (SPBs) at a record pace in the first half of the year, while in June Beijing added 800 billion RMB to its policy banks' credit quota and ordered the lenders to sell 300 billion RMB worth of bonds under the country's "all-out" infrastructure investment campaign.

"...profitable projects are not as easy to find this time." - Zhang Liao, Chairman of Shanghai Jumbo Consulting Co. Ltd.

However, compared with the 4 trillion RMB investment round the government went on between 2008 and 2009 to stimulate the economy during the global financial crisis, profitable projects are not as easy to find this time, Zhang Liao, chairman of infrastructure advisory firm Shanghai Jumbo Consulting Co. Ltd., told Caixin.

As a result, some projects are expected to benefit from the construction drive more than others.

Projects related to digital infrastructure such as 5G base stations and data centres, as well as water conservancy, and wind and solar power farms, are seeing strong growth due to policy support and increased funding, according to analysts and industry insiders. Urban gas supply projects are also expected to benefit due to much-needed upgrades to decades-old pipeline networks.

'All out' effort

The National Development and Reform Commission (NDRC) approved 48 fixed-asset investment projects in the first five months of this year worth a combined 654.2 billion RMB - equal to more than 80% of the total investment amount for the whole of 2021.

And by the end of June, local governments had nearly maxed out their annual SPB quota to fund infrastructure and public welfare projects, having issued 3.41 trillion RMB in new paper, or 93% of the total, according to data from China's Ministry of Finance.

Projects that the funds are earmarked for have already seen an increase in investment, the latest data published by the National Bureau of Statistics (NBS) show.

Railway and road projects - the main target of investment in the wake of the global financial crisis - often have lengthy approval processes and construction cycles, meaning that they take a long time to boost economic growth.

For example, utility infrastructure - production and supply of electricity, heat, gas and water - saw investment growth of 15.1% year-on-year in the first six months of 2022, while investment in water conservancy, environment and public utility management grew 10.7% year-on-year in the same period, according to NBS data published 15 July.

By contrast, investment in railway and road transport dropped 4.4% and 0.2% respectively, in the same period, the data showed. Railway and road projects - the main target of investment in the wake of the global financial crisis - often have lengthy approval processes and construction cycles, meaning that they take a long time to boost economic growth. Meanwhile, many parts of the country are saturated by transport networks, hence limiting the potential for growth.

"The country has formed a proper network of railways, highways and airports," Zhu Changzheng, a Beijing-based independent macroeconomic analyst, wrote in a commentary in early April.

"There may be some room to expand infrastructure in the fields of digital infrastructure and soft infrastructure, such as data centres and public service facilities," he said.

...create a new computing network system that integrates data centres, cloud computing and big data, by taking advantage of western China's huge renewable energy resources to store, process and analyse data from the eastern region...

New capital towards new infrastructure

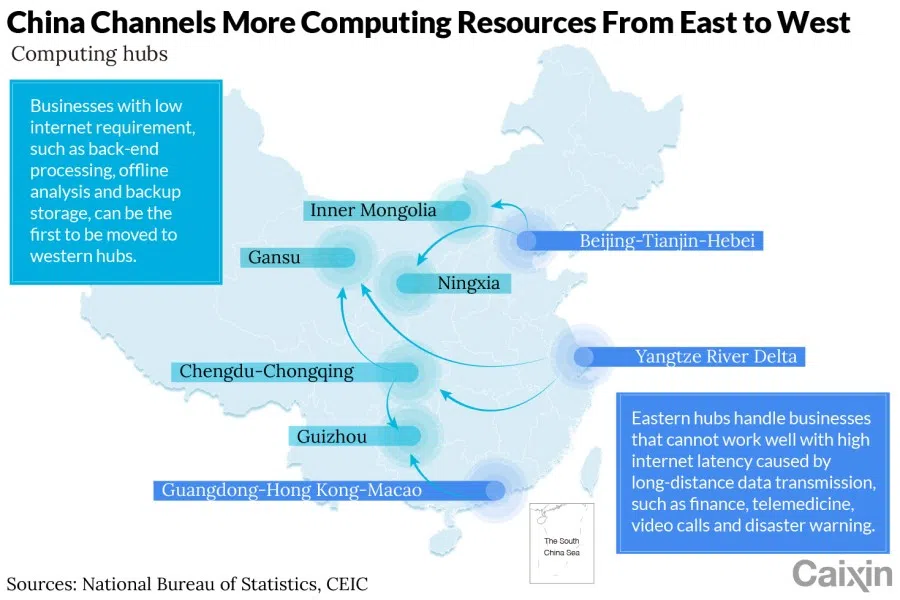

Projects falling under the NDRC's "new infrastructure" category, elaborated in April 2020, can expect an injection of fresh capital following the rollout of major state initiatives, such as the ambitious Eastern Data and Western Computing project.

Launched in February, the plan is to create a new computing network system that integrates data centres, cloud computing and big data, by taking advantage of western China's huge renewable energy resources to store, process and analyse data from the eastern region, where most of the country's internet industry is based.

The new-infrastructure label applies to three broad groups:

- Information, including 5G networks, Internet of Things technology, artificial intelligence (AI), cloud computing, blockchain applications and data centres;

- Integration, such as smart transportation and smart energy infrastructure based on big data and AI;

- Innovation, covering projects with public benefits that support scientific research and technological development.

Zhu Jia, managing director at US investment firm Bain Capital Private Equity LP, told Caixin that he expects new-infrastructure investment to accelerate in the second half of this year, driven by demand for reliable high-speed broadband for remote work, online entertainment, and consumption under the pandemic.

China has begun building its first batch of large-scale wind and solar power projects in desert and Gobi areas, including in the far north of the country.

Renewable energy

Development in the energy sector, meanwhile, is booming largely due to China's commitment to carbon neutrality. Under its "dual carbon" goals, the country aims to peak carbon dioxide emissions before 2030 and ultimately be carbon neutral by 2060.

"As rapid growth of the country's electricity consumption requires a stronger commitment to ensuring power supply, we expect infrastructure investment in new energy including solar and wind power, and in energy grids, to maintain a relatively high growth rate," analysts at Citic Securities Co. Ltd. said in a May research note.

To wean itself off polluting fuel, China has begun building its first batch of large-scale wind and solar power projects in desert and Gobi areas, including in the far north of the country. The development, announced by the NDRC and the National Energy Administration late last year, is expected to add an installed capacity of more than 97 gigawatts (GW).

In February, the authorities revealed plans for a second set of projects, which are set to add 455 GW of clean energy by 2030.

But in the meantime, China has to continue using traditional fuels; consequently, it is pumping cash into gas infrastructure.

Urban pipelines

Investment in gas production and supply projects grew 18.1% year-on-year in the first five months, faster than two other utility production and delivery sectors - 12.1% for electricity and heat and 8% for water, NBS data show. That was followed by an order from the State Council, China's cabinet, in June for a complete refurbishment of the country's ageing urban gas, water and heat pipelines, with a deadline of the end of 2025 for gas pipelines. Parts of the networks are dangerously deteriorated and have caused accidents including gas explosions, an NDRC official said in a question and answer session that month.

It will take between 200 billion RMB and 300 billion RMB to fully revamp the country's aged urban gas pipelines and corresponding facilities...

"Investment standards weren't high back in the day [when the gas pipes were built]," said Zhang of Shanghai Jumbo Consulting. "They have been operating for 20 years and leakages are frequent. We've definitely arrived at a new cycle of renewal or reinvestment."

It will take between 200 billion RMB and 300 billion RMB to fully revamp the country's aged urban gas pipelines and corresponding facilities, such as leak detectors and meters, people with knowledge of the matter told Caixin.

Managing water

Investment in water conservancy management jumped 12.7% year-on-year in the first six months of 2022, faster than 11.8% in the first five months, according to the NBS.

In the first five months, completed investment in the sector already topped 310 billion RMB - a 54% increase year-on-year, said Wei Shanzhong, a vice minister of the Ministry of Water Resources, at a 10 June press briefing. Investment in water conservancy management projects is expected to reach at least 800 billion RMB this year, according to Wei.

A significant portion of that will likely be in flood control and water diversion projects, said Xu Bin, head of industrials and infrastructure for Asia-Pacific at UBS Securities Co. Ltd. Areas of the country near major rivers have been hit by deadly floods in recent years, such as the deluge in Zhengzhou, Henan province, last summer, which killed hundreds of people.

The nation's uneven distribution of water resources and increased need for farmland water conservancy in rural revitalisation projects are also expected to prompt more investment in the area over the next two years, Xu told Caixin.

Uncertain impact

Beijing's commitment to infrastructure stimulus is ultimately in the hope that it can spur growth in the economy as soon as possible. And some analysts have responded positively to the move.

A team led by Robin Xing at Morgan Stanley upgraded their forecast for annual infrastructure investment to grow between 9% and 10%, up from the previous 5%, which they expect will support a gradual GDP growth recovery in the second half of the year, according to a 5 July note.

Economists led by Lu Ting at Nomura Holdings Inc. and the analysts at Citic Securities have also predicted a 10% growth in infrastructure investment this year.

However, some analysts have also warned that growth in infrastructure could be undermined by rising costs of raw materials, which would limit the sector's capacity to stimulate economic growth.

If inflation is taken into consideration, real infrastructure investment growth may be below 5% this year, said Nomura economists.

In addition, uncertainties surrounding China's Covid-19 situation have slowed construction activity and purchases of equipment. In May, domestic purchases of excavators fell 44.8% year-on-year to 12,179 units, according to data from the China Construction Machinery Association.

"We believe the zero-Covid strategy and still-sluggish property sector will remain major drags on infrastructure construction." - Nomura economists

As Covid-19 controls were eased in June, building activity did pick up again, with the NBS' Purchasing Managers Index for the construction industry rising to 56.6 from 52.2 in May, but analysts said that risks posed by resurging Covid-19 infections remain a threat to the sector and broader growth.

"We believe the zero-Covid strategy and still-sluggish property sector will remain major drags on infrastructure construction," Nomura economists said in a note in late June.

This article was first published by Caixin Global as "In Depth: China Doubles Down on Infrastructure to Spur Growth". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)