[Big read] Transform or be annihilated: How Taiwanese businesses are dealing with US tariffs

With the US as Taiwan’s largest export market, Taiwanese businesses are expected to bear the brunt of the US’s reciprocal tariffs. Lianhe Zaobao journalist Chuang Hui Liang speaks with academics and industry insiders to find out more.

Initially set to expire on 9 July, the 90-day pause on reciprocal tariffs set by US President Donald Trump has been extended to 1 August. Although Taiwan’s Executive Yuan said that there was “constructive progress” made in the second round of US-Taiwan tariff negotiations on 25 June, the US’s sudden announcement on 2 April to impose a 32% tariff on Taiwan (excluding semiconductors) has left Taiwan extremely cautious this time, especially the industrial sector.

“Where should the supply chain move next?”

At the Taiwan Future international summit organised by Business Today in June, Hazel Chen, head of Tax at KPMG Taiwan, recalled the anxious calls from colleagues and businesses in Taiwan while she was on vacation in early April.

... so shocking that even Taiwan Premier Cho Jung-tai admitted he “nearly fainted”.

A rate below 20% ‘would be good’

Looking back at Taiwanese manufacturers’ evolution — from the MIT (Made in Taiwan) era of the 1970s, to the westward expansion into mainland China in the 1980s, and the New Southbound and New Eastbound policies from the 1990s onwards — Chen praised the globally unmatched flexibility and experience of Taiwanese companies in managing global supply chains. However, in the face of US tariffs of at least 10% for many countries: “There’s no going back to the way things were.”

Taiwan imposes an average tariff of around 6.5% on US imports, and just this past March, Taiwan Semiconductor Manufacturing Company (TSMC) announced an additional US$100 billion investment in the US. Previously, most in Taiwan had predicted US tariffs on Taiwanese goods would range between 15% to 20%.

In recent years, Taiwan has benefited from rising demand for artificial intelligence (AI), with its export ratio to the US climbing steadily. Taiwan has become the sixth largest source of US trade deficit, and in response, Trump proposed a steep 32% tariff based on blunt calculations — so shocking that even Taiwan Premier Cho Jung-tai admitted he “nearly fainted”.

Professor Dachrahn Wu from the Department of Economics at National Central University told Lianhe Zaobao that the US has over US$400 billion worth of imports from three countries, namely mainland China, Canada and Mexico. In 2024, Taiwan’s exports to the US totalled US$116.3 billion, but its trade surplus with the US reached US$73.9 billion, exceeding Canada’s surplus of more than US$60 billion.

... it is estimated that the tariffs Taiwan faces may fall between 15% and 25%. “If negotiations can bring the rate below 20%, that would be good.” — Professor Dachrahn Wu, Department of Economics, National Central University

He said that even the UK, which has a trade deficit with the US, is still subject to tariffs of at least 10%. In contrast, Taiwan has shown a high level of cooperation — major semiconductor companies such as TSMC have invested in the US. Furthermore, Taiwan has also agreed to help construct a natural gas pipeline in Alaska and to increase purchases of American weapons and agricultural products.

Therefore, it is estimated that the tariffs Taiwan faces may fall between 15% and 25%. “If negotiations can bring the rate below 20%, that would be good,” Wu added.

Industries likely to shift to US and Mexico

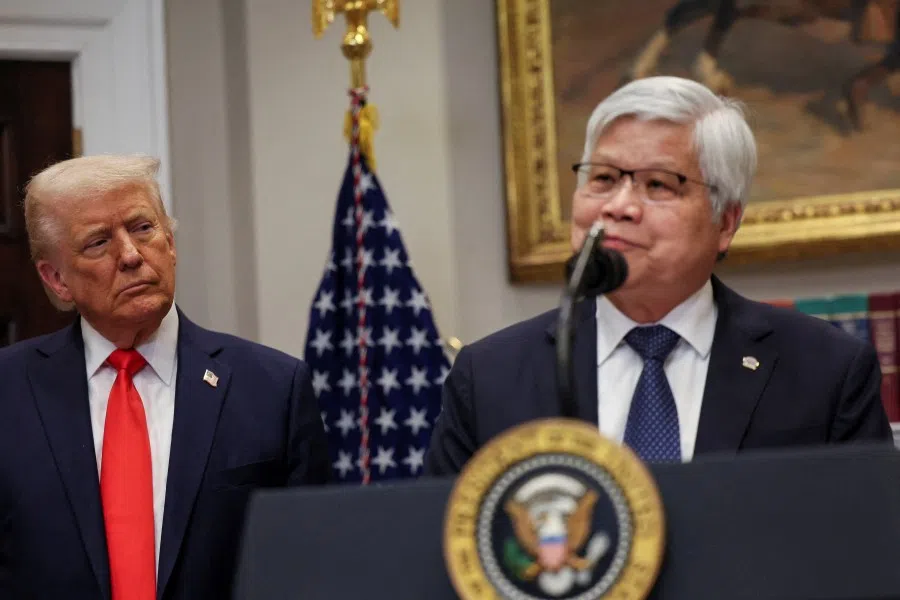

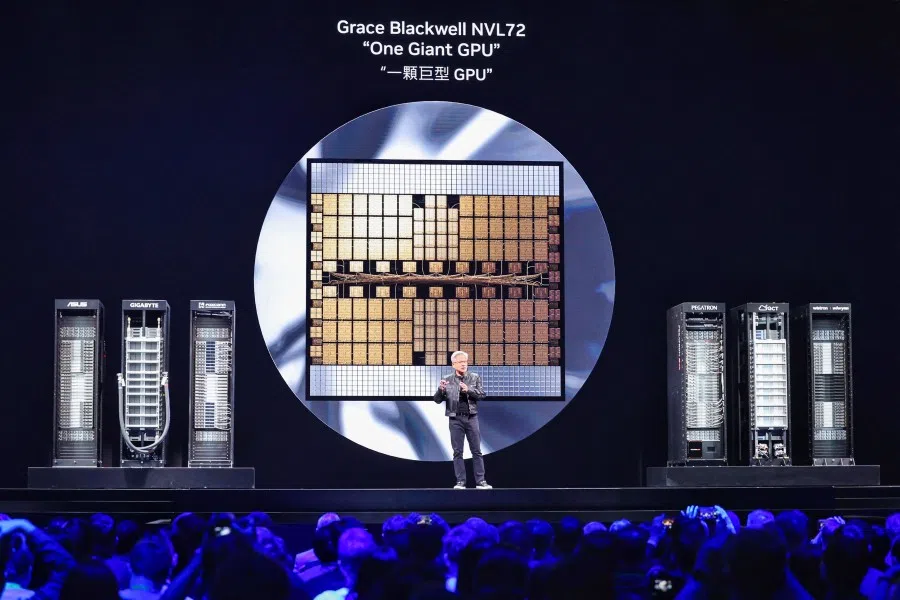

Washington aims to use tariffs to pressure countries into increasing investments in the US, and the complete semiconductor supply chain — from TSMC and beyond — is one of the most coveted. Given TSMC’s globally unique and irreplaceable position in advanced manufacturing processes, it can pass on the cost of a 32% tariff. Meanwhile, other major Taiwanese electronics firms such as Foxconn, Quanta Computer and others among Taiwan’s Big Five tech manufacturers are also accelerating their investment plans in the US.

Liu Pei-chen, head of the Taiwan Industry Economics Database under the Taiwan Institute of Economic Research, said that semiconductors and information and communications technology (ICT) from Taiwan are shifting to the US, especially servers and large automotive components for electric vehicles.

In the long run, laptop and personal computer supply chains will most likely split into “red” and “non-red” camps, with the latter focused on the US market and peripheral components for the non-red supply chain increasingly being manufactured in the US. — Wang Jiann-Chyuan, Vice-President, Chung-Hua Institution for Economic Research

She said, “The US has always been after semiconductors. American companies are also applying pressure, hoping to source locally. Besides TSMC, Advanced Semiconductor Engineering (a major chip packaging and test manufacturing company) is also considering it, along with GlobalWafers for silicon wafers, and suppliers of consumables, factory operations, equipment and distribution. The supply chain will gradually shift, but not all companies will be able to follow. In the short term, Taiwan’s supply chain will still be comparatively complete and cost-efficient.”

Wang Jiann-Chyuan, vice-president of the Chung-Hua Institution for Economic Research, added that AI servers, chips, high-end automotive components and advanced machine tools will gradually shift to the US due to their high profit margins, while low- to mid-end automotive parts and machine tools may slowly move from Southeast Asia to Mexico. While Trump has set Mexico’s tariff rate at 30% on 12 July, it has yet to be finalised; if it ends up lower than expected, it may attract investment from manufacturers targeting the US market.

In the long run, laptop and personal computer supply chains will most likely split into “red” and “non-red” camps, with the latter focused on the US market and peripheral components for the non-red supply chain increasingly being manufactured in the US. Meanwhile, production for printed circuit boards will be divided, with high-end boards made in Taiwan and low-end ones in Southeast Asia.

... highly competitive giants like TSMC will follow a “winner-takes-all” trajectory and continue to grow larger. In contrast, small and medium-sized enterprises that lack the capacity for global expansion... will be affected... — Liu Pei-chen, Head, Taiwan Industry Economics Database, Taiwan Institute of Economic Research

‘Winner-takes-all’?

Taiwan Industry Economics Database’s Liu highlighted that due to differences in industry scale, the semiconductor sector will most likely take an M-shaped development pattern.

She explained that highly competitive giants like TSMC will follow a “winner-takes-all” trajectory and continue to grow larger. In contrast, small and medium-sized enterprises that lack the capacity for global expansion — such as those involved in mature or low- to mid-end process technologies — will be affected by China’s pricing advantages and may shrink further. For example, smaller integrated circuit design firms and second-tier foundries have been making changes, but their future still warrants close observation.

TSMC had urged the US Department of Commerce to exempt semiconductor tariffs in order to prevent increased costs of building factories in the US, which could delay the progress of the Arizona plant’s construction. At the same time, this would also impact global supply chain integration, weaken the competitiveness of customers’ products, and lead to a decline in demand for the semiconductor application market. The US has yet to make a decision on semiconductor tariffs.

With over 70% of Taiwan’s exports to the US coming from the semiconductor and electronic information sectors, Taiwan’s Ministry of Economic Affairs views Section 232 of the US Trade Expansion Act of 1962 as particularly critical. This provision allows the US to investigate and impose tariffs on imports deemed a threat to national security.

To avoid potential trade disruptions, the ministry emphasised that Section 232 should be a key topic in US-Taiwan trade talks, ensuring that Taiwan’s high-tech exports are not unfairly targeted. It also urged Taiwanese companies to strengthen their competitiveness by embracing AI development and low-carbon innovation, as national security and industrial policy become increasingly interconnected.

... because information and communication technology, audiovisual products and AI servers were mainly sold to the US, the US thus surpassed mainland China to become Taiwan’s largest export market.

US is Taiwan’s largest export market

With the extended 90-day global tariff exemption, Taiwanese manufacturers took the chance to ride the export wave and achieve impressive results again. From January to May 2025, exports grew by 24% in US dollar terms and 27% in Taiwan dollar terms, far more than the single-digit growth of other countries.

The Taiwan Institute of Economic Research pointed out that in May, information and communication technology and audiovisual products surpassed electronic components for the first time to become the largest export product, with a growth rate of 110% and accounting for the largest proportion. Moreover, because information and communication technology, audiovisual products and AI servers were mainly sold to the US, the US thus surpassed mainland China to become Taiwan’s largest export market.

Since 2018, Taiwanese companies have aligned with former US President Joe Biden’s policy of friendshoring, by relocating factories from mainland China to Vietnam and other Southeast Asian countries or Mexico. When Trump took office, he saw countries like Vietnam and Mexico as locations for mainland China’s transshipment, which made it difficult for Taiwanese businesses to avoid tariffs no matter where they moved. Furthermore, the electronic supply chain is very complex, and most companies would not have the extra resources to relocate again.

According to a CEO economic outlook survey by CommonWealth Magazine at the end of 2024, over 60% of Taiwanese businessmen planned to increase investment in Taiwan. However, the latest survey showed that less than 30% plan to expand production in Taiwan in the next three years, while 24.6% of them plan to increase production capacity in the US. In fact, Taiwanese businessmen are more inclined to find a new path that is “non-US, non-China”.

However, National Central University’s Wu felt that intention is one thing, but having the ability to follow through is another. He said, “From investing in factories to hiring employees, these are major decisions impacting livelihoods, while these companies must also answer to shareholders. Trump’s policies have a high degree of uncertainty, so Taiwan companies have no choice but to proceed with caution when considering investments.”

Taiwanese firms cautious amid Trump’s unpredictability

Relocating supply chains is a tall task, and since the US launched a trade war in 2018, Apple was forced to set up a separate production base in India. However, currently, only 10% of its production capacity is in India, while costs have increased significantly with issues such as inadequate employee training. Because of this, Taiwan’s Foxconn expanded its investment in Zhengzhou, China, last year.

If tariffs in Vietnam and other countries are similar to those in China, “under the US’s comprehensive blockade, many investments could flow back to China — the US could end up with nothing to show for all that trouble.” — Wu

TSMC founder Morris Chang has long criticised America’s chip manufacturing push as “a wasteful, expensive and futile exercise” with costs being 50% higher. TSMC CEO C. C. Wei also described the investment process in the US as “undergoing challenges with blood, sweat and tears”.

The Democratic Progressive Party government hopes to reduce dependence on mainland China, but National Central University’s Wu opined that this is unachievable. The proportion of Taiwan’s exports to mainland China and Hong Kong has dropped from a peak of 43.9% of the total in 2020 to 31.7% in 2024, but further reduction would prove difficult.

Wu boldly assessed that in the past, the US trade war targeted only mainland China, forcing Taiwan companies to retreat to Southeast Asia, in turn benefiting Vietnam. Now, although China’s economy is flailing, its land prices have decreased and the cost of production factors is attractive. If tariffs in Vietnam and other countries are similar to those in China, “under the US’s comprehensive blockade, many investments could flow back to China — the US could end up with nothing to show for all that trouble.”

Global tariff outcomes would undoubtedly affect industry supply chain trends, but due to Trump’s unpredictability, academics and experts still recommend that until tariffs are finalised, it is best to stay the course in response to the myriad of changes.

“The US imposes tariffs to increase jobs for its own workers, yet our government grovels at their feet — it’s unfair to Taiwan’s workforce.” — Tuan Wei-chung, Chairman, TPMLU, a Taiwanese machinery labour union

Taiwan’s traditional manufacturing sectors in danger

“Fortunately, the other party said they would pay the tariffs first and let the goods in; otherwise, I have no idea what to do.” Shortly after the Qingming Festival holidays in early April, the sudden imposition of a 32% tariff by the US shocked many Taiwanese manufacturers exporting to the US. A New Taipei City manufacturer of automotive parts such as car lights and handlebars told Lianhe Zaobao that they are still shaken.

However, Taichung’s machine tool manufacturers are not that lucky. Tuan Wei-chung, chairman of TPMLU, a Taiwanese machinery labour union, said, “Machine tool exports have halted, and Taiwanese firms that set up factories in the US are losing money because of the big cost increases on goods negotiated before the tariffs introduced on 2 April. Everything’s been stopped, and everyone’s just waiting to see what happens.”

Trump’s reciprocal tariffs are set to take effect, impacting the overseas production bases of Taiwanese firms operating in mainland China and Southeast Asia. Taiwan’s Lai Ching-te administration hopes to negotiate a “zero-tariffs” regime with the US, but many industry players are worried. To make matters worse, the New Taiwan dollar has appreciated about 10% against the US dollar since May, dealing another blow to traditional industries.

Citing the auto industry as an example, Tuan noted that Taiwan sold 450,000 cars last year, with approximately half of the sales attributed to imported vehicles and the other half to vehicles manufactured by six domestic brands. If tariffs on US car imports to Taiwan are reduced, the market share of domestically made cars will shrink. If sales are sluggish, workers will inevitably be pared down. Some automakers are already working just four days of the week.

He warned that traditional manufacturing sectors, such as screw production, are on the brink of collapse under the weight of escalating tariffs. Without timely government intervention, the entire industrial chain risks being “wiped out,” potentially leaving hundreds of thousands of workers without livelihoods.

TPMLU, together with over 60 grassroots unions in Taoyuan and Kaohsiung, among others, have formed the Taiwan Labor Action Coalition in Response to Tariff Impact, urging the government to inform the US during negotiations about the effects on various sectors.

Tuan said, “The US imposes tariffs to increase jobs for its own workers, yet our government grovels at their feet — it’s unfair to Taiwan’s workforce.”

Bleak prospects across the board

Chung-Hua Institution for Economic Research’s Wang analysed at a new economy forum in early June titled “Tariff Shock: A Global Trade Realignment” that after the relocation of the high-tech sector, some industries are hollowing out. In particular, traditional sectors are under multiple pressures, which could threaten economic stability and dampen employment confidence.

These pressures include the weakening yen, which greatly challenges Taiwan’s machine tool and petrochemical industries — even at similar costs, Japanese products are of higher quality than Taiwan’s. Next, screw and nut manufacturers are forced to explore options elsewhere, which would raise supply chain costs. Also, with Chinese dumping, traditional industry leaders such as Formosa Plastics and China Steel Corporation face bleak prospects.

Although the government has allocated NT$93 billion (US$3.2 billion) for industry and employment support in a special budget in the hope of cushioning against tariff shocks, industry practitioners and academics believe that it is far from sufficient.

Wang said that if manufacturing falters, pay cuts and unemployment will follow. The service sector will be dragged down, and household incomes will fall. While the stock and housing markets may temporarily look good due to the New Taiwan dollar’s surge and hot money inflows, these bubbles will not last without fundamental support.

As a result of the 90-day tariff pause, which has now been extended to 1 August, tech and some traditional industries are racing to ship products before the deadline.

Due to this rush of orders, the Directorate General of Budget, Accounting and Statistics (DGBAS) upgraded its economic forecast: 5.35% growth in the first half of the year due to AI and high-performance computing demand, but just 1% projected for the rest of the year, leading to a 3.1% growth rate for the year.

However, National Central University’s Wu pointed out that DGBAS’s 1% projected growth for the second half of the year assumes that reciprocal tariffs imposed on Taiwan, Japan and South Korea are capped at 10%, while tariffs on mainland China are at 30%, which represents the most optimistic case. However, if Taiwan faces tariffs of 15% or 20%, economic growth would not reach 1%, and the economy would very likely enter recession in the second half of the year.

“Because of Taiwan’s small market, developing moulds for precision parts is not cost-effective, and industry practitioners are unwilling to invest. Meanwhile, mainland China offers a massive market and low costs, so when Taiwanese businesses can’t source parts, they are forced to import via Vietnam instead.” — Tuan

Guarding against ‘origin laundering’

To prevent mainland Chinese goods from evading US tariffs by rerouting through Taiwan and falsifying their origin, the Taiwanese government has increased personnel and resources for investigations, to gain a stronger position in trade negotiations.

TPMLU’s Tuan told Lianhe Zaobao that since last year, the government has imposed strict checks on parts related to mainland China. For example, it introduced a specified percentage of locally produced parts that must be included in Chinese car models assembled in Taiwan — 15% in the first year, 25% in the second, and 35% in the third. Increasing the local content rate is to prevent “origin laundering”.

However, he also pointed out, “Because of Taiwan’s small market, developing moulds for precision parts is not cost-effective, and industry practitioners are unwilling to invest. Meanwhile, mainland China offers a massive market and low costs, so when Taiwanese businesses can’t source parts, they are forced to import via Vietnam instead.”

This article was first published in Lianhe Zaobao as “美国关税漩涡逼近 台商避险负重前行”.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)