Building bridges, not walls: Tan Yinglan steering Asia’s venture capital through global rivalries

How does a boy who carried his schoolbooks in a rice sack grow up to lead a venture capital firm driving innovation across Asia? Lianhe Zaobao senior writer Woon Wei Jong speaks with Insignia Ventures Partners founder Tan Yinglan on trust, growth and global challenges.

From Primary One through Secondary Two, Tan Yinglan carried his schoolbooks in a plastic rice sack sturdy enough to hold five kilograms of rice, with two cloth straps sewn on as handles.

That durable rice-bag schoolbag stood out and reflected his knack for making full use of things, as well as his unique sense of thrift and practicality. Today, he has a similar bag hanging on the wall of his office, with a short inscription beneath that sums up his youthful credo: “From Rice Bag to Chic: Zero Cost, Pure Utility.”

Simple frugal life

Tan, 44, is the only child of retired Chinese language teachers Tan Lian Pheng, 82, and Ng Guek Im, 77, who taught at St Andrew’s Primary School and Raffles Girls’ Primary School, respectively. As part of Singapore’s simple-living pioneer generation, frugality was a big part of what they instilled in the family.

Tan recalled that during his childhood, he had no extra toys, tuition classes or overseas trips, and his greatest pleasure was reading for free at the bookstores in Bras Basah Complex.

Through reading a lot and memorising English essays, he gradually became fluently bilingual. He was proud that his parents were teachers, and he dreamed of nurturing the next generation, while hoping to apply knowledge in economics.

After graduating from Hwa Chong Junior College, he applied for a Ministry of Education teaching scholarship, hoping to study economics at the University of Cambridge in the UK and eventually return to teach. However, his parents persuaded him to take a different path.

Tan said frankly that leaving the government service was “the hardest decision”. At the time, Southeast Asia’s venture capital scene was still in its infancy, and the risk of failure was relatively high.

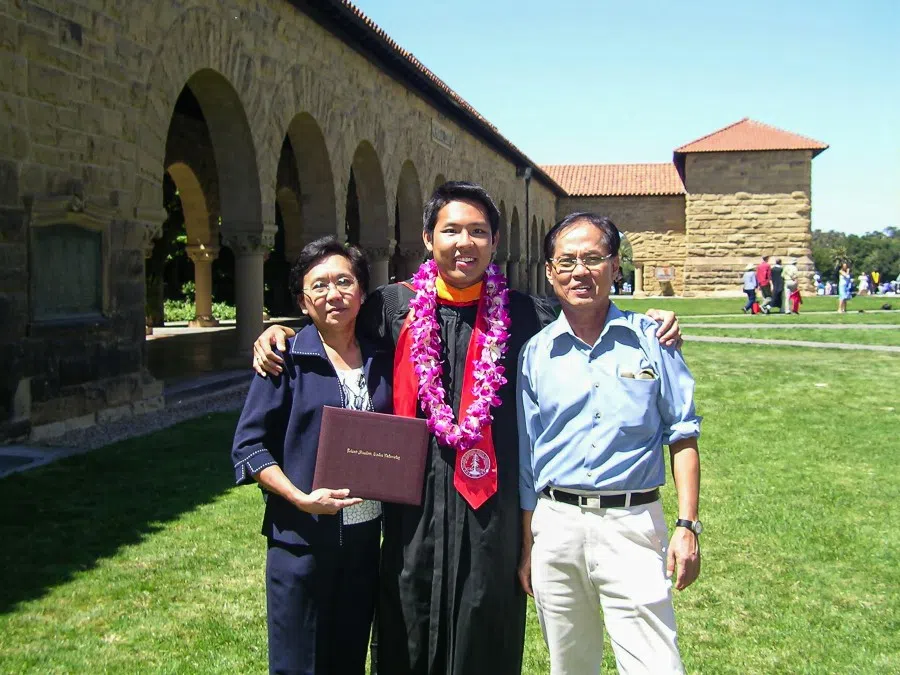

In the end, he received the prestigious Public Service Commission Overseas Merit Scholarship and went to the US, where he earned dual degrees in Economics and Electrical & Computer Engineering at Carnegie Mellon University, followed by a Master’s in Management from Stanford University. Upon returning to Singapore, he served for six years as an Administrative Service Officer, holding key positions at the Ministry of Trade and Industry and the National Research Foundation under the Prime Minister’s Office (PMO), where he gained extensive experience in policymaking and management.

Leaving government service the ‘hardest decision’

After completing his service bond with the government, Tan gave up the stability of an elite civil service career to break into venture capital, throwing himself into the risky world of startups. In 2012, he joined Sequoia Capital, where he worked for five years, and in 2017, he founded Insignia Ventures Partners.

Tan said frankly that leaving the government service was “the hardest decision”. At the time, Southeast Asia’s venture capital scene was still in its infancy, and the risk of failure was relatively high.

His wife, 46-year-old semiconductor engineer Yeh Huei Yu, said her husband’s choice was an unusual gamble. “It isn’t easy to secure a top Administrative Service post, and once you leave, it’s very difficult to return.” That was why the couple spent more than half a year discussing before he made the leap.

“I trusted his sense of what he’s good at and what he’s interested in. Since my job was pretty stable, I figured letting him go after what he really wanted was the best way to avoid regrets. As his wife, supporting him was just natural.”

Taiwan-born Yeh was Tan’s classmate in Stanford’s master’s programme in management. After Tan graduated and returned to Singapore, he first fulfilled national service, earning about S$400 (US$315) a month, as was customary for overseas scholarship recipients. At the time still his girlfriend, Yeh made her “first venture investment in life” by following her modestly paid soldier boyfriend to Singapore to look for work. Their relationship eventually blossomed into marriage, and they now have one daughter and two sons. When Tan left the PMO, their eldest daughter Yu Tong was only four years old.

... when he worked at the PMO overseeing enterprise innovation and development, it was like being a referee; when he moved into international venture capital, it was like stepping onto the pitch as a player...

The Liverpool FC fan said that when he worked at the PMO overseeing enterprise innovation and development, it was like being a referee; when he moved into international venture capital, it was like stepping onto the pitch as a player; and when he founded his own fund and academy, it was like being both the club owner and the coach.

He explained: “In innovation and entrepreneurship, if you don’t become a player yourself, you can’t truly understand how players feel. I also asked myself: if I don’t make this choice, will I regret it when I’m 70 or 80?”

Leaving the government was a major decision, so Tan sought guidance from his seniors. He met with then GIC (Government of Singapore Investment Corporation) Group president and former head of Civil Service Lim Siong Guan. Tan recalled that Lim’s advice was to first fulfill his scholarship bond and to focus on Southeast Asia and technological innovation.

Tan took that to heart. He only resigned after completing his bond, and once he embarked on entrepreneurship, he kept his attention firmly on Southeast Asia and tech-driven growth.

Back in 2012, Southeast Asia’s venture capital market had yet to attract much attention from global funds. Tan foresaw that the region’s nascent tech innovation sector would grow rapidly, and that the next wave of capital would pour in, making it crucial to establish an early foothold. To prepare, he first joined Sequoia Capital, where he learned the fundamentals of managing venture risk and built up his network. He also participated in several successful projects that yielded significant returns.

Anticipating Southeast Asia’s takeoff

After five years at Sequoia Capital, Tan judged that Southeast Asia was on the verge of taking off. He proposed spinning off a dedicated Southeast Asia fund, but the company felt the timing was not yet ripe and suggested waiting another five years. Unwilling to miss the window of opportunity, he struck out on his own and founded Insignia Ventures Partners, positioning it as “a Southeast Asian early-to-growth stage technology venture capital firm”.

During the first year of his startup, to save costs on business trips, he often stayed in “third-rate hotels without hot water”.

In general, venture capital is a more specialised form of startup investing, usually targeting tech-innovation companies. The outcome is uncertain, and the risks are high — but if successful, the rewards are equally significant.

Tan described Insignia as “like his fourth child”. Jokingly, he said that raising his 17-year-old daughter Yu Tong, 14-year-old son Yu Hong, and 10-year-old son Yu An is already a “money-burning enterprise”. He hopes Insignia (禹徽, Yuhui), by contrast, can “pioneer governance like the legendary Yu the Great taming the floods, and emulate the merchants of Huizhou by valuing cultural heritage while building sustainable wealth.”

He said entrepreneurship is like moving from being a “player” to a “club owner”. In the past, he only needed to focus on playing and scoring goals; now, he must build the team, secure the stadium, and raise funds. During the first year of his startup, to save costs on business trips, he often stayed in “third-rate hotels without hot water”. The team spent their days brainstorming, reaching out to companies, and knocking on doors to open new opportunities for collaboration.

Bilingualism and cross-cultural edge

From the hardships of its early years to its present, eight years on, Insignia Ventures Partners has grown into a widely recognised international venture capital firm, now managing US$1.1 billion in funds. Its investors include institutional backers, sovereign wealth funds, university endowments, and family offices. The firm has invested in over 90 companies, with unicorns valued at more than US$1 billion among them: Southeast Asian used-car marketplace Carro, Indonesian investment platform Ajaib, AI marketing company Appier, Indian investment platform Groww, and logistics company J&T Express. It also plays a leading role in incubating six startups, including logistics platform Shipper and social e-commerce company Super.

Tan now resides in a landed home in the Ang Mo Kio area, and external estimates place his personal assets at over S$100 million.

Take Insignia’s recent investment in fintech firm Surfin as an example. Headquartered in Singapore with operations in ten countries, Surfin combines China’s technological capabilities with Singapore’s managerial strengths, while working closely with local teams.

He is quick to stress, however, that such achievements are not his alone but the result of his team’s bilingual and cross-cultural strengths, as well as the Singaporean reputation for execution and trustworthiness.

Take Insignia’s recent investment in fintech firm Surfin as an example. Headquartered in Singapore with operations in ten countries, Surfin combines China’s technological capabilities with Singapore’s managerial strengths, while working closely with local teams. Since Insignia’s investment, Surfin’s net profit has nearly doubled year-on-year, and it is expected to sustain a compound annual growth rate of over 50% for the coming years.

Insignia’s bilingual team communicates fluently in Mandarin, provides Chinese-language contracts, and creates a sense of familiarity for Chinese tech partners. At the same time, the team deeply studies Surfin’s business model and applies their insights to various markets, supporting areas such as team-building, fundraising, licensing, and avoiding costly missteps. Insignia’s principal Ong Yongcheng, 35, and vice-president Allen Chng, 32, both graduated from local university accounting programmes and maintain strong ties to China — Ong’s wife is from Putian, Fujian, and is now a Singaporean citizen, while Chng previously worked in China for a year.

Tan added that Insignia supports its portfolio companies by setting up engineering teams. For instance, they have invested in an AI-driven legal platform to process contracts quickly, and they use an in-house ESG (Environmental, Social, and Governance) assessment tool to help companies improve their ESG scores. The firm’s head of technology, 44-year-old Ridy Lie, was an engineer at Amazon, and is also Tan’s university classmate and entrepreneurial partner.

“We live in a multicultural society and receive bilingual education. This gives us a unique Nanyang perspective — we can stay grounded while also seeing far ahead. Many countries lack this, and it highlights Singapore’s strength.” — Tan

‘Singapore’ as a benchmark of trust and execution

Tan believes that the Singapore brand itself is a powerful resource for any company. “We live in a multicultural society and receive bilingual education. This gives us a unique Nanyang perspective — we can stay grounded while also seeing far ahead. Many countries lack this, and it highlights Singapore’s strength. Our longstanding consistency in principles and execution has made foreigners generally see Singapore as a benchmark for reliability and keeping promises. We should leverage these unique advantages to the fullest, playing the role of communicator, facilitator, and doer in the global market.”

He pointed out that against the backdrop of the US–China trade war and ongoing strategic rivalry, some American investment institutions are cautious about investing in Chinese companies. At the same time, when Chinese tech companies expand overseas, they often lack trust in Western venture capital funds.

As a Singapore-based team, Insignia can bridge this gap by helping US investment institutions connect with outstanding Chinese companies going global, while also explaining differences in management culture and investment expansion pace. As a result, one US Ivy League university endowment fund not only chose to co-invest with Insignia but also regards the firm as its preferred partner for entering the Southeast Asian market.

Tan concluded: “This once again proves that Singaporean teams play a dual role on the international stage — as both a symbol of trust and a model of execution.”

No need to be an entrepreneur to have an entrepreneurial spirit

Not everyone will start a business, but everyone can cultivate an entrepreneurial spirit — the resilience to never give up and the courage to solve problems.

Tan explained: “When you’re faced with a wall, a true entrepreneur will find a way to climb over it, go around it, dig a tunnel beneath it — or simply call a friend to help move it aside.”

In recent years, businesses at home and abroad have faced mounting challenges: the US–China trade war, the Covid-19 pandemic, and new American tariffs. Within China, many industries are caught in fierce internal competition; internet finance platforms and private tutoring companies have also come under strict regulatory pressure. Some companies chose to venture overseas, while others transformed themselves in order to survive.

As an example, Tan cited IMCOCO, a company operating across the entire coconut water supply chain. Its co-founder, Weng Xiangjian, originally ran an education technology business. But when the pandemic hit and regulatory headwinds mounted, he pivoted abroad. Two years ago, he teamed up with a coconut industry specialist to combine the strengths of Thai aromatic coconuts and Chinese engineering, laying out a global expansion that now spans coconut farming, cross-border trade, coconut water R&D and production, and beverage processing.

Tan noted that his team has partnered with many such entrepreneurs in Southeast Asia and China. They found that outstanding founders all share the same qualities: adaptability and tenacity.

“Their resilience shows in being able to advance when conditions allow, retreat when necessary, and always adapt their strategies to the circumstances, responding swiftly to changes in timing and situation.”

Building an academy to train and select talent

By weaving his passion for education into venture capital, Tan created an academy to nurture and retain talent for the industry, while also turning fellow students into long-term entrepreneurial partners.

Staying true to his childhood dream of becoming a teacher, Tan founded the Insignia Ventures Academy (IVA) after launching his firm. The academy provides entrepreneurship training and cultivates future venture capital professionals. Over the past four years, it has trained 11 cohorts, each with over 20 participants, carefully chosen from more than 2,000 applicants, resulting in a pool of over 200 outstanding students.

By regularly cultivating talent through the academy, his firm ensures that this “fertile water” stays within the family’s fields (肥水不流外人田), maintaining a steady flow of qualified candidates for both Insignia’s team and its portfolio companies.

The programme is distinguished by its strong emphasis on practice. Each week, students attend one theoretical lesson and one practicum, shadowing corporate executives and directly engaging in live investment projects.

Tan noted that many companies urgently need capable people in finance, technology, operations, and legal functions. Hiring through headhunters may yield results if you're lucky, but it is often costly and inefficient. By regularly cultivating talent through the academy, his firm ensures that this “fertile water” stays within the family’s fields (肥水不流外人田), maintaining a steady flow of qualified candidates for both Insignia’s team and its portfolio companies.

He stressed that people tend to remember those who supported them at the start of their learning or entrepreneurial journey. This philosophy of playing the long game also underpins his enduring relationships and collaborations with Chinese entrepreneurs.

Building bonds with Chinese entrepreneurs

Tan has attended various entrepreneurship and management programmes, where he befriended many Chinese entrepreneurs as classmates. To date, he has authored five English-language books on venture capital. Among them, Chinovation (2011) analysed China’s early leadership in technology application and innovation. By sharing strategies from his books on overseas investment, Tan connected with many Chinese entrepreneurs.

Over time, a number of these investors came to Singapore to set up headquarters, establish family offices, or send their children for schooling. They frequently sought his advice, and these relationships gradually deepened from that of classmates to long-term entrepreneurial partnerships.

Tan noted that with global trade rules and the technological landscape changing rapidly, waiting for university programmes to update curricula often means lagging behind global trends. One of the academy’s key functions is to provide participants, investors, and partners with timely insights, enabling them to identify trends before they become obvious in the industry, and to act swiftly.

Operating out of SGX Centre, Tan continues to stay committed to education. Beyond founding his academy, he served for ten years on the board of Hwa Chong Institution before stepping down last year. He is currently a member of the National University of Singapore’s Innovation and Enterprise Committee, and also serves on the government’s Pro-Enterprise Panel, which advises on policy and is chaired by the head of Civil Service Leo Yip.

Tan said he has always taken pride in having parents who were teachers and hopes to carry on the mission of “nurturing people for a hundred years” in different ways. Even after leaving the Administrative Service many years ago, he remains committed to public service in new forms — staying true to the meaning of his name “映岚”: helping others, like morning light breaking through mountain mist, to see clearly into the distance amid uncertainty.

This article was first published in Lianhe Zaobao as “禹徽资本创办人陈映岚 公务员闯风投界 信念藏在米袋间”.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)